Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 20 2021 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 Under

the

Securities Exchange Act of 1934

For

the month of January 2021

Commission

File Number: 001-38304

DOGNESS

(INTERNATIONAL) CORPORATION

(Registrant’s

name)

Tongsha

Industrial Estate, East District

Dongguan,

Guangdong 523217

People’s

Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.:

Form

20-F [X] Form 40-F [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Cautionary

Note Regarding Forward-Looking Statements

This

Report, including the exhibits included herein, may contain forward-looking statements. We have based these forward-looking statements

on our current expectations and projections about future events. Our actual results may differ materially from those discussed

herein, or implied by, these forward-looking statements. Forward-looking statements are generally identified by words such as

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,”

“project” and other similar expressions. In addition, any statements that refer to expectations or other characterizations

of future events or circumstances are forward-looking statements. Forward-looking statements included in this Report are subject

to significant risks and uncertainties, including but limited to: risks and uncertainties associated with the integration of the

assets and operations we have acquired and may acquire in the future; our possible inability to raise or generate additional funds

that will be necessary to continue and expand our operations; our potential lack of revenue growth and other factors detailed

in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements involve certain risks

and uncertainties that are subject to change based on various factors (many of which are beyond the Company’s control).

The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

Cautionary

Note Regarding Forward-Looking Statements

This

Report, including the exhibits included herein, may contain forward-looking statements. We have based these forward-looking statements

on our current expectations and projections about future events. Our actual results may differ materially from those discussed

herein, or implied by, these forward-looking statements. Forward-looking statements are generally identified by words such as

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,”

“project” and other similar expressions. In addition, any statements that refer to expectations or other characterizations

of future events or circumstances are forward-looking statements. Forward-looking statements included in this Report are subject

to significant risks and uncertainties, including but limited to: risks and uncertainties associated with the integration of the

assets and operations we have acquired and may acquire in the future; our possible inability to raise or generate additional funds

that will be necessary to continue and expand our operations; our potential lack of revenue growth and other factors detailed

in the Registrant’s filings with the Securities and Exchange Commission. These forward-looking statements involve certain

risks and uncertainties that are subject to change based on various factors (many of which are beyond the Registrant’s control).

The Registrant undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

Other

Events.

On

January 20, 2021, Dogness (International) Corporation (the “Registrant”) announced the closing of a previously announced

securities purchase agreement with certain institutional investors for the sale of 3,455,130 Class A common shares in a registered

offering at the price of $2.15 per common share. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated

by reference herein.

After

payment of expenses, the Registrant received approximately $6.6 million in net proceeds from the sale of the common shares. In

addition, warrants to purchase an aggregate of 1,727,565 common shares for $2.70 per share were issued to the investors and warrants

to purchase an aggregate of 276,410 common shares for $2.70 per share were issued as commission to the placement agent in the

offering. If fully exercised, the Registrant would receive aggregate gross proceeds from the warrants of approximately $5.4 million.

The Registrant intends to use the net proceeds from this offering for working capital and other general corporate purposes.

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Dogness

(International) Corporation

|

|

|

|

|

|

Date:

January 20, 2021

|

By:

|

/s/

Silong Chen

|

|

|

Name:

|

Silong

Chen

|

|

|

Title:

|

Chief

Executive Officer

(Principal

Executive Officer) and Duly Authorized Officer

|

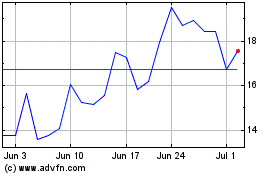

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024