U.S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of June 2019

Commission

File Number: 001-38304

DOGNESS

(INTERNATIONAL) CORPORATION

(Registrant’s

name)

Tongsha

Industrial Estate, East District

Dongguan,

Guangdong

People’s

Republic of China 523217

+86

769-8875-3300

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F [X] Form 40-F [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Explanatory

Note:

On

June 18, 2019, the Registrant issued a press release announcing its financial results for the first six months of fiscal

year 2019, which press release is attached as Exhibit 99.1 to this Form 6-K.

Summary

Financial Results

|

|

|

Six Months Ended December

31,

|

|

|

|

|

|

(USD, except for %)

|

|

2018

|

|

|

2017

|

|

|

% Change

|

|

|

Sales

|

|

$

|

12,836,651

|

|

|

$

|

14,832,705

|

|

|

|

(13.5

|

)%

|

|

Cost of sales

|

|

|

(8,208,059

|

)

|

|

|

(8,818,550

|

)

|

|

|

(6.9

|

)%

|

|

Gross profit

|

|

|

4,628,592

|

|

|

|

6,014,155

|

|

|

|

(23.0

|

)%

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

1,155,750

|

|

|

|

532,287

|

|

|

|

117.1

|

%

|

|

General and administrative expenses

|

|

|

2,821,646

|

|

|

|

1,583,049

|

|

|

|

78.2

|

%

|

|

Research and development expense

|

|

|

538,680

|

|

|

|

170,387

|

|

|

|

216.2

|

%

|

|

Total operating expenses

|

|

|

4,516,076

|

|

|

|

2,285,723

|

|

|

|

97.6

|

%

|

|

Income from operations

|

|

|

112,516

|

|

|

|

3,728,432

|

|

|

|

(97.0

|

)%

|

|

Other income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net

|

|

|

400,104

|

|

|

|

(153,154

|

)

|

|

|

(361.2

|

)%

|

|

Foreign transaction exchange gain (loss)

|

|

|

526,745

|

|

|

|

(175,053

|

)

|

|

|

(400.9

|

)%

|

|

Other income

|

|

|

16,322

|

|

|

|

1,506

|

|

|

|

983.8

|

%

|

|

Total other income (expenses)

|

|

|

943,171

|

|

|

|

(326,701

|

)

|

|

|

(388.7

|

)%

|

|

Income before income taxes

|

|

|

1,055,687

|

|

|

|

3,401,731

|

|

|

|

(69.0

|

)%

|

|

Provision for income taxes

|

|

|

329,096

|

|

|

|

511,010

|

|

|

|

(35.6

|

)%

|

|

Net income

|

|

$

|

726,591

|

|

|

$

|

2,890,721

|

|

|

|

(74.9

|

)%

|

Financial

Results for Six Months Ended December 31, 2018

Revenues

Revenues

decreased by approximately $2.0 million, or 13.5%, to approximately $12.8 million for the six months ended December 31, 2018 from

approximately $14.8 million for the same period of the prior fiscal year. The decrease in revenue was primarily attributable to

a sales volume decrease of 10.3% and a decrease in average selling price of 3.6% as compared to the same period of fiscal 2018.

The decrease in sales volume was mainly due to the negative impact of increased tariffs during the six months ended December 31,

2018 on some of our products as a result of the trade dispute between China and the United States started since September 2018,

which led to reduced purchase orders from several of our major customers located in the United States. Starting on May 10, 2019,

the tariff has jumped from 10% to 25%, and we are anticipating a further cutting-down of our export sales to the United States

in the coming months due to uncertainties arising from the China-US continuous talks on the trade deals.

Revenue

by Geographic Area

|

|

|

For the six months ended

December 31,

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

Countries

|

|

Revenue

|

|

|

% of

total

Revenue

|

|

|

Revenue

|

|

|

% of

total

Revenue

|

|

|

Variance

|

|

|

Variance %

|

|

|

United States

|

|

$

|

2,963,086

|

|

|

|

23.1

|

%

|

|

$

|

6,071,386

|

|

|

|

40.9

|

%

|

|

$

|

(3,108,300

|

)

|

|

|

(51.2

|

)%

|

|

Europe

|

|

|

1,260,242

|

|

|

|

9.8

|

%

|

|

|

951,754

|

|

|

|

6.4

|

%

|

|

|

308,488

|

|

|

|

32.4

|

%

|

|

Australia

|

|

|

110,960

|

|

|

|

0.9

|

%

|

|

|

185,127

|

|

|

|

1.2

|

%

|

|

|

(74,166

|

)

|

|

|

(40.1

|

)%

|

|

Canada

|

|

|

58,353

|

|

|

|

0.5

|

%

|

|

|

92,328

|

|

|

|

0.6

|

%

|

|

|

(33,975

|

)

|

|

|

(36.8

|

)%

|

|

Central and south America

|

|

|

81,927

|

|

|

|

0.6

|

%

|

|

|

103,891

|

|

|

|

0.7

|

%

|

|

|

(21,964

|

)

|

|

|

(21.1

|

)%

|

|

Japan and other Asian countries and regions

|

|

|

112,490

|

|

|

|

0.9

|

%

|

|

|

207,383

|

|

|

|

1.4

|

%

|

|

|

(94,893

|

)

|

|

|

(45.8

|

)%

|

|

China

|

|

|

8,249,593

|

|

|

|

64.3

|

%

|

|

|

7,220,836

|

|

|

|

48.7

|

%

|

|

|

1,028,757

|

|

|

|

14.2

|

%

|

|

Total

|

|

$

|

12,836,651

|

|

|

|

100

|

%

|

|

$

|

14,832,706

|

|

|

|

100

|

%

|

|

$

|

(1,996,055

|

)

|

|

|

(13.5

|

)%

|

Our

export sales to the United States decreased approximately $3.1 million or 51.2%, during the first half of fiscal 2019, as compared

to the same period of fiscal 2018. Due to the uncertainties and higher tariff created by the China-U.S. trade dispute, several

major customers in the United States reduced their purchase orders from us by approximately 1.0 million units or 19% as compared

to the same period of fiscal 2018.

