Community West Bancshares (Community West or the Company), (NASDAQ:

CWBC), parent company of Community West Bank (Bank), today reported

net income increased to $2.7 million, or $0.32 per diluted share,

for the fourth quarter of 2019 (4Q19), compared to $2.2 million, or

$0.25 per diluted share, in 3Q19, and $1.4 million, or $0.16 per

diluted share, in 4Q18. For the full year 2019, net income

increased 7.5% to $8.0 million, or $0.93 per diluted share,

compared to $7.4 million, or $0.88 per diluted share, in 2018.

“We ended the year producing solid earnings for

the fourth quarter and full year of 2019, highlighted by top-line

revenue growth, steady year-over-year loan and deposit growth, and

above industry-average net interest margin of 4.07% for the fourth

quarter of 2019,” said Martin E. Plourd, President and Chief

Executive Officer. “Although the growth of the bank has

slowed in 2019, our performance metrics improved at

quarter-end. Return on average assets, return on average

common equity and our efficiency ratio all improved as we continue

to deepen our presence throughout California’s Central Coast of

Ventura, Santa Barbara and San Luis Obispo Counties, with our

long-term goal to deliver consistent earnings performance for our

shareholders. We anticipate loan growth to remain muted in

2020 and will look to profitable lines of business, within our

bank’s risk tolerance.”

Fourth Quarter 2019 Financial

Highlights:

- Net income was $2.7 million, or

$0.32 per diluted share, in 4Q19, compared to $2.2 million, or

$0.25 per diluted share in 3Q19, and $1.4 million, or $0.16 per

diluted share in 4Q18.

- Net interest margin of 4.07% for

4Q19, compared to 4.10% for 3Q19 and 3.97% for 4Q18.

- Total deposits were $750.9 million

at December 31, 2019, compared to $761.7 million at September 30,

2019, and increased compared to $716.0 million at December 31,

2018.

- Total demand deposits represented

56.6% of total deposits at December 31, 2019.

- Total loans decreased $13.9 million

during the quarter to $775.6 million at December 31, 2019, compared

to $789.5 million at September 30, 2019, and increased compared to

$768.2 million at December 31, 2018.

- Book value per common share

increased to $9.68 at December 31, 2019, compared to $9.40 at

September 30, 2019, and $8.92 at December 31, 2018.

- Provision (credit) for loan losses

was ($210,000) for the quarter, compared to a credit for loan

losses of ($75,000) for 3Q19, and a provision for loan losses of

$238,000 for 4Q18.

- Total risked based capital improved

to 11.41% for the Bank at December 31, 2019, compared to 11.18% at

September 30, 2019 and 10.83% at December 31, 2018.

- Net nonaccrual loans improved to

$2.4 million at December 31, 2019, compared to $5.5 million at

September 30, 2019, and $3.4 million at December 31, 2018.

- Other assets acquired through

foreclosure, net was $2.5 million at December 31, 2019, compared to

$317,000 at September 30, 2019, and zero at December 31, 2018.

Income Statement

Net interest income was $8.8 million in 4Q19 and

3Q19 and increased compared to $8.4 million in 4Q18. For

4Q19, net interest income benefited from a net decrease in the cost

of funds. For the year, net interest income increased to

$34.4 million, compared to $33.6 million in 2018.

“A key component of our business strategy was to

grow non-interest income. Additionally with the disruption in

the agriculture industry we shifted our agriculture lending from

on-balance sheet products to making agriculture loans that could be

sold,” said Plourd. “This shift resulted in loan sale gains

of $765,000 during the quarter. While we anticipate continued focus

on this strategy in future quarters, we don’t anticipate the same

level of activity and resulting gains as we experienced in

4Q19.” Non-interest income increased to $1.7 million in 4Q19,

compared to $647,000 in 3Q19 and $660,000 in 4Q18.

Non-interest income was $3.6 million for the year 2019,

compared to $2.6 million in 2018.

“Our reduced cost of funds rate has helped to

sustain our net interest margin year-over-year despite the three

interest rate reductions during the second half of 2019,” said

Susan C. Thompson, Executive Vice President and Chief Financial

Officer. Fourth quarter net interest margin was 4.07%,

compared to 4.10% in 3Q19, and improved 13 basis points compared to

3.97% in 4Q18. For the year, the net interest margin was

4.06%, compared to 4.07% in 2018.

