Filed Pursuant to Rule 424(b)(5)

Registration No. 333-222847

The information contained in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 16, 2019

PRELIMINARY PROSPECTUS SUPPLEMENT

(To the Prospectus dated February 12, 2018)

DOLPHIN ENTERTAINMENT, INC.

Shares of Common Stock

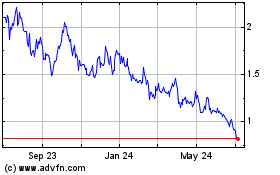

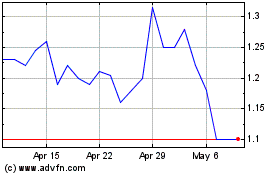

We are offering shares of our common stock, $0.015 par value per share. Our shares of common stock are listed on the Nasdaq Capital Market under the symbol “DLPN.” On October 15, 2019, the last reported sale price of our common stock on the Nasdaq Capital Market was $0.76.

In offering securities by means of this prospectus supplement and the accompanying base prospectus, we are relying on General Instruction I.B.6 of Form S-3, which limits the amount of securities we can sell pursuant to the registration statement to one-third of the market value of our common stock held by non-affiliates, or our public float, in any 12-month period. On the date of this prospectus supplement, our public float was $10,822,987, based on the closing sale price of our common stock of $1.08 on August 23, 2019. We have not offered any securities pursuant to General Instruction I.B.6 during the 12-month period ending on, and including, the date of this prospectus supplement.

We have engaged Maxim Group LLC to act as sole underwriter for this offering. See “Underwriting” on page S-10.

Investing in our securities involves significant risks. See the risks described in the “Risk Factors” section on page S-5 in this prospectus supplement, and in the documents incorporated by reference into this prospectus supplement and the base prospectus, respectively.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discount (1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

———————

(1)

In addition, we have agreed to reimburse the underwriter for certain expenses up to an aggregate amount of (i) $55,000 if we receive gross proceeds from the offering less than or equal to $2,500,000 or (ii) $60,000 if we receive gross proceeds from the offering greater than $2,500,000. See “Underwriting” for additional disclosure regarding total underwriter compensation.

We have granted the underwriter the option for a period of 45 days to purchase additional shares of common stock at the public offering price, less underwriting discount, set forth above, solely to cover over-allotments, if any.

The underwriter expects to deliver our shares to purchasers in the offering on or about October , 2019.

MAXIM GROUP LLC

The date of this prospectus supplement is October , 2019

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the underwriter has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus or in any documents incorporated by reference herein or therein is accurate only as of the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS

All references to the terms “Dolphin,” the “Company,” “we,” “us” or “our” in this prospectus supplement refer to Dolphin Entertainment, Inc. and its consolidated subsidiaries, unless the context requires otherwise.

This prospectus supplement and the accompanying base prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “Commission” or the “SEC”) utilizing the Commission’s “shelf” registration rules. This document consists of two parts, this prospectus supplement, which provides you with specific information about this offering, and the base prospectus, which provides more general information, some of which may not apply to this offering. When we refer in this prospectus supplement to the term “this prospectus,” we are referring collectively to this prospectus supplement, the base prospectus and any free-writing prospectus we may utilize pursuant to Rule 433 of the Securities Act of 1933, as amended (the “Securities Act”).

This prospectus supplement and the documents incorporated herein may add, update or change information contained in the base prospectus. To the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the base prospectus, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the base prospectus. You should read carefully this prospectus supplement, the base prospectus and the additional information described under the headings “Where You Can Find More Information,” and “Incorporation of Certain Information by Reference” before making an investment decision.

You should rely only on the information contained in or incorporated by reference to this prospectus supplement and the base prospectus relating to the offering described in this prospectus supplement. We have not authorized any person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it.

You should not assume that the information in this prospectus supplement, the base prospectus or any documents we incorporate by reference herein or therein is accurate as of any date other than the respective dates on the front cover of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

We are not offering or selling the shares of common stock offered hereby in any jurisdiction or to any person if such offer or sale is not permitted by applicable law, rule or regulation.

S-ii

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents and information incorporated by reference herein and therein may contain “forward-looking statements.” Forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies as well as statements, other than historical facts, that address activities, events, or developments that we intend, expect, project, believe or anticipate will or may occur in the future. These statements are often characterized by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “goal” or “continue” or the negative of these terms or other similar expressions.

Forward-looking statements are based on assumptions and assessments made in light of our experience and perception of historical trends, current conditions, expected future developments and other factors believed to be appropriate. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which are outside of our control. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this prospectus, and we undertake no obligation to update these forward-looking statements in the future, except as required by applicable law.

Factors could cause actual results to differ materially from those indicated by the forward-looking statements include those factors described under the caption “Risk Factors” in this prospectus supplement and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, which is incorporated by reference in this prospectus supplement, and under similar headings in our subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, as well as the other risks and uncertainties described in the other documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

S-iii

|

|

|

|

|

|

|

|

|

PROSPECTUS SUPPLEMENT SUMMARY

This summary description highlights selected information contained elsewhere in this prospectus supplement, or in the information incorporated by reference in this prospectus supplement or the base prospectus. This summary does not contain all of the information you should consider in making your decision whether to invest in our securities. You should read carefully this entire prospectus supplement and the accompanying prospectus, including each of the documents incorporated herein or therein by reference, before making an investment decision. When we use the terms “Dolphin,” the “Company,” “we,” “us” or “our” in this prospectus, we are referring to Dolphin Entertainment, Inc. and its consolidated subsidiaries, unless the context requires otherwise.

OUR COMPANY

Overview

We are a leading independent entertainment marketing and premium content development company. Through our subsidiaries, 42West LLC (“42 West”) and The Door Marketing Group LLC (“The Door”), we provide expert strategic marketing and publicity services to many of the top brands, both individual and corporate, in the entertainment and hospitality industries. The Door and 42West are both recognized global leaders in the PR services for the industries they serve. Through our subsidiary, Viewpoint Computer Animation Incorporated (“Viewpoint”), we have added full-service creative branding and production capabilities to our marketing group. Dolphin’s legacy content production business, founded by Emmy-nominated Chief Executive Officer, Bill O’Dowd, has produced multiple feature films and award-winning digital series, primarily aimed at the family and young adult markets. We produce original feature films and digital programming primarily aimed at the family and young adult markets.