We

have increased our marketing activities and sales efforts in domestic market in the wake of the growing pet consumption market

in China in general. With more pet ordinances and regulations being enforced by local authorities, Chinese pet owners are required

to keep dogs on leashes. As a result, we expect growing demand from pet owners in China for our quality products. The total sales

in our domestic market increased by approximately $1.0 million or 14.2% as compared to the same period of fiscal 2018.

We

also expanded our sales channels to more European countries in fiscal 2019, such as Germany, Poland, Greece, Bulgaria and Ireland.

Our export sales to Europe increased by $308,488 or 32.4% in the six months ended December 31, 2018 as compared to the same period

of last year.

Our

increase in sales in China and Europe partially offset our decreased sales in the United States.

Revenue

by Product Type

Our

pet collars, pet leashes, gift suspenders and pet harnesses continued to account for the greatest percentages of total sales at

26.7%, 24.1%, 16.2% and 14.6% of total sales, respectively, during the first half of fiscal 2019, compared to 37.1%, 22.4%, 11.6%

and 17.6% of total sales, respectively, in the first half of fiscal 2018. Sales of our retractable dog leashes slightly decreased

from 6.2% of our total sales in the six months ended December 31, 2017 to 5.9% of our total sales for the six months ended December

31, 2018 due to decreased sales volume as affected by reduced export sales to the United States. We launched our intelligent pet

products in March 2018 and intelligent pet products account for 4.4% of our total sales during the first half of fiscal 2019.

We had no such sales in the same period of fiscal 2018.

|

|

|

Revenue by Product Type

|

|

|

|

|

|

|

|

|

|

|

For the six months ended

December 31,

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

Product category

|

|

Revenue

|

|

|

% of

total

Revenue

|

|

|

Revenue

|

|

|

% of

total

Revenue

|

|

|

Variance

|

|

|

Variance %

|

|

|

Pet leashes

|

|

$

|

3,094,754

|

|

|

|

24.1

|

%

|

|

$

|

3,328,950

|

|

|

|

22.4

|

%

|

|

$

|

(234,196

|

)

|

|

|

(7.0

|

)%

|

|

Pet collars

|

|

|

3,423,555

|

|

|

|

26.7

|

%

|

|

|

5,504,792

|

|

|

|

37.1

|

%

|

|

|

(2,081,237

|

)

|

|

|

(37.8

|

)%

|

|

Pet harnesses

|

|

|

1,875,311

|

|

|

|

14.6

|

%

|

|

|

2,610,480

|

|

|

|

17.6

|

%

|

|

|

(735,169

|

)

|

|

|

(28.2

|

)%

|

|

Gift suspenders

|

|

|

2,074,218

|

|

|

|

16.2

|

%

|

|

|

1,726,310

|

|

|

|

11.6

|

%

|

|

|

347,908

|

|

|

|

20.2

|

%

|

|

Retractable dog leashes

|

|

|

762,508

|

|

|

|

5.9

|

%

|

|

|

919,254

|

|

|

|

6.2

|

%

|

|

|

(156,746

|

)

|

|

|

(17.1

|

)%

|

|

Intelligent pet products

|

|

|

568,474

|

|

|

|

4.4

|

%

|

|

|

-

|

|

|

|

-

|

|

|

|

568,474

|

|

|

|

-

|

|

|

Other pet accessories

|

|

|

1,037,831

|

|

|

|

8.1

|

%

|

|

|

742,920

|

|

|

|

5.0

|

%

|

|

|

294,911

|

|

|

|

39.7

|

%

|

|

Total

|

|

$

|

12,836,651

|

|

|

|

100.0

|

%

|

|

$

|

14,832,706

|

|

|

|

100.0

|

%

|

|

$

|

(1,996,055

|

)

|

|

|

(13.5

|

)%

|

|

|

|

Quantity sold for six

months ended December

31,

|

|

|

|

|

|

% of

|

|

|

Average unit price for six

months ended

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Quantity

variance

|

|

|

Quantity

variance

|

|

|

2018

|

|

|

2017

|

|

|

Price

Difference

|

|

|

Pet leashes

|

|

|

1,222,145

|

|

|

|

2,072,485

|

|

|

|

(850,340

|

)

|

|

|

(41.0

|

)%

|

|

$

|

2.5

|

|

|

$

|

1.6

|

|

|

$

|

0.9

|

|

|

Pet collars

|

|

|

2,384,063

|

|

|

|

4,062,335

|

|

|

|

(1,678,272

|

)

|

|

|

(41.3

|

)%

|

|

|

1.4

|

|

|

|

1.4

|

|

|

|

-

|

|

|

Pet Harnesses

|

|

|

967,215

|

|

|

|

1,198,133

|

|

|

|

(230,918

|

)

|

|

|

(19.3

|

)%

|

|

|

1.9

|

|

|

|

2.2

|

|

|

|

(0.3

|

)

