Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-237738

PROSPECTUS

SUPPLEMENT

(To

the Prospectus dated May 13, 2020)

26,000,000

Shares of Common Stock

We

are offering 26,000,000 shares of our common stock, par value $0.001 per share, at a purchase price of $1.54 per

share pursuant to this prospectus supplement and the accompanying prospectus.

The

offering is being underwritten on a firm commitment basis. The underwriters may offer the shares of common stock from time to time to

purchasers directly or through agents, or through brokers in brokerage transactions on The Nasdaq Capital Market, or to dealers in negotiated

transactions or in a combination of such methods of sale, or otherwise, at fixed price or prices, which may be changed, or at market

prices prevailing at the time of sale, at prices related to such prevailing market prices.

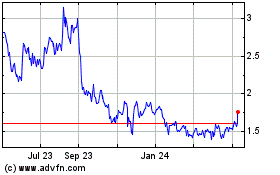

Our

common stock is traded on The Nasdaq Capital Market under the symbol “COCP.” On May 3, 2021, the last reported sale price

of our common stock on The Nasdaq Capital Market was $1.24 per share.

Investing

in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page S-6 of this prospectus

supplement, and in our Annual Report on Form 10-K for the year ended December 31, 2020, which is incorporated by reference into this

prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.54

|

|

|

$

|

40,040,000

|

|

|

Underwriting discounts and

commissions (1)

|

|

$

|

0.1155

|

|

|

$

|

3,003,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.4245

|

|

|

$

|

37,037,000

|

|

|

|

(1)

|

In

addition, we have agreed to pay the underwriter a management fee of 1.0% of the aggregate gross proceeds from this offering and to

reimburse the underwriter for certain of its expenses. See the “Underwriting” section beginning on page S-8 of this

prospectus supplement for a description of the compensation payable to the underwriter.

|

The

underwriter expects to deliver the shares of common stock on or about May 7, 2021.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is May 4, 2021

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the terms of the offering and also adds to and

updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement

and the accompanying prospectus. The second part consists of a prospectus dated May 13, 2020, included in the registration statement

on Form S-3 (No. 333-237738) that was initially filed on April 17, 2020 with the Securities and Exchange Commission (“SEC”),

as amended on May 4, 2020, and was declared effective by the SEC on May 13, 2020. Since the accompanying prospectus provides general

information about us, some of the information may not apply to this offering. This prospectus supplement describes the specific details

regarding this offering. Generally, when we refer to the “prospectus,” we are referring to both parts of this document. Additional

information is incorporated by reference in this prospectus supplement. If information in this prospectus supplement is inconsistent

with the accompanying prospectus, you should rely on this prospectus supplement. You should read this prospectus supplement, the accompanying

prospectus and any information incorporated by reference before you make any investment decision.

Neither

we nor Wainwright are making an offer to sell the securities in jurisdictions where the offer or sale is not permitted. The distribution

of this prospectus supplement and the accompanying prospectus and the offer and sale of our securities in certain jurisdictions may be

restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus

must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution of this prospectus

supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not

constitute an offer of, or an invitation to purchase, any shares of common stock in any jurisdiction in which such offer or invitation

would be unlawful.

You

should rely only on information contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate

by reference in this prospectus supplement. We have not authorized anyone to provide you with information that is different from that

contained in this prospectus supplement. We are not offering to sell or seeking offers to buy shares of common stock in jurisdictions

where offers and sales are not permitted. The information contained in this prospectus supplement and the accompanying prospectus supplement

is accurate only as of their respective dates, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Unless

otherwise mentioned or unless the context requires otherwise, all references in this prospectus supplement to the “Company,”

“we,” “us,” “our” and “Cocrystal” refer to Cocrystal Pharma, Inc., a Delaware corporation,

and its consolidated subsidiaries.

To

the extent this prospectus supplement contains summaries of the documents referred to herein, you are directed to the actual documents

for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents

referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which

this prospectus supplement is a part, and you may obtain copies of those documents as described below under the section entitled “Where

You Can Find More Information.”

