CPS Technologies Corporation Announces First Quarter 2020 Results

May 05 2020 - 4:00PM

CPS Technologies Corporation (NASDAQ:CPSH) today announced revenues

of $6.5 million and an operating profit of $622 thousand for the

quarter ended March 28, 2020. This compares with revenues of $5.3

million and an operating loss of $744 thousand for the quarter

ended March 30, 2019.

Grant Bennett, President and CEO, said: “Revenues in the first

quarter were up significantly compared to the first quarter of

2019. We have previously commented on new contracts with our

three largest customers. As new prices and higher volumes

from these contracts continue to be phased in, we see the positive

impact they are having on our results. This phase-in period

began in the fourth quarter last year should be completed during

the second quarter this year. Our sales team is focused on

both profitability and volume and is doing an excellent job of

balancing appropriate pricing with increasing our volumes in the

market segments we serve. These developments suggest

continued strong performance throughout 2020 – subject of course to

possible unforeseen coronavirus impacts.

We continue to generate new customers and new products. We

have taken and continue to take actions to strengthen our sales and

marketing efforts in the US aerospace and defense electronics

industries; these actions are showing positive results. These

actions should continue to result in new design wins, new bookings,

new customers, and new products in our two main product families,

AlSiC components and hermetic packages.

Regarding the coronavirus, as part of the Defense Industrial

Base, CPS has been open and operating throughout the

pandemic. To date all of our major customers remain open and

operational. Some smaller customers have closed some

manufacturing facilities temporarily. Demand remains strong,

although we are beginning to see some demand being stretched out

over a longer period of time. Similarly, most of our vendors

remain open and we have not experienced any meaningful supply chain

disruptions.

These observations do not mean that CPS has been or will be

unaffected by the pandemic. We have seen increased freight

costs on our overseas shipments and increased expenses related to

higher absenteeism, higher facility cleaning costs, increased

purchases and use of PPE, etc. School closures, and the

need to quarantine or care for family members, continue to cause

increased absenteeism.

We have implemented CDC and OSHA guidance in our

workplace. Employees’ temperatures are taken at the beginning

of each shift, shifts have been staggered to reduce employee

overlap, workstations have been rearranged to ensure social

distancing, all employees are using facemasks, etc.

It is difficult to predict the overall impact this pandemic will

have on CPS’ business going forward. Nevertheless, we remain

optimistic about our 2020 performance.”

The Company will be hosting its first quarter conference call

with investors at 4:30pm on Tuesday, May 5. Those interested in

participating in the conference call should dial:

Call in Number: 1-833-953-1394

Conference ID: 6096452

About CPS CPS Technologies Corporation is a global leader in

producing metal-matrix composite components used to improve the

reliability and performance of various electrical systems.

CPS products are used in motor controllers for hybrid and electric

vehicles, high-speed trains, subway cars and wind turbines.

They are also used as heatspreaders in internet switches, routers

and high-performance microprocessors. CPS also develops and

produces metal-matrix composite armor.

Safe Harbor Statements made in this document that are not

historical facts or which apply prospectively, including those

relating to 2020 financial results, are forward-looking

statements that involve risks and uncertainties. These

forward-looking statements are identified by the use of terms and

phrases such as "will," "intends," "believes," "expects," "plans,"

"anticipates" and similar expressions. Investors should not rely on

forward looking statements because they are subject to a variety of

risks and uncertainties and other factors that could cause actual

results to differ materially from the company's expectation.

Additional information concerning risk factors is contained from

time to time in the company's SEC filings, including its Annual

Report on Form 10-K and other periodic reports filed with the SEC.

Forward-looking statements contained in this press release speak

only as of the date of this release. Subsequent events or

circumstances occurring after such date may render these statements

incomplete or out of date. The company expressly disclaims any

obligation to update the information contained in this release.

