Current Report Filing (8-k)

November 01 2018 - 6:28AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 24, 2018

CO-DIAGNOSTICS,

INC.

(Exact

name of registrant as specified in its charter)

|

Utah

|

|

1-38148

|

|

46-2609363

|

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

2401

S. Foothill Drive, Suite D, Salt Lake City, Utah 84109

(Address

of principal executive offices and zip code)

(801)

438-1036

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 3.01

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard.

On

October 24, 2018, Co-Diagnostics, Inc. (the “Company”) received a letter (the “Notice”) from the Listing

Qualifications staff of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that for the last 30 consecutive

business days prior to the date of the letter, the market value of the Company’s listed securities was less than $35 million,

which does not meet the requirement for continued listing on The Nasdaq Capital Market, as required by Nasdaq Listing Rule 5550(b)(2)

(the “Market Value Rule”). In accordance with Nasdaq Listing Rule 5810(c)(3)(C), Nasdaq has provided the Company with

180 calendar days, or until April 23, 2019, to regain compliance with the Market Value Rule. If the Company regains compliance

with the Market Value Rule, Nasdaq will provide written confirmation to the Company and close the matter.

The

Notice does not result in the delisting of the Company’s common stock from The Nasdaq Capital Market. To regain compliance

with the Market Value Rule, the market value of the Company’s listed securities must meet or exceed $35 million for a minimum

of ten consecutive business days during the 180-day grace period ending on or before April 23, 2019. The Company could also regain

compliance with Nasdaq’s alternative continued listing requirements by having stockholders’ equity of $2.5 million

or more, or net income from continuing operations of $500,000 in the most recently completed fiscal year.

In

the event that the Company does not regain compliance within this 180-day period, the Company may be eligible to seek an additional

compliance period of 180 calendar days if it meets the continued listing requirement for market value of publicly held shares

and all other initial listing standards for the Nasdaq Capital Market, and provides written notice to Nasdaq of its intent to

cure the deficiency during this second compliance period.

Item

7.01. Regulation FD Disclosure.

On

October 30, 2018, the Company issued a press release announcing the License Agreement. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference. Information contained in or accessible through any website reference

in the press release is not part of, or incorporated by reference in, this Current Report on Form 8-K, and the inclusion of such

website addresses in this Current Report on Form 8-K by incorporation by reference of the press release is as inactive textual

references only.

The

information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any

filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Information contained on or accessible through any website reference in the press release is not part of, or incorporated by reference

in, this Current Report on Form 8-K, and the inclusion of any such website address in this Current Report on Form 8-K by incorporation

by reference of the press release is as an inactive textual reference only.

Item 9.01

Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CO-DIAGNOSTICS,

INC.

|

|

|

|

|

|

Dated:

October 31, 2018

|

/s/

DWIGHT H. EGAN

|

|

|

By:

|

Dwight

H. Egan, President/CEO

|

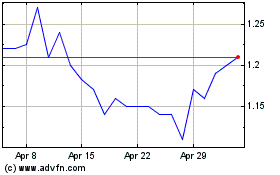

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Mar 2024 to Apr 2024

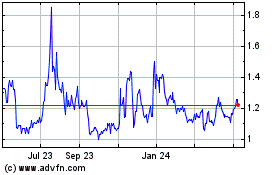

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Apr 2023 to Apr 2024