Current Report Filing (8-k)

March 09 2023 - 5:22PM

Edgar (US Regulatory)

0001847986

false

0001847986

2023-03-05

2023-03-05

0001847986

DFLI:CommonStockParValue0.0001PerShareMember

2023-03-05

2023-03-05

0001847986

DFLI:RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember

2023-03-05

2023-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 5, 2023

DRAGONFLY

ENERGY HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40730 |

|

85-1873463 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1190

Trademark Drive #108

Reno,

Nevada 89521

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (775) 622-3448

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Common

Stock, par value $0.0001 per share

|

|

DFLI

|

|

The

Nasdaq Global Market

|

| Redeemable

warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

DFLIW |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry

into Material Definitive Agreement. |

On

March 5, 2023, Dragonfly Energy Holdings Corp. (the “Company”) issued an unsecured promissory note (the “Note”)

in the principal amount of $1,000,000 (the “Principal Amount”) to Brian Nelson, a director of the Company (the “Holder”),

in a private placement in exchange for cash in an equal amount (the “Private Placement”). The Company intends to use

the proceeds of the Private Placement for working capital and general corporate purposes.

The

Note becomes due and payable in full on April 1, 2023 (the “Maturity Date”). The Company is also obligated to pay

$100,000 (the “Loan Fee”) to the Holder on April 4, 2023 (the “Loan Fee Payment Date”). If the

Company does not pay the Loan Fee by the Loan Fee Payment Date, an additional $100,000 will accrue in full on April 5, 2023 (the “Penalty

Fee”). In addition, for so long as the Principal Amount, the Loan Fee and the Penalty Fee remain outstanding, an additional

$100,000 will accrue in full on May 3, 2023. If the balance of the Note, including the outstanding Principal Amount and all accrued but

unpaid fees, charges and expenses under the Note, has not been fully repaid by June 1, 2023, the Company will have the option to repay

the balance with any combination of cash and shares of the Company’s common stock, par value $0.0001 per share (the “Common

Stock”). If the Company opts to repay the balance of the Note with shares of Common Stock, the amount of shares to be issued

will be calculated at a price per share equal to the consolidated closing bid price of the Common Stock as reported by The Nasdaq Global

Market (“Nasdaq”) on the date immediately prior to payment; however, such price will not be less than $4.18

per share.

The

Note contains customary events of default, including nonpayment of any amounts under the Note when due, upon which the payment of the

Principal Amount, the Loan Fee and any other unpaid fees, expenses or other charges may be accelerated. The Company may, at any time,

prepay the amount due under the Note without premium or penalty. In addition, the Company is obligated to repay all outstanding obligations

under the Note within one business day upon the occurrence of a Change of Control (as defined in the Note) of the Company.

The

Holder has represented to the Company that it is an “accredited investor” as that term is defined in Rule 501(a) of Regulation

D promulgated under the Securities Act of 1933, as amended (the “Securities Act”). The Company relied on the exemption

from registration afforded by Section 4(2) of the Securities Act in connection with the issuance of the Note.

The

foregoing summary is qualified in its entirety by reference to the full text of the Note, which is attached hereto as Exhibit 4.1 and

incorporated herein by reference.

| Item

2.03. |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

information provided in response to Item 1.01 of this Current Report is incorporated by reference into this Item 2.03.

| Item

3.02. | Unregistered

Sales of Equity Securities. |

The

information provided in response to Item 1.01 of this Current Report is incorporated by reference into this Item 3.02.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

DRAGONFLY

ENERGY HOLDINGS CORP. |

| |

|

| Date:

March 9, 2023 |

By: |

/s/

Denis Phares |

| |

Name: |

Denis

Phares |

| |

Title: |

President

and Chief Executive Officer |

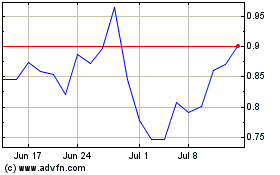

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Apr 2023 to Apr 2024