Dogness (International) Corporation (“Dogness” or the “Company”)

(NASDAQ: DOGZ), a developer and manufacturer of pet products in

China, including smart products, hygiene products, health and

wellness products, and leash products, today announced its

unaudited financial results for the first six months of fiscal year

2019 ended December 31, 2018.

First Half of Fiscal Year 2019 Financial Highlights

(compared to prior year period unless stated

otherwise)

- Total sales decreased by 13.5% to $12.8 million from $14.8

million.

- Gross profit decreased by 23.0% to $4.6 million from $6.0

million. Gross margin decreased to 36.1% from 40.5%.

- Income from operations decreased by 97.0% to $0.1 million from

$3.7 million. Operating margin decreased to 0.9% from 25.1%.

- Net income decreased by 75% to $0.7 million from $2.9 million.

Fully diluted net income per share decreased to $0.03 from

$0.18.

Mr. Aaron (Silong) Chen, Chairman and Chief

Executive Officer of Dogness, commented, “Despite the challenges

and uncertainties that we faced due to the ongoing trade disputes

between China and the United States during the first half of fiscal

2019, we were able to maintain our profitability. While we remain

committed to expanding our position in the U.S. market, as

demonstrated by the grand opening of our U.S. headquarters in Texas

in November, we broadened our sales strategy to pursue

opportunities in the growing Chinese domestic market and further

expanded into more countries in Europe. In addition, we increased

sales of higher-margin products in our traditional product

categories and were able to grow sales of our new intelligent pet

products more than eight fold since the previous reporting

period.”

“For the remainder of the fiscal year, we will

continue to adapt to the macro environment while focusing on our

growth through technological innovation, new product development,

international expansion, and strategic partnerships,” concluded Mr.

Chen.

Unaudited Financial Results for the Six Months Ended

December 31, 2018

Revenues

Revenues decreased by approximately $2.0

million, or 13.5%, to $12.8 million for the six months ended

December 31, 2018, from approximately $14.8 million for the same

period of the prior fiscal year. The decrease in revenue was

primarily attributable to a sales volume decrease of 10.3% and a

decrease in average selling price of 3.6% compared to the same

period of fiscal 2018. The decrease in sales volume was mainly due

to the negative impact of a 10% tariff increase during the six

months ended December 31, 2018, on some of the Company’s products

as a result of the trade dispute between China and the United

States. The tariff led to reduced purchase orders from several of

the Company’s major customers located in the United States.

Revenue by geography

| |

|

For the six months ended December 31, |

|

|

|

|

|

|

|

| |

|

2018 |

|

|

2017 |

|

|

|

|

|

|

|

|

Countries |

|

Revenue |

|

|

% of total Revenue |

|

|

Revenue |

|

|

% of total Revenue |

|

|

Variance |

|

|

Variance % |

|

|

China |

|

$ |

8,249,593 |

|

|

64.3 |

% |

|

$ |

7,220,836 |

|

|

48.7 |

% |

|

$ |

1,028,757 |

|

|

14.2 |

% |

| United States |

|

|

2,963,086 |

|

|

23.1 |

% |

|

|

6,071,386 |

|

|

40.9 |

% |

|

|

(3,108,300 |

) |

|

(51.2 |

)% |

| Europe |

|

|

1,260,242 |

|

|

9.8 |

% |

|

|

951,754 |

|

|

6.4 |

% |

|

|

308,488 |

|

|

32.4 |

% |

| Australia |

|

|

110,960 |

|

|

0.9 |

% |

|

|

185,127 |

|

|

1.2 |

% |

|

|

(74,166 |

) |

|

(40.1 |

)% |

| Canada |

|

|

58,353 |

|

|

0.5 |

% |

|

|

92,328 |

|

|

0.6 |

% |

|

|

(33,975 |

) |

|

(36.8 |

)% |

| Central and South America |

|

|

81,927 |

|

|

0.6 |

% |

|

|

103,891 |

|

|

0.7 |

% |

|

|

(21,964 |

) |

|

(21.1 |

)% |

| Japan and other Asian

countries and regions |

|

|

112,490 |

|

|

0.9 |

% |

|

|

207,383 |

|

|

1.4 |

% |

|

|

(94,893 |

) |

|

(45.8 |

)% |

| Total |

|

$ |

12,836,651 |

|

|

100 |

% |

|

$ |

14,832,706 |

|

|

100 |

% |

|

$ |

(1,996,055 |

) |

|

(13.5 |

)% |

The Company’s export sales to the United States decreased

approximately $3.1 million, or 51.2%, during the first half of

fiscal 2019, compared to the same period of fiscal 2018. Due to the

uncertainties and higher tariff created by the trade dispute, the

Company’s major customers in the United States reduced purchase

orders by approximately 1.0 million units, or 19%, compared to the

same period of fiscal 2018.

