Current Report Filing (8-k)

September 12 2019 - 5:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 9, 2019

DLH Holdings Corp.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey

|

|

0-18492

|

|

22-1899798

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

3565 Piedmont Road, NE

Building 3, Suite 700

Atlanta, GA 30305

(Address of Principal Executive Offices, and Zip Code)

(866) 952-1647

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

DLHC

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On September 9, 2019, DLH Holdings Corp. (“DLH” or the “Company”) along with its subsidiaries named as borrowers under that certain Credit Agreement dated as of June 7, 2019 (the “Credit Agreement”), entered into a First Amendment to Credit Agreement dated as of September 6, 2019 (the “Amendment”), among the Company, the borrowers signatory to the Credit Agreement, the Lenders identified on the signature pages to the Amendment, and First National Bank of Pennsylvania, as Administrative Agent. The Amendment amends the Credit Agreement by modifying the covenant prohibiting certain restricted payments to provide that DLH may repurchase up to $2,000,000 of shares of its Common Stock. The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the Amendment, filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference

On September 12, 2019, DLH issued a press release announcing that its Board of Directors has approved a new stock repurchase program authorizing the Company to repurchase up to $1.0 million of shares of the Company’s common stock. Under the stock repurchase program, the Company intends to repurchase shares through open market purchases, privately-negotiated transactions, block purchases or otherwise in accordance with applicable federal securities laws, including Rule 10b-18 of the Securities Exchange Act of 1934 (the “Exchange Act”).

The repurchase program does not obligate the Company to repurchase any particular number or amount of shares of common stock and such stock repurchase program will depend on a number of factors, including the market price of its common stock, general business and market conditions, and alternative investment opportunities. The Board also authorized the Company to enter into written trading plans under Rule 10b5-1 of the Exchange Act to facilitate the repurchase of its common stock pursuant to the share repurchase program. A plan under Rule 10b5-1 allows companies to repurchase shares at times when it might otherwise be prevented from doing so by securities laws or because of self-imposed trading blackout periods. Information regarding share repurchases will be available in the Company’s periodic reports on Form 10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act. The new stock repurchase program does not have an expiration date and may be suspended or discontinued by the Company in its discretion. As of September 1, 2019, the Company had 12,036,131 shares of common stock outstanding.

In September 2013, the Company’s Board of Directors had authorized a repurchase program for up to $350,000 of shares of Common Stock. As of the date of the Board’s authorization of the new repurchase program, approximately $77,000 was available under the prior program. In authorizing the new stock repurchase program, the prior share repurchase program was terminated and the Company will now conduct repurchases of its common stock under the newly-authorized program. A copy of the press release is attached as Exhibit 99.1 hereto, and is incorporated herein by reference.

All statements in this Current Report on Form 8-K that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” Forward looking statements include those that refer to expectations, projections or other characterizations of future events or circumstances. Such statements involve risks and uncertainties which could cause actual events or DLH’s actual results to differ materially from those indicated by the forward-looking statements. You can identify forward-looking statements by words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” and similar words or phrases. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Forward-looking statements regarding our plans with respect to share repurchases reflect our current beliefs and assumptions and are subject to various risks and uncertainties, including our stock price, the trading volume of our stock, our cash flows from operations, general economic conditions, and others that are more fully described in our filings with the SEC, including under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2018, and in our subsequent filings with the SEC. Such forward-looking statements are made as of the date hereof and may become outdated over time. The Company does not assume any responsibility for updating forward-looking statements, except as may be required by law.

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibits are attached to this Current Report on Form 8-K:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Title or Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

DLH Holdings Corp.

|

|

|

|

|

|

|

|

By: /s/ Kathryn M. JohnBull

|

|

|

|

|

|

|

|

Name: Kathryn M. JohnBull

|

|

|

|

Title: Chief Financial Officer

|

|

Date: September 12, 2019

|

|

|

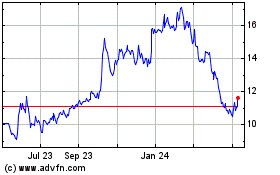

DLH (NASDAQ:DLHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

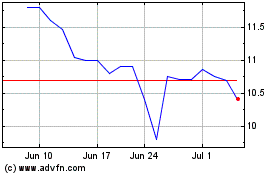

DLH (NASDAQ:DLHC)

Historical Stock Chart

From Apr 2023 to Apr 2024