Entertainment Publicity and Marketing

42West

Through 42West, an entertainment public relations agency, we offer talent publicity, entertainment (motion picture and television) marketing and strategic communications services. Prior to its acquisition by us, 42West grew to become one of the largest independently-owned public relations firms in the entertainment industry. As such, we believe that 42West has served, and will continue to serve, as an “acquisition magnet” for us to acquire new members for our marketing “super group”, which has the ability to provide synergistic new members with the opportunity to grow revenues and profits through 42West’s access, relationships and experience in the entertainment industry.

Our public relations and marketing professionals at 42West develop and execute marketing and publicity strategies for dozens of movies and television shows annually, as well as for individual actors, filmmakers, recording artists, and authors. Through 42West, we provide services in the following areas:

Talent Publicity

We focus on creating and implementing strategic communication campaigns for performers and entertainers, including television and film stars, recording artists, authors, models and theater actors. Our talent roster includes Oscar and Emmy-winning actors and Grammy-nominated singers and musicians and New York Times best-selling authors. Our services in this area include ongoing strategic counsel, media relations, studio, network, charity, corporate liaison and event and tour support.

Entertainment Marketing

We provide marketing direction, public relations counsel and media strategy for productions (including theatrical films, DVD and VOD releases, television programs, and online series) as well as content producers, ranging from individual filmmakers and creative artists to production companies, film financiers, DVD distributors, and other entities. Our capabilities include worldwide studio releases, independent films, television programming and web productions. We provide entertainment marketing services in connection with film festivals, awards campaigns, event publicity and red carpet management.

|

|

|

|

|

|

S-1

|

|

|

|

|

|

|

|

|

Strategic Communications

Our strategic communications team advises high-profile individuals and companies faced with sensitive situations or looking to raise, reposition, or rehabilitate their public profiles. We also help studios and filmmakers deal with controversial movies.

Much of the activities of our strategic communications team involves orchestrating high-stakes communications campaigns in response to sensitive, complex situations where clients seek to rehabilitate their public profiles. We also help companies define objectives, develop messaging, create brand identities, and construct long-term strategies to achieve specific goals, as well as manage functions such as media relations or internal communications on a day-to-day basis. The strategic communications team focuses on strategic communications counsel, corporate positioning, brand enhancement, media relations, reputation and issues management, litigation support and crisis management and communications. Our clients include major studios and production companies, record labels, media conglomerates, technology companies, philanthropic organizations, talent guilds, and trade associations, as well as a wide variety of high-profile individuals, ranging from major movie and pop stars to top executives and entrepreneurs.

The Door

Through The Door, a hospitality, lifestyle and consumer products public relations agency, we offer traditional public relations services, as well as social media marketing, creative branding, and strategic counsel. Prior to its acquisition by us, The Door was widely considered the leading independent public relations firm in the hospitality and lifestyle industries. Among other benefits, The Door acquisition has expanded our entertainment verticals through the addition of celebrity chefs and their restaurants, as well as with live events, such as some of the most prestigious food and wine festivals.

Our public relations and marketing professionals at The Door develop and execute marketing and publicity strategies for dozens of restaurant and hotel groups annually, as well as for individual chefs, live events, and consumer-facing corporations.

Viewpoint

Viewpoint is a full-service, boutique creative branding and production agency that has earned a reputation as one of the top producers of promotional brand-support videos for a wide variety of leading cable networks in the television industry. Viewpoint’s capabilities run the full range of creative branding and production, from concept creation to final delivery, and include: brand strategy, concept and creative development, design & art direction, script & copywriting, live action production & photography, digital development, video editing & composite, animation, audio mixing & engineering, project management and technical support.

Content Production

Dolphin Films

Dolphin Films is a content producer of motion pictures. We own the rights to several scripts that we intend to produce at a future date.

Our pipeline of feature films includes:

·

Youngblood, an updated version of the 1986 hockey classic;

·

Out of Their League, a romantic comedy pitting husband against wife in the cut-throat world of fantasy football; and

·

Ask Me, a teen comedy in which a high-school student starts a business to help her classmates create elaborate “promposals”.

We have completed development of each of these feature films, which means that we have completed the script and can begin pre-production if and when financing is obtained. We also own several other scripts that we may determine to produce as digital content if online distribution is secured.

|

|

|

|

|

|

S-2

|

|

|

|

|

|

|

|

|

Dolphin Digital Studios

Dolphin Digital Studios creates original content to premiere online in the form of web series, sources financing for our digital media projects and distributes our web series through a variety of distribution partners depending on the demographic served.

Our Company Background

We were originally incorporated in the State of Nevada on March 7, 1995, and we subsequently domesticated in the State of Florida on December 4, 2014. Effective July 6, 2017, we changed our name from Dolphin Digital Media, Inc. to Dolphin Entertainment, Inc. Our principal executive offices are located at 2151 Le Jeune Road, Suite 150-Mezzanine, Coral Gables, Florida 33134. We also have offices located at 600 3rd Avenue, 23rd Floor, New York, New York, 10016; 37 West 17th Street, 5th Floor, New York, New York, 10011; 1840 Century Park East, Suite 700, Los Angeles, California 90067; 1460 West Chicago Avenue, Chicago, Illinois, 60642 and 55 Chapel Street, Newton, Massachusetts 02458. Our telephone number is (305) 774-0407 and our website address is www.dolphinentertainment.com. Neither our website nor any information contained on, or accessible through, our website is part of this prospectus.

|

|

|

|

|

|

S-3

|

|

|

|

|

|

|

|

|

|

The Offering

|

|

|

|

Common stock offered by us

|

shares (or shares if the underwriter exercises its over-allotment option in full).

|

|

|

|

Offering Price

|

$ per share

|

|

|

|

Common stock outstanding before this offering

|

14,641,466 shares.(1)

|

|

|

|

Common stock outstanding after this offering

|

shares (or shares if the underwriter exercises its over-allotment option in full).(1)

|

|

|

|

Use of proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, including acquisitions of complementary businesses, and working capital. See “Use of Proceeds” for additional information.