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus, including documents incorporated by reference into this prospectus supplement

and the accompanying prospectus, contain “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933 (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”).

Such forward-looking statements include those statements that express plans, anticipation, intent, contingency, goals, targets or future

development and/or otherwise are not statements of historical fact. Forward-looking statements can generally be identified by the use

of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,”

“should,” “would,” “intend,” “seem,” “potential,” “appear,” “continue,”

“future,” believe,” “estimate,” “forecast,” “project” and other words of similar

meaning, although not all forward-looking statements contain these identifying words. In particular, these forward-looking statements

include, among others, statements about our expectations with respect to the expected progress of our coronavirus program, Influenza

program, including the anticipated results of our collaboration with Merck under the Collaboration Agreement, the expected progress of

our Norovirus program, and intended use of proceeds

from this offering.

These

statements are based on our current expectations and projections and involve estimates, assumptions, risks and uncertainties that could

cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety

by reference to the factors discussed in this prospectus supplement, and the accompanying prospectus, and the documents incorporated

by reference herein and therein. Important factors that could cause actual results to differ from those in the forward-looking statements

include the risks arising from the impact of the COVID-19 pandemic on our Company, including supply chain disruptions, and the national

and global economy, our continued ability to proceed with our programs, our reliance on certain third parties, our reliance on continuing

collaboration with Merck under the Collaboration Agreement, the future results of preclinical and clinical studies, general risks arising

from clinical trials, receipt of regulatory approvals, and development of effective treatments and/or vaccines by competitors. We also

refer you to the Risk Factors which begin on page S-6 of this prospectus supplement and our most recent Annual Report on Form 10-K

for the year ended December 31, 2020, under the caption “Item 1A – Risk Factors” of such report, and the other documents

incorporated by reference into this prospectus supplement for both an expanded discussion of the risks and uncertainties described above

and additional risks and uncertainties that could cause actual results to differ materially and adversely from those expressed or implied

by forward-looking statements. However, factors or events that could cause our actual results to differ may emerge from time to time,

and it is not possible for us to predict all of them.

You

should read this prospectus supplement, the accompanying prospectus and the documents that we reference herein and therein, completely

and with the understanding that our actual future results may be materially different from what we expect. You are cautioned not to place

undue reliance on the forward-looking statements contained in, or incorporated by reference into, this prospectus supplement. Each forward-looking

statement speaks only as of the date of this prospectus supplement or, in the case of documents incorporated by reference, the date of

the applicable document (or any earlier date indicated in the statement), and we undertake no obligation to update or revise any of these

statements, whether as a result of new information, future developments or otherwise, except as required by law. We qualify all of our

forward-looking statements by these cautionary statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary is not complete and does not contain all of the information that you should consider before investing in the securities offered

by this prospectus supplement and the accompanying prospectus. You should read this summary together with the entire prospectus supplement

and the accompanying prospectus, including our financial statements, the notes to those financial statements and the other documents

that are incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision.

See “Risk Factors” beginning on page S-6 of this prospectus supplement for a discussion of the risks involved in investing

in our securities.

Our

Company

Cocrystal

Pharma, Inc. is a biotechnology company seeking to discover and develop novel antiviral therapeutics as treatments for serious

and/or chronic viral diseases. We employ unique structure-based technologies and Nobel Prize winning expertise to create first-

and best-in-class antiviral drugs. These technologies are designed to efficiently deliver small molecule therapeutics that are

safe, effective, and convenient to administer. We have identified promising discovery, preclinical and clinical stage antiviral

compounds for unmet medical needs caused by influenza virus, coronavirus, and norovirus infections. The Company is also seeking

a partner for further clinical development of its Hepatitis C product which has completed Phase 2a clinical trials.

