Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

February 18 2020 - 5:17PM

Edgar (US Regulatory)

Prospectus Supplement filed pursuant to Rule

424(b)(3) in connection with Registration No. 333-230919

Prospectus Supplement No. 1 dated

February 18, 2020

(to Prospectus dated April 26, 2019)

3,670,551

Shares of Common Stock

This Prospectus Supplement No. 1 updates, amends, and supplements

the information previously included in the prospectus dated April 26, 2019, relating the sale or other disposition from time to

time of up to 3,670,551 shares of our common stock, $0.001 par value per share, issuable upon the exercise of warrants held by

the selling stockholders named in the prospectus, including their transferees, pledgees, donees or successors. We are not selling

any shares of common stock under the prospectus and will not receive any of the proceeds from the sale of shares of common stock

by the selling stockholders.

The sole purpose of this prospectus supplement is to modify

certain information in the prospectus set forth under the captions “The Offering,” “Use of Proceeds” and

“Selling Stockholders” to update information regarding the exercise price of certain of the warrants and information

regarding the selling stockholders.

On February 14, 2020,

we entered into a warrant exercise agreement with a selling stockholder to exercise certain of the selling stockholder’s

warrants for an aggregate of 2,135,923 shares of common stock at a reduced exercise price of $1.02.

This prospectus supplement should be read in conjunction with

the prospectus, which is required to be delivered with this prospectus supplement. This prospectus supplement is qualified in its

entirety by reference to the prospectus except to the extent that the information herein modifies or supersedes the information

contained in the prospectus. Except as amended by this prospectus supplement, the “The Offering,” “Use of Proceeds”

and “Selling Stockholders” sections of the prospectus are not otherwise affected by this prospectus supplement.

This Prospectus Supplement No. 1 is not complete without, and

may not be delivered or used except in connection with, our prospectus, including all amendments and supplements thereto.

Investing

in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under

the heading “Risk Factors” beginning on page 8 of the original prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement

No. 1 is February 18, 2020.

The information regarding

use of proceeds in the “The Offering” and “Use of Proceeds” sections

of the prospectus is hereby amended as follows:

On February 14, 2020, we entered into a warrant exercise

agreement with a selling stockholder to exercise certain of the selling stockholder’s warrants for an aggregate of

2,135,923 shares of common stock at a reduced exercise price of $1.02. As a result of

the reduced exercise price of $1.02 for an aggregate of 2,135,923 shares of common stock, we may receive up to a total

of $4,480,580 in gross proceeds if all of the warrants are exercised hereunder for cash. However, as we are unable to predict

the timing or amount of potential exercises of the warrants, we have not allocated any proceeds of such exercises to any

particular purpose. Accordingly, all such proceeds are allocated to working capital. It is possible that the warrants may

expire and may never be exercised.

The “Selling

Stockholders” section of the prospectus is hereby amended as follows:

The

following table set forth certain information regarding the selling stockholders and the shares of common stock beneficially

owned by them, which information is available to us as of February 7, 2020. The selling stockholders may offer the shares

under this prospectus from time to time and may elect to sell some, all or none of the shares set forth under this

prospectus. However, for the purposes of the table below, we have assumed that, after completion of the offering, none of the

shares covered by this prospectus will be held by the selling stockholders. In addition, a selling stockholder may have sold,

transferred or otherwise disposed of all or a portion of that holder’s shares of common stock since the date on which

the selling stockholder provided information for this table. We have not made independent inquiries about such transfers or

dispositions. See the section entitled “Plan of Distribution” beginning on page 33 of the prospectus.

