1. NATURE OF OPERATIONS AND BASIS OF PRESENTATION

A. Nature of Operations

Duluth Holdings Inc. (“Duluth Trading” or the “Company”), a Wisconsin corporation, is a lifestyle brand of men’s and women’s casual wear, workwear and accessories sold exclusively through the Company’s own direct and retail channels. The Company’s products are marketed under the Duluth Trading brand, with the majority of products being exclusively developed and sold as Duluth Trading branded merchandise.

The Company has historically identified two operating segments, direct and retail. The direct segment, consisting of the Company’s website and catalogs, offers products nationwide. In 2010, the Company initiated its omnichannel platform with the opening of its first store. Since then, Duluth Trading has expanded its retail presence, and as of August 2, 2020, the Company operated 59 retail stores and three outlet stores. The Company identifies its operating segments according to how its business activities are managed and evaluated. The Company continues to grow its omnichannel distribution network which allows the consumer to interact with the Company through a consistent customer experience whether on the Company website or at Company stores. As the Company expands its distribution network, and in conjunction with assessing the similar nature of products sold, production process, distribution process, target customers and economic characteristics between the two segments, the Company determined that the historical structure of separate reporting segments for direct and retail was no longer representative. Therefore, as of February 3, 2020, the Company updated its segment reporting to one reportable external segment, consistent with the Company’s omnichannel business approach. The Company’s revenues generated outside the United States were insignificant.

The Company has two classes of authorized common stock: Class A common stock and Class B common stock. The rights of holders of Class A common stock and Class B common stock are identical, except for voting and conversion rights. Each share of Class A common stock is entitled to ten votes per share and is convertible at any time into one share of Class B common stock. Each share of Class B common stock is entitled to one vote per share. The Company’s Class B common stock trades on the NASDAQ Global Select Market under the symbol “DLTH.”

B. Basis of Presentation

The condensed consolidated financial statements are prepared in accordance with U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). The Company consolidates TRI Holdings, LLC (“TRI”) as a variable interest entity (see Note 6 “Variable Interest Entity” for further information). All significant intercompany balances and transactions have been eliminated in consolidation.

The Company’s fiscal year ends on the Sunday nearest to January 31 of the following year. Fiscal 2020 is a 52-week period and ends on January 31, 2021. Fiscal 2019 was a 52-week period and ended on February 2, 2020. The three and six months of fiscal 2020 and fiscal 2019 represent the Company’s 13 and 26-week periods ended August 2, 2020 and August 4, 2019, respectively.

The accompanying condensed consolidated financial statements as of and for the three and six months ended August 2, 2020 and August 4, 2019 have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) and, in the opinion of the Company, include all adjustments (which are normal and recurring in nature) necessary to present fairly the financial position, results of operations and cash flows of the Company for the interim periods presented. Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such SEC rules and regulations as of and for the three and six months ended August 2, 2020 and August 4, 2019. These interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in the Company’s annual report on Form 10-K for the fiscal year ended February 2, 2020.

C. COVID-19

In March 2020, a novel strain of coronavirus (“COVID-19”) was declared a global pandemic by the World Health Organization. This pandemic has negatively affected the U.S. and global economies, disrupted global supply chains and financial markets, led to significant travel and transportation restrictions, including mandatory business closures and orders to shelter in place. The Company’s business operations and financial performance for the three and six months ended August 2, 2020 were impacted by COVID-19. These impacts are discussed within these notes to the condensed consolidated financial statements.

The ultimate impact of COVID-19 on our operational and financial performance still depends on future developments outside of our control. Given the uncertainty, we cannot reasonably estimate the continued impact on our business and whether that impact will be different than what we have already experienced.

D. Impairment Analysis

The Company determined that the effects of COVID-19 may represent indicators of asset impairment, and as a result, performed interim impairment assessments for the Company’s intangible assets, long-lived assets and goodwill at May 3, 2020. Due to the nature of the Company’s intangible assets balance, the Company concluded that no indicators of impairment were present. In the first fiscal quarter of 2020, the Company performed undiscounted cash flow analyses on certain long-lived assets, including retail stores at the individual store level and determined that the estimated undiscounted future cash flows exceeded the net carrying values. The Company also performed an additional qualitative assessment of goodwill as of May 3, 2020 and determined that it was more likely than not that the fair value of these assets was greater than their carrying value.

Based on these assessments, the Company concluded that no impairment losses had been incurred. However, the Company cannot predict the future impact or duration of the negative effect of COVID-19 and as a result, cannot reasonably predict the probability or amount of impairment losses that may be incurred in future periods.

There were no triggering events or long-lived asset impairments charges recorded for the three months ended August 2, 2020.

E. Inventory Valuation

Inventory, consisting of purchased product, is valued at the lower of cost and net realizable value, under the first-in, first-out method. The significant estimates used in inventory valuation are obsolescence (including excess and slow-moving inventory and lower of cost or market reserves) and estimates of inventory shrinkage. Both estimates have calculations that require the Company to make assumptions and apply judgement regarding a number of factors, including market conditions, the selling environment, historical results and current inventory trends. Inventory is adjusted periodically to reflect current market conditions, which requires management’s judgement that may significantly affect the ending inventory valuation, as well as gross margin.

The reserve for inventory shrinkage is adjusted to reflect the trend of historical physical inventory count results. The Company performs its retail store physical inventory counts in July and the difference between actual and estimated shrinkage, recorded in Cost of goods sold, may cause fluctuations in second fiscal quarter results.