|

|

|

|

Risk factors

|

Investing in our securities involves risks. You should read carefully the “Risk Factors” section of this prospectus for a discussion of factors that you should carefully consider before deciding to invest in our securities.

|

|

|

|

The Nasdaq Capital Market ticker symbol of common stock

|

“DLPN”

|

|

|

|

———————

(1)

The number of shares of our common stock outstanding is based on 14,641,466 shares outstanding as of October 9, 2019, which excludes:

·

2,139,753 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $3.59 per share;

·

shares of our common stock issuable upon the conversion of 50,000 shares of Series C Convertible Preferred Stock outstanding;

·

46,392 shares of our common stock issuable as consideration and 975,690 shares of our common stock issuable as earn-out consideration in connection with the 42West acquisition. The earn-out shares will be issued in equal installments over a three-year period, beginning in 2019;

·

26,821 shares of our common stock issuable in connection with a working capital adjustment related to The Door acquisition. In addition, the former members of The Door may earn up to 1,538,462 additional shares if certain financial targets are met over a three-year period;

·

3,946,899 shares of our common stock issuable upon the conversion of thirteen convertible promissory notes in the aggregate principal amount of $4,452,500 (calculated based on conversion prices as of October 9, 2019) and;

·

1,000,000 shares of our common stock reserved for future issuance under our 2017 Equity Incentive Plan.

In addition, pursuant to put agreements with the principals from whom we acquired 42West, we agreed to purchase up to an aggregate of 1,187,087 shares of common stock from such persons during certain specified exercise periods until December 2020 at a purchase price of $9.22 per share. As of June 30,2019, we had purchased 731,607 shares of common stock and have purchased 90,835 shares of common stock since June 30, 2019 under such agreements. We also entered into put agreements with three 42West employees with change of control provisions in their employment agreements. We agreed to purchase up to 50% of the shares of common stock to be received by the employees in satisfaction of the change of control provision in their employment agreements at a purchase price of $9.22 per share. These employees have put rights to sell an additional 20,246 shares of common stock to us, including in respect of the earn out consideration.

Except as otherwise stated herein, the information in this prospectus supplement assumes no exercise by the underwriter of its over-allotment option.

|

|

|

|

|

|

S-4

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, the risks described under the heading “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2018 and in the accompanying prospectus and other information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus, including our audited consolidated financial statements and the related notes, before you decide whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition, results of operations, cash flow and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to This Offering

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering, as described in “Use of Proceeds”. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our market value.

You will experience immediate and substantial dilution.

The public offering price for the common stock offered pursuant to this prospectus supplement is substantially higher than the net tangible book value of each outstanding share of our common stock. Purchasers of common stock in this offering will experience immediate and substantial dilution on a book value basis. Following this offering, there will be an immediate increase in net tangible book value of approximately $ per share to our existing shareholders, and an immediate dilution of $ per share to investors purchasing shares in this offering, based on an initial public offering price of $ per share. If the holders of outstanding options or other securities convertible into our common stock exercise those options or other such securities at prices below the public offering price, you will incur further dilution. Please see the section in the prospectus supplement entitled “Dilution” for a more detailed discussion of the dilution you will incur in this offering.

We may require additional funding through further issuances of shares of our common stock, which may negatively affect the market price of our common stock.

To operate our business, we may need to raise additional capital through sales of our common stock or securities exercisable for or convertible into shares of our common stock. Future sales of our common stock, or securities exercisable for or convertible into shares of our common stock, including shares of our common stock issued upon exercise of warrants, could adversely affect the prevailing market price of our common stock and our ability to raise capital in the future.

S-5

USE OF PROCEEDS

We estimate that the net proceeds from our sale of the shares in this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ , or $ if the underwriter exercises its over-allotment option in full.

We intend to use the net proceeds from this offering for general corporate purposes, including acquisitions of complementary businesses, working capital. We will have broad discretion over the manner in which the net proceeds of the offering will be applied, and we may not use these proceeds in a manner desired by our shareholders.

S-6

CAPITALIZATION

The following table summarizes our capitalization and cash and cash equivalents as of June 30, 2019:

|

|

|

|

|

·

|

on an actual basis; and

|

|

|

·

|

on an as adjusted basis to reflect (i) the sale by us of shares in this offering, based on a public offering price of $ per share, assuming no exercise of the underwriter’s over-allotment option, and (ii) the deduction of estimated underwriting discounts and commissions and estimated offering expenses payable by us.

|

You should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” in our Quarterly Report on Form 10-Q for the period ended June 30, 2019 as well as our financial statements and related notes and the other financial information, incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2019

(Unaudited)

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

Cash and cash equivalents

|

|

$

|

2,559,367

|

|

|

$

|

|

|

|

Debt:

|

|

|

|

|

|

|

|

|

|

Current line of credit

|

|

$

|

1,700,390

|

|

|

$

|

1,700,390

|

|

|

Current debt(1)

|

|

|

2,312,461

|

|

|

|

2,312,461

|

|

|

Current loan from related party

|

|

|

1,107,873

|

|

|

|

1,107,873

|

|

|

Current note payable

|

|

|

283,952

|

|

|

|

283,952

|

|

|

Current convertible notes payable

|

|

|

1,988,462

|

|

|

|

1,988,462

|

|

|

Current put rights(2)

|

|

|

4,030,280

|

|

|

|

4,030,280

|

|

|

Non-current convertible notes payable

|

|

|

1,044,232

|

|

|

|

1,044,232

|

|

|

Non-current put rights(2)

|

|

|

677,911

|

|

|

|

677,911

|

|

|

Non-current notes payable

|

|

|

769,338

|

|

|

|

769,338

|

|

|

Total debt

|

|

$

|

13,914,899

|

|

|

$

|

13,914,899

|

|

|

Common stock, $0.015 par value, 200,000,000 shares authorized, 14,394,562 issued and outstanding, actual, and issued and outstanding, as adjusted

|

|

|

215,918

|

|

|

|

|

|

|

Series C Convertible Preferred stock, $0.001 par value, 50,000 shares authorized, issued and outstanding

|

|

|

1,000

|

|

|

|

1,000

|

|

|

Additional paid in capital

|

|

|

103,571,126

|

|

|

|

103,571,126

|

|

|

Accumulated deficit

|

|

|

(95,298,433

|

)

|

|

|

(95,298,433

|

)

|

|

Total stockholders’ equity

|

|

$

|

8,489,611

|

|

|

$

|

|

|

|

Total capitalization

|

|

$

|

22,404,510

|

|

|

$

|

|

|

———————

|

|

|

(1)

|

Consists of debt of our subsidiaries used to produce and pay the print and advertising expenses of Max Steel.

