CSX Beats 3Q Profit Expectations, Tees Up More Stock Buybacks

October 21 2020 - 4:48PM

Dow Jones News

By Micah Maidenberg

CSX Corp. reported third-quarter results that were better than

in the second period, but the railroad company still has a ways to

go to recover from the economic downturn caused by the Covid-19

pandemic lockdowns.

Despite that challenge, the Jacksonville, Fla.-based company

said Wednesday its board authorized spending an additional $5

billion on share repurchases. That adds to $1.1 billion CSX

currently has available for buybacks.

The railroad company focused on parts of the Northeast, the

Midwest and the South reported a quarterly profit of $736 million,

or 96 cents a share, down from $856 million, or $1.08 a share, for

the year-earlier period.

Analysts expected 92 cents a share in earnings for the latest

period, or 93 cents a share following adjustments.

Revenue for the third quarter fell 11% year over year to $2.65

billion, CSX said. Analysts had forecast $2.67 billion for the

third quarter.

During the second quarter, CSX reported a profit of 65 cents a

share on $2.26 billion in revenue, according to FactSet.

Railroads have been hurt as the coronavirus pandemic rippled

through the industrial sector and consumer economy, dampening

demand for all manner of goods.

CSX said coal-related revenue dropped 36% in the third quarter

compared with last year. Revenue from metals and related equipment

shipments slid 18%, while those for automotive products fel 9%.

Intermodal revenue was flat year over year.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 21, 2020 16:33 ET (20:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

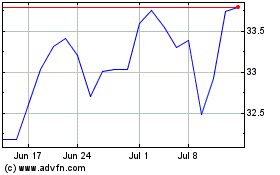

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

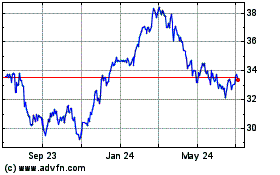

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024