Initial Statement of Beneficial Ownership (3)

January 10 2020 - 1:47PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Bald Eagle Acquisition Corp |

2. Date of Event Requiring Statement (MM/DD/YYYY)

1/10/2020

|

3. Issuer Name and Ticker or Trading Symbol

Dermira, Inc. [DERM]

|

|

(Last)

(First)

(Middle)

LILLY CORPORATE CENTER |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director ___X___ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Street)

INDIANAPOLIS, IN 46285

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

___ Form filed by One Reporting Person

_X_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock, par value $0.001 per share | 0 (1)(2)(3)(4)(5) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Eli Lilly and Company ("Lilly") and its wholly owned subsidiary, Bald Eagle Acquisition Corporation ("Purchaser"), entered into an Agreement and Plan of Merger, dated as of January 10, 2020 (the "Merger Agreement"), with Dermira, Inc. (the "Issuer"), pursuant to which Purchaser will commence a cash tender offer (as may be amended from time to time in accordance with the terms of the Merger Agreement, the "Offer") to purchase all the outstanding shares of common stock, par value $0.001 per share, of the Issuer (the "Issuer Common Stock"), at a price per share of Issuer Common Stock of $18.75 (such amount or, as the Offer is amended in accordance with the terms of the Merger Agreement and a different amount per share is paid pursuant to the Offer, such different amount, the "Offer Price"), net to the seller in cash, without interest, on the terms and subject to the conditions set forth in the Merger Agreement. (Continued in Footnote 2) |

| (2) | Upon successful completion of the Offer, and subject to the terms and conditions of the Merger Agreement, Purchaser will be merged with and into the Issuer (the "Merger") with the Issuer surviving the Merger and becoming a wholly-owned subsidiary of Lilly. (Continued in Footnote 3) |

| (3) | In connection with the Merger Agreement, Lilly and Purchaser entered into tender and support agreements, each dated as of January 10, 2020 (the "Tender and Support Agreements""), with (i) Bay City Capital and certain of its affiliates (collectively, the "BCC Stockholder") and (ii) New Enterprise Associates and certain of its affiliates (collectively, the "NEA Stockholder"), each of which agreed, subject to certain limited specified exceptions, to tender into the Offer, and not withdraw, all Issuer Common Stock owned of record or beneficially owned or acquired by them after such date (the "Subject Shares"), to vote the Subject Shares in favor of the Merger and vote against certain alternative acquisition proposals to the Merger. (Continued in Footnote 4) |

| (4) | As of the date hereof, the Subject Shares include 7,057,984 shares of Issuer Common Stock beneficially owned by the BCC Stockholder and the NEA Stockholder. (Continued in Footnote 5) |

| (5) | As Purchaser is a wholly-owned subsidiary of Lilly, and because Purchaser and Lilly executed the Tender and Support Agreements, each of Purchaser and Lilly (collectively, the "Reporting Persons") may be deemed to have acquired beneficial ownership over the Subject Shares for the purpose of determining its status as a ten percent holder thereof. However, as none of the Reporting Persons have any pecuniary interest in the Subject Shares, beneficial ownership over the Subject Shares is expressly disclaimed for reporting purposes. |

Remarks:

Exhibit 99.1 (Joint Filer Information) is incorporated herein by reference. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Bald Eagle Acquisition Corp

LILLY CORPORATE CENTER

INDIANAPOLIS, IN 46285 |

| X |

|

|

ELI LILLY & Co

LILLY CORPORATE CENTER

INDIANAPOLIS, IN 46285 |

| X |

|

|

Signatures

|

| /s/ Joshua S. Smiley | | 1/10/2020 |

| **Signature of Reporting Person | Date |

| /s/ Heather Wasserman | | 1/10/2020 |

| **Signature of Reporting Person | Date |

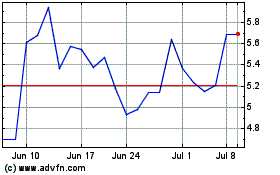

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Mar 2024 to Apr 2024

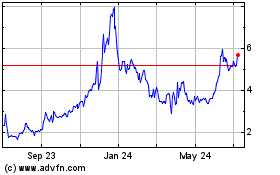

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Apr 2023 to Apr 2024