The Company increased its marketing activities

and sales efforts in the domestic market in the wake of the growing

pet consumption market in China. Sales in China were also supported

by favorable government activity, such as increasing local

enforcement of regulations in which pet owners are required to keep

dogs on leashes. Total sales in the Company’s domestic market

increased by approximately $1.0 million, or 14.2%, compared to the

same period of fiscal 2018.

The Company also expanded its sales channels to

more European countries, such as Germany, Poland, Greece, Bulgaria

and Ireland. The Company’s export sales to Europe increased by

$308,488, or 32.4%, for the six months ended December 31, 2018,

compared to the same period of last year.

The Company’s increase in sales in China and Europe partially

offset the decreased sales in the United States.

Revenue by product category

| |

|

For the six months ended December 31, |

|

|

|

|

|

|

|

| |

|

2018 |

|

|

2017 |

|

|

|

|

|

|

|

|

Product category |

|

Revenue |

|

|

% of total Revenue |

|

|

Revenue |

|

|

% of total Revenue |

|

|

Variance |

|

|

Variance % |

|

|

Pet collars |

|

$ |

3,423,555 |

|

|

26.7 |

% |

|

$ |

5,504,792 |

|

|

37.1 |

% |

|

$ |

(2,081,237 |

) |

|

(37.8 |

)% |

| Pet leashes |

|

|

3,094,754 |

|

|

24.1 |

% |

|

|

3,328,950 |

|

|

22.4 |

% |

|

|

(234,196 |

) |

|

(7.0 |

)% |

| Gift suspenders |

|

|

2,074,218 |

|

|

16.2 |

% |

|

|

1,726,310 |

|

|

11.6 |

% |

|

|

347,908 |

|

|

20.2 |

% |

| Pet harnesses |

|

|

1,875,311 |

|

|

14.6 |

% |

|

|

2,610,480 |

|

|

17.6 |

% |

|

|

(735,169 |

) |

|

(28.2 |

)% |

| Retractable dog leashes |

|

|

762,508 |

|

|

5.9 |

% |

|

|

919,254 |

|

|

6.2 |

% |

|

|

(156,746 |

) |

|

(17.1 |

)% |

| Intelligent pet products |

|

|

568,474 |

|

|

4.4 |

% |

|

|

- |

|

|

- |

|

|

|

568,474 |

|

|

- |

|

| Other pet accessories |

|

|

1,037,831 |

|

|

8.1 |

% |

|

|

742,920 |

|

|

5.0 |

% |

|

|

294,911 |

|

|

39.7 |

% |

| Total |

|

$ |

12,836,651 |

|

|

100.0 |

% |

|

$ |

14,832,706 |

|

|

100.0 |

% |

|

$ |

(1,996,055 |

) |

|

(13.5 |

)% |

The Company’s pet collars, pet leashes, gift

suspenders, and pet harnesses continued to account for the greatest

percentages of total sales. Sales of the Company’s retractable dog

leashes slightly decreased from 6.2% of the Company’s total sales

for the six months ended December 31, 2017, to 5.9% of the

Company’s total sales for the six months ended December 31, 2018,

due to decreased sales volume as affected by reduced export sales

to the United States. The Company launched its intelligent pet

products in March 2018, which accounted for 4.4% of the Company’s

total sales during the first half of fiscal 2019. The Company had

no such sales in the same period of fiscal 2018.

Pet leashes

Revenue from pet leashes decreased by

approximately $0.2 million, or 7.0%, from $3.3 million for the six

months ended December 31, 2017, to $3.1 million for the six months

ended December 31, 2018. The decrease was mainly driven by a 41.0%

decrease in sales volume during the period, which was offset by an

increase in average unit price due to an increase in higher-cost

leather dog leashes being sold. The decrease was due to reduced

purchase orders from major customers located in the United

States.

