Bronx Warehouse's Answer to Truck Congestion: Its Own Rail Link

February 20 2020 - 5:59AM

Dow Jones News

By Keiko Morris

The developer of a four-story warehouse in the South Bronx plans

to include a freight-rail connection in the project to address

trucking costs and traffic congestion associated with the

e-commerce boom.

Turnbridge Equities expects to break ground this fall on what

would be the only multistory New York City distribution center

designed with a rail spur linking it to a rail network run by CSX

Corp.

At the Bronx Logistics Center, the spur would allow freight to

enter the warehouse grounds by train, whereas most New York City

warehouses rely entirely on truck delivery.

The push for faster delivery, the rise in online shopping --

including food orders -- and the city's population growth have

driven companies to seek distribution operations within the five

boroughs to be closer to their customers.

Truck congestion and delays resulted in $862 million in lost

economic activity for the city in 2017, according to a report by

the New York City Economic Development Corp. That figure could rise

to $1.1 billion annually by 2045 if no measures are taken to

address the issue, the EDC said. The city's economic development

arm is pushing for more investment in rail and maritime freight

transportation.

"As trucks clog the road and there's more traffic, people are

going to look to logistics solutions that can solve that problem,"

said Ryan Nelson, a Turnbridge managing principal. "And this is one

of them."

Mr. Nelson and his partner Andrew Joblon said they were

negotiating a construction contract for the $700 million

development. They want to attract e-commerce sellers, food

distributors and other tenants.

While the Bronx Logistics Center wouldn't be the first warehouse

in the city to offer rail service, it would be one of the few with

the amenity.

Railcars carry about 2% of the city's overall freight, according

to the city's Economic Development Corporation.

About 5% of potential tenants now looking for space want it to

have direct rail service, according to JLL, a real-estate services

firm that is advising Turnbridge on the Bronx Logistics Center

project.

Typically, companies looking for direct freight-rail service are

those receiving raw goods and products such as food or beverages

that are heavy and would be less expensive to transport long

distances by rail than by truck, real-estate consultants said.

But the types of companies interested in warehouse access to

rail service are starting to expand, the consultants said. A

truck-driver shortage has added to rising freight costs. The

increased expenses and shorter delivery-time requirements are

pushing companies to consider shipping more products by rail.

The number of train cars transported by barge from trains at New

Jersey terminals to Brooklyn rose 25% between 2017 and 2018,

according to the city's economic development corporation.

"Rail was used more for raw materials and goods before the

recession," said James Breeze, global head of industrial logistics

research at real estate services firm CBRE Group Inc. "Today it is

more diverse and more about lower costs and distributing rather

than just moving larger raw materials."

Turnbridge's 1.24 million square-foot project is set to rise on

five parcels of land adjacent to Oak Point Yard, a rail yard that

also services the Hunts Point Cooperative Market Inc. The first

three floors will have ramp access and loading docks for 53-foot

trucks. Vans and smaller trucks will be able to access the fourth

floor by ramps, and the warehouse will have 1,400 parking

spaces.

The project is one of about six, modern, multistory warehouses

in the city either under construction or in the planning stages.

With little land available in New York to build more distribution

centers, the developers are betting warehouse tenants will be

willing to pay a premium on rent to be close to their New York City

customers and to save on delivery costs from distribution centers

outside the city.

"Being closer to the consumer is the name of the game," said Rob

Kossar, a vice chairman at JLL. "Your rent is higher but

transportation costs go down so significantly that it offsets the

higher rental rate."

Write to Keiko Morris at Keiko.Morris@wsj.com

(END) Dow Jones Newswires

February 20, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

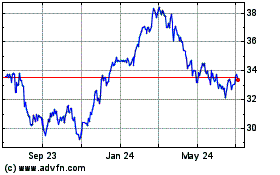

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

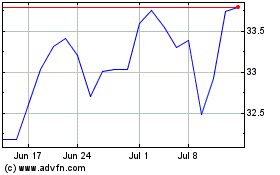

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024