Cocrystal

Technology

We

are developing antiviral therapeutics that inhibit the essential viral replication function of RNA viruses causing acute and chronic

viral diseases. Our goals include treating influenza virus, coronavirus, and norovirus infections by discovering and developing drug

candidates targeting the viral replication process. In the case of coronavirus, we target a major protease enzyme that produces the active

form of the viral replication enzyme. We have selected a lead coronavirus development candidate which we have licensed from Kansas State

University Research Foundation. To discover and design these inhibitors, we use a proprietary platform comprising computation, medicinal

chemistry, X-ray crystallography, and our extensive know-how. We determine the structures of cocrystals containing the inhibitors bound

to the enzyme or protein to guide our structure-based drug design. We also use advanced computational methods to screen and design product

candidates using proprietary cocrystal structural information. In designing the candidates, we seek to anticipate and avert potential

viral mutations leading to resistance. By designing and selecting drug candidates that interrupt the viral replication process and also

have specific binding characteristics, we seek to develop drugs that are not only effective against both the virus and possible mutants

of the virus, but which also have reduced off-target interactions that cause undesirable clinical side effects. The successful application

of our approach requires an extensive knowledge of viruses and drug targets. In addition, knowledge and experience in the fields of structural

biology, and enzymology are required. We developed our proprietary structure-based drug design under the guidance of Dr. Roger Kornberg,

our Chief Scientist, Chairman of our Scientific Advisory Board and recipient of the Nobel Prize in Chemistry in 2006. Our drug discovery

process focuses on the highly conserved regions of the viral enzymes and inhibitor-enzyme interactions at the atomic level. Additionally,

we have developed proprietary chemical libraries consisting of non-nucleoside inhibitors, metal-binding inhibitors, and drug-like fragments.

Our drug discovery process is different from traditional, empirical, medicinal chemistry approaches that often require iterative high-throughput

compound screening and lengthy hit-to-lead processes. We will continue developing preclinical and clinical drug candidates using our

proprietary drug discovery technology.

Corporate

Information

Our

principal executive offices are located at 19805 North Creek Parkway, Bothell, Washington 98011 and our telephone number is (786) 459-1831.

Our Internet website address is www.cocrystalpharma.com. The information on our website is not incorporated into this prospectus supplement.

The

Offering

|

Issuer

|

|

Cocrystal

Pharma, Inc.

|

|

|

|

|

|

Common

stock offered

|

|

26,000,000 shares

of common stock

|

|

|

|

|

|

Common

stock to be outstanding immediately after this offering

|

|

97,468,755 shares of common stock

|

|

|

|

|

|

Use

of proceeds

|

|

We

intend to use the net proceeds from this offering for the expansion of our coronavirus and influenza programs, and for working capital

and other general corporate purposes. See “Use of Proceeds” on page S-7 of this prospectus supplement.

|

|

|

|

|

|

Nasdaq

Capital Market symbol

|

|

“COCP”

|

|

|

|

|

|

Risk

factors

|

|

This

investment involves a high degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement,

our Annual Report on Form 10-K for the year ended December 31, 2020, which is incorporated by reference into this prospectus supplement,

and the other reports incorporated by reference into the accompanying prospectus for a discussion of factors you should carefully

consider before deciding to invest in our common stock.

|

The

number of shares of common stock to be outstanding immediately after this offering is based on 71,468,755 shares of common stock outstanding

as of May 3, 2021 and excludes, as of that date:

|

|

●

|

243,375

shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $15.00 per share;

|

|

|

|

|

|

|

●

|

1,772,287

shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $2.52 per

share; and

|

|

|

|

|

|

|

●

|

2,262,736

shares of common stock available for future grants under our 2015 Equity Incentive Plan (“Equity Plan”).

|

Except

as otherwise indicated, all information in this prospectus supplement assumes no exercise of outstanding options.

RISK

FACTORS

An

investment in our common stock involves a substantial risk of loss. You should carefully consider the risk factors set forth below, in

our Annual Report on Form 10-K for the year ended December 31, 2020, , together with the other information included or incorporated by

reference into this prospectus supplement and the accompanying prospectus, before you decide to invest in our common stock. The occurrence

of any of these risks could harm our business. In that case, the trading price of our common stock could decline, and you may lose all

or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

impair our operations. You should also refer to the other information contained in this prospectus supplement and the accompanying prospectus

or incorporated by reference herein or therein, including our financial statements and the notes to those statements and the information

set forth under the heading “Cautionary Note Regarding Forward-Looking Statements.”