Pet collars

Revenue from pet collars decreased by

approximately $2.1 million, or 37.8%, from $5.5 million for the six

months ended December 31, 2017, to $3.4 million for the six months

ended December 31, 2018. The decrease in revenue was due to a 41.3%

decrease in sales volume during the six months ended December 31,

2018. The Company’s exports of pet collars decreased 43.9% for the

six months ended December 31, 2018, compared to the prior year

period due to reduced purchase orders from major customers located

in the United States. The average selling price for pet collars

remained consistent compared to the same period of the prior fiscal

year.

Pet harnesses

Revenue from pet harnesses decreased by

approximately $0.7 million, or 28.2%, from $2.6 million for the six

months ended December 31, 2017, to $1.9 million for the six months

ended December 31, 2018. The decrease in revenue was due to a 19.3%

decrease in sales volume during the six months ended December 31,

2018. The Company’s exports of pet harnesses decreased 56.4% for

the six months ended December 31, 2018, compared to the prior year

period due to reduced purchase orders from major customers located

in the United States. The average selling price for pet harnesses

decreased by $0.3 per unit compared to the same period of the prior

fiscal year due to promotional activity.

Gift suspenders

Revenue from gift suspenders increased by

approximately $0.4 million, or 20.2%, from $1.7 million for the six

months ended December 31, 2017, to $2.1 million for the six months

ended December 31, 2018. The increase in revenue was due to a 14.5%

increase in sales volume during the six months ended December 31,

2018. The Company’s export for gift suspender sales increased 60.8%

for the six months ended December 31, 2018, compared to the prior

year period. The average selling price for gift suspenders remained

consistent.

Retractable dog leashes

Revenue from retractable dog leashes decreased

by 17.1%, to approximately $0.8 million during the six months ended

December 31, 2018, from $0.9 million for the six months ended

December 31, 2017. The decrease in revenue was attributable to a

17.6% decrease in the sales volume during the six months ended

December 31, 2018, due to reduced purchase orders from major

customers located in the United States.

Intelligent pet products

Revenue from intelligent pet products amounted

to approximately $0.6 million for the six months ended December 31,

2018, compared to nil for the prior year period. A new product line

launched in March 2018, the Company’s intelligent pet product line

includes app-controlled pet food containers and feeders, pet water

containers and dispensers, and smart pet toys. Compared to other

products, intelligent pet products typically have higher selling

prices. The Company intends to focus on new, smart, and innovative

pet products and expect the sales of intelligent pet products to

continue to increase in the near future.

Other pet accessories

Other pet accessories include various comfort

wrap harnesses, pet muzzles, metal chain traffic leashes, pet belt

and ropes, and others, which are normally customized to fulfill

customers’ purchase orders. Revenue from other pet accessories

increased by 39.7%, to approximately $1 million during the six

months ended December 31, 2018, from $0.7 million for the six

months ended December 31, 2017. The increase in revenue was

attributable to a 57.0% increase in the sales volume.

Sales to related party

During the six months ended December 31, 2018,

the Company invested RMB 2.0 million to eventually acquire 10% of

the ownership interest in Dogness Network Technology Co., Ltd

(“Dogness Network”) in order to develop new products and new

technologies in smart pet tech. The Company sold certain

intelligent pet products to Dogness Network and accordingly

reported related party sales of $206,052, which accounted for 1.6%

of the Company’s total revenue for the six months ended December

31, 2018. There were no such related party sales in the prior year

period.

Gross profit

During the six months ended December 31, 2018,

gross profit decreased by approximately $1.4 million to

approximately $4.6 million, from approximately $6.0 million in the

same period of the prior fiscal year. The decrease was primarily

attributable to the decreased sales volume of the Company’s pet

leashes, pet collars, pet harnesses, and retractable dog leashes,

in addition to increased cost of revenue due to an increase in

sales of pet leashes and pet collars made of higher-cost leather

materials. Overall gross profit margin was 36.1%, a decrease of

4.4%, compared to 40.5% in the prior year period.