F. Other Assets, net

Other assets, net includes goodwill, loan origination fees, trade names, security deposits and prepaid expenses. Goodwill was $0.4 million as of August 2, 2020 and February 2, 2020. The Company’s other intangible asset, net of accumulated amortization was $0.3 million as of August 2, 2020 and February 2, 2020. Accumulated amortization was $0.3 million as of August 2, 2020 and February 2, 2020.

G. Seasonality of Business

The Company’s business is affected by the pattern of seasonality common to most apparel businesses. Historically, the Company has recognized a significant portion of its revenue and operating profit in the fourth fiscal quarter of each year as a result of increased sales during the holiday season.

H. Restricted Cash and Reconciliation of cash and cash equivalents and restricted cash to the condensed statement of cash flows

The Company’s restricted cash is held in escrow accounts and is used to pay a portion of the construction loans entered into by third party landlords (the “Landlords”) in connection with the Company’s retail store leases. The restricted cash is disbursed based on the escrow agreements entered into by and among the Landlords, the Company and the escrow agent.

The Company considers short-term investments with original maturities of three months or less when purchased to be cash equivalents. Amounts receivable from credit card issuers are typically converted to cash within 2 to 4 days of the original sales transaction and are considered to be cash equivalents.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of the financial condition and results of our operations should be read in conjunction with the financial statements and related notes of Duluth Holdings Inc. included in Item 1of this Quarterly Report on Form 10-Q and with our audited financial statements and the related notes included in our Annual Report on Form 10-K for the fiscal year ended February 2, 2020 (“2019 Form 10-K”).

The Company’s fiscal year ends on the Sunday nearest to January 31 of the following year. Fiscal 2020 is a 52-week period and ends on January 31, 2021. Fiscal 2019 was a 52-week period and ended on February 2, 2020. The three and six months of fiscal 2020 and fiscal 2019 represent our 13 and 26-week periods ended August 2, 2020 and August 4, 2019, respectively.

Unless the context indicates otherwise, the terms the “Company,” “Duluth,” “Duluth Trading,” “we,” “our,” or “us” are used to refer to Duluth Holdings Inc.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. All statements other than statements of historical or current facts included in this Quarterly Report on Form 10-Q are forward-looking statements. Forward looking statements refer to our current expectations and projections relating to our financial condition, results of operations, plans, objectives, strategies, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “could,” “estimate,” “expect,” “project,” “plan,” “potential,” “intend,” “believe,” “may,” “might,” “will,” “objective,” “should,” “would,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected earnings, revenue, costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties, including the risks and uncertainties described under Part I, Item 1A “Risk Factors,” in our 2019 Form 10-K, Part II, Item 1A “Risk Factors” in our first quarter Form 10-Q and in this report on Form 10-Q and other SEC filings, which factors are incorporated by reference herein. These risks and uncertainties include, but are not limited to, the following: adverse changes in the economy or business conditions, including the adverse effects of the COVID-19 pandemic; prolonged effects of the COVID-19 on store traffic and disruptions to our distribution network, supply chains and operations; our ability to maintain and enhance a strong brand image; our ability to successfully open new stores; effectively adapting to new challenges associated with our expansion into new geographic markets; generating adequate cash from our existing stores to support our growth; the inability to maintain the performance of a maturing store portfolio; the impact of changes in corporate tax regulations; identifying and responding to new and changing customer preferences; the success of the locations in which our stores are located; our ability to attract and retain customers in the various retail venues and locations in which our stores are located; competing effectively in an environment of intense competition; our ability to adapt to significant changes in sales due to the seasonality of our business; price reductions or inventory shortages resulting from failure to purchase the appropriate amount of inventory in advance of the season in which it will be sold; natural disasters, unusually adverse weather conditions, boycotts and unanticipated events; increases in costs of fuel or other energy, transportation or utility costs and in the costs of labor and employment; failure of our information technology systems to support our current and growing business, before and after our planned upgrades; and other factors that may be disclosed in our SEC filings or otherwise. Moreover, we operate in an evolving environment, new risk factors and uncertainties emerge from time to time and it is not possible for management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. We qualify all of our forward-looking statements by these cautionary statements.

We undertake no obligation to update or revise these forward-looking statements, except as required under the federal securities laws.

Overview

We are a lifestyle brand of men’s and women’s casual wear, workwear and accessories sold exclusively through our own omnichannel platform. We offer products nationwide through our website and catalog. In 2010, we initiated our omnichannel platform with the opening of our first store. Since then, we have expanded our retail presence, and as of August 2, 2020, we operated 59 retail store and three outlet stores.

We offer a comprehensive line of innovative, durable and functional products, such as our Longtail T® shirts, Buck NakedTM underwear, Fire Hose® work pants, and No-Yank® Tank, which reflect our position as the Modern, Self-Reliant American Lifestyle brand. Our brand has a heritage in workwear that transcends tradesmen and appeals to a broad demographic for everyday and on-the-job use.

From our heritage as a catalog for those working in the building trades, Duluth Trading has become a widely recognized brand and proprietary line of innovative and functional apparel and gear. Over the last decade, we have created strong brand awareness, built a loyal customer base and generated robust sales momentum. We have done so by sticking to our roots of “there’s gotta be a better way” and through our relentless focus on providing our customers with quality, functional products.