Risk

Related to This Offering and Our Common Stock

We

have broad discretion in the use of the net proceeds we receive from this offering and may not use them effectively.

We

cannot specify with certainty the particular uses of the net proceeds we will receive from this offering. We will have broad discretion

in the application of these net proceeds, including for any of the purposes described in the section entitled “Use of Proceeds.”

Accordingly, you will have to rely upon our judgment with respect to the use of these net proceeds, with only limited information concerning

our specific intentions. We may spend a portion or all of the net proceeds we will receive from this offering in ways that our stockholders

may not desire or that may not yield a favorable return. Our failure to apply these funds effectively could harm our business.

If

you purchase shares in this offering, you will suffer immediate and substantial dilution of your investment. You will experience further

dilution if we issue additional equity securities in future financing transactions.

Because

the offering price per share of our common stock is higher than the net tangible book value per share of our common stock, you will suffer

immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering.

Investors

purchasing shares of common stock in this offering will incur immediate dilution of approximately $0.82 per share. In addition,

we have stock options and warrants outstanding that are exercisable into shares of our common stock. To the extent that such outstanding

securities are exercised into shares of our common stock, investors purchasing our securities in this offering may experience

further dilution.

Because

our common stock was, with infrequent exceptions, not actively traded, if the current liquidity dissipates purchasers of our stock may

incur difficulty in selling their shares at or above the price they paid for them, or at all.

Until

2020, our common stock was not actively traded with infrequent exceptions. The active market for our common stock in 2020 may

not be sustained. Accordingly, investors may experience difficulty is selling their shares of common stock at or above

the price they paid for them.

Future

sales of our common stock, or the perception that such sales may occur, could cause the market price for our common stock to decline.

We

cannot predict the effect, if any, that market sales of shares of our common stock or the availability of shares of our common stock

for sale will have on the market price of our common stock prevailing from time to time. Sales of substantial amounts of shares of our

common stock in the public market, or the perception that those sales will occur, could cause the market price of our common stock to

decline or be depressed.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $36.4 million, after deducting underwriting discounts

and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for

the expansion of our coronavirus and influenza programs, and for general corporate purposes and working capital.

As

of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses of the proceeds from this offering.

Accordingly, we will retain broad discretion over the use of such proceeds.

DILUTION

If

you purchase shares of our common stock in this offering, your interest will be diluted to the extent of the difference between the price

per share you pay in this offering and the net tangible book value per share of our common stock after this offering. Our net tangible

book value as of December 31, 2020 was approximately $33.4 million, or $0.47 per share. Net tangible book value per share represents

the amount of our total tangible assets, excluding goodwill and intangible assets, less total liabilities divided by the total number

of shares of our common stock outstanding.

After

giving effect to the sale of 26,000,000 shares of our common stock at the offering price of $1.54 per share, and

after deducting the underwriting discounts and commissions and estimated offering expenses, our as adjusted net tangible book

value as of December 31, 2020 would have been approximately $69.8 million or approximately $0.72 per share. This

represents an immediate increase in the net tangible book value of approximately $0.25 per share to our existing stockholders

and an immediate dilution in as adjusted net tangible book value of approximately $0.82 per share to purchasers of our

common stock in this offering.

Dilution

per share of common stock to new investors is determined by subtracting as adjusted net tangible book value per share of common stock

after this offering from the offering price per share of common stock paid by new investors.

