Current Report Filing (8-k)

July 23 2020 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2020

YUNHONG CTI LTD.

(Exact name of registrant as specified in charter)

|

Illinois

|

|

000-23115

|

|

36-2848943

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

22160 N. Pepper Road, Lake Barrington, IL 60010

(Address of principal executive offices) (Zip Code)

(847) 382-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

CTIB

|

|

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As previously disclosed on a Current Report on Form 8-K of Yunhong CTI Ltd. (the “Company”), on December 14, 2017, the Company entered into a Revolving Credit, Term Loan and Security Agreement (the “Loan Agreement”) with PNC Bank, National Association (“Lender”).

Prior to January 13, 2020, certain events of default under the Loan Agreement had occurred (the "Prior Defaults"). On January 13, 2020, a Limited Waiver, Consent, Amendment No. 5 and Forbearance Agreement (the “Forbearance Agreement”) between Lender and the Company became effective, pursuant to which Lender agreed to, among other things, forebear from exercising the rights and remedies in respect of the Prior Defaults afforded to Lender under the Loan Agreement for a period ending no later than December 31, 2020 (the “Forbearance Period”).

On June 15, 2020, the Lender provided the Company notice (the “Default Notice”) that (i) an additional Event of Default (as defined in the Loan Agreement) had occurred and is continuing as a result of the Company's failure to maintain a Fixed Charge Coverage Ratio (as defined in the Loan Agreement) of 0.75 to 1.00 for the three-month period ended March 31, 2020 (the "March FCCR Default"), (ii) as a result of the occurrence and continuance of the March FCCR Default, the Forbearance Period has ended, and (iii) as a result of the termination of the Forbearance Period, the Lender is entitled to exercise immediately all of its rights and remedies under the Loan Agreement including, without limitation, ceasing to make further advances to the Company and declaring all obligations to be immediately due and payable in accordance with the Loan Agreement.

The Lender has continued to make advances to the Company (“Discretionary Advances”), although it is not required to do so under the terms of the Loan Agreement due to the Events of Default. On July 17, 2020, the Lender provided the Company notice that multiple previously disclosed events, which each constitute an Event of Default, are continuing to occur. Additionally, the Lender required that the Company obtain a commitment for third-party equity funding in an amount not less than $3,000,000 by no later than July 31, 2020. Absent such commitment, the Lender advised that it may cease making discretionary advances to the Company. On July 22, 2020, the Company’s board of directors authorized the Company to seek such funding. In addition, Mr. Yubao Li, the Company’s Chairman, committed that, in the event the Company does not obtain funding of at least $3,000,000 by August 31, 2020, he would provide the necessary funding to ensure the Company meets this requirement.

|

Item 9.01 Financial Statements And Exhibits.

|

(d) Exhibits

The exhibits listed below are furnished as Exhibits to this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 23, 2020

|

|

YUNHONG CTI LTD.

|

|

|

|

|

|

By:

|

/s/ Frank Cesario

|

|

|

|

Frank Cesario

|

|

|

|

President and Chief Executive Officer

|

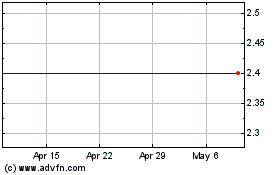

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

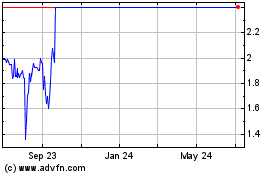

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2023 to Apr 2024