Current Report Filing (8-k)

December 06 2018 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November

30, 2018

DARÉ BIOSCIENCE, INC.

(Exact name of

registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36395

|

|

20-4139823

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

3655 Nobel

Drive, Suite 260

San Diego, CA 92122

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code:

(858)

926-7655

Not Applicable

(Former name or former address,

if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of

the Securities Exchange Act of

1934 (§240.12b-2 of

this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

|

Item 1.01

|

Entry Into a Material Definitive Agreement.

|

On December 5, 2018, Daré Bioscience, Inc. (“Daré”) entered into an Assignment Agreement (the “Assignment

Agreement”) with Hammock Pharmaceuticals, Inc. (“Hammock”) and a First Amendment to License Agreement (the “License Amendment”) with TriLogic Pharma, LLC (“TriLogic”) and MilanaPharm LLC (“MilanaPharm,”

and, together with TriLogic, the “Licensors”), both of which relate to the Exclusive License Agreement among Hammock and the Licensors dated as of January 9, 2017 (the “MilanaPharm License Agreement”). Under the Assignment

Agreement and the MilanaPharm License Agreement, as amended by the License Amendment, Daré acquired an exclusive, royalty-bearing, worldwide license, including the right to grant sublicenses, under certain patents, patent applications, other

patent rights and

know-how

controlled by either of the Licensors or their respective affiliates, to research, develop, make, have made, use, offer for sale, sell, import and commercialize products or processes

for the diagnosis, treatment and prevention, or supportive care of human diseases, disorders, conditions, symptoms, or state of health or wellness in or through any intravaginal or urological applications, pathways or routes of administration. The

licensed intellectual property relates to the Licensors’ hydrogel drug delivery platform known as

TRI-726.

The following is a summary of the material terms of the MilanaPharm License Agreement, as amended by the License Amendment:

|

|

●

|

|

License Fees

. Daré paid $25,000 to MilanaPharm in connection with the execution of the License Amendment

and must pay $200,000 to MilanaPharm (the “MilanaPharm Deferred Fee”) within 15 days of the first to occur of December 5, 2019 or the closing of an equity financing in which Daré raises aggregate proceeds of at least

$10.0 million. The MilanaPharm Deferred Fee may be paid, in Daré’s discretion, either in cash or with shares of Daré’s common stock.

|

|

|

●

|

|

Milestone Payments

. Daré must make potential future development milestone payments to MilanaPharm of up to

$300,000. Daré is also required to make milestone payments to MilanaPharm of up to $500,000 upon the first commercial sale in the United States of the first licensed product or process for each vaginal use and urological use, and up to

$250,000 upon the first commercial sale in the United States of successive licensed products or processes for vaginal or urological use. In addition, upon achievement of $50 million in cumulative worldwide net sales of licensed products and

processes, Daré must make a

one-time

payment of $1.0 million to MilanaPharm.

|

|

|

●

|

|

Foreign Sublicense Income

. Daré will pay MilanaPharm a low double-digit percentage of all income received

by Daré or its affiliates in connection with any sublicense granted to a third party for use outside of the United States, subject to certain exclusions.

|

|

|

●

|

|

Royalty Payments

. During the royalty term, Daré will pay MilanaPharm high single-digit to low double-digit

royalties based on annual worldwide net sales of licensed products and processes. The royalty term, which is determined on a

country-by-country

basis and licensed

product-by-product

basis (or

process-by-process

basis), begins with the first commercial sale

of a licensed product or process in a country and terminates on the latest of (a) the expiration date of the last valid claim of the licensed patent rights that cover the method of use of such product or process in such country, or (b) 10 years

following the first commercial sale of such product or process in such country. Royalty payments are subject to reduction in certain circumstances, including as a result of generic competition, patent prosecution expenses incurred by Daré, or

payments to third parties for rights or

know-how

that are required for Daré to exercise the licenses granted to it under the MilanaPharm License Agreement or that are strategically important or could

add value to a licensed product or process in a manner expected to materially generate or increase sales.

|

|

|

●

|

|

Efforts

. Daré must use commercially reasonable efforts and resources consistent with those undertaken by

it in pursuing development and commercialization of other pharmaceutical products, taking into account program-specific factors, (a) to develop and commercialize at least one licensed product or process in the United States and at least one

licensed product or process in at least one of Canada, the United Kingdom, France, Germany, Italy or Spain, and (b) following the first commercial sale of a licensed product or process in any jurisdiction, to continue to commercialize that

product or process in that jurisdiction.

|

|

|

●

|

|

Term

. Unless earlier terminated, the term of the MilanaPharm License Agreement will continue until (a) on a

licensed

product-by-product

(or

process-by-process

basis) and

country-by-country

basis, the date of expiration of the royalty term with respect to such licensed product in such country, and (b) the expiration of all applicable

royalty terms under the MilanaPharm License Agreement with respect to all licensed products and processes in all countries. Upon expiration of the term with respect to any licensed product or process in a country (but not upon earlier termination of

the MilanaPharm License Agreement), the licenses granted to Daré under the MilanaPharm License Agreement will convert automatically to an exclusive, fully

paid-up,

royalty-free, perpetual,

non-terminable

and irrevocable right and license, with the right to grant sublicenses, under the licensed intellectual property. The MilanaPharm License Agreement is subject to customary termination rights in favor

of both Daré and the Licensors, and in addition MilanaPharm may terminate the license granted to Daré solely with respect to a licensed product or process in a country if, after having launched such product or process in such country,

(i) Daré, or its affiliates or sublicensees, as applicable, discontinues the sale of such product or process in such country and MilanaPharm notifies Daré of such termination within 60 days of having first been notified by