The

following table illustrates this per share dilution:

|

Offering price per share

|

|

|

|

|

|

$

|

1.54

|

|

|

|

|

|

|

|

|

|

|

|

|

Net tangible book value per share as of December 31, 2020

|

|

$

|

0.47

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in net tangible

book value per share attributable to new investors this offering

|

|

$

|

0.25

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share

after giving effect to this offering

|

|

|

|

|

|

$

|

0.72

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution in net tangible

book value per share to new investors in this offering

|

|

|

|

|

|

$

|

0.82

|

|

The

number of shares of our common stock to be outstanding after this offering is based on the actual number of shares outstanding as of

December 31, 2020, which was 70,438,755, and excludes as of such date:

|

|

●

|

243,375

shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $15.00 per share;

|

|

|

|

|

|

|

●

|

1,779,399

shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $2.53 per

share; and

|

|

|

|

|

|

|

●

|

2,262,736

shares of common stock available for future grants under our Equity Plan.

|

To

the extent that any outstanding options or warrants are exercised, or we otherwise issue additional shares of common stock in the future,

at a price less than the public offering price, there will be further dilution to the investors.

UNDERWRITING

Pursuant

to an underwriting agreement with H.C. Wainwright & Co., LLC (the “underwriter”), we have agreed to issue and sell, and

the underwriter has agreed to purchase, the number of shares of common stock listed opposite its name below, less the underwriting discount,

on the closing date, subject to the terms and conditions contained in the underwriting agreement. The underwriting agreement provides

that the obligations of the underwriter are subject to certain customary conditions precedent, representations and warranties contained

therein.

|

Underwriter

|

|

Number

of

Shares

|

|

|

H.C. Wainwright & Co., LLC

|

|

|

26,000,000

|

|

|

Total

|

|

|

26,000,000

|

|

Pursuant

to the underwriting agreement, the underwriter has agreed to purchase all of the shares sold under the underwriting agreement

if any of these shares are purchased. The underwriter has advised us that it does not intend to confirm sales to any account

over which it exercises discretionary authority.

Discounts,

Commissions and Expenses

The

underwriter may offer the shares of common stock from time to time to purchasers directly or through agents, or through brokers in brokerage

transactions on Nasdaq, or to dealers in negotiated transactions or in a combination of such methods of sale, or otherwise, at a fixed

price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related to such prevailing market

prices or at negotiated prices, subject to receipt and acceptance by it and subject to its right to reject any order in whole or in part.

The difference between the price at which the underwriter purchases shares from us and the price at which the underwriter resells such

shares may be deemed underwriting compensation. If the underwriter effects such transactions by selling shares of common stock to or

through dealers, such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or

purchasers of shares of common stock for whom they may act as agents or to whom they may sell as principal.

The

underwriter is offering the shares, subject to prior sale, when, as and if issued to and accepted by it, subject to approval of legal

matters and other conditions specified in the underwriting agreement. The underwriter reserves the right to withdraw, cancel or modify

offers to the public and to reject orders in whole or in part.

The

following table shows the public offering price, underwriting discount and proceeds, before expenses, to us.

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.54

|

|

|

$

|

40,040,000

|

|

|

Underwriting discounts and commissions payable

by us

|

|

$

|

0.1155

|

|

|

$

|

3,003,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.4245

|

|

|

$

|

37,037,000

|

|

We

have also agreed to pay the underwriter a management fee equal to 1.0% of the aggregate gross proceeds in this offering. We have agreed

to reimburse the expenses of the underwriter in the non-accountable sum of $50,000 in connection with this offering, up to $90,000 for

expenses of legal counsel, and up to $15,950 for the clearing expenses of the underwriter in connection with this offering.

Right

of First Refusal

We

have granted the underwriter a twelve-month right of first refusal to act as our exclusive underwriter or placement agent for any further

capital raising transactions undertaken by us, and to act as the exclusive advisor, manager or underwriter or placement agent, as applicable,

if we sell or acquire a business, finance any indebtedness, or decide to raise funds by means of a public offering or a private placement

or any other capital-raising financing of equity, equity-linked or debt securities using an underwriter or placement agent.

Tail

Financing Payments

In

the event that any investors that participate in this offering or were introduced to this offering by the underwriter provide any capital

to us in a public or private offering or capital-raising transaction within 6 months following the termination of our engagement of the

underwriter, we shall pay the underwriter the cash compensation provided above on the gross proceeds from such investors.