|

|

Gift suspenders

|

|

|

6,016,973

|

|

|

|

5,255,411

|

|

|

|

761,562

|

|

|

|

14.5

|

%

|

|

|

0.3

|

|

|

|

0.3

|

|

|

|

-

|

|

|

Retractable dog leashes

|

|

|

164,485

|

|

|

|

199,622

|

|

|

|

(35,137

|

)

|

|

|

(17.6

|

)%

|

|

|

4.6

|

|

|

|

4.6

|

|

|

|

-

|

|

|

Intelligent pet products

|

|

|

20,043

|

|

|

|

-

|

|

|

|

20,043

|

|

|

|

-

|

|

|

|

28.4

|

|

|

|

-

|

|

|

|

28.4

|

|

|

Other pet accessories

|

|

|

1,638,656

|

|

|

|

1,043,814

|

|

|

|

594,842

|

|

|

|

57.0

|

%

|

|

|

0.6

|

|

|

|

0.7

|

|

|

|

(0.1

|

)

|

|

Total

|

|

|

12,413,580

|

|

|

|

13,831,800

|

|

|

|

(1,418,220

|

)

|

|

|

(10.3

|

)%

|

|

$

|

1.0

|

|

|

$

|

1.1

|

|

|

$

|

(0.1

|

)

|

Pet

leashes

Revenue from pet leashes decreased by approximately

$0.2 million, or 7.0%, from $3.3 million in the six months ended December 31, 2017, to $3.1 million in the six months ended December

31, 2018. The decrease was mainly driven by a 41.0% decrease in sales volume during the period compared to the same period of

the prior fiscal year, compensated by an increase in average unit price by $0.9 per unit or 56%, which was mainly due to more

higher cost leather dog leashes were sold. The decrease in our export sales volume for pet leashes was due to reduced purchase

orders from major customers located in the United States.

Pet

collars

Revenue

from pet collars decreased by approximately $2.1 million, or 37.8%, from $5.5 million in the six months ended December 31, 2017,

to $3.4 million in the six months ended December 31, 2018. The decrease in revenue was due to a 41.3% decrease in sales volume

during the six months ended December 31, 2018. Our export for pet collars sales decreased 43.9% in the six months ended December

31, 2018, comparing to the same period last year due to reduced purchase orders from major customers located in the United States.

The average selling price for pet collars remained consistent compared to the same period of the prior fiscal year.

Pet

harnesses

Revenue

from pet harnesses decreased by approximately $0.7 million, or 28.2%, from $2.6 million in the six months ended December 31, 2017,

to $1.9 million in the six months ended December 31, 2018. The decrease in revenue was due to a 19.3% decrease in sales volume

during the six months ended December 31, 2018. Our export for pet harnesses sales decreased 56.4% in the six months ended December

31, 2018, comparing to the same period last year due to reduced purchase orders from major customers located in the United States.

The average selling price for pet harnesses decreased by $0.3 per unit comparing to the same period of the prior fiscal year because

we lowered the selling price on several pet harnesses products in order to promote the sales to customers.

Gift

suspender

Revenue

from gift suspender increased by approximately $0.4 million, or 20.2%, from $1.7 million in the six months ended December 31,

2017, to $2.1 million in the six months ended December 31, 2018. The increase in revenue was due to a 14.5% increase in sales

volume during the six months ended December 31, 2018. Our export for gift suspender sales increased 60.8% in the six months ended

December 31, 2018, comparing to the same period last year. The average selling price for gift suspender remained consistent compared

to the same period of the prior fiscal year.

Retractable

dog leashes

Revenue

from retractable dog leashes decreased by 17.1%, to approximately $0.8 million during the six months ended December 31, 2018,

from $0.9 million in the six months ended December 31, 2017. The decrease in revenue was attributable to a 17.6% decrease in the

sales volume of retractable dog leashes during the six months ended December 31, 2018, as compared to the same period of last

year due to reduced purchase orders from major customers located in the United States.

Intelligent

pet products

Sales

of our intelligent pet products amounted to approximately $0.6 million in the six months ended December 31, 2018 as compared to

$Nil for the same comparative period of 2017. As a new product we launched in March 2018, our intelligent pet product line includes

app-controlled pet food containers and feeders, pet water containers and dispensers, and smart pet toys. As compared with other

products, intelligent pet products typically have high selling price. We are increasing our focus on new, smart and innovative

pet products and expect sales of intelligent pet products will continue to increase in the near future.

Other

pet accessories

Other

pet accessories include various dog comfort wrap harnesses, pet muzzles, metal chain traffic leashes, pet belt and ropes, etc.,

which are normally customized to fulfill customers’ purchase orders. Revenue from other pet accessories increased by 39.7%,

to approximately $1 million during the six months ended December 31, 2018, from $0.7 million in the six months ended December

31, 2017. The increase in revenue was attributable to a 57.0% increase in the sales volume of other pet accessories during the

six months ended December 31, 2018, as compared to the same period of last year.

Sales

to related party

During

the six months ended December 31, 2018, we invested RMB 2.0 million to eventually acquire 10% of the ownership interest in Dogness

Network Technology Co., Ltd (“Dogness Network”) in order to work together with Dogness Network to develop new products

and new technologies in smart pet tech area. We sold certain intelligent pet products to Dogness Network and accordingly reported

related party sales of $206,052, which accounted for 1.6% of our total revenue for the six months ended December 31, 2018. As

of the date of this filing, we have received partial payment from Dogness Network and we anticipate to fully collect the remaining

amount before June 30, 2019. There were no such related party sales in the same period of last fiscal year.

