Co-Diagnostics Expects New Royalty Structure to Lift Revenue and Expand Customer Base

September 11 2019 - 7:00AM

Analysts for Co-Diagnostics, Inc.

(Nasdaq: CODX),

a molecular diagnostics company with a patented diagnostic testing

platform, maintained their Buy rating with a target well above the

current price following news last week that increased royalties

from their expanded license agreement with LGC, Biosearch

Technologies are expected to bring revenue growth and boost

adoption of the CoPrimer technology.

The recent joint press release indicates that

Co-Diagnostics will benefit from LGC’s sales force to increase

their CoPrimer user base for research products included under the

expanded agreement. Co-Diagnostics CEO Dwight Egan also remarked

that the royalty structure has been increased from the original

license agreement between Co-Diagnostics and LGC, which was signed

roughly a year ago and limited to AgBio applications. Since that

time, LGC has launched their own-labeled BHQplex CoPrimer

product.

LGC is described as an international leader in

the extended life sciences sector. Recent coverage for CODX by

Maxim Group reports that the 175-year-old company has 20,000

customers and 12,000 labs in 200+ countries, including some of the

world’s largest seed and livestock producers. At the present time

LGC is owned by funds affiliated with KKR, although last month

Bloomberg reported that KKR was considering a buyout for LGC in the

$1.2b range following an annual report that showed an Adjusted

EBITDA of £86.4m (up 18.5% from 2017), which represents a margin of

26.1%.

LGC also owns all of or a controlling interest

in several molecular diagnostics companies, including Douglas

Scientific and Lucigen Corporation. With such a large footprint and

impressive revenue growth, combined with Co-Diagnostics’ increased

royalties and wider scope of products under the new agreement, it

is easy to see why H.C. Wainwright and Maxim Group maintained their

$2.00 price target for CODX after the news. The international sales

efforts of LGC will surely augment Co-Diagnostics’ own marketing

endeavors, the budget for which itself doubled according to their

most recent 10-Q filing.

What’s more, the release points out that as LGC

customers move to commercialize products built on the CoPrimer

platform, those deals would be subject to license agreements

directly with Co-Diagnostics, making the LGC expansion a direct

pathway to even greater licensing revenue.

Disclosure: Co-Diagnostics Inc is a client of BDA

International.

About BDA International,

Inc.:

BDA International is an independent global

Investor Relations firm offering a wide range of IR-related

analysis, research and advisory services. In particular, we provide

and are compensated for service packages that include strategic

action plans and investor/market perception studies to help

entities improve communication with customers and investors, and to

increase their visibility. BDA International has received no direct

compensation related to this release but its principles hold shares

of client companies in our personal portfolios, including CODX. BDA

International accepts sole responsibility for the content and

distribution of the foregoing release, which does not contain any

previously unpublished or non-public information. Parties

interested in learning more about the relationship between BDA and

CODX may do so via the contact information at the bottom of this

release.

Disclaimer

The information, opinions and analysis

contained herein are based on sources believed to be reliable, but

no representation, expressed or implied, is made as to its

accuracy, completeness or correctness. The opinions contained in

this analysis reflect our current judgment and are subject to

change without notice. We do not accept any responsibility or

liability for any losses, damages or costs arising from an

investor’s or other person’s reliance on or use of this analysis.

This analysis is for information purposes only, and is neither a

solicitation to buy nor an offer to sell securities, nor a

recommendation of any security, although members of the BDA may at

times hold a position in the company covered within the article.

Co-Diagnostics is a client of BDA International. Past gains are not

a representative of future gains. The opinions herein contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to, statements concerning manufacturing, marketing, growth,

and expansion. When used herein, the words “anticipate,” “intend,”

“estimate,” “believe,” “expect,” “plans,” “should,” “potential,”

“forecast,” and variations of such words and similar expressions

are intended to identify forward-looking statements. Such

forward-looking information involves important risks and

uncertainties that could affect actual results and cause them to

differ materially from expectations expressed herein. A company’s

actual results could differ materially from those described in any

forward-looking statements contained herein. BDA is not a licensed

broker, broker dealer, market maker, investment advisor, analyst or

underwriter. We recommend that you use the information found herein

as an initial starting point for conducting your own research in

order to determine your own personal opinion of the companies

discussed herein before deciding whether or not to invest. You

should seek such investment, tax, financial, accounting or legal

advice appropriate for your particular circumstances. Information

about many publicly traded companies and other investor resources

can be found at www.sec.gov. Investing in securities is speculative

and carries risk.

Investor Relations Contact:M.

Dost

BDA International www.bda-ir.com

dost@bda-ir.com

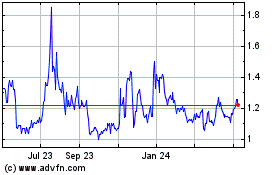

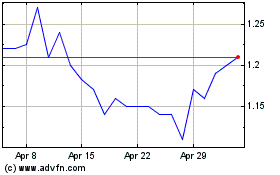

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Apr 2023 to Apr 2024