Non-interest expenses totaled $6.8 million in

4Q19, compared to $6.5 million in the preceding quarter and $6.8

million in 4Q18. For the full year 2019, non-interest expense

was $26.8 million, compared to $26.0 million in 2018.

Balance Sheet

“We have been actively managing both sides of

the balance sheet, adhering to strict underwriting standards with

loan originations and replacing higher cost funding,” said

Thompson. Total assets increased modestly to $913.9 million

at December 31, 2019, compared to $903.3 million at September 30,

2019 and increased $36.6 million, or 4.2%, compared to $877.3

million at December 31, 2018. Total loans decreased to $775.6

million at December 31, 2019, compared to $789.5 million at

September 30, 2019, and increased modestly compared to $768.2

million at December 31, 2018.

Commercial real estate loans outstanding (which

include SBA 504, construction and land) were up 5.4% from year ago

levels to $385.6 million at December 31, 2019 and comprise 49.7% of

the total loan portfolio. Manufactured housing loans were up

4.1% from year ago levels to $257.2 million and represent 33.2% of

total loans. Commercial loans (which include agriculture

loans) were down 14.4% from year ago levels to $101.5 million and

represent 13.1% of the total loan portfolio.

Total deposits decreased to $750.9 million at

December 31, 2019, compared to $761.7 million at September 30,

2019, and increased $34.9 million, or 4.9% compared to $716.0

million at December 31, 2018. Non-interest-bearing demand

deposits decreased $3.6 million to $110.8 million at December 31,

2019 compared to $114.4 million at September 30, 2019 and increased

$2.6 million compared to $108.2 million at December 30, 2018.

Interest-bearing demand deposits decreased to $314.3 million

compared to $333.7 million at September 30, 2019 but increased

$43.9 million compared to $270.4 million at December 31,

2018. Certificates of deposit, which include broker deposits

increased $12.0 million during the quarter to $310.1 million at

December 31, 2019 compared to $298.1 million at September 30, 2019

and decreased $12.6 million compared to $322.8 million at December

31, 2018 as the Company divests itself from higher priced

funding.

Stockholders’ equity increased to $82.0 million

at December 31, 2019, compared to $79.6 million at September 30,

2019, and $76.2 million at December 31, 2018. Book value per

common share increased to $9.68 at December 31, 2019, compared to

$9.40 at September 30, 2019, and $8.92 at December 31,

2018.

Credit Quality

The Company recorded a credit to its provision

for loan losses of ($210,000) in 4Q19. This compares to a

credit to the provision for loan losses of ($75,000) in 3Q19 and a

provision for loan losses of $238,000 in 4Q18. The allowance

for loan losses, including the reserve for undisbursed loans, was

$8.8 million, or 1.19% of total loans held for investment, at

December 31, 2019. Net nonaccrual loans plus net other assets

acquired through foreclosure were $4.9 million at December 31,

2019, compared to $5.8 million at September 30, 2019, and $3.4

million at December 31, 2018.

Net nonaccrual loans totaled $2.4 million at

December 31, 2019, compared to $5.5 million at September 30, 2019

and $3.4 million a year ago. Of the $2.4 million of net

nonaccrual loans at December 31, 2019, $1.6 million were commercial

loans, $0.6 million were manufactured housing loans, $0.1 million

were SBA loans, and $0.1 million were commercial real estate

loans.

There was $2.5 million in other assets acquired

through foreclosure as of December 31, 2019. This compares to

$317,000 of other assets acquired through foreclosure at September

30, 2019, and no other assets acquired through foreclosure a year

prior.

Cash Dividend Declared

The Company’s Board of Directors declared a cash

dividend of $0.055 per common share, payable February 28, 2020 to

common shareholders of record on February 11, 2020. The

current annualized yield, based on the closing price of CWBC shares

of $11.10 on December 31, 2019, was 1.94%.

Stock Repurchase Program

The Company repurchased a total of 99,983 shares

during the first three quarters of 2019 and did not repurchase any

shares of its common stock in the fourth quarter of 2019, leaving

$1.4 million available under the previously announced repurchase

program.

Company Overview

Community West Bancshares is a financial

services company with headquarters in Goleta, California. The

Company is the holding company for Community West Bank, the largest

publicly traded community bank serving California’s Central Coast

area of Ventura, Santa Barbara and San Luis Obispo counties.

