Costco Keeps Drawing Homebound Shoppers -- Update

December 10 2020 - 7:14PM

Dow Jones News

By Sarah Nassauer

Costco Wholesale Corp. reported strong quarterly sales Thursday

as homebound Americans continue to spend more on food, homegoods

and fitness products during the pandemic, especially the

high-income shoppers that make up much of the warehouse chain's

shopper base.

Comparable sales, those from stores or digital channels

operating for at least 12 months, rose 17.1% during the quarter

ended Nov. 22, excluding the impact of gasoline sales and currency

movements. The retailer's e-commerce sales jumped 86% in the

quarter.

Big-box retailers including Walmart Inc. and Target Corp. have

generally fared well amid the coronavirus crisis, offering

pandemic-weary shoppers one-stop shopping and in some cases, easy

buy online, pick up in store parking lot options.

Costco's shoppers, who pay a membership fee to shop, are

spending less on travel and eating out during the pandemic and more

on food, appliances, homegoods and other items, said finance chief

Richard Galanti on a call with analysts Thursday. "They seem to

have redirected some of those dollars," he said.

Profit also rose during the quarter to $1.17 billion, up from

$844 million in the same period last year. Costco raised wages

during the quarter due to Covid-19, adding about $212 million in

costs for the period, said Mr. Galanti. But the company boosted

profits elsewhere, for example selling more food by reducing

spoilage, he said. Costco has extended premium wages through

January, he said.

Revenue grew to $43.2 billion in the quarter, from $37 billion a

year earlier.

For online orders, Costco is currently struggling with some

shipping delays, said Mr. Galanti, as e-commerce sales rise

dramatically during the holiday season, straining delivery

capacity.

Costco has adjusted its stated delivery windows and is warning

shoppers on its website, he said. It also has begun selling several

hundred nonfood items such as AirPods and Instant Pots through

Instacart, making them available for same-day delivery. Typically

Costco would only offer grocery items through Instacart.

Due to Covid-19 surges in some regions, the retailer continues

to limit store capacity in some areas and is trying to build

inventory for fast-selling items "that aren't going to go out of

style," such as toilet paper, paper towels and cleaning wipes, said

Mr. Galanti. "Although, then you get the next rush of spiking and

whatever extra inventory you had, it goes away pretty quickly," he

said.

Costco doesn't plan to join its competitors by offering more

ways to buy products online to pick up in stores or parking lots

anytime soon, said Mr. Galanti, mirroring longstanding skepticism

from the company on the financial merits of the concept. It

generally costs more for a retailer to sell online versus in a

store. "We continue to look at it and scratch our heads a little

bit," he said. "We don't have any current plan to do so."

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

December 10, 2020 18:59 ET (23:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

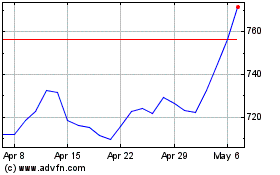

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024