Costco Wholesale Corporation Reports First Quarter Fiscal Year 2021 Operating Results

December 10 2020 - 4:15PM

Costco Wholesale Corporation (“Costco” or the “Company”) (Nasdaq:

COST) today announced its operating results for the first quarter

(twelve weeks) of fiscal 2021, ended November 22, 2020.

Net sales for the first quarter increased 16.9

percent, to $42.35 billion from $36.24 billion last year.

Comparable sales for the first quarter fiscal

2021 were as follows:

|

|

|

12 Weeks |

|

12 Weeks |

|

|

|

|

|

|

Adjusted* |

|

|

|

U.S. |

14.6% |

|

17.0% |

|

|

|

Canada |

16.2% |

|

16.8% |

|

|

|

Other

International |

18.7% |

|

17.7% |

|

|

|

|

|

|

|

|

|

|

Total

Company |

15.4% |

|

17.1% |

|

|

|

|

|

|

|

|

|

|

E-commerce |

86.4% |

|

86.2% |

|

| |

| *Excluding the impacts from changes in gasoline

prices and foreign exchange. |

Net income for the quarter was $1,166 million,

or $2.62 per diluted share, compared to $844 million, or $1.90 per

diluted share, last year. This year’s first quarter included tax

benefits of $145 million or $0.33 per diluted share, $0.16 of which

was due to the deductibility of the $10 per share special cash

dividend, to the extent received by the Company’s 401(k) plan

participants; and $0.17 cents related to stock-based compensation.

Last year’s first quarter included a $77 million or $0.17 per

diluted share tax benefit related to stock-based compensation. This

year’s results reflect an expense for COVID-19 premium wages of

$212 million pre-tax or $0.35 per diluted share.

Costco currently operates 803 warehouses,

including 558 in the United States and Puerto Rico, 102 in Canada,

39 in Mexico, 29 in the United Kingdom, 27 in Japan, 16 in Korea,

14 in Taiwan, 12 in Australia, three in Spain, and one each in

Iceland, France, and China. Costco also operates e-commerce sites

in the U.S., Canada, the United Kingdom, Mexico, Korea, Taiwan,

Japan, and Australia.

A conference call to discuss these results is

scheduled for 2:00 p.m. (PT) today, December 10, 2020, and is

available via a webcast on www.costco.com (click on Investor

Relations and “Play Webcast”).

Certain statements contained in this document

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. For these

purposes, forward-looking statements are statements that address

activities, events, conditions or developments that the Company

expects or anticipates may occur in the future. In some cases

forward-looking statements can be identified because they contain

words such as “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or similar expressions and the negatives of those

terms. Such forward-looking statements involve risks and

uncertainties that may cause actual events, results or performance

to differ materially from those indicated by such statements. These

risks and uncertainties include, but are not limited to, domestic

and international economic conditions, including exchange rates,

the effects of competition and regulation, uncertainties in the

financial markets, consumer and small business spending patterns

and debt levels, breaches of security or privacy of member or

business information, conditions affecting the acquisition,

development, ownership or use of real estate, capital spending,

actions of vendors, rising costs associated with employees

(generally including health-care costs), energy and certain

commodities, geopolitical conditions (including tariffs), the

ability to maintain effective internal control over financial

reporting, COVID-19 related factors and challenges, including

(among others) the duration of the pandemic, the unknown long-term

economic impact, reduced shopping due to illness, travel

restrictions or financial hardship, shifts in demand away from

discretionary or higher-priced products, reduced workforces due to

illness, quarantine, or government mandates, temporary store

closures due to reduced workforces or government mandates, or

supply-chain disruptions, capacity constraints of third-party

logistics suppliers, and other risks identified from time to time

in the Company’s public statements and reports filed with

the Securities and Exchange Commission. Forward-looking

statements speak only as of the date they are made, and the Company

does not undertake to update these statements, except as required

by law.

|

CONTACTS: |

Costco

Wholesale Corporation |

| |

Richard Galanti, 425/313-8203 |

| |

Bob Nelson, 425/313-8255 |

| |

David Sherwood, 425/313-8239 |

| |

Josh Dahmen, 425/313-8254 |

COSTCO WHOLESALE

CORPORATION CONSOLIDATED STATEMENTS OF

INCOME (dollars in millions, except per share

data) (unaudited)

