Current Report Filing (8-k)

July 01 2020 - 4:25PM

Edgar (US Regulatory)

0001576427false00015764272020-06-252020-06-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 30, 2020

Date of Report (Date of earliest event reported)

CRITEO S.A.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France

|

|

001-36153

|

|

Not Applicable

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 Rue Blanche

|

Paris

|

France

|

|

75009

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

+33 14 040 2290

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

American Depositary Shares, each representing one ordinary share, nominal value €0.025 per share

|

CRTO

|

Nasdaq Global Select Market

|

|

|

Ordinary Shares, nominal value €0.025 per share*

|

|

Nasdaq Global Select Market

|

|

*Not for trading, but only in connection with the registration of the American Depositary Shares.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. c

|

|

|

|

|

|

|

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

As previously disclosed, on March 29, 2017, Criteo S.A. (the “Company”) and its subsidiaries Criteo Finance S.A.S. and Criteo Corp. (together, the “Additional Borrowers”) entered into an Amendment and Restatement Agreement amending and restating the Multicurrency Revolving Facility Agreement (as amended, the “Facility Agreement”) originally dated September 24, 2015, as amended on June 20, 2016, with BNP Paribas, Crédit Lyonnais (LCL), HSBC France, Natixis and Société Générale Corporate & Investment Banking as arrangers, Natixis as coordinator and documentation agent, Crédit Lyonnais (LCL) as agent, and the financial institutions listed therein as lenders.

Pursuant to the terms of the Facility Agreement, the Company has certain extension options, which may be taken by giving written notice to Crédit Lyonnais (LCL). On June 30, 2020, the parties to the Facility Agreement agreed to further amend the terms of the Facility Agreement as follows: the lenders listed in the Facility Agreement other than Natixis but also including CEPAL have agreed to extend the term of the Facility Agreement for one additional year, from March 2022 to March 2023, composed of a €350 million (approximately $389 million) commitment through March 2022, and a €294 million (approximately $326 million) commitment from the end of March 2022 through March 2023. The cost of the one-year extension is 0.025% of the extended amount. Further, the parties have agreed to revise the extension option in the Facility Agreement to allow delivery of the first extension request in May 2020, as opposed to March 2021.

Additionally, the lenders have agreed to amend the definition of "Adjusted Consolidated EBITDA" under the Facility Agreement. From June 30, 2020, "Adjusted Consolidated EBITDA" will be defined as "consolidated earnings before financial income (expense), income taxes, depreciation and amortization, adjusted to eliminate the impact of equity awards compensation expense, pension service costs, restructuring costs (provided that such deduction in respect of restructuring costs shall not exceed an amount equal to 15 per cent of Adjusted Consolidated EBITDA calculated (without taking into account this cap) immediately prior to such adjustment), acquisition related costs and deferred price consideration, calculated using the same calculation methods, accounting principles and scope as those used for the Group's annual financial statements published in respect of the financial year ending in 2017". The parties also agreed to revise the definition of “Reference Financial Statements” to refer to financial statements prepared in respect of financial reporting periods ending in 2018 through 2020, as opposed to 2014 through 2016. Specifically, reference in the definition to “31 December 2015” has been changed to “31 December 2019”, “31 December 2014” has been changed to “31 December 2018”, “30 June 2016” has been revised to “30 June 2019” and “31 March 2016” has been revised to “31 March 2020”.

|

|

|

|

|

|

|

|

|

|

|

ITEM 2.03

|

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

|

|

The information set forth in Item 1.01 is incorporated herein by reference into this Item 2.03.

|

|

|

|

|

|

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Criteo S.A.

|

|

|

|

|

|

Date: July 1, 2020

|

By:

|

/s/ Ryan Damon

|

|

|

Name:

|

Ryan Damon

|

|

|

Title:

|

Executive Vice President, General Counsel and Secretary

|

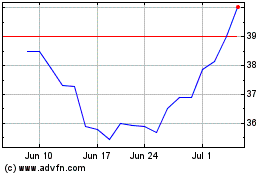

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

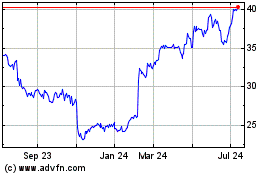

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Apr 2023 to Apr 2024