A summary of our financial results is as follows:

Net sales in fiscal 2020 second quarter increased by 12.6% over the prior year second quarter to $137.4 million, and net sales in the first six months of fiscal 2020 increased by 4.7% over the first six months of the prior year to $247.3 million;

Net income of $5.9 million in fiscal 2020 second quarter compared to the prior year second quarter net income of $1.9 million and net loss in the first six months of fiscal 2020 of $9.2 million compared to the net loss in the first six months of fiscal 2019 of $5.6 million; and

Adjusted EBITDA increased by 75.3% to $16.8 million in fiscal 2020 second quarter compared to the prior year second quarter Adjusted EBITDA of $9.6 million and adjusted EBITDA in the first six months of fiscal 2020 increased by 9.6% over the first six months of the prior year to $5.2 million.

See “Reconciliation of Net Income to EBITDA and EBITDA to Adjusted EBITDA” section for a reconciliation of our net income to EBITDA and EBITDA to Adjusted EBITDA, both of which are non-U.S. GAAP financial measures. See also the information under the heading “Adjusted EBITDA” in the section “How We Assess the Performance of Our Business” for our definition of Adjusted EBITDA.

Our business is seasonal, and as a result, our net sales fluctuate from quarter to quarter, which often affects the comparability of our results between quarters. Net sales are historically higher in the fourth quarter of our fiscal year due to the holiday selling season.

With an emphasis on profitability we are pursuing several strategies to continue our growth, including building brand awareness to continue customer acquisition, continuing selective retail expansion, selectively broadening assortments in certain men’s product categories and growing our women’s business.

We continue to grow our omnichannel distribution network which allows the consumer to interact with us through a consistent customer experience whether on the company website or at company stores. As we expand our distribution network, and in conjunction with assessing the similar nature of products sold, production process, distribution process, target customers and economic characteristics between our sales channels, we have determined that the historical structure of separate reporting segments for direct and retail was no longer representative of the way in which we manage our business. Therefore, as of February 3, 2020, we have updated our segment reporting to one reportable external segment, consistent with our omnichannel business approach.

Our management’s discussion and analysis includes market sales metrics for our retail stores, website and catalog sales. Market areas are determined by a third-party that divides the United States and Puerto Rico into 280 unique geographical areas. Our store market sales metrics include sales from our retail stores, website and catalog. Our non-store market sales metrics include sales from our website and catalog.

COVID-19

In March 2020, a novel strain of coronavirus (“COVID-19”) was declared a global pandemic by the World Health Organization. This pandemic has negatively affected the U.S. and global economies, disrupted global supply chains and financial markets, led to significant travel and transportation restrictions, including mandatory business closures and orders to shelter in place.

The Company has focused on protecting the health and safety of our employees, customers and suppliers, working with our customers, landlords, suppliers and vendors to minimize potential disruptions and supporting our community, while managing our business in these unprecedented times. The Company took the following significant actions during the first fiscal quarter as a response to the pandemic:

Beginning March 20, 2020 temporarily closed all stores for a period of seven weeks;

Made operational changes to accommodate social distancing within our distribution centers;

Made work from home accommodations for corporate employees;

Amended our Credit Agreement to include an incremental delayed draw term loan of $20.5 million and amended the loan covenants to provide greater flexibility during peak borrowing periods in fiscal 2020;

Partnered with landlords, suppliers and vendors to materially reduce costs, extend payment terms and cancel merchandise receipts;

Initiated furloughs of varying lengths with benefits intact for 68% of salaried staff;

Began a six-month pay reduction for senior leadership ranging from 10 to 20 percent;

The Company’s Chief Executive Officer (“CEO”) agreed to temporarily forgo his base salary starting March 22, 2020 through the end of fiscal 2020;

Reduced planned capital spend levels by 50% primarily by decreasing new store openings to four in fiscal 2020; and

Partnered with the American Red Cross to donate a portion of proceeds on key apparel items.

While the business environment and above actions have impacted our results for the first half of the fiscal year, our strong brand awareness and loyal customer base were evident by a continued surge in direct sales and improved profitability during the second fiscal quarter. As of June 15, 2020, all of our 62 retail stores have re-opened in some capacity, but prolonged COVID-19 safety concerns are expected to keep store traffic at subdued levels through fiscal 2020. In light of the Company’s better than expected year-to-date performance, the Board of Directors has decided to reinstate the Company’s CEO’s base salary effective October 19, 2020. Senior leadership’s pay reduction will also expire as originally planned on October 19, 2020.

The ultimate impact of COVID-19 on our operational and financial performance still depends on future developments outside of our control, including the duration and spread of the pandemic and related actions taken by federal, state and local government officials, and international governments to prevent disease spread. Given the uncertainty, we cannot reasonably estimate store traffic patterns and the prolonged impact on overall consumer demand. We continue to actively evaluate all federal, state and local regulations to ensure compliance with store operations.

How We Assess the Performance of Our Business

In assessing the performance of our business, we consider a variety of financial and operating measures that affect our operating results.

Net Sales

Net sales reflect our sale of merchandise plus shipping and handling revenue collected from our customers, less returns and discounts. Direct-to-consumer sales are recognized upon shipment of the product and retail store sales are recognized at the point of sale. We also use net sales as one of the key financial metrics in determining our annual bonus compensation for our employees. The shipping thresholds allocated to us by our primary delivery provider, United Parcel Service (“UPS”), may not be sufficient for anticipated sales volume in the third and fourth quarter, which may affect our sales. We are considering adding additional shipping partners to mitigate these constraints on our shipping capacity.