|

|

(2)

|

Consists of our obligation to purchase up to an aggregate of 1,187,087 shares of common stock from the sellers of 42West persons during certain specified exercise periods until December 2020 at a purchase price of $9.22 per share. As of June 30,2019, we had purchased 731,607 shares of common stock and have purchased 90,835 shares of common stock since June 30, 2019 under such agreements. We also entered into put agreements with three 42West employees with change of control provisions in their employment agreements. We agreed to purchase up to 50% of the shares of common stock to be received by the employees in satisfaction of the change of control provision in their employment agreements at a purchase price of $9.22 per share. The employees have put rights to sell an additional 20,246 shares of common stock to us, including in respect of the earn out consideration.

|

S-7

The number of shares of our outstanding common stock, actual and as adjusted, excludes:

|

|

|

|

|

·

|

As of October 9, 2019, 2,139,753 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $3.59 per share;

|

|

|

·

|

shares of our common stock issuable upon the conversion of 50,000 shares of Series C Convertible Preferred Stock outstanding;

|

|

|

·

|

46,392 shares of our common stock issuable as consideration and 975,690 shares of our common stock issuable as earn-out consideration in connection with the 42West acquisition. The earn-out shares will be issued in equal installments over a three-year period, beginning in 2019;

|

|

|

·

|

3,946,899 shares of our common stock issuable upon the conversion of thirteen convertible promissory notes in the aggregate principal amount of $4,452,500 (calculated based on conversion prices as of October 9, 2019); 1,000,000 shares of our common stock reserved for future issuance under our 2017 Equity Incentive Plan and;

|

|

|

·

|

26,821 shares of our common stock issuable in connection with a working capital adjustment related to The Door acquisition. In addition, the members may earn up to 1,538,462 additional shares if certain financial targets are met over a three-year period.

|

S-8

DILUTION

If you invest in the common stock being offered by this prospectus, you will suffer immediate and substantial dilution in the net tangible book value per share of common stock. Our net tangible deficit as of June 30, 2019 was approximately $(15.6) million, or approximately $(1.08) per share. Net tangible deficit per share represents our total tangible assets less total tangible liabilities, divided by the number of shares of common stock outstanding as of June 30, 2019.

Dilution in net tangible book value per share represents the difference between the public offering price per share paid by purchasers in this offering and the net tangible book value per share of our common stock immediately after this offering. After giving effect to the sale by us of shares in this offering, assuming all shares are sold, at a public offering price of $ per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, our net tangible book value as of June 30, 2019 would have been approximately $ million, or approximately $ per share of common stock. This represents an immediate increase of $ in net tangible book value per share to our existing shareholders and an immediate dilution of $ per share to purchasers of securities in this offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

Public offering price per share

|

|

$

|

|

|

|

Net tangible book value deficit per share as of June 30, 2019

|

|

$

|

(1.08

|

)

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

|

|

|

Adjusted net tangible book value deficit per share as of June 30, 2019, after giving effect to the offering

|

|

$

|

|

|

|

Dilution per share to new investors in the offering

|

|

$

|

|

|

If the underwriter exercises its over-allotment option in full, the adjusted net tangible book value will increase to $ per share, representing an immediate dilution of $ per share to new investors, after deducting underwriting discounts and commissions and the estimated offering expenses payable by us.

The above discussion and tables do not include the following:

|

|

|

|

|

·

|

As of October 9, 2019, 2,139,753 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $3.59 per share;

|

|

|

·

|

shares of our common stock issuable upon the conversion of 50,000 shares of Series C Convertible Preferred Stock outstanding;

|

|

|

·

|

46,392 shares of our common stock issuable as consideration and 975,690 shares of our common stock issuable as earn-out consideration in connection with the 42West acquisition. The earn-out shares will be issued in equal installments over a three-year period, beginning in 2019;;

|

|

|

·

|

3,946,899 shares of our common stock issuable upon the conversion of thirteen convertible promissory notes in the aggregate principal amount of $4,452,500 (calculated based on conversion prices as of October 9, 2019); 1,000,000 shares of our common stock reserved for future issuance under our 2017 Equity Incentive Plan; and

|

|

|

·

|

26,821 shares of our common stock issuable in connection with a working capital adjustment related to The Door acquisition. In addition, the members may earn up to 1,538,462 additional shares if certain financial targets are met over a three-year period.

|

In addition, pursuant to put agreements with the principals from whom we acquired 42West, we have agreed to purchase up to an aggregate of 1,187,087 shares of common stock from such persons during certain specified exercise periods until December 2020 at a purchase price of $9.22 per share. As of June 30, 2019, we had purchased 731,607 shares of common stock and have purchased 90,835 shares of common stock since June 30, 2019, under such agreements. We also entered into put agreements with three 42West employees with change of control provisions in their employment agreements. We agreed to purchase up to 50% of the shares of common stock to be received by the employees in satisfaction of the change of control provision in their employment agreements at a purchase price of $9.22 per share. The employees have put rights to sell an additional 20,246 shares of common stock to us, including in respect of the earn out consideration.

