CSX Projects Another Revenue-Challenging Year in 2020

January 16 2020 - 5:24PM

Dow Jones News

By Maria Armental

Freight rail operator CSX Corp. (CSX) projects expects another

challenging year in 2020, following a steeper-than-expected 3%

revenue decline this year.

CSX, which operates one of the two major freight railroads east

of the Mississippi River, has been overhauling operations through a

series of cost cuts, modeled on the late railroad executive Hunter

Harrison's "precision-scheduled railroading" principles, that have

helped it sustain its financial performance even as shipment

volumes and revenue have fallen.

Jacksonville, Fla.-based CSX on Thursday posted a record

operating ratio of 58.4% for 2019, slightly better than analysts

had projected.

It is an efficiency level record among the largest U.S.

freights, CSX said, adding this year it expects it to come in at

about 59%.

Operating ratio is a key metric for railroads that measures the

proportion of operating revenue consumed by operating expenses.

"Our service is the best it has ever been and getting better,"

Chief Executive Jim Foote said in a conference call with

analysts.

"The key here is reliability," Mr. Foote said, touching on one

of the challenges for railroad companies: winning back

customers.

"By operating a simpler, more efficient network," Mr. Foote

said, "we are able to offer rail users a service that is truck-like

in consistency, but with lower cost and more environmentally

responsible."

Volume fell a steeper-than-expected 7% in the December quarter,

including a double-digit decline in coal.

Company officials have noted that the business environment

remains soft and warned that CSX would face difficult comparisons

for the first half of the year.

"It took industrial activity a while to cool off, and it will

take a while to heat back up," Mr. Foote said Thursday.

Overall, CSX reported a 9% profit decline and 8% revenue decline

for the December quarter.

It ended the year at with profit up 1% at $3.33 billion, or

$4.17 a share, on $11.94 billion in revenue.

This year, it expects revenue to remain flat to down 2% and

expects capital expenditures to remain at roughly $1.6 billion to

$1.7 billion.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 16, 2020 17:09 ET (22:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

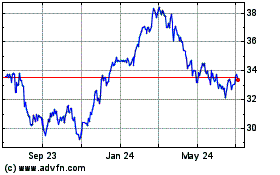

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

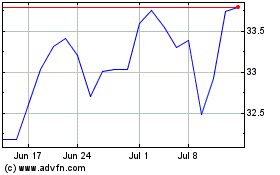

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024