Indemnification

We

have agreed to indemnify the underwriter against certain liabilities, including civil liabilities under the Securities Act of 1933, as

amended, or the Securities Act, or to contribute to payments that the underwriter may be required to make in respect of those liabilities.

Lock-Up

Agreements

We

have agreed to not sell any shares of our common stock or any securities convertible into or exercisable or exchangeable into share of

common stock, subject to certain exceptions, for a period of 90 days after the date of this prospectus supplement.

Price

Stabilization, Short Positions and Penalty Bids

In

connection with this offering, the underwriter may engage in stabilizing transactions, syndicate covering

transactions and penalty bids in connection with our common stock.

|

|

●

|

Stabilizing

transactions permit bids to purchase shares of common stock so long as the stabilizing bids do not exceed a specified maximum.

|

|

|

●

|

Syndicate

covering transactions involve purchases of common stock in the open market after the distribution has been completed in order to

cover syndicate short positions. Such a naked short position would be closed out by buying securities in the open market. A naked

short position is more likely to be created if the underwriter is concerned that there could be downward pressure on the price of

the securities in the open market after pricing that could adversely affect investors who purchase in the offering.

|

|

|

●

|

Penalty

bids permit the underwriter to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate

member are purchased in a stabilizing or syndicate covering transaction to cover syndicate short positions.

|

These

stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price

of our common stock or preventing or retarding a decline in the market price of our common stock. As a result, the price of our common

stock in the open market may be higher than it would otherwise be in the absence of these transactions. Neither we nor the underwriter

make any representation or prediction as to the effect that the transactions described above may have on the price of our common stock.

These transactions may be effected on The Nasdaq Capital Market, in the over-the-counter market or otherwise and, if commenced, may be

discontinued at any time.

Regulation

M

In

connection with this offering, the underwriter also may engage in passive market making transactions in our common stock in accordance

with Regulation M during a period before the commencement of offers or sales of shares of our common stock in this offering and extending

through the completion of the distribution. In general, a passive market maker must display its bid at a price not in excess of the highest

independent bid for that security. However, if all independent bids are lowered below the passive market maker’s bid that bid must

then be lowered when specific purchase limits are exceeded. Passive market making may stabilize the market price of the securities at

a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

Electronic

Distribution

A

prospectus in electronic format may be made available on the websites maintained by the underwriter, if any, participating in this offering

and the underwriter may distribute prospectuses electronically. Other than the prospectus in electronic format, the information on these

websites is not part of this prospectus or the registration statement of which this prospectus form a part, has not been approved or

endorsed by us or the underwriter, and should not be relied upon by investors.

Other

Relationships

From

time to time, the underwriter has provided and may provide in the future, various advisory, investment and commercial banking and other

services to us in the ordinary course of business, for which they have received and may continue to receive customary fees and discounts

and commissions. However, except as disclosed in this prospectus supplement, we have no present arrangements with the underwriter for

any further services.

H.C.

Wainwright & Co., LLC acted as our exclusive placement agent in connection with our registered direct offering we consummated in

March 2020, as our exclusive sales agent in connection with an at-the-market offering facility in June 2020, and as our underwriter in

August 2020, in each case for which it received compensation.

Transfer

Agent

The

transfer agent of our common stock is Equity Stock Transfer. Their address is 237 West 37th Street,

Suite 602, New York, NY 10018.

Nasdaq

Capital Market Listing

Our

common stock is listed on The Nasdaq Capital Market under the symbol “COCP”.

DIVIDEND

POLICY

We

have never declared or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in

our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will

be at the discretion of our Board after taking into account various factors, including our financial condition, operating results, current

and anticipated cash needs and plans for expansion.

LEGAL

MATTERS

Nason,

Yeager, Gerson, Harris & Fumero, P.A., Palm Beach Gardens, Florida, will pass upon certain legal matters relating to this offering.

Ellenoff Grossman & Schole LLP, New York, New York, is acting as counsel to the underwriter in connection with certain legal matters

relating to this offering.

