S&P Drops Twitter, Walmart, Other Big Names From ESG Index

May 07 2020 - 3:17PM

Dow Jones News

By Dieter Holger

S&P Global Inc. said Wednesday that it kicked out big-name

companies and added others to its sustainable version of its

bellwether S&P 500 index, a move that will impact a growing

swath of investments tied to the benchmark.

Following this year's rebalance of the S&P 500 ESG Index,

the New York-based ratings agency firm now excludes Equifax Inc.

and ViacomCBS Inc. for landing in the bottom quarter of

environmental, social and governance scores among S&P 500

members. It also kicked out Twitter since it had a low score under

the United Nations Global Compact.

S&P said it replaced Walmart Inc. with Costco Wholesale

Corp. because its ESG score fell below its industry peers.

In response to S&P's decision, a Walmart spokesperson said

the company hasn't "been engaged in a discussion or exchanged

information with anyone from S&P regarding the S&P 500 ESG

Index. ESG rating systems are evolving and current methodologies

are inconsistent across rating organizations."

"We stand by our ESG work which has been recognized by others,"

the spokesperson added.

Twitter declined to comment. Equifax and ViacomCBS didn't

immediately respond to requests for comment.

Other well-known companies that S&P excluded were Clorox

Co., Ford Motor Co., Nordstrom Inc. and Southwest Airlines Co., but

it said these were actually eligible based on their ESG performance

and were removed at the firm's discretion.

Companies S&P added to the index include American Airlines

Group., Royal Caribbean Cruises and DTE Energy Co.

After screening out companies involved in tobacco or

controversial weapons or with a low United Nations Global Compact

score, the S&P 500 ESG Index aims to hold as many companies

with high ESG scores by targeting 75% of the parent benchmark

market cap by specific industry groups.

S&P said the index has seen higher performance than the

parent S&P 500 year-to-date, returning 2.68% above the

traditional index in the last year.

As of the 2020 rebalance, 311 members of the S&P 500 made it

in the index and 56 were excluded, while another 138 were eligible

but not selected.

Meeting sustainability standards has become increasingly

important for companies as a growing wave of investments are tied

to ESG performance. S&P has licensed the S&P 500 ESG Index

for funds, including the Xtrackers S&P 500 ESG ETF, which now

holds more than $100 million in assets.

Invesco Ltd. also has exchange-traded funds tracking the index:

the Invesco S&P 500 ESG Index ETF listed in Canada and the

Invesco S&P 500 ESG UCITS ETF listed in Europe.

In January, S&P and BlackRock Inc., the world's largest

money manager with close to $7 trillion in assets, agreed to create

ESG versions of S&P's flagship indexes to launch new

sustainable funds.

BlackRock forecasts that sustainable investments in

exchange-traded and index funds will soar to $1.2 trillion by 2030.

It said there is around $220 billion in such funds currently.

Write to Dieter Holger at dieter.holger@wsj.com;

@dieterholger

(END) Dow Jones Newswires

May 07, 2020 15:02 ET (19:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

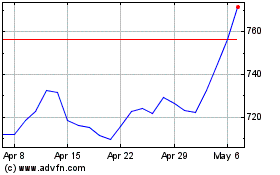

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024