Statement of Changes in Beneficial Ownership (4)

June 09 2020 - 4:06PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

LF International Pte. Ltd. |

2. Issuer Name and Ticker or Trading Symbol

Yunhong CTI Ltd.

[

CTIB

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

470 NORTH BRIDGE ROAD #05-12 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/5/2020 |

|

(Street)

SINGAPORE, U0 188735

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series A Preferred Stock | $1 (1)(2)(3)(4) | 6/5/2020 (1)(2)(4)(5) | | P | | 50000 | | (4) | (2) | Common Stock | 500000 | $10 | 500000 | D | |

| Explanation of Responses: |

| (1) | Pursuant to that certain Stock Purchase Agreement by and between Yunhong CTI Ltd. (formerly known as CTI Industries Corporation, the "Company") and LF International Pte. Ltd. ("LF") dated January 3, 2020, as amended, the Company agreed to issue and sell up to 500,000 shares of Series A Convertible Preferred Stock ("Series A Preferred Stock") of the Company to LF. The parties conducted the first and two interim closings for an aggregate 450,000 shares of Series A Preferred Stock and 400,000 shares of the Company's common stock ("Common Stock") on January 13, February 28 and April 13, 2020, respectively. |

| (2) | On June 5, 2020, the parties completed a final closing by which the Company issued to LF 50,000 shares of Series A Preferred Stock. Each share of Series A Preferred Stock of the Company is initially convertible into ten (10) shares of Common Stock, subject to certain conditions, and has no expiration date. Mr. Yubao Li has 95% voting and dispositive control over the shares held by the LF and may be deemed the beneficial owner of such Series A Preferred Stock and Common Stock. |

| (3) | Each holder of Series A Preferred Stock shall have the right to convert the stated value of such shares, as well as accrued but unpaid declared dividends thereon (collectively the "Conversion Amount") into Common Stock. The number of shares of Common Stock issuable upon conversion of the Conversion Amount shall equal the Conversion Amount divided by the conversion price of $1.00, subject to certain customary adjustments, such that each share of Series A Preferred Stock is initially convertible into ten (10) shares of Common Stock. |

| (4) | The Series A Preferred Stock is convertible at any time, except that it may not be converted into shares of Common Stock to the extent such conversion would result in the holder beneficially owning more than 4.99% ("Maximum Percentage") of the Company's outstanding Common Stock. In connection with the additional interim closing on April 13, 2020, LF waived such Maximum Percentage. |

| (5) | Holders of Series A Preferred Stock shall vote together with the holders of the Common Stock on an as-if-converted basis, whereby each share of the Series A Preferred Stock will be entitled to ten (10) votes, subject to adjustment. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

LF International Pte. Ltd.

470 NORTH BRIDGE ROAD #05-12

SINGAPORE, U0 188735 |

| X |

|

|

Signatures

|

| /s/ Yubao Li, Authorized Representative, on behalf of LF International Pte. Ltd | | 6/9/2020 |

| **Signature of Reporting Person | Date |

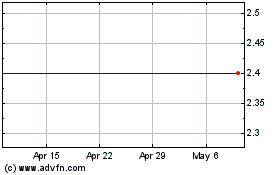

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

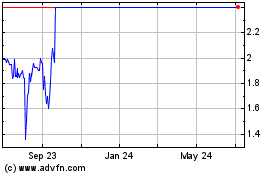

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2023 to Apr 2024