Cisco's Revenue Rises as Investors Weigh Possible Tariff Effects

May 15 2019 - 5:21PM

Dow Jones News

By Maria Armental

Networking giant Cisco Systems Inc. reported quarterly results

that beat Wall Street targets despite higher tariffs from a

U.S.-China trade clash.

Cisco, considered a proxy for high-tech hardware demand, is

being closely watched for how it has navigated the escalating trade

dispute between the two countries. But Chief Executive Chuck

Robbins has said the company has largely evaded financial damage

from tariffs by raising prices.

The U.S. increased tariffs on $200 billion of Chinese goods to

25% last week, and China plans to increase levies on $60 billion in

U.S. imports starting June 1.

On Wednesday, Cisco said its profit in the quarter ended April

27 rose 13% to $3.04 billion, or 69 cents a share. On an adjusted

basis, profit rose to 78 cents a share from 66 cents a share a year

earlier.

Revenue in Cisco's fiscal third quarter rose 4% to $12.96

billion.

Cisco had projected an adjusted profit of 76 cents to 78 cents a

share with revenue increasing 4% to 6% from a year earlier, while

analysts surveyed by FactSet expected an adjusted profit of 77

cents a share on $12.89 billion in revenue.

Gross profit margin improved to 63.1% from 62.3% a year

earlier.

This quarter, Cisco projected adjusted profit of 80 cents to 82

cents a share with revenue increasing 4.5% to 6.5%. That compares

with analysts' projected 81 cents a share and revenue rising about

3% to $13.29 billion.

Shares in Cisco rose 3.2% to $54.11 in after-hours trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 15, 2019 17:06 ET (21:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

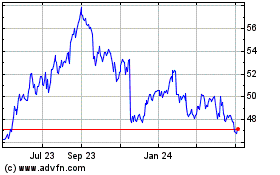

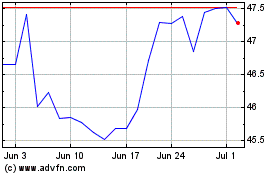

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024