S-9

UNDERWRITING

Maxim Group LLC will act as our sole underwriter for this offering. We have entered into an underwriting agreement dated October , 2019 with the underwriter with respect to the shares to be offered. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriter and the underwriter has agreed to purchase, at the public offering price less the underwriting discounts and commissions set forth on the cover page of this prospectus supplement, the following number of shares:

|

|

|

|

|

|

Underwriter

|

|

Number of Shares

|

|

|

Maxim Group LLC

|

|

|

|

|

|

Total

|

|

|

|

|

The underwriter is committed to purchase all the shares offered by us other than those covered by the option to purchase additional shares described below, if it purchases any shares. The obligations of the underwriter may be terminated upon the occurrence of certain events specified in the underwriting agreement. Furthermore, pursuant to the underwriting agreement, the underwriter’s obligations are subject to customary conditions, representations and warranties contained in the underwriting agreement, such as receipt by the underwriter of officers’ certificates and legal opinions.

We have agreed to indemnify the underwriter against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the underwriter may be required to make in respect thereof.

The underwriter is offering the shares, subject to prior sale, when, as and if issued to and accepted by the underwriter, subject to approval of legal matters by its counsel and other conditions specified in the underwriting agreement. The underwriter reserves the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Underwriter Compensation

We have agreed to pay the underwriter a cash fee equal to 7.0% of the aggregate gross proceeds sold in the offering. The underwriter proposes to offer the shares offered by us to the public at the public offering price set forth on the cover of this prospectus supplement. In addition, the underwriter may offer some of the shares to other securities dealers at such price less a concession of $ per share. After the initial offering, the public offering price and concession to dealers may be changed.

Option to Purchase Additional Securities

We have granted to the underwriter an option exercisable not later than 45 days after the date of this prospectus supplement to purchase up to additional shares of common stock solely to cover over-allotments, if any, made in connection with this offering. If any additional shares of common stock are purchased pursuant to the over-allotment option, the underwriter will offer these shares of common stock on the same terms as those on which the other securities are being offered.

Discounts and Commissions

The following table shows the public offering price, underwriting discount and proceeds, before expenses, to us. The information assumes either no exercise or full exercise by the underwriter of its over-allotment option.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

Per Share

|

|

|

Without Over-Allotment

|

|

|

With Over-Allotment

|

|

|

Public offering price(1)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discount ( %)(2)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

———————

|

|

|

(1)

|

The public offering price and underwriting discount corresponds to a public offering price per share of common stock of $ .

|

|

(2)

|

We have granted a 45 day option to the underwriter to purchase additional shares of common stock at the public offering price per share of common stock set forth above less the underwriting discounts and commissions, solely to cover over-allotments, if any.

|

S-10

We have agreed to reimburse the underwriter its actual, out-of-pocket expenses, including the reasonable fees and disbursements of the underwriter’s counsel related to the offering, up to an aggregate maximum amount of (i) $55,000 if we receive gross proceeds from the offering less than or equal to $2,500,000 or (ii) $60,000 if we receive gross proceeds from the offering greater than $2,500,000 but in any event in compliance with the provisions of FINRA Rule 5110(f)(2). In the event of a termination of the offering, the underwriter will be entitled to reimbursement of their actual out-of-pocket expenses, not to exceed $55,000. We estimate that the total expenses of the offering including all expenses to be reimbursed to the underwriter excluding the underwriter’s discount, will be approximately $ .

We and our subsidiaries have agreed to certain restrictions on the ability to sell additional shares of our common stock for a period ending 60 days after the date that the offering is completed. Subject to certain exceptions, we and our subsidiaries have agreed not to directly or indirectly offer, issue, sell, contract to sell, encumber, grant any option for the sale of, or otherwise issue or dispose of, any of our securities without the underwriter’s prior written consent.

We have granted the underwriter the right of first refusal for a period of twelve (12) months from the commencement of sales of the offering to at a minimum act as co-lead manager and co-book runner and/ or co-lead placement agent, as the case may be, with at least 50.0% of the economics, for any and all of our future equity, equity-linked, or debt (excluding commercial bank debt, certain exempt issuances and issuances of securities provided by or solicited from any person or entity who is, or has been within the past 12 months, a holder of our debt or equity securities) financings or any financings of any successor to or any subsidiary of ours.

Lock-Up Agreements

All of our executive officers and holders of ten percent (10%) or more of our outstanding securities (or securities convertible into shares of our common stock), have agreed that, for a period of 60 days after the date of this prospectus supplement, subject to certain limited exceptions, they will not directly or indirectly, without the prior written consent of the underwriter, (1) offer, sell, agree to offer or sell, solicit offers to purchase, grant any call option or purchase any put option with respect to, pledge, encumber, assign, borrow or otherwise dispose of or transfer any shares of common stock, warrant to purchase shares of common stock or any other security of the company or any other entity that is convertible into, or exercisable or exchangeable for, shares of common stock or any other equity security of the company owned beneficially or otherwise as of the date of this prospectus supplement, which we refer to as relevant securities, or otherwise publicly disclose the intention to do so, (2) establish or increase any “put equivalent position” or liquidate or decrease any “call equivalent position” (in each case within the meaning of Section 16 of the Exchange Act) with respect to any relevant security or otherwise enter into any swap, derivative or other transaction or arrangement that transfers to another, in whole or in part, any economic consequence of ownership of relevant securities, whether or not such transaction is to be settled by the delivery of relevant securities, other securities, cash or other consideration, or otherwise publicly disclose the intention to do so, (3) file or participate in the filing with the SEC of any registration statement or circulate or participate in the circulation of any preliminary or final prospectus or other disclosure document, in each case with respect to any proposed offering or sale of relevant securities or (4) exercise any rights to require registration with the SEC of any proposed offering or sale of relevant securities. We expect that our one director who was unable to sign his lockup agreement prior to the date hereof will, within a reasonable period of time following consummation of this offering, enter into a lockup agreement containing the foregoing terms.

Price Stabilization, Short Positions and Penalty Bids

The underwriter may engage in over-allotment, stabilizing transactions, syndicate covering transactions, and penalty bids or purchases for the purpose of pegging, fixing or maintaining the price of the common stock, in accordance with Regulation M under the Exchange Act:

·

Over-allotment involves sales by the underwriter of securities in excess of the number of securities the underwriter is obligated to purchase, which creates a syndicate short position. The short position may be either a covered short position or a naked short position. In a covered short position, the number of securities over-allotted by the underwriter is not greater than the number of securities that they may purchase in the over-allotment option. In a naked short position, the number of securities involved is greater than the number of securities in the over-allotment option. The underwriter may close out any short position by either exercising their over-allotment option (which they anticipate will occur if our stock prices are greater than the price per security in this offering) and/or purchasing securities in the open market (which they anticipate will occur if our stock prices are less than the price per security in this offering).