Gross profit by product

category

| |

|

For the six months ended December 31, |

|

|

|

|

|

|

|

| |

|

2018 |

|

|

2017 |

|

|

|

|

|

|

|

|

Product category |

|

Gross profit |

|

|

Gross profit % |

|

|

Gross profit |

|

|

Gross profit % |

|

|

Variance in Gross profit |

|

|

Variance in Gross profit % |

|

|

Pet collars |

|

$ |

1,256,541 |

|

|

36.7 |

% |

|

$ |

2,282,617 |

|

|

41.5 |

% |

|

$ |

(1,026,076 |

) |

|

(4.8 |

)% |

| Pet leashes |

|

|

1,134,887 |

|

|

36.7 |

% |

|

|

1,285,758 |

|

|

38.6 |

% |

|

|

(150,871 |

) |

|

(1.9 |

)% |

| Pet harnesses |

|

|

735,971 |

|

|

39.2 |

% |

|

|

1,112,320 |

|

|

42.6 |

% |

|

|

(376,349 |

) |

|

(3.4 |

)% |

| Gift suspenders |

|

|

678,785 |

|

|

32.7 |

% |

|

|

699,399 |

|

|

40.5 |

% |

|

|

(20,614 |

) |

|

(7.8 |

)% |

| Retractable dog leashes |

|

|

324,192 |

|

|

42.5 |

% |

|

|

342,809 |

|

|

37.3 |

% |

|

|

(18,617 |

) |

|

5.2 |

% |

| Intelligent pet products |

|

|

196,171 |

|

|

34.5 |

% |

|

|

- |

|

|

- |

|

|

|

196,171 |

|

|

34.5 |

% |

| Other pet accessories |

|

|

302,045 |

|

|

29.1 |

% |

|

|

291,252 |

|

|

39.2 |

% |

|

|

10,793 |

|

|

(10.1 |

)% |

| Total |

|

$ |

4,628,592 |

|

|

36.1 |

% |

|

$ |

6,014,155 |

|

|

40.5 |

% |

|

$ |

(1,385,563 |

) |

|

(4.4 |

)% |

Gross margins for pet leashes, pet collars, and

gift suspenders decreased by 1.9%, 4.8% and 7.8%, respectively,

compared to the same period in fiscal 2018. Raw material costs

increased in conjunction with the increase in production of more

leather products instead of fabric products. Salary expenses also

increased due to higher labor costs.

Gross margins for pet harnesses and other pet

accessories decreased by 3.4% and 10.1%, respectively, compared to

the same period in fiscal 2018. The decrease was mainly due to

lower average unit selling prices as part of promotional

activity.

The gross margin for retractable dog leashes

increased by 5.2% compared to the same period in fiscal 2018. The

increase was mainly a result of improved materials and

functionality of the Company’s retractable dog leash products,

which reduced the cost of production per unit.

Gross margin for the Company’s intelligent pet

products was 34.5% during the six months ended December 31, 2018,

as expected.

Selling expenses

Selling expenses primarily included expenses

incurred for participating in various trade shows to promote

product sales, salary and sales commission expenses paid to the

Company’s sales personnel, customs clearance charges for product

exports, and shipping and delivery expenses. Selling expenses

increased by $0.6 million, or 117.1%, from $0.5 million for the six

months ended December 31, 2017, to $1.1 million for the six months

ended December 31, 2018. As a percentage of sales, selling expenses

were 9.0% and 3.6% of total revenues for the six months ended

December 31, 2018 and 2017, respectively.

General and administrative

expenses

General and administrative expenses increased by

approximately $1.2 million, or 78.2%, from approximately $1.6

million for the six months ended December 31, 2017, to

approximately $2.8 million for the six months ended December 31,

2018. The increase was mainly due to increased salaries of

approximately $0.3 million due to higher labor costs and increased

public company related fees such as auditing fees, IR fees, legal

counsel fees, capital market advisory fees, as well as notarization

fees. In addition, the Company incurred approximately $700,000 in

one-time expenses in connection with its U.S. headquarters. As a

percentage of sales, general and administrative expenses were 22.0%

and 10.7% of total revenues for the six months ended December 31,

2018 and 2017, respectively.

Research and development

expenses

Research and development expenses increased by

approximately $0.3 million, or 216.2%, from approximately $0.2

million for the six months ended December 31, 2017, to

approximately $0.5 million for the six months ended December 31,

2018. As a percentage of sales, research and development expenses

were 4.2% and 1.1% of total revenues for the six months ended

December 31, 2018 and 2017, respectively. The increase was due to

the Company’s continued efforts to develop cutting edge smart

products as well as to improve some of the functions and exterior

designs of the Company’s existing products in order to meet

customer demand. The Company expects such expenses to continue to

increase as research and development activities increase.