Community West Bank has eight full-service California branch

banking offices in Goleta, Santa Barbara, Santa Maria, Ventura,

Westlake Village, San Luis Obispo, Oxnard and Paso Robles.

The principal business activities of the Company are

Relationship Banking, Manufactured Housing lending and Government

Guaranteed lending.

Industry Accolades

In April 2019, Community West was awarded a

“Premier” rating by The Findley Reports. For 51 years, The

Findley Reports has been recognizing the financial performance of

banking institutions in California and the Western United

States. In making their selections, The Findley Reports

focuses on these four ratios: growth, return on beginning equity,

net operating income as a percentage of average assets, and loan

losses as a percentage of gross loans.

Safe Harbor Disclosure

This release contains forward-looking statements

that reflect management's current views of future events and

operations. These forward-looking statements are based on

information currently available to the Company as of the date of

this release. It is important to note that these

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, including, but not limited to,

the ability of the Company to implement its strategy and expand its

lending operations.

|

COMMUNITY WEST BANCSHARES |

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

| (in 000's,

except per share data) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

|

2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

11,136 |

|

|

$ |

11,306 |

|

|

$ |

10,582 |

|

$ |

43,890 |

|

|

$ |

40,865 |

|

Investment securities and other |

|

|

492 |

|

|

|

413 |

|

|

|

459 |

|

|

1,849 |

|

|

|

1,766 |

|

Total interest income |

|

|

11,628 |

|

|

|

11,719 |

|

|

|

11,041 |

|

|

45,739 |

|

|

|

42,631 |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

2,413 |

|

|

|

2,615 |

|

|

|

2,329 |

|

|

10,055 |

|

|

|

7,702 |

|

Other borrowings |

|

|

377 |

|

|

|

306 |

|

|

|

358 |

|

|

1,327 |

|

|

|

1,286 |

|

Total interest expense |

|

|

2,790 |

|

|

|

2,921 |

|

|

|

2,687 |

|

|

11,382 |

|

|

|

8,988 |

| Net

interest income |

|

|

8,838 |

|

|

|

8,798 |

|

|

|

8,354 |

|

|

34,357 |

|

|

|

33,643 |

| Provision

(credit) for loan losses |

|

|

(210 |

) |

|

|

(75 |

) |

|

|

238 |

|

|

(165 |

) |

|

|

14 |

|

Net interest income after provision for loan losses |

|

|

9,048 |

|

|

|

8,873 |

|

|

|

8,116 |

|

|

34,522 |

|

|

|

33,629 |

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

Other loan fees |

|

|

500 |

|

|

|

302 |

|

|

|

350 |

|

|

1,383 |

|

|

|

1,348 |

|

Gains from loan sales, net |

|

|

765 |

|

|

|

- |

|

|

|

- |

|

|

765 |

|

|

|

- |

|

Service charges |

|

|

160 |

|

|

|

129 |

|

|

|

108 |

|

|

567 |

|

|

|

459 |

|

Document processing fees |

|

|

116 |

|

|

|

96 |

|

|

|

122 |

|

|

423 |

|

|

|

489 |

|

Other |

|

|

123 |

|

|

|

120 |

|

|

|

80 |

|

|

469 |

|

|

|

332 |

|

Total non-interest income |

|

|

1,664 |

|

|

|

647 |

|

|

|

660 |

|

|

3,607 |

|

|

|

2,628 |

|

Non-interest expenses |

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

4,141 |

|

|

|

4,254 |

|

|

|

3,991 |

|

|

17,094 |

|

|

|

16,329 |

|

Occupancy, net |

|

|

750 |

|

|

|

788 |