Cost

of revenues

Cost of revenues decreased by approximately

$0.6 million, or 6.9%, to $8.2 million in the six months ended December 31, 2018, from approximately $8.8 million in the same

period of the prior fiscal year. The decrease in our cost of revenues was mainly due to the decrease of sales volume by 13.5%

in the current period. As a percentage of revenues, the cost of goods sold increased by approximately 4.4% to 63.9% in the current

period from 59.5% in the same period of the prior fiscal year. This was mainly because more higher cost leather materials instead

of fabric materials have been used in the production in order to fulfill customer purchase orders of our pet leashes and pet collars

in fiscal 2019, which increased our related production cost to certain extent.

Gross

profit

During the six months ended December 31,

2018, gross profit decreased by approximately $1.4 million to approximately $4.6 million, from approximately $6.0 million in the

same period of the prior fiscal year, primarily attributable to decreased sales volume of our pet leash, pet collars, pet harnesses

and retractable dog leash, and increased cost of revenue on pet leashes and pet collars because more higher cost leather materials

have been used to fulfil customer orders. Overall gross profit margin was 36.1%, a decrease of 4.4 percentage points, compared

to 40.5% in the same period of the prior fiscal year.

Gross

margins for pet leashes, pet collars and gift suspenders decreased by 1.9 percentage points, 4.8 percentage points and 7.8 percentage

points, respectively, as compared to the same period in fiscal 2018. The decrease was mainly due to the increased raw material

costs because we produced more leather products instead of fabric products, as well as the increased salary expenses due to higher

labor costs as compared to the same period last year.

Gross

margin for pet harnesses and other pet accessories decreased by 3.4 percentage points and 10.1 percentage points, respectively,

as compared to the same period in fiscal 2018. The decrease was mainly due to the decreased average unit selling price when we

lowered down the selling price on certain products in order to promote sales to customers.

Gross

margin for retractable dog leashes increased by 5.2 percentage points, as compared to the same period in fiscal 2018. The increase

was mainly a result of the improved material and functionality of our retractable dog leash products, which reduced the cost of

production per unit, and increased the gross margin.

Gross

margin for our intelligent pet products was 34.5% during the six months ended December 31, 2018. The gross margin for intelligent

pet products is within our expectation.

Gross

profits by product type were as follows:

|

|

|

For the six months ended

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

Product category

|

|

Gross

profit

|

|

|

Gross

profit %

|

|

|

Gross

profit

|

|

|

Gross

profit %

|

|

|

Variance

in Gross

profit

|

|

|

Variance

in Gross

profit %

|

|

|

Pet leashes

|

|

$

|

1,134,887

|

|

|

|

36.7

|

%

|

|

$

|

1,285,758

|

|

|

|

38.6

|

%

|

|

$

|

(150,871

|

)

|

|

|

(1.9

|

)%

|

|

Pet collars

|

|

|

1,256,541

|

|

|

|

36.7

|

%

|

|

|

2,282,617

|

|

|

|

41.5

|

%

|

|

|

(1,026,076

|

)

|

|

|

(4.8

|

)%

|

|

Pet harnesses

|

|

|

735,971

|

|

|

|

39.2

|

%

|

|

|

1,112,320

|

|

|

|

42.6

|

%

|

|

|

(376,349

|

)

|

|

|

(3.4

|

)%

|

|

Gift suspenders

|

|

|

678,785

|

|

|

|

32.7

|

%

|

|

|

699,399

|

|

|

|

40.5

|

%

|

|

|

(20,614

|

)

|

|

|

(7.8

|

)%

|

|

Retractable dog leashes

|

|

|

324,192

|

|

|

|

42.5

|

%

|

|

|

342,809

|

|

|

|

37.3

|

%

|

|

|

(18,617

|

)

|

|

|

5.2

|

%

|

|

Intelligent pet products

|

|

|

196,171

|

|

|

|

34.5

|

%

|

|

|

-

|

|

|

|

-

|

|

|

|

196,171

|

|

|

|

34.5

|

|

|

Other pet accessories

|

|

|

302,045

|

|

|

|

29.1

|

%

|

|

|

291,252

|

|

|

|

39.2

|

%

|

|

|

10,793

|

|

|

|

(10.1

|

)%

|

|

Total

|

|

$

|

4,628,592

|

|

|

|

36.1

|

%

|

|

$

|

6,014,155

|

|

|

|

40.5

|

%

|

|

$

|

(1,385,563

|

)

|

|

|

(4.4

|

)%

|

Selling

expenses

Selling

expenses primarily included expenses incurred for participating in various trade shows to promote product sales, salary and sales

commission expenses paid to the Company’s sales personnel, customs clearance charges for product exports, and shipping and

delivery expenses. Selling expenses increased by $0.6 million, or 117.1% from $0.5 million in the six months ended December 31,

2017, to $1.1 million in the six months ended December 31, 2018. The increase in selling expense was primarily due to increased

trade show expenses by $148,065, increased sales and marketing expenses by $325,950, and an increased sales commission expense

by $54,049. Due to the our decreased export sales to the United States due to the higher tariff, in order to promote the sales

to European market and China domestic market, we initiated more promotion activities to these targeted markets and we participated

in some trade shows in these markets, which led to increased trade shows expense and marketing expenses as mentioned above. On

the other hand, our advertising expense through social media decreased by $17,947 and our duty and customs declaration expense

decreased by $18,259 due to reduced export sales to the United States during the period compared to the same period of the prior

fiscal year. As a percentage of sales, our selling expenses were 9.0% and 3.6% of our total revenues for the six months ended

December 31, 2018 and 2017, respectively.