EXPERTS

The

consolidated financial statements as of December 31, 2020 and 2019 and for the years then ended incorporated by reference in this prospectus

supplement have been so incorporated by reference in reliance on the reports of Weinberg & Company, our independent registered public

accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet website

that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC,

including Cocrystal at www.sec.gov. You may also access our SEC reports and proxy statements free of charge at our website, www.cocrystalpharma.com.

The information contained in, or that can be accessed through, our website is not part of this prospectus supplement.

This

prospectus supplement and the accompanying prospectus are part of the registration statement on Form S-3 filed with the SEC under the

Securities Act for the common stock offered by this prospectus supplement. This prospectus supplement does not contain all of the information

set forth in the registration statement, certain parts of which have been omitted in accordance with the rules and regulations of the

SEC. For further information, reference is made to the registration statement and its exhibits. Whenever we make references in this prospectus

supplement or the accompanying prospectus to any of our contracts, agreements or other documents, the references are not necessarily

complete and you should refer to the exhibits attached to the registration statement for the copies of the actual contract, agreement

or other document.

DOCUMENTS

INCORPORATED BY REFERENCE

The

SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to

you by referring you to another document that we have filed separately with the SEC. Any information that we incorporate by reference

is considered part of this prospectus supplement. We hereby incorporate by reference the following information or documents into this

prospectus supplement and the accompanying prospectus:

|

|

●

|

Our

Annual Report on Form 10-K for the year ended December 31, 2020;

|

|

|

|

|

|

|

●

|

Our

current report on Form 8-K filed on March 9, 2021 (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K

and exhibits that are related to such item); and

|

|

|

|

|

|

|

●

|

The

description of our common stock contained in our Registration Statement on Form 8-A (File No. 001-38418), filed under Section 12(b)

of the Exchange Act on March 9, 2018, including any subsequent amendment or report filed for the purpose of amending such description.

|

Any

information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information

in this prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated

herein by reference modifies or replaces such information.

We

also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act,

until we sell all of the securities offered by this prospectus supplement. Information in such future filings updates and supplements

the information provided in this prospectus supplement. Any statements in any such future filings will automatically be deemed to modify

and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein

by reference to the extent that statements in the later filed document modify or replace such earlier statements.

Upon

written or oral request, we will provide to you, without charge, a copy of any or all of the documents that are incorporated by reference

into this prospectus supplement and the accompanying prospectus but not delivered with the prospectus, including exhibits which are specifically

incorporated by reference into such documents. Requests should be directed to:

Cocrystal

Pharma, Inc.

19805

North Creek Parkway

Bothell,

Washington 98011

Telephone

number: (786) 459-1831

PROSPECTUS

$150,000,000

Cocrystal

Pharma, Inc.

Common

Stock

Preferred

Stock

Warrants

Units

Cocrystal

Pharma, Inc. intends to offer and sell from time to time the securities described in this prospectus. The total offering price of the

securities described in this prospectus will not exceed a total of $150,000,000.

This

prospectus describes some of the general terms that apply to the securities. We will provide specific terms of any securities we may

offer in supplements to this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you

invest. We also may authorize one or more free writing prospectuses to be provided to you in connection with the offering. The prospectus

supplement and any free writing prospectus also may add, update or change information contained or incorporated in this prospectus.

We

may offer and sell these securities to or through one or more underwriters, brokers or agents, or directly to purchasers on a continuous

or delayed basis. The prospectus supplement for each offering of securities will describe the plan of distribution for that offering.

For general information about the distribution of securities offered, see “Plan of Distribution” in this prospectus. The

prospectus supplement also will set forth the price to the public of the securities and the net proceeds that we expect to receive from

the sale of such securities.

Our

common stock is traded on The Nasdaq Capital Market under the symbol “COCP.” On April 16, 2020, the last reported sales price

of our common stock on the Nasdaq Capital Market was $0.90 per share and our public float consisted of 36,909,583 shares of common stock.

