Current Report Filing (8-k)

November 04 2022 - 9:08AM

Edgar (US Regulatory)

0001847986

false

0001847986

2022-10-11

2022-10-11

0001847986

us-gaap:CommonStockMember

2022-10-11

2022-10-11

0001847986

DFLI:RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember

2022-10-11

2022-10-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 4, 2022 (October 11, 2022)

DRAGONFLY ENERGY

HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40730 |

|

85-1873463 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1190 Trademark Drive #108

Reno, Nevada 89521

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (775) 622-3448

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered: |

| Common stock, par value $0.0001 per share |

|

DFLI |

|

The Nasdaq Global Market |

| Redeemable warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

DFLIW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 11, 2022, Dragonfly Energy Holdings Corp., a

Delaware corporation (the “Company”), entered into employment agreements

with each of Dr. Denis Phares, the Company’s Chief Executive Officer, and Mr. John Marchetti, the Company’s

Chief Financial Officer. Each agreement provides for a three-year initial employment term, with automatic three-year renewal terms

thereafter, subject to 90 days’ notice of non-renewal by either party. Each agreement also provides for the executive to

receive an annual base salary (Dr. Phares — $622,000; Mr. Marchetti — $370,000) and to

be eligible for an annual bonus of up to a specified percentage of the executive’s base salary

(Dr. Phares — 100%; Mr. Marchetti — 63%). The executive is generally eligible for an

annual bonus only if he remains employed with the Company through the date the bonus is paid (or if the executive’s employment

terminates due to his death or disability during the year). The executive is also eligible to receive a long-term incentive award

each fiscal year with a grant-date value not less than a dollar amount specified in the agreement

(Dr. Phares — $1,532,000; Mr. Marchetti — $646,000), with the terms and conditions of

each such award to be determined by the Compensation Committee of the Board of Directors (the “Board”). Each agreement also includes non-competition and non-solicitation

covenants that apply for 12 months following the executive’s termination of employment, and certain confidentiality and other

covenants.

If the executive’s employment is terminated by the Company without

“cause” or by the executive for “good reason” (as such terms are defined in the employment agreement) and other

than a termination in connection with a change in control as described below, the executive would be entitled to receive (i) cash

severance equal to 1.5 times the executive’s annual base salary (in the case of Dr. Phares) or 1.0 times the executive’s

annual base salary (in the case of Mr. Marchetti), payable in installments over two years following the termination date, (ii) reimbursement

of monthly COBRA premiums for the executive and his dependents for up to 18 months (in the case of Dr. Phares) or 12 months (in the

case of Mr. Marchetti), and (iii) vesting in full of any time-based equity awards granted by the Company to the executive (with

any performance-based awards to remain eligible to vest following termination if the applicable performance conditions are satisfied).

In such circumstances, Dr. Phares would also be entitled to receive payment of 1.5 times the annual bonus he would have received

for the fiscal year in which his termination occurs, pro-rated to reflect the portion of the fiscal year he was employed prior to his

termination.

If, during the period commencing three months before a change in control

of the Company and ending 12 months after a change in control, the executive’s employment is terminated by the Company without cause

(or as a result of the Company’s not renewing the term of the agreement) or by the executive for good reason, the executive would

be entitled to receive the severance benefits described in the preceding paragraph (except that the cash severance would be 1.5 times

the executive’s base salary for Mr. Marchetti, the severance in each case would be payable in a lump sum rather than installments,

and the pro-rated bonus provision for Dr. Phares described above would not apply). In addition, the executive’s outstanding

stock options granted by the Company would fully vest and be exercisable for the remainder of the term of the option. In the event any

of the executive’s benefits under the agreement would be subject to an excise tax as a “parachute payment” under U.S.

tax laws, the executive would be entitled to an additional payment equal to the sum of the excise tax and any additional amount necessary

to put the executive in the same after-tax position as if no excise tax has been imposed.

In each case, the executive’s right to receive the severance

benefits described above is subject to his providing a release of claims to the Company and his continued compliance with the restrictive

covenants in favor of the Company in the agreement.

Departure of Chief Operating Officer

On November 4, 2022, the Board of the Company announced that

Sean Nichols, the Company’s Chief Operating Officer, would be leaving the Company to pursue other interests. His last day of employment

will be November 7, 2022. Mr. Nichols and the Company have entered into a separation and release agreement (the “Separation

Agreement”) that became effective and fully irrevocable on November 2, 2022. Pursuant to the Separation Agreement, Mr. Nichols

will receive a cash payment of $100,000 in one installment in December 2022 and a cash payment of $1,000,000 in 24 monthly installments

commencing in December 2022. Mr. Nichols’ outstanding equity awards granted by the Company will fully vest and, in the

case of options, will be exercisable for 12 months following his termination date. The Separation Agreement also provides the Company

will pay a portion of Mr. Nichols’ premiums to continue participation in the Company’s health insurance plans for up

to 18 months following his termination. The Separation Agreement includes a general release of claims by Mr. Nichols and certain

restrictive covenants in favor of the Company, including non-competition and non-solicitation covenants for 12 months following his termination

date.

Item 7.01. Regulation FD Disclosure.

On November 4, 2022, the Company issued a press release announcing

the appointment of Nicole Harvey as its Chief Legal Officer, Wade Seaburg as its Chief Revenue Officer and Tyler Bourns as its Chief Marketing

Officer, and the departure of Sean Nichols as its Chief Operating Officer. A copy of the press release is attached as Exhibit 99.1

hereto and is hereby incorporated by reference in its entirety.

The information set forth in Item 7.01 (including Exhibit 99.1)

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

DRAGONFLY ENERGY HOLDINGS CORP. |

| |

|

|

| Date: November 4, 2022 |

By: |

/s/ Denis Phares |

| |

Name: |

Denis Phares |

| |

Title: |

President and Chief Executive Officer |

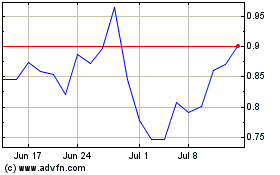

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

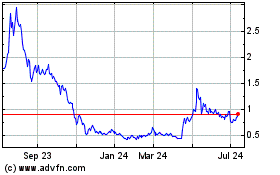

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Apr 2023 to Apr 2024