Current Report Filing (8-k)

January 16 2020 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2020

CTI INDUSTRIES CORPORATION

(Exact name of registrant as specified in charter)

|

Illinois

|

|

000-23115

|

|

36-2848943

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

22160 N. Pepper Road Lake Barrington, IL 60010

(Address of principal executive offices) (Zip Code)

(847) 382-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

CTIB

|

|

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Private Placement

As previously disclosed on a Current Report on Form 8-K of CTI Industries Corporation (the “Company”), on January 3, 2020, the Company entered into a stock purchase agreement (the “Purchase Agreement”), pursuant to which the Company agreed to issue and sell, and LF International Pte. Ltd., a Singapore private limited company (the “Investor”), agreed to purchase, up to 500,000 shares of the Company’s newly created Series A Convertible Preferred Stock, no par value per share (“Series A Preferred”), with each share of Series A Preferred initially convertible into ten shares of the Company’s common stock, at a purchase price of $10.00 per share, for aggregate gross proceeds of $5,000,000 (the “Offering”). On January 13, 2020, the Company conducted its first closing of the Offering, resulting in aggregate gross proceeds of $2,500,000. The source of funds was working capital of the Investor. The Company paid the placement agent for the Offering a fee equal to ten percent (10%) of the gross proceeds from the first closing and warrants to purchase shares of the Company’s common stock in an amount equal to ten percent (10%) of the common stock issuable upon conversion of the Series A Preferred sold in the first closing at an exercise price of $1.00 per share. Upon the contemplated second closing of the Offering, which is subject to certain closing conditions, the placement agent shall receive compensation on the same economic terms as the first closing.

In connection with the foregoing, the Company relied upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, for transactions not involving a public offering.

Forbearance Agreement

On December 14, 2017, the Company entered into a Revolving Credit, Term Loan and Security Agreement (the “Loan Agreement”) with PNC Bank, National Association (“Lender”). Currently, multiple events of default under the Loan Agreement have occurred (the "Existing Defaults").

On January 13, 2020, a Limited Waiver, Consent, Amendment No. 5 and Forbearance Agreement (the “Forbearance Agreement”) between Lender and the Company became effective, pursuant to which Lender agreed to (i) waive the Loan Agreement’s requirement that the Company apply the net proceeds of the Offering first to the Term Loans (as defined in the Loan Agreement), and agreed that the Company shall instead apply the net proceeds of the Offering to the Revolving Advances (as defined in the Loan Agreement) and in connection therewith the Revolving Commitment Amount (as defined in the Loan Agreement) shall be reduced on a dollar for dollar basis by the amount so applied to the Revolving Advances, and (ii) forebear from exercising the rights and remedies in respect of the Existing Defaults afforded to Lender under the Loan Agreement for a period ending no later than December 31, 2020.

This description of the Forbearance Agreement is only a summary and is qualified in its entirety by reference to the full text of the form of the Forbearance Agreement attached as Exhibit 10.1 hereto.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed on a Current Report on Form 8-K of the Company, on November 21, 2019, the Company received a notice of failure to satisfy a continued listing standard from Nasdaq under Listing Rule 5550(b)(1) which requires a minimum stockholders’ equity of $2,500,000. On January 2, 2020, the Company submitted to Nasdaq its plan to regain compliance under Listing Rule 5550(b)(1). On January 13, 2020, the Company received notice from Nasdaq that it had granted the Company an extension until March 31, 2020 to regain compliance under Listing Rule 5550(b)(1) (the “Extension Notice”). The Company believes that, as a result of the first closing of the Offering, on January 13, 2020 it regained compliance under Listing Rule 5550(b)(1). Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’ equity requirement and, if at the time of its next periodic report the Company does not evidence compliance, it may be subject to delisting.

This description of the Extension Notice is only a summary and is qualified in its entirety by reference to the full text of the form of the Extension Notice attached as Exhibit 99.1 hereto.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 is incorporated by reference herein.

Item 5.01 Changes in Control of Registrant.

The information set forth in Item 1.01 is incorporated by reference herein.

