SoftBank Offered To Help Fund Dish Wireless Network -- WSJ

December 19 2019 - 3:02AM

Dow Jones News

By Drew FitzGerald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 19, 2019).

SoftBank Group Corp. offered to help finance Dish Network

Corp.'s construction of a new cellphone network intended to shore

up competition if the merger of the nation's No. 3 and No. 4

wireless carriers closes, Dish's chairman said Wednesday.

Charlie Ergen, who is also a Dish co-founder, finished

testifying Wednesday in support of T-Mobile US Inc.'s purchase of

rival Sprint Corp., arguing that the merger would allow his company

to enter the consumer wireless market as a stronger competitor than

Sprint. Mr. Ergen had said Tuesday that the satellite company's

plans were credible and could count on loans of $10 billion from

three separate bank lenders based on letters they issued Dec.

9.

A group of state attorneys general is suing to block the merger

of Sprint -- which is controlled by Japan's SoftBank -- and

T-Mobile, arguing the combination would hurt competition.

JPMorgan, one of the banks lined up this month to lend Dish

cash, was offering to back the company even earlier. A June 27

email from a JPMorgan banker displayed in court Wednesday arranged

for financing of Dish's purchase of Sprint prepaid brand Boost

Mobile with SoftBank's support.

Mr. Ergen said the company was seeking a $1 billion

general-purpose loan at the time and thought the SoftBank

assistance "would give us margin" because the Japanese investment

company can borrow at a "much lower rate" that could save Dish $70

million to $100 million. The Justice Department also approved the

funding arrangement, which remains contingent on the T-Mobile

purchase of Sprint closing, Mr. Ergen added.

Dish swooped in during the summer with an offer to buy spectrum

and customer accounts from Sprint to help satisfy federal antitrust

concerns about the merger.

The Dish proposal was enough to win the U.S. Department of

Justice's support for T-Mobile's takeover of Sprint, but a

coalition of state attorneys general were unconvinced and took the

wireless merger to a federal trial in New York. The states have

argued that Dish, which serves no cellphone customers today,

wouldn't be a credible player in the wireless market, while Sprint

still has tens of millions of customers.

Dish has told investors it can use cash on hand to pay for

Sprint's prepaid customer accounts, including Boost Mobile, along

with certain wireless spectrum licenses. But Mr. Ergen said Tuesday

that Dish will need $8 billion to $10 billion to build its

nationwide network over several years.

Attorneys for the states challenging the wireless merger have

argued that SoftBank founder Masayoshi Son could use the

multinational company's financial resources to help rescue Sprint,

which has been losing customers for years. They cited an email from

Mr. Son telling executives "if we need to pay back most or all of

bonds, I am willing to pay back all of those" for Sprint.

Sprint Chairman Marcelo Claure, who is also SoftBank's operating

chief, testified Monday that the wireless carrier couldn't draw on

Mr. Son's company for more capital. "Sprint is meant to be a

self-funded entity," Mr. Claure said.

Another Sprint executive testified earlier that the company

wouldn't be viable in its current form within the next two years.

Sprint Chief Executive Michel Combes said Monday that the company

faced a "vicious cycle" that affects its ability to afford

financing.

Dish had about $14 billion of net debt at the end of September,

while Sprint's net debt stood at $33 billion.

Mr. Ergen, joined in court Wednesday by senior executives and

family members, also fought back against evidence presented by

California's deputy attorney general that suggested his past

tangles with federal regulators and judges made him unreliable.

Judge Victor Marrero asked the Dish boss more specific questions

about the company's future under the merger arrangement, including

whether T-Mobile might try to put Dish out of the wireless

business.

Mr. Ergen said it would be difficult for T-Mobile to wage a

price war against his company because its Justice

Department-brokered agreement has "a formula to protect us."

The judge also asked Mr. Ergen about his view of the wireless

market's "status quo" if T-Mobile fails to buy Sprint.

"We're still going to enter the marketplace" if that happens,

the Dish chairman said, "just maybe not to consumers."

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

December 19, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

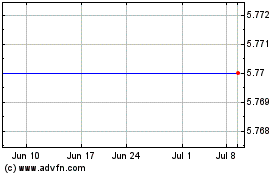

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

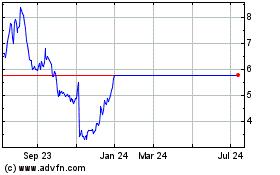

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024