Gross Profit

Gross profit is equal to our net sales less cost of goods sold. Gross profit as a percentage of our net sales is referred to as gross margin. Cost of goods sold includes the direct cost of purchased merchandise; inventory shrinkage; inventory adjustments due to obsolescence, including excess and slow-moving inventory and lower of cost and net realizable reserves; inbound freight; and freight from our distribution centers to our retail stores. The primary drivers of the costs of individual goods are raw material costs. Depreciation and amortization are excluded from gross profit. We expect gross profit to increase to the extent that we successfully grow our net sales. Given the size of our sales through our direct-to-consumer sales channel relative to our total net sales, shipping and handling revenue has had a significant impact on our gross profit and gross profit margin. Historically, this revenue has partially offset shipping and handling expense included in selling, general and administrative expenses. We have experienced declines in shipping and handling revenues, and this trend is expected to continue. Declines in shipping and handling revenues may have a material adverse effect on our gross profit and gross profit margin, as well as Adjusted EBITDA to the extent there are not commensurate declines, or if there are increases, in our shipping and handling expense. Our gross profit may not be comparable to other retailers, as we do not include distribution network and store occupancy expenses in calculating gross profit, but instead we include them in selling, general and administrative expenses.

Selling, General and Administrative Expenses

Selling, general and administrative expenses include all operating costs not included in cost of goods sold. These expenses include all payroll and payroll-related expenses and occupancy expenses related to our stores and to our operations at our headquarters, including utilities, depreciation and amortization. They also include marketing expense, which primarily includes television advertising, catalog production, mailing and print advertising costs, as well as all logistics costs associated with shipping product to our customers, consulting and software expenses and professional services fees. Selling, general and administrative expenses as a percentage of net sales is usually higher in lower-volume quarters and lower in higher-volume quarters because a portion of the costs are relatively fixed.

Our historical sales growth has been accompanied by increased selling, general and administrative expenses. The most significant components of these increases are advertising, marketing, rent/occupancy and payroll costs. While we expect these expenses to increase as we continue to open new stores, increase brand awareness and grow our organization to support our growing business, we believe these expenses will decrease as a percentage of sales over time. Our shipping and handling expenses are also expected to increase in the third and fourth quarter, in part because of additional surcharges during our peak holiday shopping season due to the expected strained distribution network. Management is considering adding additional shipping partners and working closely with UPS to mitigate the effect of these surcharges.

Adjusted EBITDA

We believe Adjusted EBITDA is a useful measure of operating performance, as it provides a clearer picture of operating results by excluding the effects of financing and investing activities by eliminating the effects of interest and depreciation costs and eliminating expenses that are not reflective of underlying business performance. We use Adjusted EBITDA to facilitate a comparison of our operating performance on a consistent basis from period-to-period and to provide for a more complete understanding of factors and trends affecting our business.

We define Adjusted EBITDA as consolidated net income (loss) before depreciation and amortization, interest expense and provision for income taxes adjusted for the impact of certain items, including non-cash and other items we do not consider representative of our ongoing operating performance. We believe Adjusted EBITDA is less susceptible to variances in actual performance resulting from depreciation, amortization and other items.

Results of Operations

The following table summarizes our unaudited consolidated results of operations for the periods indicated, both in dollars and as a percentage of net sales.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

|

|

|

August 2, 2020

|

|

August 4, 2019

|

|

August 2, 2020

|

|

August 4, 2019

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

137,375

|

|

$

|

121,963

|

|

$

|

247,292

|

|

$

|

236,207

|

|

|

Cost of goods sold (excluding depreciation and amortization)

|

|

|

64,903

|

|

|

57,159

|

|

|

122,488

|

|

|

110,485

|

|

|

Gross profit

|

|

|

72,472

|

|

|

64,804

|

|

|

124,804

|

|

|

125,722

|

|

|

Selling, general and administrative expenses

|

|

|

62,680

|

|

|

61,069

|

|

|

133,986

|

|

|

132,091

|

|

|

Operating income (loss)

|

|

|

9,792

|

|

|

3,735

|

|

|

(9,182)

|

|

|

(6,369)

|

|

|

Interest expense

|

|

|

1,778

|

|

|

1,203

|

|

|

3,128

|

|

|

1,631

|

|

|

Other (loss) income, net

|

|

|

(250)

|

|

|

(8)

|

|

|

(191)

|

|

|

196

|

|

|

Income (loss) before income taxes

|

|

|

7,764

|

|

|

2,524

|

|

|

(12,501)

|

|

|

(7,804)

|

|

|

Income tax expense (benefit)

|

|

|

1,866

|

|

|

678

|

|

|

(3,220)

|

|

|

(2,005)

|

|

|

Net income (loss)

|

|

|

5,898

|

|

|

1,846

|

|

|

(9,281)

|

|

|

(5,799)

|

|

|

Less: Net loss attributable to noncontrolling interest

|

|

|

(43)

|

|

|

(90)

|

|

|

(87)

|

|

|

(163)

|

|

|

Net income (loss) attributable to controlling interest

|

|

$

|

5,941

|

|

$

|

1,936

|

|

$

|

(9,194)

|

|

$

|

(5,636)

|

|

|

Percentage of Net sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

|

100.0

|

%

|

|

100.0

|

%

|

|

100.0

|

%

|

|

100.0

|

%

|

|

Cost of goods sold (excluding depreciation and amortization)

|

|

|

47.2

|

%

|

|

46.9

|

%

|

|

49.5

|

%

|

|

46.8

|

%

|

|

Gross margin

|

|

|

52.8

|

%

|

|

53.1

|

%

|

|

50.5

|

%

|

|

53.2

|

%

|

|

Selling, general and administrative expenses

|

|

|

45.6

|

%

|

|

50.1

|

%

|

|

54.2

|

%

|

|

55.9

|

%

|

|

Operating income (loss)