| |

12 Weeks Ended |

| |

November 22, 2020 |

|

November 24, 2019 |

|

REVENUE |

|

|

|

|

Net sales |

$ |

42,347 |

|

|

$ |

36,236 |

|

|

Membership fees |

861 |

|

|

804 |

|

|

Total revenue |

43,208 |

|

|

37,040 |

|

|

OPERATING EXPENSES |

|

|

|

|

Merchandise costs |

37,458 |

|

|

32,233 |

|

|

Selling, general and administrative |

4,298 |

|

|

3,732 |

|

|

Preopening expenses |

22 |

|

|

14 |

|

|

Operating income |

1,430 |

|

|

1,061 |

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

Interest expense |

(39 |

) |

|

(38 |

) |

|

Interest income and other, net |

29 |

|

|

35 |

|

|

INCOME BEFORE INCOME

TAXES |

1,420 |

|

|

1,058 |

|

|

Provision for income taxes |

239 |

|

|

202 |

|

|

Net income including noncontrolling interests |

1,181 |

|

|

856 |

|

|

Net income attributable to noncontrolling interests |

(15 |

) |

|

(12 |

) |

| NET

INCOME ATTRIBUTABLE TO

COSTCO |

$ |

1,166 |

|

|

$ |

844 |

|

| |

|

|

|

| NET

INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO: |

|

|

|

|

Basic |

$ |

2.63 |

|

|

$ |

1.91 |

|

|

Diluted |

$ |

2.62 |

|

|

$ |

1.90 |

|

| |

|

|

|

| Shares used

in calculation (000’s): |

|

|

|

|

Basic |

442,952 |

|

|

441,818 |

|

|

Diluted |

444,386 |

|

|

443,680 |

|

| |

|

|

|

COSTCO WHOLESALE

CORPORATION CONSOLIDATED BALANCE SHEETS

(amounts in millions, except par value and share

data) (unaudited)

Subject to Reclassification

| |

|

|

November 22, 2020 |

|

August 30, 2020 |

|

ASSETS |

|

|

|

|

CURRENT ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

13,590 |

|

|

$ |

12,277 |

|

|

Short-term investments |

833 |

|

|

1,028 |

|

|

Receivables, net |

1,646 |

|

|

1,550 |

|

|

Merchandise inventories |

14,901 |

|

|

12,242 |

|

|

Other current assets |

1,126 |

|

|

1,023 |

|

|

Total current assets |

32,096 |

|

|

28,120 |

|

|

OTHER ASSETS |

|

|

|

|

Property and equipment, net |

22,288 |

|

|

21,807 |

|

|

Operating lease right-of-use assets |

2,785 |

|

|

2,788 |

|

|

Other long-term assets |

3,048 |

|

|

2,841 |

|

|

TOTAL

ASSETS |

$ |

60,217 |

|

|

$ |

55,556 |

|

| LIABILITIES

AND EQUITY |

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

Accounts payable |

$ |

17,014 |

|

|

$ |

14,172 |

|

|

Accrued salaries and benefits |

3,586 |

|

|

3,605 |

|

|

Accrued member rewards |

1,451 |

|

|

1,393 |

|

|

Deferred membership fees |

1,985 |

|

|

1,851 |

|

|

Current portion of long-term debt |

96 |

|

|

95 |

|

|

Other current liabilities |

8,535 |

|

|

3,728 |

|

|

Total current liabilities |

32,667 |

|

|

24,844 |

|

|

OTHER LIABILITIES |

|

|

|

|

Long-term debt, excluding current portion |

7,529 |

|

|

7,514 |

|

|

Long-term operating lease liabilities |

2,574 |

|

|

2,558 |

|

|

Other long-term liabilities |

2,138 |

|

|

1,935 |

|

|

TOTAL

LIABILITIES |

44,908 |

|

|

36,851 |

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

EQUITY |

|

|

|

|

Preferred stock $0.01 par value; 100,000,000 shares authorized; no

shares issued and outstanding |

— |

|

|

— |

|

|

Common stock $0.01 par value; 900,000,000 shares authorized;

442,955,000 and 441,255,000 shares issued and outstanding |

4 |

|

|

4 |

|

|

Additional paid-in capital |

6,725 |

|

|

6,698 |

|

|

Accumulated other comprehensive loss |

(1,101 |

) |

|

(1,297 |

) |

|

Retained earnings |

9,232 |

|

|

12,879 |

|

|

Total Costco stockholders’ equity |

14,860 |

|

|

18,284 |

|

|

Noncontrolling interests |

449 |

|

|

421 |

|

|

TOTAL

EQUITY |

15,309 |

|

|

18,705 |

|

|

TOTAL LIABILITIES AND

EQUITY |

$ |

60,217 |

|

|

$ |

55,556 |

|

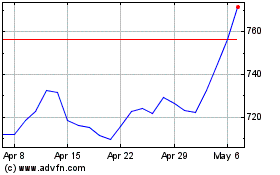

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024