General

and administrative expenses

General

and administrative expenses increased by approximately $1.2 million, or 78.2%, from approximately $1.6 million in the six months

ended December 31, 2017, to approximately $2.8 million in the six months ended December 31, 2018. The increase was mainly due

to increased salaries of approximately $0.3 million due to higher labor costs, and increased public company maintenance expenses

such as auditing fees, IR fees, legal counsel fees, capital market advisory fees as well as notarization fees. As a percentage

of sales, our general and administrative expenses were 22.0% and 10.7% of our total revenues for the six months ended December

31, 2018 and 2017, respectively.

Research

and development expenses

Research

and development expenses increased by approximately $0.3 million, or 216.2%, from approximately $0.2 million in the six months

ended December 31, 2017, to approximately $0.5 million in the six months ended December 31, 2018. As a percentage of sales, our

research and development expenses were 4.2% and 1.1% of our total revenues for the six months ended December 31, 2018 and 2017,

respectively. The increase was due to the Company’s continuous efforts to develop cutting edge smart products for pets,

as well as to improve some of the functions and exterior designs of our existing products in order to meet customer demands. We

expect R&D expenses to continue to increase, as we continue to expand our research and development activities to increase

the use of environmentally-friendly materials, and develop more new high-tech products to meet customer demands.

Other

income (expense)

Other

income (expense) primarily included interest income or expense and foreign exchange gain or loss. For the six months ended December

31, 2018, the Company had other income of approximately $0.9 million and had other expense of $0.3 million for the same period

of the prior fiscal year. The other income was mainly attributable to the foreign exchange gain of $0.5 million in the current

period due to the favorable USD, Euro, and other currency exchange rates against RMB on our foreign currency denominated account

receivables, as well as $0.4 million interest income from our short-term investments.

Income

tax

Income

tax expense decreased by approximately $0.3 million in six months ended December 31, 2018, or 35.6%, from approximately $0.5 million

in the six months ended December 31, 2017, to approximately $0.3 million in the six months ended December 31, 2018. The decrease

was consistent with the decrease in our taxable income for the six months ended December 31, 2018.

We

had accrued tax liabilities of approximately $2.6 million and $2.3 million as of December 31, 2018 and June 30, 2018, respectively,

mostly related to our unpaid income tax and business tax in China. According to PRC taxation regulation, if tax has not been fully

paid, tax authorities may impose tax and late payment penalties within three years. In practice, since all of the taxes owed are

local taxes, the local tax authority is typically more flexible and willing to provide incentives or settlements with local small

and medium-size businesses to relieve their burden and to stimulate the local economy. Management has discussed with local tax

authorities regarding the outstanding tax payable balance after the Company successfully completed its IPO and is in the process

of negotiating a settlement plan agreement. Management believes it is likely that the Company can reach an agreement with the

local tax authority to fully settle its tax liabilities within one year but cannot guarantee such settlement will ultimately occur.

Net

income

Net

income was approximately $0.73 million for the first half of fiscal 2019, a decrease of $2.2 million or 74.9%, from $2.9 million

in the same period of the prior fiscal year. The decrease in net income was the result of decreased sales and gross profit, and

increased operating expenses as discussed above.

Cash

and cash flows

As of December 31, 2018, we had we had

cash and cash equivalents of approximately $3.2 million. Cash from the IPO proceeds were used to purchase short-term investments

of approximately $17.5 million, which consists of wealth management financial products with maturities within one to three months.

These short-term investments are highly liquid upon maturity and can be used as working capital when needed.

Our current assets were approximately $33.8

million, and our current liabilities were approximately $7.7 million, which resulted in a current ratio of 4.4:1. Total shareholders’

equity as of December 31, 2018 was approximately $60.6 million.

As

of December 31, 2018, we have outstanding loans of approximately $2.9 million from various banks in China. To secure these debts,

we pledged certain land use rights and buildings as collateral to safeguard these bank loans, and Mr. Silong Chen and his parents

also jointly signed a maximum guarantee agreement to provide additional guarantee to these bank loans.

Net cash used in operating activities was

$3.6 million for the six months ended December 31, 2018, comparing to $4.1 million net cash provided by operating activities for

the six months ended December 31, 2017. The decrease in operating cash flow was mainly due to decreased net income during the

current period, increased inventory stockpile of approximately $1 million to meet the anticipated increased customer demands during

the second half of fiscal year 2019 and increased prepayments of approximately $4.3 million to our suppliers to secure our raw

material purchase, offset by increased accounts payables of approximately $1 million.

Net cash provided by investing activities

was $2.0 million for the six months ended December 31, 2018, comparing to $0.8 million net cash used in investing activities for

the six months ended December 31, 2017. The increase in investing cash flow was mainly due to the proceeds upon maturity of $9.7

million short-term investment, offset by $7.3 million investment on property, plant and equipment, and $0.5 million capital expenditure

in our investments in Linsun Smart Technology Co., Ltd (“Linsun”) and Dogness Network Technology Co., Ltd for certain

ownership interest in these entities in order to jointly develop new products and new technologies in the smart pet tech area,

we accounted for these investments using the cost method .

Net

cash used in financing activities was $1.7 million for the six months ended December 31, 2018, comparing to $48.5 million net

cash provided by financing activities for the six months ended December 31, 2017. The decrease in financing cash flow was mainly

due to the repayment of $1.7 million for bank loans upon maturity. We received cash in net proceeds from initial public offering

approximately $50.2 million for the six months ended December 31, 2017, which caused our cash from financing activities in the

six months ended December 31, 2017 was higher than in the six months ended December 31, 2018.