|

|

|

7.1

|

%

|

|

3.1

|

%

|

|

(3.7)

|

%

|

|

(2.7)

|

%

|

|

Interest expense

|

|

|

1.3

|

%

|

|

1.0

|

%

|

|

1.3

|

%

|

|

0.7

|

%

|

|

Other (loss) income, net

|

|

|

(0.2)

|

%

|

|

-

|

%

|

|

(0.1)

|

%

|

|

0.1

|

%

|

|

Income (loss) before income taxes

|

|

|

5.7

|

%

|

|

2.1

|

%

|

|

(5.1)

|

%

|

|

(3.3)

|

%

|

|

Income tax expense (benefit)

|

|

|

1.4

|

%

|

|

0.6

|

%

|

|

(1.3)

|

%

|

|

(0.8)

|

%

|

|

Net income (loss)

|

|

|

4.3

|

%

|

|

1.5

|

%

|

|

(3.8)

|

%

|

|

(2.5)

|

%

|

|

Less: Net loss attributable to noncontrolling interest

|

|

|

-

|

%

|

|

(0.1)

|

%

|

|

-

|

%

|

|

(0.1)

|

%

|

|

Net income (loss) attributable to controlling interest

|

|

|

4.3

|

%

|

|

1.6

|

%

|

|

(3.7)

|

%

|

|

(2.4)

|

%

|

Three Months Ended August 2, 2020 Compared to Three Months Ended August 4, 2019

Net Sales

Net sales increased $15.4 million, or 12.6%, to $137.4 million in the three months ended August 2, 2020 compared to $122.0 million in the three months ended August 4, 2019. The increase was primarily due to an increase in non-store market sales slightly offset by a decrease in store market sales.

Non-store market sales increased $17.3 million, or 58.6%, to $46.8 million in the three months ended August 2, 2020 compared to $29.5 million in the three months ended August 4, 2019. The increase was driven by an increase in digital advertising to promote our Mother’s Day, Father’s Day and online warehouse clearance events. Store market sales decreased $1.6 million, or 1.8%, to $89.2 million in the three months ended August 2, 2020 compared to $90.9 million in the three months ended August 4, 2019. The decrease was due to the temporary closure of stores that continued from the first fiscal quarter until they re-opened beginning in the first week of May through the third week of June, partially offset by an increase in existing customers shifting from buying in-store to buying online.

Gross Profit

Gross profit increased $7.7 million, or 11.8%, to $72.5 million in the three months ended August 2, 2020 compared to $64.8 million in the three months ended August 4, 2019. As a percentage of net sales, gross margin decreased to 52.8% of net sales in the three months ended August 2, 2020, compared to 53.1% of net sales in the three months ended August 4, 2019. The decrease in gross margin rate was driven by promotional, clearance and sitewide sales events to continue moving inventory during the period of slower store traffic and uncertainty in customer demand. The decrease was partially offset by reduced store

delivery costs from lower store sales volumes, lower product returns as well as favorable retail physical inventory count results during the three months ended August 2, 2020 as compared to the three months ended August 4, 2019.

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased $1.6 million, or 2.6%, to $62.7 million in the three months ended August 2, 2020 compared to $61.1 million in the three months ended August 4, 2019. Selling, general and administrative expenses as a percentage of net sales decreased to 45.6% in the three months ended August 2, 2020, compared to 50.1% in the three months ended August 4, 2019. The positive leverage was primarily due to shifting to a more efficient digital marketing approach as customer purchasing patterns migrated to online.

The increase in selling, general and administrative expense was due to increased shipping costs to support website sales, higher retail overhead costs driven by new store growth and increased depreciation expense associated with investments in technology, partially offset by reduced catalog spend and national TV advertising.

Income Tax Expense

Income tax expense was $1.9 million in the three months ended August 2, 2020, compared to $0.7 million in the three months ended August 4, 2019. Our effective tax rate related to controlling interest was 24% for the three months ended August 2, 2020 compared to 26% for the three months ended August 4, 2019.

Net Income

Net income was $5.9 million, in the three months ended August 2, 2020 compared to net income of $1.9 million in the three months ended August 4, 2019, primarily due to the factors discussed above.

Six Months Ended August 2, 2020 Compared to Six Months Ended August 4, 2019

Net Sales

Net sales increased $11.1 million, or 4.7%, to $247.3 million in the six months ended August 2, 2020 compared to $236.2 million in the six months ended August 4, 2019. The increase was primarily due to an increase in non-store market sales slightly offset by a decrease in store market sales.

Non-store market sales increased $25.9 million, or 41.7%, to $88.2 million in the six months ended August 2, 2020 compared to $62.3 million in the six months ended August 4, 2019. The increase was also primarily driven by an increase in digital advertising to promote our Mother’s Day, Father’s Day, online warehouse clearance and global sales events, coupled with extended free shipping offers. Store market sales decreased $14.2 million, or 8.3%, to $156.4 million in the six months ended August 2, 2020 compared to $170.6 million in the six months ended August 4, 2019. The decrease was due to the temporary closure of all stores beginning on March 20, 2020 until they re-opened beginning in the first week of May through the third week of June, partially offset by an increase in existing customers shifting from buying in-store to buying online.

Gross Profit

Gross profit decreased $0.9 million, or 0.7%, to $124.8 million in the six months ended August 2, 2020 compared to $125.7 million in the six months ended August 4, 2020. As a percentage of net sales, gross margin decreased to 50.5% of net sales in the six months ended August 2, 2020, compared to 53.2% of net sales in the six months ended August 4, 2019. The decrease in gross margin rate was driven by promotional events, extending clearance events and sitewide sales events to continue moving inventory during the period of store closures and uncertainty in customer demand.

