Current Report Filing (8-k)

June 02 2020 - 4:55PM

Edgar (US Regulatory)

0001261333--01-31FALSE00012613332020-05-292020-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________

FORM 8-K

______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 29, 2020

Commission File Number: 001-38465

______________________________________

DOCUSIGN, INC.

(Exact name of registrant as specified in its charter)

______________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

|

91-2183967

|

|

|

(State or Other Jurisdiction of Incorporation)

|

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

|

221 Main St. Suite 1550

San Francisco, California 94105

(Address of Principal Executive Offices)

(415) 489-4940

(Registrant's Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

DOCU

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

(b)

John Hinshaw and Louis J. Lavigne, Jr. completed their terms as Class II directors and did not stand for re-election to the Board of Directors (the “Board”) of DocuSign, Inc. (the “Company”) at the Company’s Annual Meeting of Stockholders held on May 29, 2020 (the “Annual Meeting”). Mr. Hinshaw served as a member of the Audit Committee of the Board (the “Audit Committee”) and Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”), and Mr. Lavigne served as a member of the Audit Committee and Compensation Committee of the Board. Neither Mr. Hinshaw’s nor Mr. Lavigne’s decision not to stand for re-election was a result of any disagreement with the Company on any matters related to the Company’s operations, policies or practices.

(d)

On May 29, 2020, following the recommendation of the Nominating Committee and after the conclusion of the Annual Meeting, the Board appointed Teresa Briggs to fill an existing vacancy on the Board to serve as a director of the Company, effective May 29, 2020. Ms. Briggs will serve as a Class I director whose term will expire at the Company’s 2022 Annual Meeting of Stockholders, which is the next stockholder meeting at which Class I directors will be elected, and until Ms. Briggs’s successor shall have been duly elected and qualified, or until Ms. Briggs’s earlier death, resignation, disqualification or removal. The Board also appointed Ms. Briggs to serve as a member of the Audit Committee, effective May 29, 2020. The Board determined that Ms. Briggs qualifies as an independent director pursuant to the Securities Act of 1933, as amended (the “Securities Act”) and the listing standards of the Nasdaq Stock Market, meets the further audit committee standards required by SEC Rule 10A-3, and is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K of the Securities Act.

There is no arrangement or understanding between Ms. Briggs and any other person pursuant to which Ms. Briggs was selected as a director. Ms. Briggs has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. Ms. Briggs will receive compensation for her service as a member of the Board in accordance with the Company’s Amended and Restated Director Compensation Program.

Ms. Briggs has also entered into the Company’s standard form of indemnity agreement, which is attached as Exhibit 10.2 to the Company’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission on March 28, 2018 (File No. 333-223990).

Item 5.03 Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 29, 2020, the Board amended and restated the Company’s bylaws (the “Amended and Restated Bylaws”) to, among other things, add and clarify provisions with respect to the process for stockholders to make nominations for election to the Board and submit stockholder proposals other than with respect to nominations for election to the Board.

Pursuant to Section 5(b)(i) of the Amended and Restated Bylaws, a stockholder proponent making a nomination for election to the Board must include in a written notice delivered to the Company as set forth in the Amended and Restated Bylaws, in addition to the existing requirements, (i) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among such proponent or any of its respective affiliates and associates, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, on the other hand, and (ii) a completed and signed questionnaire, representation and agreement meeting the requirements of Section 5(g) of the Amended and Restated Bylaws.

Section 5(b)(ii) of the Amended and Restated Bylaws provides that (other than proposals sought to be included in the Company’s proxy materials) for a stockholder proposal relating to business other than nominations for the election to the Board, the stockholder proponent must include in a written notice delivered to the Company as set forth in the Amended and Restated Bylaws, in addition to the existing requirements, (i) a description of all agreements, arrangements and understandings between or among any such proponent and any of its respective affiliates or associates, on the one hand, and any other person or persons, on the other hand (including their names), in connection with the proposal of such business by such proponent and (ii) the information required by Section 5(b)(iv) of the Amended and Restated Bylaws.