Commitments

and Contractual Obligations

The

following table presents the company’s material contractual obligations as of December 31, 2018:

|

Contractual Obligations

|

|

Total

|

|

|

Less than 1

year

|

|

|

1-3 years

|

|

|

3-5 years

|

|

|

More than 5

years

|

|

|

Operating leases commitment (1)

|

|

$

|

4,595,030

|

|

|

$

|

331,545

|

|

|

$

|

491,324

|

|

|

$

|

911,924

|

|

|

$

|

2,860,237

|

|

|

Repayment of bank loan (2)

|

|

|

2,923,498

|

|

|

|

2,923,498

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Capital expenditure commitments on Meijia (3)

|

|

|

6,800,000

|

|

|

|

6,800,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Capital expenditure commitments on Dongguan Jiasheng (4)

|

|

|

9,700,000

|

|

|

|

3,990,000

|

|

|

|

5,710,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

$

|

24,018,528

|

|

|

$

|

14,045,043

|

|

|

$

|

6,201,324

|

|

|

$

|

911,924

|

|

|

$

|

2,860,237

|

|

|

(1)

|

The

Company’s subsidiary Dogness Jiasheng leases manufacturing facilities and administration office spaces under multiple

operating lease agreements.

|

|

|

|

|

(2)

|

The

Company signed a credit agreement with Bank of Communications of China Dongguan Branch, which allows the Company to have access

of maximum amount of approximately $4.4 million (RMB 30 million) during August 17, 2018 to August 13, 2019, and this revolving

credit is renewable upon maturity. As of December 31, 2018, the Company had a loan balance of $2,923,498 (RMB 20 million)

under this credit agreement. The loan has a term of one year from August 21, 2018 to August 20, 2019 with effective interest

rate of 5.873% per annum.

|

|

|

|

|

(3)

|

The

Company acquired Zhangzhou Meijia Metal Product Co., Ltd (“Meijia”) in fiscal year 2018. Meijia owns the land

use right to a land parcel of 19,144.54 square meters and a factory and office buildings of an aggregate of 18,912.38 square

meters. Total original budgeted capital expenditure for Meijia acquisition and post-acquisition decoration and equipment purchase

was RMB 160 million. The Company paid $10.7 million (RMB 71 million ) in March 2018 to acquire Meijia and planned to use additional

$13.1 million (RMB 90 million ) on decoration and purchase of equipment and machinery to bring Meijia manufacturing facility

into use. As of December 31, 2018, the Company already spent approximately $6.3 million (RMB 43 million) decoration costs.

From January 2019 up to the date of this filing, additional approximately $3.6 million (RMB 25 million) has been spent on

machinery and equipment purchase and installation. The Company will spend additional approximately $3.2 million (RMB $22 million)

on machinery and equipment purchase and installation in the next few months. Meijia plant is expected to start the manufacturing

in October 2019.

|

|

|

|

|

(4)

|

The

Company’s subsidiary Dongguan Jiasheng also plans to build a warehouse with original estimated budgeted costs of RMB

140 million ($20.3 million). The budget has been recently revised to approximately $12.3 million (RMB 85 million) based on

discussions with local planning authorities. The Company has already spent approximately $2.6 million (RMB 17.8 million) as

of December 31, 2018, and will spend additional $9.7 million on the remaining construction work in 2019 and 2020. The construction

is expected to be completed by the end of 2020.

|

Presently,

our principal sources of liquidity are generated from our operations, proceeds from our IPO, and loans from commercial banks.

In assessing its liquidity, management monitors and analyzes our cash on-hand, our ability to generate sufficient revenue sources

in the future and our operating and capital expenditure commitments. As of December 31, 2018, our estimated future minimum capital

expenditures for the next 12 months are around $14 million. We plan to fund these investment through our working capital generated

from our operations, bank borrowings, the proceeds from the IPO and other capital raising activities.

As

of December 31, 2018, we had approximately $3.2 million cash and approximately $17.5 million short-term investments with maturities

within one to three months. We also had outstanding accounts receivable of approximately $6 million, among which approximately

$5.2 million has been subsequently collected back during January to April 2019, and become available for use in our operation

as working capital if necessary.

As

of December 31, 2018, we had outstanding bank loans of approximately $2.9 million, and an unused line of credit of $1.5 million

(RMB 10 million) with the bank that is available for withdrawal whenever we need the fund. We expect that we will be able to renew

all of the existing bank loans upon their maturity based on past experience and the Company’s good credit history. We are

now also exploring additional capital raising opportunities. Management expects to generate significant amount of revenue from

the new developed intelligent pet products, which may further strength our cash position.

Based

on the current operating plan, we believe that the above-mentioned measures collectively will provide sufficient liquidity for

the Company to meet its future liquidity and capital requirement for at least next 12 months from the date of this filing.

Recent

developments

We

have recently invested RMB 1.5 million out of an approved RMB 3.0 million to acquire 13% ownership interest in third party Linsun

Smart Technology Co., Ltd (“Linsun”). Linsun will share its related technologies, patents and manufacturing capabilities

with Dogness after the acquisition. Going forward, Dogness and Linsun will further develop new products and new technologies in

the smart pet tech area together.

We

have recently invested RMB 2.0 million out of an approved RMB 8.0 million to acquire 10% of the ownership interest in Dogness

Network Technology Co., Ltd (“Network”) in order to integrate the industrial chain and to further develop new products

and new technologies in smart pet tech area. The remaining RMB 6.0 million investment is expected before June 2019.