|

|

|

829 |

|

|

3,088 |

|

|

|

3,132 |

|

Professional services |

|

|

552 |

|

|

|

341 |

|

|

|

425 |

|

|

1,679 |

|

|

|

1,356 |

|

Data processing |

|

|

236 |

|

|

|

215 |

|

|

|

233 |

|

|

876 |

|

|

|

852 |

|

Depreciation |

|

|

214 |

|

|

|

219 |

|

|

|

212 |

|

|

864 |

|

|

|

764 |

|

Advertising and marketing |

|

|

228 |

|

|

|

187 |

|

|

|

198 |

|

|

774 |

|

|

|

685 |

|

FDIC assessment |

|

|

118 |

|

|

|

(15 |

) |

|

|

223 |

|

|

427 |

|

|

|

770 |

|

Stock-based compensation |

|

|

100 |

|

|

|

90 |

|

|

|

194 |

|

|

382 |

|

|

|

478 |

|

Other |

|

|

475 |

|

|

|

385 |

|

|

|

542 |

|

|

1,571 |

|

|

|

1,673 |

|

Total non-interest expenses |

|

|

6,814 |

|

|

|

6,464 |

|

|

|

6,847 |

|

|

26,755 |

|

|

|

26,039 |

| Income

before provision for income taxes |

|

|

3,898 |

|

|

|

3,056 |

|

|

|

1,929 |

|

|

11,374 |

|

|

|

10,218 |

| Provision

for income taxes |

|

|

1,179 |

|

|

|

902 |

|

|

|

570 |

|

|

3,411 |

|

|

|

2,809 |

| Net

income |

|

$ |

2,719 |

|

|

$ |

2,154 |

|

|

$ |

1,359 |

|

$ |

7,963 |

|

|

$ |

7,409 |

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.32 |

|

|

$ |

0.25 |

|

|

$ |

0.16 |

|

$ |

0.94 |

|

|

$ |

0.89 |

|

Diluted |

|

$ |

0.32 |

|

|

$ |

0.25 |

|

|

$ |

0.16 |

|

$ |

0.93 |

|

|

$ |

0.88 |

| |

|

|

|

|

|

|

|

|

|

|

|

COMMUNITY WEST BANCSHARES |

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

| (in 000's,

except per share data) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

December 31, |

|

September 30, |

|

December 31, |

| |

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

| Cash and

interest-earning deposits in other financial institutions |

|

$ |

82,661 |

|

|

$ |

56,347 |

|

|

$ |

56,915 |

|

| Investment

securities |

|

|

25,563 |

|

|

|

28,707 |

|

|

|

32,353 |

|

| Loans: |

|

|

|

|

|

|

|

Commercial |

|

|

101,485 |

|

|

|

110,153 |

|

|

|

118,518 |

|

|

Commercial real estate |

|

|

385,642 |

|

|

|

392,288 |

|

|

|

365,809 |

|

|

SBA |

|

|

14,777 |

|

|

|

17,018 |

|

|

|

19,077 |

|

|

Manufactured housing |

|

|

257,247 |

|

|

|

253,229 |

|

|

|

247,114 |

|

|

Single family real estate |

|

|

11,668 |

|

|

|

11,936 |

|

|

|

11,261 |

|

|

HELOC |

|

|

4,531 |

|

|

|

4,847 |

|

|

|

6,756 |

|

|

Other |

|

|

213 |

|

|

|

(14 |

) |

|

|

(292 |

) |

| Total

loans |

|

|

775,563 |

|

|

|

789,457 |

|

|

|

768,243 |

|

| |

|

|

|

|

|

|

| Loans,

net |

|

|

|

|

|

|

|

Held for sale |

|

|

42,046 |

|

|

|

44,816 |

|

|

|

48,355 |

|

|

Held for investment |

|

|

733,517 |

|

|

|

744,641 |

|

|

|

719,888 |

|

|

Less: Allowance for loan losses |

|

|

(8,717 |

) |

|

|

(8,868 |

) |

|

|

(8,691 |

) |

|

Net held for investment |

|

|

724,800 |

|

|

|

735,773 |

|

|

|

711,197 |

|

|

NET LOANS |

|

|

766,846 |

|

|

|

780,589 |

|

|

|

759,552 |

|

| |

|

|

|

|

|

|

| Other

assets |

|

|

38,800 |

|

|

|

37,609 |

|

|

|

28,471 |

|

| |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

913,870 |

|

|

$ |

903,252 |

|

|

$ |

877,291 |

|

| |

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

Non-interest-bearing demand |