·

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum.

S-11

·

Syndicate covering transactions involve purchases of securities in the open market after the distribution has been completed in order to cover syndicate short positions. In determining the source of securities to close out the short position, the underwriter will consider, among other things, the price of securities available for purchase in the open market as compared to the price at which they may purchase securities through the over-allotment option. If the underwriter sells more securities than could be covered by the over-allotment option, a naked short position, the position can only be closed out by buying securities in the open market. A naked short position is more likely to be created if the underwriter is concerned that there could be downward pressure on the price of the securities in the open market after pricing that could adversely affect investors who purchase in the offering.

·

Penalty bids permit the underwriter to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member is purchased in a stabilizing or syndicate covering transaction to cover syndicate short positions.

These stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price of our securities, or preventing or retarding a decline in the market price of those securities. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market. These transactions may be effected on an exchange or in the over-the-counter market or otherwise and, if commenced, may be discontinued at any time.

Neither we nor the underwriter makes any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of the securities. In addition, neither we nor the underwriter makes any representation that the underwriter will engage in these stabilizing transactions or that any transaction, once commenced, will not be discontinued without notice.

In connection with this offering, the underwriter may also engage in passive market making transactions in our securities. Passive market making consists of displaying bids on a national securities exchange limited by the prices of independent market makers and effecting purchases limited by those prices in response to order flow. Rule 103 of Regulation M promulgated by the SEC limits the amount of net purchases that each passive market maker may make and the displayed size of each bid. Passive market making may stabilize the market price of our securities at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

Electronic Offer, Sale and Distribution of Shares

The underwriter may facilitate the marketing of this offering online directly or through one of the underwriter’s affiliates. In those cases, prospective investors may view offering terms and a prospectus online and place orders online or through their financial advisors. Such websites and the information contained on such websites, or connected to such sites, are not incorporated into and are not a part of this prospectus. In connection with this offering, the underwriter may distribute prospectuses electronically.

Other Relationships

The underwriter and its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriter may in the future, engage in investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. The underwriter may in the future, receive customary fees and commissions for these transactions.

In the ordinary course of their various business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments of the issuer. The underwriter and its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

S-12

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon by Morrison & Foerster LLP.

EXPERTS

The consolidated financial statements of Dolphin Entertainment, Inc. as of December 31, 2018 and 2017 and for each of the years then ended incorporated by reference in this prospectus and in the registration statement of which this prospectus forms a part have been so included in reliance on the report of BDO USA, LLP, an independent registered public accounting firm, as set forth in their report which is incorporated by reference in this prospectus and elsewhere in the registration statement, given on the authority of said firm as experts in auditing and accounting.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information that we incorporate by reference is considered to be part of this prospectus. Information that we file with the SEC in the future and incorporate by reference in this prospectus automatically updates and supersedes previously filed information as applicable.

We incorporate by reference into this prospectus the following documents filed by us with the SEC, other than any portion of any such documents that is not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules:

|

|

|

|

|

·

|

our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on April 15, 2019;

|

|

|

·

|

our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2019, filed with the SEC on May 15, 2019 and for the quarter ended June 30, 2019, filed with the SEC on August 13, 2019;

|

|

|

·

|

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 26, 2019;

|

|

|

·

|

our Current Reports on Form 8-K, filed with the SEC on May 22, 2019 and June 7, 2019; and

|

|

|

·

|

the description of our common stock contained in our registration statement on Form 8-A filed on December 19, 2017 pursuant to Section 12 of the Exchange Act, including any subsequent amendment or report filed for the purpose of updating that description.

|

In addition, all documents subsequently filed by us (including all documents subsequently filed by us after the date of this registration statement and prior to the effectiveness of this registration statement) pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering, will be deemed to be incorporated herein by reference and to be a part of this registration statement from the date of filing of such documents.

This prospectus supplement does not, however, incorporate by reference any documents or portions thereof, whether specifically listed above or furnished by us in the future, that are not deemed “filed” with the SEC, including information “furnished” pursuant to Items 2.02, 7.01 and 9.01 of Form 8-K.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any subsequently filed document that is also incorporated by reference herein modifies or replaces such statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Any information incorporated by reference herein is available to you without charge upon written or oral request. If you would like a copy of any of this information, please submit your request to us at the following address:

Dolphin Entertainment, Inc.

Attn: Mirta A. Negrini

2151 Le Jeune Road, Suite 150-Mezzanine

Coral Gables, FL 33134

(305) 774-0407

S-13

PROSPECTUS

DOLPHIN ENTERTAINMENT, INC.

$30,000,000

Common Stock

Warrants

Units

————————————————————

We are Dolphin Entertainment, Inc., a corporation incorporated under the laws of the State of Florida. This prospectus relates to the public offer and sale of common stock, warrants and units that we may offer and sell from time to time, in one or more series or issuances and on terms that we will determine at the time of the offering, any combination of the securities described in this prospectus, up to an aggregate amount of $30,000,000.

This prospectus provides you with a general description of the securities we may offer and sell. We will provide specific terms of any offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement, as well as the documents incorporated by reference in this prospectus before you invest in any of our securities.

We may offer the securities from time through public or private transactions, and in the case of our common stock, on or off the Nasdaq Capital Market, at prevailing market prices or at privately negotiate prices. These securities may be offered and sold in the same offering or in separate offerings, to or through underwriters, dealers and agents, or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities registered hereunder and any applicable fees, commissions, or discounts will be described in the applicable prospectus supplement. Our net proceeds from the sale of securities will also be set forth in the applicable prospectus supplement.

This prospectus may not be used to consummate a sale of our securities unless accompanied by the applicable prospectus supplement.

Our common stock is listed on the Nasdaq Capital Market under the symbol “DLPN.”