Because

we do not have the ability to exercise significant influence over the operating and financial policies in both Linsun and Network

due to insignificant investments and minor share holdings, we account for our investments in these two entities using the cost

method.

The

Board has approved the investment of RMB 3.5 million to jointly open Dogness Pet Store with Mr. Liwen Zheng, his company Changxuan

Yuandong Co., Ltd., and Mr. Shiting Deng.

In

order to expand into the Japanese market and expedite the development of new smart pet products, we have invested $250,000 for

51% ownership interest to establish and operate Japan Dogness Company. The Japan Dogness Company was established in February 2019.

In

connection with these initiatives and to incentivize the Company’s employees, the Board has granted options to purchase

1.2 million Class A Common Shares to certain management and employees at an exercise price of $3.50 per share. This grant was

made pursuant to the employee incentive plan.

On

November 28, 2018, Dongguan Jiasheng was recognized as a High-technology Company by Chinese government. As a result, revenues

generated by Dongguan Jiasheng will be subject to a favorable income tax rate of 15%. The High-technology certificate is valid

for three year and is subject to renewal.

In

January 2019, we entered two lease agreements to lease one property with building areas of 4439 square meters and a piece of land

of 191 square meters located in Tongsha Industry Zone, Dongcheng District, Dongguan, China. The leased building and land will

provide additional administration office spaces and parking space for our subsidiary Dongguan Jiasheng.

On

May 23, 2019, we signed a service termination agreement with TJ Capital Management, L.P. to terminate the consulting service previously

entered on November 10, 2017 because TJ Capital has not performed certain specified services. As a result, the options granted

under the original service agreement are also cancelled or void. There was no stock-based compensation expense accrued for the

six months ended December 31, 2018 and 2017 and up to the date of the termination of this agreement, because TJ Capital has not

provided the services.

UNAUDITED

CONDENSED CONSOLIDATED FINANCIAL DATA

Unaudited

Condensed Consolidated Balance Sheets

(In

USD)

|

|

|

As of

|

|

|

|

|

December 31, 2018

|

|

|

June 30, 2018

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

3,202,532

|

|

|

$

|

7,085,235

|

|

|

Short-term investments

|

|

|

17,479,325

|

|

|

|

28,233,035

|

|

|

Accounts receivable, net

|

|

|

6,036,343

|

|

|

|

5,641,501

|

|

|

Accounts receivable - related parties

|

|

|

238,364

|

|

|

|

-

|

|

|

Inventories, net

|

|

|

5,673,259

|

|

|

|

4,153,583

|

|

|

Due from related party

|

|

|

8,982

|

|

|

|

-

|

|

|

Prepayments and other current assets

|

|

|

1,203,611

|

|

|

|

1,105,783

|

|

|

Total current assets

|

|

|

33,842,416

|

|

|

|

46,219,137

|

|

|

|

|

|

|

|

|

|

|

|

|

Long term investments

|

|

|

471,224

|

|

|

|

-

|

|

|

Long term prepayment

|

|

|

4,107,550

|

|

|

|

-

|

|

|

Property, plant and equipment, net

|

|

|

26,843,483

|

|

|

|

20,950,685

|

|

|

Intangible assets, net

|

|

|

2,313,381

|

|

|

|

2,390,571

|

|

|

Deferred tax assets

|

|

|

30,927

|

|

|

|

22,297

|

|

|

TOTAL ASSETS

|

|

$

|

67,608,981

|

|

|

$

|

69,582,690

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Short-term bank loans

|

|

$

|

2,923,498

|

|

|

$

|

4,835,200

|

|

|

Accounts payable

|

|

|

1,267,039

|

|

|

|

351,375

|

|

|

Accounts payable - related party

|

|

|

104,975

|

|

|

|

-

|

|

|

Advance from customers

|

|

|

178,888

|

|

|

|

240,216

|

|

|

Accrued liabilities and other payable

|

|

|

624,488

|

|

|

|

1,120,579

|

|

|

Taxes payable

|

|

|

2,565,193

|

|

|

|

2,295,788

|

|

|

Total current liabilities

|

|

|

7,664,081

|

|

|

|

8,843,158

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares, $0.002 par value, 100,0000,0000 shares authorized, 25,913,631

and 15,000,0000 issued and outstanding at December 31, 2018 and June 30, 2018, respectively

|

|

|

|

|

|

|

|

|

|

Class A Common Shares

|

|

|

33,689

|

|

|

|

33,689

|

|

|

Class B Common Shares

|

|

|

18,138

|

|

|

|

18,138

|

|

|

Additional paid-in capital

|

|

|

52,486,018

|

|

|

|

52,144,891

|

|

|

Statutory reserves

|

|

|

164,367

|

|

|

|

164,367

|

|

|

Retained earnings

|

|

|

10,989,789

|

|

|

|

10,263,198

|

|

|

Accumulated other comprehensive (deficit)

|

|

|

(3,747,101

|

)

|

|

|

(1,884,751

|

)

|

|

Total stockholders’ equity

|

|

|

59,944,900

|

|

|

|

60,739,532

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$

|

67,608,981

|

|

|

$

|

69,582,690

|

|

Unaudited

Condensed Consolidated Statement of

Income

and Other Comprehensive Income (Loss)