|

$ |

110,843 |

|

|

$ |

114,366 |

|

|

$ |

108,161 |

|

|

Interest-bearing demand |

|

|

314,278 |

|

|

|

333,679 |

|

|

|

270,431 |

|

|

Savings |

|

|

15,689 |

|

|

|

15,481 |

|

|

|

14,641 |

|

|

Certificates of deposit ($250,000 or more) |

|

|

96,431 |

|

|

|

90,298 |

|

|

|

93,439 |

|

|

Other certificates of deposit |

|

|

213,693 |

|

|

|

207,848 |

|

|

|

229,334 |

|

| Total

deposits |

|

|

750,934 |

|

|

|

761,672 |

|

|

|

716,006 |

|

| Other

borrowings |

|

|

65,000 |

|

|

|

45,000 |

|

|

|

75,000 |

|

| Other

liabilities |

|

|

15,958 |

|

|

|

16,984 |

|

|

|

10,134 |

|

| TOTAL

LIABILITIES |

|

|

831,892 |

|

|

|

823,656 |

|

|

|

801,140 |

|

| |

|

|

|

|

|

|

|

Stockholders' equity |

|

|

81,978 |

|

|

|

79,596 |

|

|

|

76,151 |

|

| |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| |

$ |

913,870 |

|

|

$ |

903,252 |

|

|

$ |

877,291 |

|

| |

|

|

|

|

|

|

| Common

shares outstanding |

|

|

8,472 |

|

|

|

8,467 |

|

|

|

8,533 |

|

| |

|

|

|

|

|

|

| Book value

per common share |

|

$ |

9.68 |

|

|

$ |

9.40 |

|

|

$ |

8.92 |

|

| |

|

|

|

|

|

|

|

ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

| (Dollars in

thousands except per share amounts)(Unaudited) |

|

|

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

Three Months

Ended |

|

Three Months

Ended |

|

Twelve

Months Ended |

|

PERFORMANCE MEASURES AND RATIOS |

December 31, 2019 |

|

September 30, 2019 |

|

December 31, 2018 |

|

December 31, 2019 |

|

December 31, 2018 |

| Return on

average common equity |

|

13.35 |

% |

|

|

10.85 |

% |

|

|

7.06 |

% |

|

|

10.15 |

% |

|

|

10.02 |

% |

| Return on

average assets |

|

1.21 |

% |

|

|

0.97 |

% |

|

|

0.63 |

% |

|

|

0.91 |

% |

|

|

0.88 |

% |

| Efficiency

ratio |

|

64.88 |

% |

|

|

68.44 |

% |

|

|

75.96 |

% |

|

|

70.47 |

% |

|

|

71.79 |

% |

| Net interest

margin |

|

4.07 |

% |

|

|

4.10 |

% |

|

|

3.97 |

% |

|

|

4.06 |

% |

|

|

4.07 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

Three Months

Ended |

|

Three Months

Ended |

|

Twelve

Months Ended |

|

AVERAGE BALANCES |

December 31, 2019 |

|

September 30, 2019 |

|

December 31, 2018 |

|

December 31, 2019 |

|

December 31, 2018 |

| Average

assets |

$ |

887,902 |

|

|

$ |

877,505 |

|

|

$ |

852,892 |

|

|

$ |

872,509 |

|

|

$ |

842,468 |

|

| Average

earning assets |

|

862,350 |

|

|

|

850,948 |

|

|

|

834,259 |

|

|

|

846,673 |

|

|

|

826,292 |

|

| Average

total loans |

|

779,698 |

|

|

|

788,965 |

|

|

|

764,411 |

|

|

|

778,745 |

|

|

|

751,775 |

|

| Average

deposits |

|

725,029 |

|

|

|

735,545 |

|

|

|

717,205 |

|

|

|

726,022 |

|

|

|

714,651 |

|

| Average

common equity |

|

80,825 |

|

|

|

78,763 |

|

|

|

76,334 |

|

|

|

78,437 |

|

|

|

73,906 |

|

| |

|

|

|

|

|

|

|

|

|

|

EQUITY ANALYSIS |

December 31, 2019 |

|

September 30, 2019 |

|

December 31, 2018 |

|

|

|

|

| Total common

equity |

$ |

81,978 |

|

|

$ |

79,596 |

|

|

$ |

76,151 |

|

|

|

|

|

| Common stock

outstanding |

|

8,472 |

|

|

|

8,467 |

|

|

|

8,533 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Book value

per common share |

$ |

9.68 |

|

|