As of January 30, 2018, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $19,990,000, which was calculated based on 6,057,720 shares of outstanding common stock held by non-affiliates and on a price per share of $3.30, the closing price of our common stock on January 30, 2018. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the shelf securities in a public primary offering with a value exceeding more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75 million. During the 12 calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 1 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

————————————————————

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 12, 2018.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf registration process, we may sell any one or more or a combination of the securities described in this prospectus in one or more offerings, up to a total dollar amount of $30,000,000. This prospectus provides you with general information regarding the securities we may offer. We will provide a prospectus supplement that contains specific information about any offering by us with respect to the securities registered hereunder.

The prospectus supplement also may add, update, or change information contained in the prospectus. You should read both this prospectus and the prospectus supplement related to any offering as well as additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We are offering to sell, and seeking offers to buy, securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus and in any accompanying prospectus supplement is accurate only as of the dates set forth on their respective covers, regardless of the time of delivery of this prospectus or any prospectus supplement or of any sale of our securities. Our business, financial condition, results of operations, and prospects may have changed since those dates. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or any accompanying prospectus supplement or any “free writing prospectus.” You should rely only on the information contained or incorporated by reference in this prospectus or any accompanying prospectus supplement or related “free writing prospectus.” To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference into this prospectus or any prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement.

Unless the context otherwise requires, the terms “Company,” “we,” “us,” or “our” refer to Dolphin Entertainment, Inc., a Florida corporation, and its consolidated subsidiaries.

ii

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the discussion of risks and uncertainties under the heading “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which is incorporated by reference in this prospectus, and under similar headings in our subsequently filed quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the other risks and uncertainties described in any applicable prospectus supplement or free writing prospectus and in the other documents incorporated by reference in this prospectus. See the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus. The risks and uncertainties we discuss in the documents incorporated by reference in this prospectus are those we currently believe may materially affect us. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial also may also materially and adversely affect our business, financial condition and results of operations.

1

FORWARD-LOOKING STATEMENTS

This prospectus, any applicable prospectus supplement and the documents and information incorporated by reference herein and therein may contain “forward-looking statements.” Forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies as well as statements, other than historical facts, that address activities, events, or developments that we intend, expect, project, believe or anticipate will or may occur in the future. These statements are often characterized by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “goal” or “continue” or the negative of these terms or other similar expressions.

Forward-looking statements are based on assumptions and assessments made in light of our experience and perception of historical trends, current conditions, expected future developments and other factors believed to be appropriate. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which are outside of our control. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this prospectus, and we undertake no obligation to update these forward-looking statements in the future, except as required by applicable law.

Factors could cause actual results to differ materially from those indicated by the forward-looking statements include those factors described under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which is incorporated by reference in this prospectus, and under similar headings in our subsequently filed quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the other risks and uncertainties described in any applicable prospectus supplement or free writing prospectus and in the other documents incorporated by reference in this prospectus.

2

OUR COMPANY

Overview

We are a leading independent entertainment marketing and premium content development company. Through our recent acquisition of 42West, LLC, referred to as 42 West, we provide expert strategic marketing and publicity services to all of the major film studios, and many of the leading independent and digital content providers, as well as for hundreds of A-list celebrities, including actors, directors, producers, recording artists, athletes and authors. Our strategic acquisition of 42West brings together premium marketing services with premium content production, which we believe creates significant opportunities to better strategically serve our constituents and to grow and diversify our business. Our content production business is a long established, leading independent producer, committed to distributing premium, best-in-class film and digital entertainment. We produce original feature films and digital programming, primarily aimed at family and young adult markets.

Entertainment Publicity

On March 30, 2017, we acquired 42West, one of the leading full-service marketing and public-relations firms in the entertainment industry, offering clients preeminent experience, contacts and expertise. The name 42West symbolizes the agency’s position in the nation’s largest entertainment markets: from Manhattan’s 42nd Street (where the firm got its start) to the West Coast (which it serves from its offices in Los Angeles). 42West’s professional capabilities are equally broad, encompassing talent, entertainment and targeted marketing, and strategic communications services.

42West grew out of The Dart Group, which Leslee Dart launched in 2004. Amanda Lundberg teamed up with Dart a few months later. In 2006, after Allan Mayer joined the partnership, the company was renamed 42West. Over the next ten years, 42West grew to become one of the largest independently-owned public-relations firms in the entertainment industry. In December 2017, the New York Observer listed 42West as one of the six most powerful PR firms of any kind in the United States.

Content Production

In addition to 42West’s leading entertainment publicity business, we are dedicated to the production of high-quality digital and motion picture content. We also intend to expand into television production in the near future. Our Chief Executive Officer, William O’Dowd, is an Emmy-nominated producer and recognized leader in family entertainment, with previous productions available in millions of homes worldwide. Mr. O’Dowd received 2017’s prestigious worldwide KidScreen Award for Best New Tween/Teen Series as Executive Producer of the sitcom “Raising Expectations,” starring Molly Ringwald and Jason Priestley. Films rated PG or PG-13 constituted 23 of the top 25 domestic grossing films in 2016, and family films are consistently the highest grossing category at the box office. We have developed a production pipeline of feature films aimed at the family market and are currently exploring television series aimed at the same market. Furthermore, we have had a dedicated division servicing the digital video market for over six years, during which time we have worked with most major ad-supported online distribution channels, including Facebook, Yahoo!, Hulu and AOL. Our digital productions have been recognized for their quality and creativity, earning multiple award nominations, a Streamy Award and a WGA Award.

Our Company Background

We were originally incorporated in the State of Nevada on March 7, 1995, and we subsequently domesticated in the State of Florida on December 4, 2014. Effective July 6, 2017, we changed our name from Dolphin Digital Media, Inc. to Dolphin Entertainment, Inc. Our principal executive offices are located at 2151 Le Jeune Road, Suite 150-Mezzanine, Coral Gables, Florida 33134. We also have offices located at 600 3rd Avenue, 23rd Floor, New York, New York, 10016 and 1840 Century Park East, Suite 700, Los Angeles, California 90067. Our telephone number is (305) 774-0407 and our website address is www.dolphinentertainment.com. Neither our website nor any information contained on, or accessible through, our website is part of this prospectus.

