Railroads Prepare for Quick Turnaround

April 23 2020 - 2:09PM

Dow Jones News

By Paul Ziobro

After having a front-row seat to the economy seizing up, freight

railroads are keeping their workers and locomotives on standby to

quickly help get things moving again.

When that happens is anyone's guess.

Railroads have retrenched during the coronavirus pandemic as

they face a drop of around 25% in their near-term shipping volumes,

which have been roiled by factory closures, declines in business

activity and another sharp slump in coal shipments due to the

oil-price rout.

CSX Corp. and Union Pacific Corp. have taken hundreds of

locomotives offline in recent weeks, reduced the number of trains

being run to better align with plunging demand and sent workers

home.

That all could reverse quickly.

Instead of laying off or furloughing its transportation workers,

CSX has worked with its unions to allow employees to take unpaid

time off or switch to a schedule where they work one week a month.

Benefits are paid under either choice.

The arrangement allows CSX to recall workers to service in as

little as 48 hours, whereas returning from furloughs has a 15-day

window.

CSX Chief Executive Jim Foote said that such a setup is needed

because of the uncertainty around how long the downturn would last.

If it knew there would be a prolonged slump, CSX could wait to

figure out when it would need more workers to run trains.

"I don't have the luxury of worrying about that in 12 months,"

Mr. Foote said in an interview Wednesday. "I have to be thinking

that it can turn around in two months."

Union Pacific has set up a similar work status in lieu of

furloughs so that the railroad can call back workers quickly.

Locomotives are also being parked but maintained so that they

can get back to hauling more freight quickly. "They are in a state

where within hours, we could turn them back on and put them out to

the fleet if we need to," Union Pacific Chief Operating Officer Jim

Vena said on an earnings call Thursday.

Railroad executives say that an overhaul of operating strategies

in the past few years has helped them contract operations quickly

during the pandemic and set them up for a rebound. CSX, Union

Pacific and other railroads have all been focused on running fewer

and longer trains that stick to tight schedules while cutting costs

and jobs to improve profitability.

"We have for a long time thought and worried about trying to

build agility into our decision making and reaction time," Union

Pacific CEO Lance Fritz said in an interview Thursday. "We are way

better at that today."

As the pandemic hit the U.S., railroads have been able to cut

costs further. CSX and Union Pacific both reported higher

first-quarter profits as costs tied to labor and fuel expenses

dropped faster than the decline in shipments and revenue.

They may not be able to cut costs enough to match the steeper

shipping-volume declines in the second quarter, when overall

shipping volume is down around 20% or more.

Both railroads withdrew most of their forecasts for the year, as

the duration of the downturn remains unclear.

"Our collective belief at this point is it's sharp and deep,"

Mr. Fritz said. "It's going to last for a while, and recovery is

going to be some kind of ramp but probably not terribly steep."

Mr. Fritz said Union Pacific has a lot of extra shipping

capacity that can be filled if the economy were to rebound

faster.

"If the economy were to snap back, we can respond to that pretty

darn quickly," he said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

April 23, 2020 13:54 ET (17:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

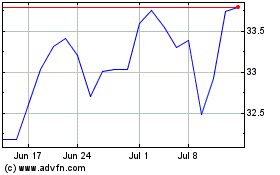

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

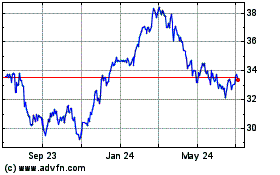

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024