Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 12 2021 - 4:55PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2021

Commission File Number: 001-38802

CASTOR MARITIME INC.

(Translation of registrant’s name into English)

223 Christodoulou Chatzipavlou Street, Hawaii Royal Gardens, 3036 Limassol, Cyprus

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b) (1) only permits the submission in paper of a Form 6-K if submitted solely to provide an

attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or

other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of

the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a

material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On January 8, 2021, Castor Maritime Inc. (the “Company” or “we” or “our”) entered into a securities purchase agreement with certain unaffiliated institutional

investors to issue 137,000,000 of its common shares (the “Common Shares”) and 137,000,000 warrants to purchase Common Shares (“Warrants”) in a registered direct offering.

Among other things, the warrant is exercisable for $0.19 per Common Share and has a term of 5 years. If at the time of exercise there is no effective

registration statement registering, or the prospectus contained therein is not available for the issuance of the Common Shares underlying the Warrants to the holder, the holder may, in its sole discretion, elect to exercise the Warrant through a

cashless exercise, in which case the holder would receive upon such exercise the net number of common shares determined according to the formula set forth in the Warrant. If we do not issue the shares in a timely fashion, the Warrant contains certain

damages provisions. A holder will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of our Common

Shares outstanding immediately after giving effect to the exercise, as such percentage of beneficial ownership is determined in accordance with the terms of the Warrants. However, any holder may increase or decrease such percentage, but not in excess

of 9.99%, provided that any increase will not be effective until the 61st day after such election. The exercise price of the Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock

combinations, reclassifications or similar events affecting our Common Shares and also upon any distributions of assets, including cash, stock or other property to our shareholders. If a fundamental transaction occurs, then the successor entity will

succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Warrants with the same effect as if such successor entity had been named in the Warrant itself. If

holders of our Common Shares are given a choice as to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise of the Warrant

following such fundamental transaction. In addition, we or the successor entity, at the request of warrant holders, will be obligated to purchase any unexercised portion of the Warrants in accordance with the terms of such Warrants.

Attached to this report on Form 6-K as

Exhibit

4.1 is a copy of the Placement Agency Agreement dated January 8, 2021 between the Company and Maxim Group LLC, as sole placement agent.

Attached to this report on Form 6-K as

Exhibit

4.2 is a copy of the form of Securities Purchase Agreement, dated January 8, 2021.

Attached to this report on Form 6-K as

Exhibit

4.3 is a copy of the form of the Common Share Purchase Warrant, to be issued to the purchasers under the Securities Purchase Agreement.

Attached to this Report on Form 6-K as

Exhibit

5.1 is the opinion of Seward & Kissel LLP relating to the legality and validity of the Common Shares.

Attached to this report on Form 6-K as

Exhibit

99.1 is a copy of the press release of the Company dated January 8, 2021 titled “Castor Maritime Inc. Announces Pricing of $26.0 Million Registered Direct Offering”.

The information contained in this report on Form 6-K is hereby incorporated by reference into the Company's registration statements on Form F-3 (File Nos. 333-232052 and

333-251957) that were filed with the SEC on

June 10, 2019 and

January 8, 2021, respectively, and declared effective on June 21, 2019 and January 8, 2021, respectively.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CASTOR MARITIME INC.

|

|

|

|

|

|

|

|

Dated: January 12, 2021

|

By:

|

/s/ Petros Panagiotidis

|

|

|

|

Petros Panagiotidis

|

|

|

|

Chairman, Chief Executive Officer and Chief Financial Officer

|

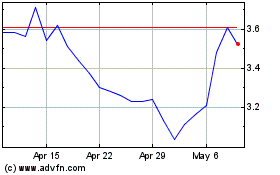

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Apr 2023 to Apr 2024