Section 5(b)(iv) of the Amended and Restated Bylaws further provides that the written notices required by Section 5(b)(i) and (ii) must include, in addition to the existing requirements, (i) all information that would be required to be set forth in a Schedule 13D filed pursuant to Rule 13d-1(a) or an amendment pursuant to Rule 13d-2(a) if such a statement were required to be filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations promulgated thereunder by such proponent stockholder, (ii) any other material relationship between such proponent stockholder

and the Company or any competitor of the Company, (iii) any other information relating to such proponent stockholder that would be required to be disclosed in a proxy statement or other filing required to be made in connection with solicitations of proxies or consents by such proponent stockholder pursuant to Section 14(a) under the Exchange Act and the rules and regulations thereunder, (iv) such proponent stockholder’s written consent to the public disclosure of information provided to the Company pursuant to Section 5(b) and (v) any proxy, contract, arrangement, or relationship pursuant to which the proponent stockholder has a right to vote, directly or indirectly, any shares of any security of the Company.

New Section 5(g) of the Amended and Restated Bylaws provides that any person proposed to be nominated must deliver to the Company’s Secretary a completed and signed questionnaire in the form required by the Company with respect to the background and qualification of such person to serve as a director of the Company and the background of any other person or entity on whose behalf the nomination is being made, as well as a signed representation and agreement regarding, among other things, voting commitments and/or compensation arrangements with respect to such person and agreement to comply with applicable laws, regulations and Company policies.

Section 20 of the Amended and Restated Bylaws provide that directors may only be removed as provided by the Company’s Certificate of Incorporation and applicable law.

The Board also approved other amendments for general consistency and administrative clarity.

The foregoing summary and description of the provisions of the Amended and Restated Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended and Restated Bylaws, a copy of which is filed as Exhibit 3.1 with this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

At the Annual Meeting, there were present, in person or by proxy, holders of 165,460,826 shares of common stock, or approximately 90.39% of the total outstanding shares entitled to vote at the Annual Meeting, which constituted a quorum for the transaction of business. The holders present voted on the three proposals presented at the Annual Meeting as follows:

Proposal One – Election of Directors

The Company’s stockholders approved the election of two directors, each to serve for a three-year term expiring at the 2023 Annual Meeting of Stockholders and until such director’s successor is elected and qualified, by the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

Votes For

|

|

Votes Withheld

|

|

Broker Non-Votes

|

|

Cynthia Gaylor

|

|

93,722,583

|

|

38,823,726

|

|

32,914,517

|

|

S. Steven Singh

|

|

92,992,462

|

|

39,551,478

|

|

32,916,886

|

Proposal Two – Advisory Vote on the Frequency of Future Non-Binding Votes on Our Named Executive Officers’ Compensation

The Company’s stockholders approved, on an advisory basis, a frequency of one year of future non-binding votes on the compensation of the Company’s named executive officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

2 Years

|

|

3 Years

|

|

Abstentions

|

|

Broker Non-Votes

|

|

131,287,416

|

|

89,094

|

|

854,780

|

|

311,935

|

|

32,917,601

|

Based on these results and consistent with the Company’s recommendation, the Board has determined that the Company will conduct future advisory votes regarding the compensation of its named executive officers once every year. This policy will remain in effect until the next stockholder vote on the frequency of advisory votes on the compensation of named executive officers, which is expected to be held at the Company’s 2026 Annual Meeting of Stockholders.

Proposal Three – Ratification of Selection of Independent Public Registered Accounting Firm

The Company’s stockholders ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered accounting firm for the fiscal year ending January 31, 2021 by the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

163,522,160

|

|

1,636,018

|

|

295,608

|

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

3.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: June 2, 2020

|

|

|

|

|

|

|

|

|

|

|

|

DOCUSIGN, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Trâm Phi

|

|

|

|

Trâm Phi

|

|

|

|

Senior Vice President, General Counsel

|

|

|

|

|

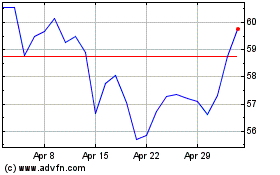

DocuSign (NASDAQ:DOCU)

Historical Stock Chart

From Mar 2024 to Apr 2024

DocuSign (NASDAQ:DOCU)

Historical Stock Chart

From Apr 2023 to Apr 2024