Other income (expense)

Other income (expense) primarily included

interest income or expense and foreign exchange gain or loss. For

the six months ended December 31, 2018, other income was

approximately $0.9 million compared to an expense of $0.3 million

for the same period of the prior fiscal year. Other income was

comprised of a foreign exchange gain of $0.5 million due to

favorable USD, Euro, and other currency exchange rates against the

RMB on the Company’s foreign currency denominated account

receivable and $0.4 million in interest income from the Company’s

short-term investments.

Income tax

Income tax expense decreased by approximately

$0.3 million for the six months ended December 31, 2018, or 35.6%,

from approximately $0.5 million for the six months ended December

31, 2017, to approximately $0.3 million for the six months ended

December 31, 2018. The decrease was consistent with the decrease in

the Company’s taxable income for the six months ended December 31,

2018.

Net income

Net income was approximately $726 thousand for

the first half of fiscal 2019, a decrease of $2.2 million from $2.9

million in the same period of the prior fiscal year.

Cash and cash flows

As of December 31, 2018, the Company cash and

cash equivalents of approximately $3.2 million. Net cash used in

operating activities was $3.6 million. Net cash provided by

investing activities was $2.0 million. Net cash used in financing

activities was $1.7 million.

Recent developments

In January 2019, the Company entered into two

lease agreements to lease one property with building areas of 4439

square meters and a piece of land of 191 square meters located in

Tongsha Industry Zone, Dongcheng District, Dongguan, China. The

leased building and land will provide additional administration

office spaces and parking space for the Company’s subsidiary

Dongguan Jiasheng.

About Dogness

Dogness (International) Corporation was born in

2003 from the belief that pet dogs and cats are important,

well-loved family members. Through its smart products, hygiene

products, health and wellness products, and leash products, Dogness

is able to simplify pet lifestyles, make them more scientific, and

enhance the relationship between pets and pet caregivers. The

Company ensures industry-leading quality through its fully

integrated vertical supply chain and world-class research and

development capabilities, which has resulted in over 100 patents

and patents pending. Dogness products reach families worldwide

through global chain stores and distributors. For more information,

please visit: ir.dognesspet.com.

Forward Looking Statements

No statement made in this press release should

be interpreted as an offer to purchase or sell any security. Such

an offer can only be made in accordance with the Securities Act of

1933, as amended, and applicable state securities laws. Certain

statements in this press release concerning our future growth

prospects are forward-looking statements regarding our future

business expectations intended to qualify for the “safe harbor”

under the Private Securities Litigation Reform Act of 1995, which

involve a number of risks and uncertainties that could cause actual

results to differ materially from those in such forward-looking

statements. The risks and uncertainties relating to these

statements include, but are not limited to, risks and uncertainties

regarding our ability to raise capital on any particular terms,

fluctuations in earnings, fluctuations in foreign exchange rates,

our ability to manage growth, our ability to realize revenue from

expanded operation and acquired assets in China and the U.S., our

ability to attract and retain highly skilled professionals, client

concentration, industry segment concentration, reduced demand for

technology in our key focus areas, our ability to successfully

complete and integrate potential acquisitions, and unauthorized use

of our intellectual property and general economic conditions

affecting our industry. Additional risks that could affect our

future operating results are more fully described in our United

States Securities and Exchange Commission filings. These filings

are available at www.sec.gov. Dogness may, from time to time, make

additional written and oral forward-looking statements, including

statements contained in the Company's filings with the Securities

and Exchange Commission and our reports to shareholders. In

addition, please note that any forward-looking statements contained

herein are based on assumptions that we believe to be reasonable as

of the date of this press release. The Company does not undertake

to update any forward-looking statements that may be made from time

to time by or on behalf of the Company unless it is required by

law.

Contacts:

ICR, Inc.