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased $1.9 million, or 1.4%, to $134.0 million in the six months ended August 2, 2020 compared to $132.1 million in the six months ended August 4, 2019. Selling, general and administrative expenses as a percentage of net sales decreased to 54.2% in the six months ended August 2, 2020, compared to 55.9% in the six months ended August 4, 2019.

The drivers of the increase in selling, general and administrative expense were consistent with those for the three months ended August 2, 2020.

Income Tax Benefit

Income tax benefit was $3.2 million in the six months ended August 2, 2020, compared to $2.0 million in the six months ended August 4, 2019. Our effective tax rate related to controlling interest was 26% for both the six months ended August 2, 2020, and six months ended August 4, 2019, respectively.

Net Loss

Net loss was $9.2 million, in the six months ended August 2, 2020 compared to $5.6 million in the six months ended August 4, 2019, primarily due to the factors discussed above.

Reconciliation of Net Income (Loss) to EBITDA and EBITDA to Adjusted EBITDA

The following table presents reconciliations of net income (loss) to EBITDA and EBITDA to Adjusted EBITDA, both of which are non-U.S. GAAP financial measures, for the periods indicated below. See the above section titled “How We Assess the Performance of Our Business,” for our definition of Adjusted EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

|

|

August 2, 2020

|

|

August 4, 2019

|

|

August 2, 2020

|

|

August 4, 2019

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

5,898

|

|

$

|

1,846

|

|

$

|

(9,281)

|

|

$

|

(5,799)

|

|

Depreciation and amortization

|

|

|

6,603

|

|

|

5,013

|

|

|

13,292

|

|

|

9,405

|

|

Interest expense

|

|

|

1,778

|

|

|

1,203

|

|

|

3,128

|

|

|

1,631

|

|

Amortization of build-to-suit operating leases

capital contribution

|

|

|

198

|

|

|

265

|

|

|

397

|

|

|

479

|

|

Income tax expense (benefit)

|

|

|

1,866

|

|

|

678

|

|

|

(3,220)

|

|

|

(2,005)

|

|

EBITDA

|

|

$

|

16,343

|

|

$

|

9,005

|

|

$

|

4,316

|

|

$

|

3,711

|

|

Stock based compensation

|

|

|

418

|

|

|

555

|

|

|

881

|

|

|

1,029

|

|

Adjusted EBITDA

|

|

$

|

16,761

|

|

$

|

9,560

|

|

$

|

5,197

|

|

$

|

4,740

|

As a result of the factors discussed above in the “Results of Operations” section, Adjusted EBITDA increased $7.2 million, or 75.3%, to $16.8 million in the three months ended August 2, 2020 compared to $9.6 million in the three months ended August 4, 2019. As a percentage of net sales, Adjusted EBITDA increased to 12.2% of net sales in the three months ended August 2, 2020 compared to 7.8% of net sales in the three months ended August 4, 2019.

As a result of the factors discussed above in the “Results of Operations” section, Adjusted EBITDA increased $0.5 million, or 9.6%, to $5.2 million in the six months ended August 2, 2020 compared to $4.7 million in the six months ended August 4, 2019. As a percentage of net sales, Adjusted EBITDA increased to 2.1% of net sales in the six months ended August 2, 2020 compared to 2.0% of net sales in the six months ended August 4, 2019.

Liquidity and Capital Resources

General

Our business relies on cash from operating activities and a credit facility as our primary sources of liquidity. Our primary cash needs have been for inventory, marketing and advertising, payroll, store leases, capital expenditures associated with opening new stores, infrastructure and information technology. The most significant components of our working capital are cash, inventory, accounts payable and other current liabilities. At August 2, 2020, our net working capital was $117.7 million, including $19.0 million of cash and cash equivalents.

We continue to expect to spend approximately $15.0 million in fiscal 2020 on capital expenditures, which is a 50% reduction from the beginning of the fiscal year plan. Capital expenditures includes a total of approximately $8.0 million for new retail store expansion and point of sale upgrades. We expect capital expenditures of approximately $2.0 million and starting inventory of $0.5 million to open a new store. Due to the seasonality of our business, a significant amount of cash from operating activities is generated during the fourth quarter of our fiscal year. During the first three quarters of our fiscal year, we typically are net users of cash in our operating activities as we acquire inventory in anticipation of our peak selling season, which occurs in the fourth quarter of our fiscal year. We also use cash in our investing activities for capital expenditures throughout all four quarters of our fiscal year.

We believe that our cash flow from operating activities and the availability of cash under our credit facility will be sufficient to cover working capital requirements and anticipated capital expenditures for the foreseeable future.

Cash Flow Analysis

A summary of operating, investing and financing activities is shown in the following table.

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

|

|

|

|

August 2, 2020

|

|

August 4, 2019

|

|

(in thousands)

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

$

|

(12,802)

|

|

$

|

(8,045)

|

|

Net cash used in investing activities

|

|

|

(9,135)

|

|

|

(16,713)

|

|

Net cash provided by financing activities

|

|

|

38,865

|

|

|

27,829

|

|

Increase in cash, cash equivalents and restricted cash

|

|

$

|

16,928

|

|

$

|

3,071

|

Net Cash used in Operating Activities

Operating activities consist primarily of net income adjusted for non-cash items that include depreciation and amortization, stock-based compensation and the effect of changes in operating assets and liabilities.

