Castor Maritime Inc. Announces Pricing of $125 Million Registered Direct Offering

April 05 2021 - 9:00AM

Castor Maritime Inc. (the “Company”) (NASDAQ: CTRM) announces today

that it has entered into a securities purchase agreement with

certain unaffiliated institutional investors to issue approximately

192.3 million of its common shares and warrants to purchase up to

an aggregate of 192.3 million common shares at a purchase price of

$0.65 per common share and accompanying warrant in a registered

direct offering (the “Offering”). The warrants will have an

exercise price of $0.65 per share, are exercisable immediately and

will expire five years following the date of issuance.

Maxim Group LLC is acting as sole placement

agent for the Offering.

The gross proceeds to the Company from the

Offering are estimated to be approximately $125.0 million before

deducting the placement agent’s fees and other estimated Offering

expenses. The Offering is expected to close on or around April 7,

2021, subject to the satisfaction of customary closing

conditions.

The securities described above are being offered

by the Company pursuant to a shelf registration statement on Form

F-3ASR (File No.: 333-254977), including a base prospectus

contained therein, which became automatically effective upon filing

with the U.S. Securities and Exchange Commission ("SEC") on April

1, 2021. Such securities are being offered only by means of a

prospectus supplement and accompanying base prospectus. A

prospectus supplement related to and describing the terms of the

Offering will be filed by the Company with the SEC and available on

the SEC's website at http://www.sec.gov. Copies of the prospectus

supplement, together with the base prospectus, relating to the

Offering may be obtained, when available, by contacting: Maxim

Group LLC, 405 Lexington Avenue, 2nd Floor, New York, NY 10174, by

telephone: at (212) 895-3500.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of, these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification of these securities under the

securities laws of any such state or jurisdiction.

About Castor Maritime Inc.

Castor Maritime Inc. is an international

provider of shipping transportation services through its ownership

of oceangoing cargo vessels.

On a fully delivered basis, Castor will have a

fleet of 14 vessels, with an aggregate capacity of 1.3 million dwt,

consisting of 1 Capesize, 5 Kamsarmax and 6 Panamax dry bulk

vessels and 2 Aframax LR2 tankers. Where we refer to information on

a “fully delivered basis”, we are referring to such information

after giving effect to the successful consummation of our recent

vessel acquisitions.

For more information please visit the Company’s

website at www.castormaritime.com. Information on our

website does not constitute a part of this press release.

Cautionary Statement Regarding Forward-Looking

Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. We desire to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and are including this cautionary statement in

connection with this safe harbor legislation. The words “believe”,

“anticipate”, “intend”, “estimate”, “forecast”, “project”, “plan”,

“potential”, “will”, “may”, “should”, “expect”, “pending” and

similar expressions identify forward-looking statements. The

forward-looking statements in this press release are based upon

various assumptions, many of which are based, in turn, upon further

assumptions, including without limitation, our management’s

examination of historical operating trends, data contained in our

records and other data available from third parties. Although we

believe that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond our control, we cannot assure you that we

will achieve or accomplish these expectations, beliefs or

projections. We undertake no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise. In addition to these important factors,

other important factors that, in our view, could cause actual

results to differ materially from those discussed in the

forward-looking statements include general dry bulk and tanker

shipping market conditions, including fluctuations in charter hire

rates and vessel values, the strength of world economies the

stability of Europe and the Euro, fluctuations in interest rates

and foreign exchange rates, changes in demand in the dry bulk and

tanker shipping industry, including the market for our vessels,

changes in our operating expenses, including bunker prices, dry

docking and insurance costs, changes in governmental rules and

regulations or actions taken by regulatory authorities, potential

liability from pending or future litigation, general domestic and

international political conditions, potential disruption of

shipping routes due to accidents or political events, the length

and severity of the COVID-19 outbreak, the impact of public health

threats and outbreaks of other highly communicable diseases, the

impact of the expected discontinuance of LIBOR after 2021 on

interest rates of our debt that reference LIBOR, the availability

of financing and refinancing and grow our business, vessel

breakdowns and instances of off-hire, potential exposure or loss

from investment in derivative instruments, potential conflicts of

interest involving our Chief Executive Officer, his family and

other members of our senior management, and our ability to complete

acquisition transactions as planned. Please see our filings with

the Securities and Exchange Commission for a more complete

discussion of these and other risks and uncertainties. The

information set forth herein speaks only as of the date hereof, and

we disclaim any intention or obligation to update any

forward-looking statements as a result of developments occurring

after the date of this communication.

CONTACT DETAILS

For further information please contact:Petros PanagiotidisCastor

Maritime Inc.Email: ir@castormaritime.com

Media Contact:Kevin KarlisCapital LinkEmail:

castormaritime@capitallink.com

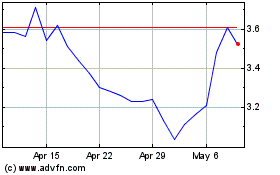

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Apr 2023 to Apr 2024