Rose Zu

Tel: +1-646-588-0383

Email: ir@dognesspet.com

| |

| UNAUDITED

CONDENSED CONSOLIDATED FINANCIAL

DATA Unaudited Condensed Consolidated Balance

Sheets (In USD) |

| |

|

|

|

As of |

|

|

|

December 31, 2018 |

|

June 30, 2018 |

|

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

Cash |

|

$ |

3,202,532 |

|

|

|

$ |

7,085,235 |

|

|

Short-term investments |

|

|

17,479,325 |

|

|

|

|

28,233,035 |

|

|

Accounts receivable, net |

|

|

6,036,343 |

|

|

|

|

5,641,501 |

|

|

Accounts receivable - related parties |

|

|

238,364 |

|

|

|

|

- |

|

|

Inventories, net |

|

|

5,673,259 |

|

|

|

|

4,153,583 |

|

|

Due from related party |

|

|

8,982 |

|

|

|

|

- |

|

|

Prepayments and other current assets |

|

|

1,203,611 |

|

|

|

|

1,105,783 |

|

|

Total current assets |

|

|

33,842,416 |

|

|

|

|

46,219,137 |

|

|

|

|

|

|

|

|

|

|

|

Long term investments |

|

|

471,224 |

|

|

|

|

- |

|

|

Long term prepayment |

|

|

4,107,550 |

|

|

|

|

- |

|

|

Property, plant and equipment, net |

|

|

26,843,483 |

|

|

|

|

20,950,685 |

|

|

Intangible assets, net |

|

|

2,313,381 |

|

|

|

|

2,390,571 |

|

|

Deferred tax assets |

|

|

30,927 |

|

|

|

|

22,297 |

|

|

TOTAL ASSETS |

|

$ |

67,608,981 |

|

|

|

$ |

69,582,690 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Short-term bank loans |

|

$ |

2,923,498 |

|

|

|

$ |

4,835,200 |

|

|

Accounts payable |

|

|

1,267,039 |

|

|

|

|

351,375 |

|

|

Accounts payable - related party |

|

|

104,975 |

|

|

|

|

- |

|

|

Advance from customers |

|

|

178,888 |

|

|

|

|

240,216 |

|

|

Accrued liabilities and other payable |

|

|

624,488 |

|

|

|

|

1,120,579 |

|

|

Taxes payable |

|

|

2,565,193 |

|

|

|

|

2,295,788 |

|

|

Total current liabilities |

|

|

7,664,081 |

|

|

|

|

8,843,158 |

|

|

|

|

|

|

|

|

|

|

|

Commitments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Shares, $0.002 par

value, 100,0000,0000 shares authorized, 25,913,631 and 15,000,0000

issued and outstanding at December 31, 2018 and June 30, 2018,

respectively |

|

|

|

|

|

|

|

| Class A Common

Shares |

|

|

33,689 |

|

|

|

|

33,689 |

|

| Class B Common

Shares |

|

|

18,138 |

|

|

|

|

18,138 |

|

| Additional paid-in

capital |

|

|

52,486,018 |

|

|

|

|

52,144,891 |

|

|

Statutory reserves |

|

|

164,367 |

|

|

|

|

164,367 |

|

|

Retained earnings |

|

|

10,989,789 |

|

|

|

|

10,263,198 |

|

|

Accumulated other comprehensive (deficit) |

|

|

(3,747,101 |

) |

|

|

|

(1,884,751 |

) |

|

Total stockholders’ equity |

|

|

59,944,900 |

|

|

|

|

60,739,532 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

67,608,981 |

|

|

|

$ |

69,582,690 |

|

Unaudited Condensed Consolidated

Statement ofIncome and Other Comprehensive Income

(Loss)(In USD)

| |

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended December 31, |

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

12,630,599 |

|

|

|

$ |

14,832,705 |

|

|

|

Revenues - related parties |

|

|

206,052 |

|

|

|

|

- |

|

|

|

Total Revenues |

|

|

12,836,651 |

|

|

|

|

14,832,705 |

|

|

|

Cost of revenues |

|

|

(8,208,059 |

) |

|

|

|

(8,818,550 |

) |

|

|

Gross Profit |

|

|

4,628,592 |

|

|

|

|

6,014,155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

1,155,750 |

|

|

|

|

532,287 |

|

|

|

General and administrative expenses |

|

|

2,821,646 |

|

|

|

|

1,583,049 |

|

|

|

Research and development expenses |

|

|

538,680 |

|

|

|

|

170,387 |

|

|

|

Total operating expenses |

|

|

4,516,076 |

|

|

|

|

2,285,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

112,516 |

|

|

|

|

3,728,432 |

|

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

Interest income (expenses), net |

|

|

400,104 |

|

|

|

|

(153,154 |

) |

|

|

Foreign transaction exchange gain (loss) |

|

|

526,745 |

|

|

|

|

(175,053 |

) |

|

|

Other income, net |

|

|

16,322 |

|

|

|

|

1,506 |

|

|

|

Total other income (expense) |

|

|

943,171 |

|

|

|

|

(326,701 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

1,055,678 |

|

|

|

|

3,401,731 |

|

|

|

Provision for income taxes |

|

|

329,096 |

|

|

|

|

511,010 |

|

|

|

Net income |

|

|

726,591 |

|

|

|

|

2,890,721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

|

|

(1,862,350 |

) |

|

|

|

364,042 |

|

|

|

Comprehensive income (loss) |

|

$ |

(1,135,759 |

) |

|

|

$ |

3,254,763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per share - Basic and Diluted |