While our cash flows from operations for the six months ended August 2, 2020 is negative, due in part to COVID-19 and in part to the seasonal nature of our business, we expect cash flows from operations for the full year fiscal 2020 to be positive based on operating performance and seasonal reductions in working capital during the fourth quarter of our fiscal year, which is consistent with previous full fiscal years.

For the six months ended August 2, 2020, net cash used in operating activities was $12.8 million, which consisted of net loss of $9.3 million and cash used in operating assets and liabilities of $21.3 million, partially offset by non-cash depreciation and amortization of $13.3 million, stock based compensation of $0.9 million and deferred income taxes of $3.3 million. The cash used in operating assets and liabilities of $21.3 million primarily consisted of a $19.7 million increase in inventory, primarily due to building of inventory for our peak season, partially offset by a $2.6 million decrease in prepaid expenses and other current assets and a $3.4 million increase in trade accounts payable.

For the six months ended August 4, 2019, net cash used in operating activities was $8.0 million, which primarily consisted of net loss of $5.8 million and cash used in operating assets and liabilities of $12.0 million, partially offset by non-cash depreciation and amortization of $9.4 million and stock based compensation of $1.0 million. The cash used in operating assets and liabilities of $12.0 million primarily consisted of a $17.2 million increase in inventory, primarily due to the increase in the number of retail stores and building of inventory for our peak season, a $10.8 million increase in trade accounts payable due to timing of payments, a $7.1 million decrease in accrued expenses and deferred rent obligations, and a $1.9 million decrease in deferred catalog costs due to a reduction in catalog circulation.

Net Cash Used in Investing Activities

Investing activities consist primarily of capital expenditures for growth related to new store openings and information technology.

For the six months ended August 2, 2020, net cash used in investing activities was $9.1 million and was primarily driven by capital expenditures of $8.8 million for new retail stores, as well as investments in information technology.

For the six months ended August 4, 2019, net cash used in investing activities was $16.7 million and was primarily driven by capital expenditures of $13.8 million for new retail stores and retail store build-out, as well as investments in information technology, and $3.0 million of capital contributions towards our build-to-suit stores.

Net Cash Provided by Financing Activities

Financing activities consist primarily of borrowings and payments related to our revolving line of credit and other long-term debt, as well as payments on finance lease obligations.

For the six months ended August 2, 2020, net cash provided by financing activities was $38.9 million, primarily consisting of proceeds of $29.5 million, net from our term loan and proceeds of $10.7 million, net from our revolving line of credit to fund working capital.

For the six months ended August 4, 2019, net cash provided by financing activities was $27.8 million, primarily consisting of proceeds of $28.5 million, net from our revolving line of credit to fund working capital.

Line of Credit

On May 17, 2018, we entered into a credit agreement (the “Credit Agreement”) which provides for borrowings of up to $80.0 million on a revolving line of credit and an additional $50.0 million in a delayed draw term loan. The $80.0 million revolving line of credit matures on May 17, 2023 and we had the option to draw in various amounts on the $50.0 million term loan through May 17, 2020, with a maturity on May 17, 2023. On April 30, 2020, the Credit Agreement was amended to include an incremental delayed draw term loan of $20.5 million that is available to draw upon before March 31, 2021, and matures on April 29, 2021, for a total credit facility of $150.5 million.

As of August 2, 2020 and for the six months then ended, the Company was in compliance with all financial and non-financial covenants for all debts discussed above and expects to be in compliance for the remainder of fiscal 2020.

Contractual Obligations

There have been no significant changes to our contractual obligations as described in our Annual Report on Form 10-K for the fiscal year ended February 2, 2020.

Off-Balance Sheet Arrangements

We are not a party to any material off-balance sheet arrangements.

Critical Accounting Policies and Critical Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses, as well as the related disclosures of contingent assets and liabilities at the date of the financial statements. We evaluate our accounting policies, estimates, and judgments on an on-going basis. We base our estimates and judgments on historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions and conditions and such differences could be material to the consolidated financial statements.

As of the date of this filing, there were no significant changes to any of the critical accounting policies and estimates described in our 2019 Form 10-K, except as discussed below.

Recently Adopted Accounting Pronouncements

On February 3, 2020, we adopted authoritative guidance related to accounting for costs of implementation activities performed in a cloud computing arrangement that is a service contract and elected the prospective transition. As such, the comparative prior period information has not been restated and continues to be reported under the accounting standards in effect for those periods. Beginning with the first quarter of fiscal 2020, our financial results reflect adoption of the standard.

See Note 1 “Nature of Operations and Basis of Presentation,” of Notes to Condensed Consolidated Financial Statements included in Part 1, Item 1, of this quarterly report on Form 10-Q for further information regarding recently adopted accounting pronouncements.

Recent Accounting Pronouncements

See Note 12 “Recent Accounting Pronouncements,” of Notes to Condensed Consolidated Financial Statements included in Part 1, Item 1, of this quarterly report on Form 10-Q for information regarding recent accounting pronouncements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There have been no significant changes in the market risks described in our 2019 Form 10-K. See Note 3 “Debt and Line of Credit,” of Notes to Condensed Consolidated Financial Statements included in Part 1, Item 1, of this quarterly report on Form 10-Q, for disclosure on our interest rate related to borrowings under our credit agreement.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Section 13a-15(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires management of an issuer subject to the Exchange Act to evaluate, with the participation of the issuer’s principal executive and principal financial officers, or persons performing similar functions, the effectiveness of the issuer’s disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act), as of the end of each fiscal quarter. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that, as of such date, our disclosure controls and procedures were effective.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting (as defined in Rule 13a-15(d) and 15d-15(d) under the Exchange Act) that occurred during the period covered by this Quarterly Report on Form 10-Q that have materially affected, or are reasonably likely to materially affect our internal control over financial reporting.

