Union Pacific Plans More Job Cuts as Demand Falls Off -- 3rd Update

October 17 2019 - 5:38PM

Dow Jones News

By Paul Ziobro

CSX Corp. and Union Pacific Corp. are running faster railroads

with longer trains and operating more efficiently. They have a

bigger challenge ahead in winning over more shippers that remain

skeptical after years of subpar service.

Both companies are at different stages of implementing a

railroad operating philosophy known as precision scheduled

railroading that focuses on keeping railcars moving and running

trains on tighter schedules.

CSX Chief Executive Jim Foote said the Jacksonville, Fla.-based

railroad, which began its transformation almost two years ago, is

trying to persuade customers to shift more of their cargo shipments

to rail from truck by showing that its shipping times have become

more reliable.

"That's the sell but we have to undo decades of bad service and

experience," Mr. Foote said in an interview Wednesday, speaking not

just about CSX but for freight railroads overall.

The company has had some success persuading some shippers to

make the shift, he said. Others are reluctant to switch to rail

service, even though it costs about 15% less to do so.

Union Pacific started its changes last year after struggling to

improve service. It has reduced dwell time at terminals and cars

arrive on time more often. The changes haven't done enough to

offset broader economic issues that have reduced shipping volume,

including declines in coal shipments. The railroad is also

contending with truck rates that have fallen dramatically because

of too much capacity.

"Not only can you get a truck anytime you want it, but it's a

very competitive price," Union Pacific CEO Lance Fritz said in an

interview Thursday.

Union Pacific has rolled out new technology that gives shippers

notifications when the railcars arrive. It has also introduced some

new services where intermodal trains, which carry goods in

containers from ports to trucks, are combined with other types of

commodities.

"The wins that are occurring are being overwhelmed by

macroeconomics," Mr. Fritz said.

Railroads could use additional volume, which is down 4.1%

through mid-October from a year ago in the U.S., in part because of

the softening economy and worries over international trade.

The cost cuts from the new operating procedures are helping

sustain profits in the meantime. CSX on Wednesday said it cut

expenses by 8% in the third quarter compared with last year, which

offset a 5% drop in revenue. Railroad volume fell by roughly the

same amount.

Overall earnings fell about 4%, but topped analysts'

expectations. Shares in CSX rose 1.1% on Thursday.

Union Pacific posted a larger decline in revenue, which fell 7%,

while operating expenses fell 10% in part because of a 13%

reduction in workers from last year. The railroad said it planned

to cut jobs further because of weak demand.

The company employed, on average, 36,659 employees as of the

third quarter.

Overall profit fell 2% to $1.6 billion, short of Wall Street

estimates. Still, Union Pacific shares rose slightly.

--Micah Maidenberg contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

October 17, 2019 17:23 ET (21:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

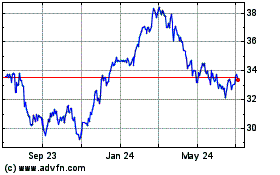

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

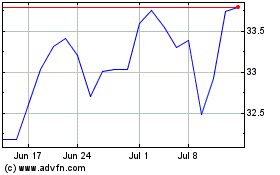

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024