|

$ |

0.03 |

|

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding - Basic and diluted |

|

|

25,913,631 |

|

|

|

|

15,775,285 |

|

|

| Unaudited

Condensed Consolidated Statements of Cash Flows

(In USD) |

| |

|

|

|

For the Six Months Ended December 31, |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net income |

|

$ |

726,591 |

|

|

|

$ |

2,890,721 |

|

|

Adjustments to reconcile net income to net cash |

|

|

|

|

|

|

|

|

(used in) provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

643,777 |

|

|

|

|

576,755 |

|

|

Share based compensation for services |

|

|

341,127 |

|

|

|

|

- |

|

|

Changes in inventory reserve |

|

|

(4,747 |

) |

|

|

|

(18,735 |

) |

|

Recovery of doubtful account |

|

|

(38,609 |

) |

|

|

|

(33,593 |

) |

|

Deferred tax expenses (benefit) |

|

|

(9,498 |

) |

|

|

|

9,730 |

|

|

Unrealized foreign exchange gain |

|

|

68,314 |

|

|

|

|

123,823 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(878,054 |

) |

|

|

|

(885,680 |

) |

|

Inventories |

|

|

(1,037,754 |

) |

|

|

|

(2,319,591 |

) |

|

Prepayments and other assets |

|

|

(4,258,776 |

) |

|

|

|

(28,083 |

) |

|

Accounts payables |

|

|

1,036,739 |

|

|

|

|

1,110,063 |

|

|

Accrued expenses and other liabilities |

|

|

(467,613 |

) |

|

|

|

2,461,702 |

|

|

Advance from customers |

|

|

(52,411 |

) |

|

|

|

(196,510 |

) |

|

Taxes payable |

|

|

356,989 |

|

|

|

|

452,151 |

|

|

Net cash (used in) provided by operating

activities |

|

|

(3,573,926 |

) |

|

|

|

4,142,753 |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Additions to property, plant and equipment |

|

|

(7,268,272 |

) |

|

|

|

(819,309 |

) |

|

Long-term investments |

|

|

(471,224 |

) |

|

|

|

- |

|

|

Purchase of intangible assets |

|

|

(22,031 |

) |

|

|

|

- |

|

|

Proceeds upon maturity of short-term investments |

|

|

9,715,318 |

|

|

|

|

- |

|

|

Net cash provided by (used in) investing

activities |

|

|

1,953,791 |

|

|

|

|

(819,309 |

) |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Net Proceeds from initial public offering |

|

|

- |

|

|

|

|

50,200,285 |

|

|

Repayment of short-term bank loans |

|

|

(1,734,102 |

) |

|

|

|

(918,660 |

) |

|

Repayment of related party loans |

|

|

(9,045 |

) |

|

|

|

(736,894 |

) |

|

Net cash (used in) provided by financing

activities |

|

|

(1,743,147 |

) |

|

|

|

48,544,731 |

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

|

(519,421 |

) |

|

|

|

(18,861 |

) |

|

Net increase (decrease) in cash |

|

|

(3,882,703 |

) |

|

|

|

51,849,314 |

|

|

Cash, beginning of period |

|

|

7,085,235 |

|

|

|

|

1,504,596 |

|

|

Cash, end of period |

|

$ |

3,202,532 |

|

|

|

$ |

53,353,910 |

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure information: |

|

|

|

|

|

|

|

|

Cash paid for income tax |

|

$ |

16,751 |

|

|

|

$ |

40,624 |

|

|

Cash paid for interest |

|

$ |

55,993 |

|

|

|

$ |

154,479 |

|

|

|

|

|

|

|

|

|

|

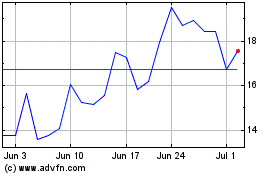

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024