There were no material impacts, due to COVID-19 and the resulting need to close our books remotely, on our ability to maintain internal control over financial reporting and disclosure controls and procedures for the six months ended August 2, 2020.

PART II. OTHER INFORMATION

Item 1. Legal Proceedings

From time to time, we are subject to certain legal proceedings and claims in the ordinary course of business. We are not presently party to any legal proceedings the resolution of which we believe would have a material adverse effect on our business, financial condition, operating results or cash flows. We establish reserves for specific legal matters when we determine that the likelihood of an unfavorable outcome is probable and the loss is reasonably estimable.

Item 1A. Risk Factors

We operate in a rapidly changing environment that involves a number of risks that may have a material adverse effect on our business, financial condition and results of operations. For a detailed discussion of the risks that affect our business, please refer to the section entitled “Risk Factors” in our 2019 Form 10-K, our first quarter fiscal 2020 Form 10-Q or other SEC filings. There have been no material changes to our risk factors as previously disclosed in our fiscal 2019 Annual Report on Form 10-K or first quarter fiscal 2020 Form 10-Q, except as discussed below.

The Coronavirus pandemic may continue to adversely affect our business operations, store traffic, employee availability, financial condition, liquidity and cash flow for an extended period of time.

The outbreak of the Coronavirus (“COVID-19”) continues to affect our business operations and it is impossible to predict the effect and ultimate impact of the COVID-19 pandemic as the situation is rapidly evolving.

As the pandemic continues, consumer fear about becoming ill with the virus and recommendations and/or mandates from federal, state and local authorities to avoid large gatherings of people or self-quarantine may continue to increase, which may continue to adversely affect traffic to our stores, results in further reduced store hours or result in store closures. Ongoing significant reductions in customer visits to, and spending at, our stores caused by COVID-19 would result in further loss of retail sales and profits and other material adverse effects.

The extent of the impact of COVID-19 on our business, financial results, liquidity and cash flows will depend largely on future developments, including new information that may emerge concerning the severity and action taken to contain or prevent further spread within the U.S. and the related impact on consumer confidence and spending, all of which are highly uncertain and cannot be predicted.

If the COVID-19 outbreak and the corresponding surge in online purchasing persists for an extended period of time, we expect there will be significant and material disruptions to our distribution network. In particular, our primary delivery provider, UPS, has increased surcharges and provided shipping thresholds that may not be sufficient based on potential volume during our peak holiday shopping season. As a result of greater competition for shipping capacity, our efforts to mitigate these reduced thresholds by engaging additional shipping partners may not be successful or may result in similar surcharges. Constraints on our shipping capacity and higher shipping costs may result in higher expenses, delayed shipments and lost sales that may have a material adverse effect on our business and results of operations.

These and other potential impacts of COVID-19, could therefore materially and adversely affect our business, financial condition and results of operations.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

We did not sell any equity securities during the quarter ended August 2, 2020, which were not registered under the Securities Act.

The following table contains information of shares acquired from employees in lieu of amounts required to satisfy minimum tax withholding requirements upon the vesting of the employees’ restricted stock during the three months ended August 2, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total number

|

|

Approximate dollar

|

|

|

|

|

|

|

|

|

of shares purchased

|

|

value of shares that

|

|

|

|

Total number

|

|

|

|

|

as part of publicly

|

|

may yet to be

|

|

|

|

of shares

|

|

Average price

|

|

announced plans

|

|

purchased under the

|

|

Period

|

|

purchased

|

|

paid per share

|

|

or programs

|

|

plans or programs

|

|

May 4, 2020 - May 31, 2020

|

|

7,669

|

|

$

|

3.87

|

|

—

|

|

$

|

—

|

|

June 1, 2020 - July 5, 2020

|

|

132

|

|

|

7.36

|

|

—

|

|

|

—

|

|

July 6, 2020 - August 2, 2020

|

|

4,939

|

|

|

7.44

|

|

—

|

|

|

—

|

|

Total

|

|

12,740

|

|

$

|

6.22

|

|

—

|

|

$

|

—

|

Item 6. Exhibits

EXHIBIT INDEX

|

|

|

|

*

|

Filed herewith

|

|

**

|

In accordance with Regulation S-T, the XBRL-related information in Exhibit 101 to this Quarterly Report on Form 10-Q shall be deemed to be “furnished” and not “filed.”

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

Date: September 4, 2020

|

|

|

|

DULUTH HOLDINGS INC.

(Registrant)

|

|

|

|

/s/ DAVID LORETTA

|

|

|

|

David Loretta

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

(On behalf of the Registrant and as Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

|

|

/s/ MICHAEL MURPHY

|

|

|

|

Michael Murphy

|

|

|

|

Vice President and Chief Accounting Officer

|

|

|

|

(On behalf of the Registrant and as Principal Accounting Officer)

|

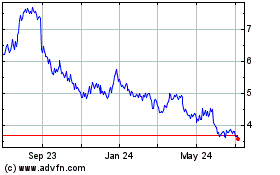

Duluth (NASDAQ:DLTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

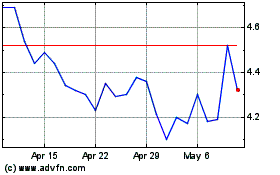

Duluth (NASDAQ:DLTH)

Historical Stock Chart

From Apr 2023 to Apr 2024