(In

USD)

|

|

|

For the Six Months Ended

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

12,630,599

|

|

|

$

|

14,832,705

|

|

|

Revenues - related parties

|

|

|

206,052

|

|

|

|

-

|

|

|

Total Revenues

|

|

|

12,836,651

|

|

|

|

14,832,705

|

|

|

Cost of revenues

|

|

|

(8,208,059

|

)

|

|

|

(8,818,550

|

)

|

|

Gross Profit

|

|

|

4,628,592

|

|

|

|

6,014,155

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

1,155,750

|

|

|

|

532,287

|

|

|

General and administrative expenses

|

|

|

2,821,646

|

|

|

|

1,583,049

|

|

|

Research and development expenses

|

|

|

538,680

|

|

|

|

170,387

|

|

|

Total operating expenses

|

|

|

4,516,076

|

|

|

|

2,285,723

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

112,516

|

|

|

|

3,728,432

|

|

|

Other income (expenses):

|

|

|

|

|

|

|

|

|

|

Interest income (expenses), net

|

|

|

400,104

|

|

|

|

(153,154

|

)

|

|

Foreign transaction exchange gain (loss)

|

|

|

526,745

|

|

|

|

(175,053

|

)

|

|

Other income, net

|

|

|

16,322

|

|

|

|

1,506

|

|

|

Total other income (expense)

|

|

|

943,171

|

|

|

|

(326,701

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

1,055,687

|

|

|

|

3,401,731

|

|

|

Provision for income taxes

|

|

|

329,096

|

|

|

|

511,010

|

|

|

Net income

|

|

|

726,591

|

|

|

|

2,890,721

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss)

|

|

|

(1,862,350

|

)

|

|

|

364,042

|

|

|

Comprehensive income (loss)

|

|

$

|

(1,135,759

|

)

|

|

$

|

3,254,763

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per share - Basic and

Diluted

|

|

$

|

0.03

|

|

|

$

|

0.18

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding - Basic and diluted

|

|

|

25,913,631

|

|

|

|

15,775,285

|

|

Unaudited

Condensed Consolidated Statements of Cash Flows

(In

USD)

|

|

|

For the Six Months Ended

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

726,591

|

|

|

$

|

2,890,721

|

|

|

Adjustments to reconcile net income to net cash (used in) provided by

operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

643,777

|

|

|

|

576,755

|

|

|

Share based compensation for services

|

|

|

341,127

|

|

|

|

-

|

|

|

Changes in inventory reserve

|

|

|

(4,747

|

)

|

|

|

(18,735

|

)

|

|

Recovery of doubtful account

|

|

|

(38,609

|

)

|

|

|

(33,593

|

)

|

|

Deferred tax expenses (benefit)

|

|

|

(9,498

|

)

|

|

|

9,730

|

|

|

Unrealized foreign exchange gain

|

|

|

68,314

|

|

|

|

123,823

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(878,054

|

)

|

|

|

(885,680

|

)

|

|

Inventories

|

|

|

(1,037,754

|

)

|

|

|

(2,319,591

|

)

|

|

Prepayments and other assets

|

|

|

(4,258,776

|

)

|

|

|

(28,083

|

)

|

|

Accounts payables

|

|

|

1,036,739

|

|

|

|

1,110,063

|

|

|

Accrued expenses and other liabilities

|

|

|

(467,613

|

)

|

|

|

2,461,702

|

|

|

Advance from customers

|

|

|

(52,411

|

)

|

|

|

(196,510

|

)

|

|

Taxes payable

|

|

|

356,989

|

|

|

|

452,151

|

|

|

Net cash (used in) provided by operating activities

|

|

|

(3,573,925

|

)

|

|

|

4,142,753

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Additions to property, plant and equipment

|

|

|

(7,268,272

|

)

|

|

|

(819,309

|

)

|

|

Long-term investments

|

|

|

(471,224

|

)

|

|

|

-

|

|

|

Purchase of intangible assets

|

|

|

(22,031

|

)

|

|

|

-

|

|

|

Proceeds upon maturity of short-term investments

|

|

|

9,715,318

|

|

|

|

-

|

|

|

Net cash provided by (used in) investing activities

|

|

|

1,953,791

|

|

|

|

(819,309

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Net Proceeds from initial public offering

|

|

|

-

|

|

|

|

50,200,285

|

|

|

Repayment of short-term bank loans

|

|

|

(1,734,102

|

)

|

|

|

(918,660

|

)

|

|

Repayment of related party loans

|

|

|

(9,045

|

)

|

|

|

(736,894

|

)

|

|

Net cash (used in) provided by financing activities

|

|

|

(1,743,147

|

)

|

|

|

48,544,731

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash

|

|

|

(519,421

|

)

|

|

|

(18,861

|

)

|

|

Net increase (decrease) in cash

|

|

|

(3,882,703

|

)

|

|

|

51,849,314

|

|

|

Cash, beginning of period

|

|

|

7,085,235

|

|

|

|

1,504,596

|

|

|

Cash, end of period

|

|

$

|

3,202,532

|

|

|

$

|

53,353,910

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure information:

|

|

|

|

|

|

|

|

|

|

Cash paid for income tax

|

|

$

|

16,751

|

|

|

$

|

40,624

|

|

|

Cash paid for interest

|

|

$

|

55,993

|

|

|

$

|

154,479

|

|

Exhibits

The

following document is filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned thereunto duly authorized.

|

|

Dogness (International) Corporation

|

|

|

|

|

|

|

By:

|

/s/ Silong Chen

|

|

|

Name:

|

Silong Chen

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer) and

Duly Authorized Officer

|

|

|

|

|

|

Dated: June 18, 2019

|

|

|

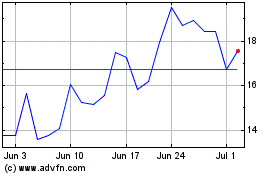

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024