As a result of the first closing of the Offering, the Investor, which is beneficially owned by Mr. Yubao Li, a newly appointed director of the Company (see Item 5.02 below), acquired the right to vote approximately 39% of the voting control of the Company. Each share of Series A Preferred is also convertible into ten (10) shares of the Company’s common stock, subject to adjustment. The Series A Preferred includes a limitation on beneficial ownership, whereby the Investor may not convert any shares of Series A Preferred to the extent that after giving effect to such conversion, the Investor (together with its affiliates) would have acquired, through conversion of shares of the Series A Preferred, beneficial ownership of a number of shares of the Company’s common stock that exceeds 4.99% ("Maximum Percentage") of the number of shares of the Company’s common stock outstanding immediately after giving effect to such conversion. The Maximum Percentage may be waived, in whole or in party, upon 61 days' prior notice from Investor to the Company. In addition, until the Company obtains shareholder approval for the issuance of the common stock underlying the Series A Preferred, as may be required by the applicable rules and regulations of the Nasdaq Stock Market, the Company may not issue, upon conversion of the Series A Preferred, a number of shares of common stock which, when aggregated with any shares of common stock previously issued upon conversion of the Series A Preferred, would equal 20% or more of the common stock of 20% or more of the voting power of the Company.

Upon the contemplated second closing of the Offering, which is subject to certain closing conditions as set forth in the Purchase Agreement, the Investor would acquire an additional 250,000 shares of Series A Preferred and would then hold, in the aggregate, approximately 57% of the voting control of the Company, resulting in a change of control of the Company.

Currently, the Company is controlled by management and certain directors of the Company.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective January 13, 2020, Mr. John Collins resigned from his position as a director of the Company. Mr. Collins’ resignation was not the result of any disagreement with the Company relating to the Company’s operations, policies, or practices.

Effective January 13, 2020, the Board of Directors of the Company appointed Mr. Yubao Li as a director of the Company. Mr. Li has been serving as the Chairman of Yunhong International since its inception in January 2019 and served as its Chief Executive Officer from January 2019 to September 2019. Mr. Li has been serving as the president of Hubei Academy of Science and Technology since July 2018, one of the key multi-disciplinary universities in the province of Hubei. Since June 2018, Mr. Li has been serving as the Director of Photoproteins Research Centre at China’s Academy of Management Science, a research institute situated in Beijing where he supports innovation by defining the research focus of the group. Mr. Li also serves as a director and/or officer of several other entities, including as the Executive Director and General Manager of Hubei Teruiga Energy Co., Ltd, a new energy technology company, since November 2017, the Executive Director of Hubei Yuntong Energy Co., Ltd., a solar power and agriculture company, since April 2016, the Executive Director and General Manager of Hubei Yun Hong photovoltaic Co., Ltd., a solar power and agriculture company, since May 2016, the President of Hubei Yunhong Deren Tourism Co., Ltd., a tourism project developer, since May 2016 and the President of Yunhong Group Holdings Co., Ltd., a company engaged in the business of solar power construction and solar photovoltaic power generation, since 2013. In addition, in 2013, Mr. Li founded China Hubei Yunhong Energy Group Co., Ltd., a Chinese nutrition company operating in China and abroad, and he currently serves as the Chairman of its board of directors. Mr. Li received his EMBA in Investment, Financing and Capital Strategy from Peking University. Due to his extensive investment and management experiences, we believe Mr. Li is well qualified to serve as a director.

Mr. Li was appointed pursuant to the Purchase Agreement, whereby the Investor, which is controlled by Mr. Li, received the right to appoint one member to the Company’s board of directors, subject to adjustment. There are no family relationships between Mr. Li and any director or executive officer of the Company.

Item 9.01 Financial Statements And Exhibits.

(d) Exhibits

The exhibits listed below are furnished as Exhibits to this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 16, 2020

|

|

CTI INDUSTRIES CORPORATION

|

|

|

|

|

|

By:

|

/s/ Frank Cesario

|

|

|

|

Frank Cesario

|

|

|

|

President, Chief Executive Officer and Chief Financial Officer

|

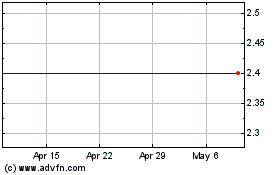

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

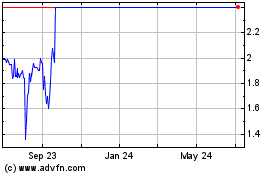

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2023 to Apr 2024