3

DILUTION

We will set forth in a prospectus supplement the following information regarding any material dilution of the equity interests of investors purchasing securities in an offering under this prospectus and the related prospectus supplement:

|

|

|

|

|

·

|

the net tangible book value per share of our equity securities before and after the offering;

|

|

|

·

|

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and

|

|

|

·

|

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

|

4

USE OF PROCEEDS

Except as may be otherwise set forth in any prospectus supplement accompanying this prospectus, we will use the net proceeds we receive from sales of securities offered hereby for general corporate purposes, which may include the repayment of indebtedness outstanding from time to time and for working capital, capital expenditures, acquisitions and repurchases of our common stock or other securities. When specific securities are offered, the prospectus supplement relating thereto will set forth our intended use of the net proceeds that we receive from the sale of such securities.

5

DESCRIPTION OF COMMON STOCK

This section describes the general terms of our common stock. A prospectus supplement may provide information that is different from this prospectus. If the information in the prospectus supplement with respect to our common stock being offered differs from this prospectus, you should rely on the information in the prospectus supplement. A copy of our amended and restated articles of incorporation, as amended, has been incorporated by reference from our filings with the SEC as an exhibit to the registration statement of which this prospectus forms a part. Our common stock and the rights of the holders of our common stock are subject to the applicable provisions of the Florida Business Corporation Act, which we sometimes refer to in this section as “Florida law,” our amended and restated articles of incorporation, as amended, our bylaws, the rights of the holders of our preferred stock, if any, and the agreements described below.

Under our amended and restated articles of incorporation, as amended, we have the authority to issue 200,000,000 shares of common stock, par value $0.015 per share. As of January 30, 2018, there were 11,292,253 shares of our common stock outstanding.

Effective May 10, 2016, we amended our articles of incorporation to effectuate a 1-for-20 reverse stock split. Effective July 6, 2017, we amended our amended articles of incorporation to (i) change our name to Dolphin Entertainment, Inc.; (ii) cancel previous designations of Series A Convertible Preferred Stock and Series B Convertible Preferred Stock; (iii) reduce the number of Series C Convertible Preferred Stock outstanding in light of our 1-for-20 reverse stock split from 1,000,000 to 50,000 shares; and (iv) clarify the voting rights of the Series C Convertible Preferred Stock that, except as required by law, holders of Series C Convertible Preferred Stock will only have voting rights once the independent directors of the Board determine that an optional conversion threshold has occurred. Effective September 14, 2017, we amended our amended and restated articles of incorporation to effectuate a 1-for-2 reverse stock split.

The table below presents earnings per share as previously reported in our Annual Report on Form 10-K for the year ended December 31, 2016, and earnings per share that has been retrospectively adjusted to reflect the 1-for-2 reverse stock split.

|

|

|

|

|

|

|

|

|

|

Years ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Earnings Per Share

|

|

|

|

|

|

|

|

Basic and diluted:

|

|

|

|

|

|

|

|

As previously reported

|

|

($4.83)

|

|

|

($2.16)

|

|

|

Adjusted for reverse stock split

|

|

($9.67)

|

|

|

($4.32)

|

|

The following description of our common stock, and any description of our common stock in a prospectus supplement, may not be complete and is subject to, and qualified in its entirety by reference to, Florida law and the actual terms and provisions contained in our amended and restated articles of incorporation and our bylaws, each as amended from time to time.

Voting Rights

The holders of our common stock are generally entitled to one vote for each share held on all matters submitted to a vote of the shareholders and do not have any cumulative voting rights. Unless otherwise required by Florida law, once a quorum is present, matters presented to shareholders, except for the election of directors, will be approved by a majority of the votes cast. The election of directors is determined by a plurality of the votes cast.

Dividends

Holders of our common stock are entitled to receive dividends if, as and when declared by the board of directors, or the Board, out of funds legally available for that purpose, subject to preferences that may apply to any preferred stock that we issue.

Liquidation Rights

In the event of our dissolution or liquidation, after satisfaction of all our debts and liabilities and distributions to the holders of any preferred stock that we issued, or may issue in the future, of amounts to which they are preferentially entitled, the holders of common stock will be entitled to share ratably in the distribution of assets to the shareholders.

6

Other Provisions

There are no cumulative, subscription or preemptive rights to subscribe for any additional securities which we may issue, and there are no redemption provisions, conversion provisions or sinking fund provisions applicable to the common stock. The rights of holders of common stock are subject to the rights, privileges, preferences and priorities of any class or series of preferred stock.

Our amended and restated articles of incorporation, as amended, and bylaws do not restrict the ability of a holder of our common stock to transfer his or her shares of our common stock.

Shares of Common Stock Reserved for Issuance

As of January 30, 2018, we had reserved for issuance:

|

|

|

|

|

·

|

an aggregate of 3,089,368 shares of our common stock issuable upon the exercise of outstanding warrants;

|

|

|

·

|

shares issuable upon the conversion of 50,000 shares of Series C Convertible Preferred Stock outstanding. For a description of the conditions upon which the shares of Series C Convertible Preferred Stock become convertible, and the number of shares of common stock into which such preferred stock would be convertible upon satisfaction of such conditions, see “Series C Convertible Preferred Stock” below;

|

|

|

·

|

133,588 shares of our common stock issuable upon the conversion of nine convertible promissory notes in the aggregate principal amount of $875,000 (calculated based on the 90-trading day average price per share as of January 30, 2018); and

|

|

|

·

|

942,302 shares of our common stock issuable to the sellers in the 42West acquisition based on the achievement of specified financial performance targets over a three-year period, which we refer to as earn out consideration.

|

We granted the sellers in the 42West acquisition the right, but not the obligation, to cause us to purchase up to an aggregate of 1,187,094 of their shares of common stock received as consideration, for a purchase price of $9.22 per share, during certain specified exercise periods until December 2020. As of the date of this prospectus, we have repurchased 189,799 shares of common stock from the sellers pursuant to the put options.

Preferred Stock