Beneficial

ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of

shares beneficially owned prior to the offering is based on 31,493,389 shares of our common stock outstanding as of February

7, 2020. The table below does not give effect to the exercise of a warrant for an aggregate of 2,135,923 shares at the reduced exercise

price of $1.02 agreed to on February 14, 2020.

|

Selling Stockholder

|

|

Number of

Shares of Common

Stock Beneficially

Owned Before

Any Sale

|

|

% of Class

|

|

Number of

Share of

Common

Stock

Offering

|

|

|

Shares of Common Stock

Beneficially Owned After

Sale of All Shares of

Common Stock Pursuant

to this Prospectus

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

|

% of Class

|

|

|

Armistice Capital Master Fund, Ltd.

|

|

|

3,459,190

|

(1)(2)

|

|

|

9.99

|

%(1)(2)

|

|

|

2,135,923

|

|

|

|

3,459,190

|

(2)

|

|

|

9.99

|

%(2)

|

|

Myron Holubiak

|

|

|

3,575,729

|

(3)

|

|

|

10.81

|

%(3)

|

|

|

129,450

|

|

|

|

3,446,279

|

|

|

|

10.46

|

%

|

|

Leonard L. Mazur

|

|

|

17,924,068

|

(4)

|

|

|

45.77

|

%(4)

|

|

|

1,165,048

|

|

|

|

16,759,020

|

|

|

|

44.11

|

%

|

|

Noam Rubinstein (5)

|

|

|

546,535

|

(6)

|

|

|

1.71

|

%(6)

|

|

|

75,641

|

|

|

|

470,894

|

|

|

|

1.48

|

%

|

|

Michael Vasinkevich (5)

|

|

|

951,572

|

(7)

|

|

|

2.93

|

%(7)

|

|

|

154,884

|

|

|

|

796,668

|

|

|

|

2.47

|

%

|

|

Mark Viklund (5)

|

|

|

42,789

|

(8)

|

|

|

|

*(8)

|

|

|

7,204

|

|

|

|

35,585

|

|

|

|

*

|

|

|

Charles Worthman (5)

|

|

|

14,731

|

(9)

|

|

|

|

*(9)

|

|

|

2,401

|

|

|

|

12,330

|

|

|

|

*

|

|

|

TOTAL

|

|

|

26,514,614

|

|

|

|

58.41

|

%

|

|

|

3,670,551

|

|

|

|

24,979,986

|

|

|

|

56.96

|

%

|

|

|

*

|

Represents

beneficial ownership of less than one percent of the outstanding shares of our common stock.

|

|

(1)

|

Includes warrants to purchase 9,057,492 shares of common stock. The business address of Armistice is 510 Madison Avenue, 22nd Floor, New York, New York 10022.

|

|

(2)

|

The warrants held by Armistice are subject to a beneficial ownership limitation of either 9.99% or 4.99% (as specified in the individual warrant agreements), which does not permit Armistice to exercise that portion of the warrants that would result in Armistice and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and percentages in the table give effect to the beneficial ownership limitation.

|

|

(3)

|

Consists of (i) 1,992,243 shares of common stock, (ii) 111,125 shares of common stock issuable upon exercise of options and (iii) warrants to purchase an aggregate of 1,472,361 shares of common stock.

|

|

(4)

|

Consists of (i) 10,255,343 shares of common stock, (ii) 304,458 shares of common stock issuable upon exercise of options and (iii) warrants to purchase an aggregate of 7,364,267 shares of common stock.

|

|

(5)

|

The selling stockholder is an affiliate of a registered broker-dealer.

|

|

(6)

|

Consists of warrants to purchase 491,535 shares of common stock.

|

|

(7)

|

Consists of warrants to purchase 951,572 shares of common stock.

|

|

(8)

|

Consists of warrants to purchase 42,789 shares of common stock.

|

|

(9)

|

Consists of warrants to purchase 14,731 shares of common stock.

|

Information

about any other selling stockholders will be included in prospectus supplements or post-effective amendments, if required. Information

about the selling stockholders may change from time to time. Any changed information with respect to which we are given notice

will be included in prospectus supplements.

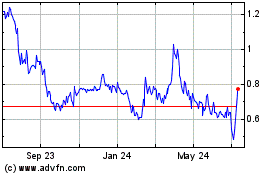

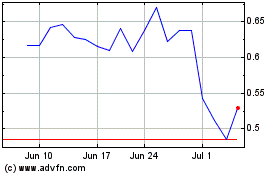

Citius Pharmaceuticals (NASDAQ:CTXR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citius Pharmaceuticals (NASDAQ:CTXR)

Historical Stock Chart

From Apr 2023 to Apr 2024