$ |

9.40 |

|

|

$ |

8.92 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY |

December 31, 2019 |

|

September 30, 2019 |

|

December 31, 2018 |

|

|

|

|

| Nonaccrual

loans, net |

$ |

2,389 |

|

|

$ |

5,476 |

|

|

$ |

3,378 |

|

|

|

|

|

| Nonaccrual

loans, net/total loans |

|

0.31 |

% |

|

|

0.69 |

% |

|

|

0.44 |

% |

|

|

|

|

| Other assets

acquired through foreclosure, net |

$ |

2,524 |

|

|

$ |

317 |

|

|

$ |

- |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Nonaccrual

loans plus other assets acquired through foreclosure, net |

$ |

4,913 |

|

|

$ |

5,793 |

|

|

$ |

3,378 |

|

|

|

|

|

| Nonaccrual

loans plus other assets acquired through foreclosure, net/total

assets |

|

0.54 |

% |

|

|

0.64 |

% |

|

|

0.39 |

% |

|

|

|

|

| Net loan

(recoveries)/charge-offs in the quarter |

$ |

(58 |

) |

|

$ |

(69 |

) |

|

$ |

66 |

|

|

|

|

|

| Net

(recoveries)/charge-offs in the quarter/total loans |

|

(0.01 |

%) |

|

|

(0.01 |

%) |

|

|

0.01 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Allowance

for loan losses |

$ |

8,717 |

|

|

$ |

8,868 |

|

|

$ |

8,691 |

|

|

|

|

|

| Plus:

Reserve for undisbursed loan commitments |

|

85 |

|

|

|

81 |

|

|

|

73 |

|

|

|

|

|

| Total

allowance for credit losses |

$ |

8,802 |

|

|

$ |

8,949 |

|

|

$ |

8,764 |

|

|

|

|

|

| Allowance

for loan losses/total loans held for investment |

|

1.19 |

% |

|

|

1.19 |

% |

|

|

1.21 |

% |

|

|

|

|

| Allowance

for loan losses/nonaccrual loans, net |

|

364.88 |

% |

|

|

161.94 |

% |

|

|

257.28 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Community West Bank * |

|

|

|

|

|

|

|

|

|

| Tier 1

leverage ratio |

|

9.06 |

% |

|

|

9.02 |

% |

|

|

8.57 |

% |

|

|

|

|

| Tier 1

capital ratio |

|

10.28 |

% |

|

|

10.04 |

% |

|

|

9.68 |

% |

|

|

|

|

| Total

capital ratio |

|

11.41 |

% |

|

|

11.18 |

% |

|

|

10.83 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

INTEREST SPREAD ANALYSIS |

December 31, 2019 |

|

September 30, 2019 |

|

December 31, 2018 |

|

|

|

|

| Yield on

total loans |

|

5.67 |

% |

|

|

5.69 |

% |

|

|

5.49 |

% |

|

|

|

|

| Yield on

investments |

|

3.47 |

% |

|

|

3.06 |

% |

|

|

2.52 |

% |

|

|

|

|

| Yield on

interest earning deposits |

|

1.66 |

% |

|

|

2.14 |

% |

|

|

2.70 |

% |

|

|

|

|

| Yield on

earning assets |

|

5.35 |

% |

|

|

5.46 |

% |

|

|

5.25 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cost of

interest-bearing deposits |

|

1.57 |

% |

|

|

1.69 |

% |

|

|

1.52 |

% |

|

|

|

|

| Cost of

total deposits |

|

1.32 |

% |

|

|

1.41 |

% |

|

|

1.29 |

% |

|

|

|

|

| Cost of

borrowings |

|

2.31 |

% |

|

|

2.64 |

% |

|

|

2.87 |

% |

|

|

|

|

| Cost of

interest-bearing liabilities |

|

1.64 |

% |

|

|

1.76 |

% |

|

|

1.63 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| * Capital

ratios are preliminary until the Call Report is filed. |

|

|

|

|

|

|

|

|

|

Contact:

Susan C. Thompson, EVP &

CFO805.692.5821www.communitywestbank.com

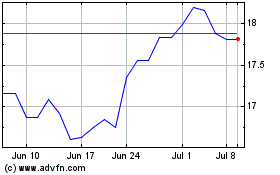

Community West Bancshares (NASDAQ:CWBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Community West Bancshares (NASDAQ:CWBC)

Historical Stock Chart

From Apr 2023 to Apr 2024