CPS Technologies Corporation Chuck Griffith, Chief Financial

Officer 111 South Worcester Street Norton, MA 02766 Telephone:

(508) 222-0614 Web Site: www.alsic.com

| CPS TECHNOLOGIES CORPORATION |

|

| STATEMENT OF OPERATIONS

(Unaudited) |

|

| |

|

| |

|

|

|

Fiscal Quarters Ended |

| |

|

|

|

March 28, |

|

|

March 30, |

|

| |

|

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

| |

Revenues: |

|

|

|

| |

|

Product sales |

|

$ |

6,511,571 |

|

|

$ |

5,269,538 |

|

| |

|

|

|

|

|

| |

|

Total revenues |

|

|

6,511,571 |

|

|

|

5,269,538 |

|

| |

|

|

|

|

|

| |

Cost of product

sales |

|

|

4,961,360 |

|

|

|

5,110,114 |

|

| |

|

|

|

|

|

| |

|

Gross Margin |

|

|

1,550,211 |

|

|

|

159,424 |

|

| |

|

|

|

|

|

| |

Selling, general,

and |

|

|

|

| |

|

administrative expense |

|

|

928,590 |

|

|

|

903,686 |

|

| |

|

|

|

|

|

| |

|

Income (loss) from

operations |

|

|

621,621 |

|

|

|

(744,262 |

) |

| |

|

|

|

|

| |

Other income

(expense), net |

|

|

(19,966 |

) |

|

|

48 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Income (loss) before

taxes |

|

|

601,654 |

|

|

|

(744,214 |

) |

| |

Income tax provision

(benefit) |

|

|

-- |

|

|

|

-- |

|

| |

|

|

|

|

|

| |

|

Net income (loss) |

|

$ |

601,654 |

|

|

$ |

(744,214 |

) |

| |

|

|

|

|

|

| |

Net income (loss)

per |

|

|

|

| |

|

basic common share |

|

$ |

0.05 |

|

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

| CPS

TECHNOLOGIES CORPORATION |

|

| BALANCE

SHEET (UNAUDITED) |

|

|

|

|

|

March 28, |

|

December 28, |

|

|

|

|

2020 |

|

|

2019 |

| ASSETS |

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash

equivalents |

$ |

122,255 |

|

$ |

133,965 |

|

|

Accounts

receivable-trade, net |

5,959,224 |

|

|

4,086,945 |

|

|

Inventories, net |

3,595,338 |

|

|

3,099,824 |

|

|

Prepaid expenses and

other current assets |

227,459 |

|

|

147,786 |

|

|

|

|

|

|

|

|

|

|

Total current

assets |

9,904,276 |

|

|

7,468,520 |

|

|

|

|

|

|

|

| Net property and

equipment |

1,424,302 |

|

1,236,878 |

|

|

| Right-of-use lease

asset |

|

136,000 |

|

|

171,000 |

| Deferred taxes,

net |

|

147,873 |

|

|

147,873 |

| |

|

|

|

|

| Total Assets |

$ |

11,612,451 |

|

$ |

9,024,271 |

| LIABILITIES AND

STOCKHOLDERS’ |

| |

EQUITY |

|

|

|

| |

|

|

|

|

|

| |

Current

liabilities: |

|

|

|

| |

Borrowings against line of credit |

|

1,577,506 |

|

|

1,249,588 |

| |

Note payable, current

portion |

|

45,980 |

|

|

-- |

| |

Accounts payable |

|

2,621,862 |

|

|

1,436,417 |

| |

Accrued expenses |

|

691,921 |

|

|

815,166 |

| |

Deferred revenue |

|

381,216 |

|

|

21,110 |

| |

Lease liability,

current portion |

|

136,000 |

|

|

148,000 |

| |

|

|

|

|

|

| |

Total current

liabilities |

|

5,454,485 |

|

|

3,670,281 |

| |

|

|

|

|

|

| |

Note payable less

current portion |

|

159,649 |

|

|

-- |

| |

Long term lease

liability |

|

-- |

|

|

23,000 |

| |

|

|

|

|

|

| |

Total

liabilities |

|

5,614,134 |

|

|

3,693,281 |

| |

|

|

|

|

| |

Total stockholders’

equity |

|

5,998,317 |

|

|

5,330,990 |

| |

|

|

|

|

| |

Total liabilities and

stockholders’ |

|

|

|

| |

equity |

$ |

11,612,451 |

|

$ |

9,024,271 |

| |

|

|

|

|

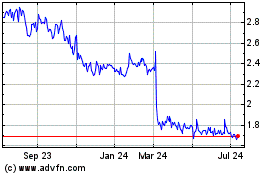

CPS Technologies (NASDAQ:CPSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

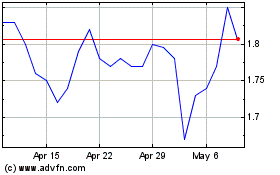

CPS Technologies (NASDAQ:CPSH)

Historical Stock Chart

From Apr 2023 to Apr 2024