Daré of such discontinuation, or (ii) Daré, or its affiliates or sublicensees, as applicable, (A) discontinues all commercially reasonable marketing efforts to sell, and discontinues all sales of, such product or process in

such country for nine months or more for reasons unrelated to force majeure, (B) fails to resume commercially reasonable marketing efforts with the intent to sell such product or process in such country within 120 days of having been notified

of such failure by MilanaPharm, (C) fails to reasonably demonstrate a strategic justification for the discontinuation and failure to resume to MilanaPharm under the circumstances set forth in the MilanaPharm License Agreement, and

(D) MilanaPharm gives 90 days’ notice to Daré.

|

The following is a summary of the material terms of the

Assignment Agreement:

|

|

●

|

|

Assignment; Technology Transfer

. Hammock assigned and transferred to Daré all of Hammock’s right,

title and interest in and to the MilanaPharm License Agreement and agreed to cooperate to transfer to Daré all of the data, materials and the licensed technology in its possession pursuant to a technology transfer plan to be agreed upon by

the parties, with a goal for Daré to independently practice the licensed intellectual property as soon as commercially practical in order to develop and commercialize the licensed products and processes. Hammock will be solely liable for any

obligations arising from any breach under the MilanaPharm License Agreement prior to the December 5, 2018.

|

|

|

●

|

|

Fees

. Daré paid $250,000 to Hammock in connection with the execution of the Assignment Agreement and must

pay $250,000 to Hammock (the “Hammock Deferred Fee”) within 15 days of the first to occur of December 5, 2019 or the closing of an equity financing in which Daré raises aggregate proceeds of at least $10.0 million. The

Hammock Deferred Fee may be paid, in Daré’s discretion, either in cash or with shares of Daré’s common stock.

|

|

|

●

|

|

Milestone Payments

. Daré must make potential future development milestone payments to Hammock of up to

$1.1 million.

|

|

|

●

|

|

Term

. The Assignment Agreement will terminate upon the later of (a) completion of the parties’

technology transfer plan, and (b) payment to Hammock of the last payment to which it may be entitled under the Hammock Deferred Fee and development milestone payment provisions.

|

The foregoing summary of the material terms of the MilanaPharm License Agreement, as amended by the License Amendment, and the Assignment Agreement does

not purport to be complete and is qualified in its entirety by reference to the MilanaPharm License Agreement, the License Amendment and the Assignment Agreement, a copy of each of which is expected to be filed with Daré’s annual report

on Form

10-K

for the year ending December 31, 2018. Daré expects to seek confidential treatment of certain terms of the MilanaPharm License Agreement, the License Amendment and the Assignment

Agreement at the time they are filed.

Item 3.01 Notice of Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 30, 2018, Daré received a letter from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market

(“Nasdaq”) notifying Daré that, for the last 30 consecutive business days, the closing bid price for Daré’s common stock was below the minimum $1.00 per share requirement for continued listing on The Nasdaq Capital

Market as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”). The Nasdaq letter has no immediate effect on the listing of Daré‘s common stock on the Nasdaq Capital Market.

In accordance with Nasdaq listing rules, Daré has been provided an initial period of 180

calendar days, or until May 29, 2019 (the “Compliance Date”), to regain compliance with the Minimum Bid Price Requirement. If, at any time during this

180-day

period, the closing bid price of

Daré’s common stock is at least $1.00 for a minimum of 10 consecutive business days, unless the Staff exercises its discretion to extend such

10-day

period, the Staff will provide Daré

written confirmation of compliance with the Minimum Bid Price Requirement and the matter will be closed. If Daré does not regain compliance by the Compliance Date, Daré may be eligible for an additional 180 calendar day compliance

period. To qualify for such additional compliance period, Daré would have to meet the continued listing requirement for the market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, except for

the Minimum Bid Price Requirement, and Daré would need to provide written notice of its intention to cure the deficiency during the additional compliance period, by effecting a reverse stock split, if necessary. If Daré is not

eligible for the additional compliance period or it appears to the Staff that Daré will not be able to cure the deficiency or if the Staff exercises its discretion to not provide such additional compliance period, the Staff will provide

written notice to Daré that its common stock will be subject to delisting. At that time, Daré may appeal the Staff’s delisting determination to a Nasdaq Hearing Panel.

Daré will monitor the closing bid price of its common stock and will consider options to regain compliance with the Minimum Bid Price

Requirement. There can be no assurance that Daré will regain compliance with the Minimum Bid Price Requirement or maintain compliance with any of the other Nasdaq continued listing requirements.

On December 6, 2018, Daré issued a press release announcing the acquisition of the licenses under the MilanaPharm License Agreement, as

amended by the License Amendment, pursuant to the Assignment Agreement, a copy of which is filed as Exhibit 99.1 to this report and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DARÉ BIOSCIENCE, INC.

|

|

|

|

|

Dated: December 6, 2018

|

|

By:

/s/ Sabrina Martucci

Johnson

|

|

|

|

Name: Sabrina Martucci Johnson

|

|

|

|

Title: President and Chief Executive Officer

|

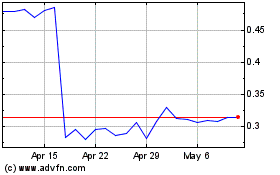

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Mar 2024 to Apr 2024

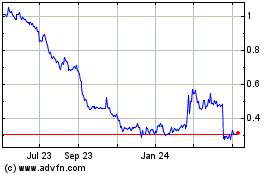

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Apr 2023 to Apr 2024