Investing

in our securities involves risks. You should read carefully and consider “Risk Factors” included in our most recent Annual

Report on Form 10-K and on page 2 of this prospectus and in the applicable prospectus supplement before investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is May 13, 2020

TABLE

OF CONTENTS

You

should rely only on information contained in this prospectus. We have not authorized anyone to provide you with information that is different

from that contained in this prospectus. We are not offering to sell or seeking offers to buy shares of common stock or other securities

in jurisdictions where offers and sales are not permitted. The information contained in this prospectus is accurate only as of the date

of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock or other securities. We

are responsible for updating this prospectus to ensure that all material information is included and will update this prospectus to the

extent required by law.

PROSPECTUS

SUMMARY

This

summary only highlights the more detailed information appearing elsewhere in this prospectus or incorporated by reference in this prospectus.

It may not contain all of the information that is important to you. You should carefully read the entire prospectus and the documents

incorporated by reference in this prospectus before deciding whether to invest in our securities. Unless otherwise indicated or the context

requires otherwise, in this prospectus and any prospectus supplement hereto references to “Cocrystal,” “we,”

“us,” and “our” refer to Cocrystal Pharma, Inc. and its consolidated subsidiaries.

About

This Prospectus

This

prospectus is part of a “shelf” registration statement that we have filed with the Securities and Exchange Commission (the

“Commission”). By using a shelf registration statement, we may sell, at any time and from time to time, in one or more offerings,

any combination of the securities described in this prospectus. The exhibits to our registration statement contain the full text of certain

contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information

that you may find important in deciding whether to purchase the securities we offer, you should review the full text of these documents.

The registration statement and the exhibits can be obtained from the Commission as indicated under the section entitled “Incorporation

of Certain Information by Reference.”

This

prospectus only provides you with a general description of the securities we may offer. Each time we sell securities, we will provide

a prospectus supplement that contains specific information about the terms of those securities. The prospectus supplement also may add,

update or change information contained in this prospectus. If there is an inconsistency between the information in this prospectus and

any prospectus supplement, you should rely on the information in the prospectus supplement. You should read carefully both this prospectus

and any prospectus supplement together with the additional information described below under the section entitled “Incorporation

of Certain Information by Reference.”

We

are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information

in this prospectus or a prospectus supplement is accurate as of any date other than the date on the front of the document.

Our

Company

Cocrystal

Pharma, Inc. is a biotechnology company seeking to discover and develop novel antiviral therapeutics as treatments for serious and/or

chronic viral diseases. We employ unique structure-based technologies and Nobel Prize winning expertise to create first- and best-in-class

antiviral drugs. These technologies are designed to efficiently deliver small molecule therapeutics that are safe, effective and convenient

to administer. We have identified promising preclinical and early clinical stage antiviral compounds for unmet medical needs including

influenza, Hepatitis C virus, coronavirus, and norovirus infections.

Corporate

Information

Our

principal executive offices are located at 19805 N. Creek Parkway, Bothell, WA 98011 and our telephone number is (786) 459-1831. Our

Internet website address is www.cocrystalpharma.com. The information on our website is not incorporated into this prospectus.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus including the documents incorporated by reference contains forward-looking statements. All statements other than statements

of historical facts, including statements regarding our future financial position, liquidity, business strategy and plans and objectives

of management for future operations, are forward-looking statements. The words “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “could,”

“target,” “potential,” “is likely,” “will,” “expect” and similar expressions,

as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on

our current expectations and projections about future events and financial trends that we believe may affect our financial condition,

results of operations, business strategy and financial needs.

The

results anticipated by any or all of these forward-looking statements might not occur. Important factors, uncertainties and risks that

may cause actual results to differ materially from these forward-looking statements are contained in the risk factors that follow and

elsewhere in this prospectus and the incorporated documents. We undertake no obligation to publicly update or revise any forward-looking

statements, whether as the result of new information, future events or otherwise. For more information regarding some of the ongoing

risks and uncertainties of our business, see the risk factors that follow and or that are disclosed in our incorporated documents.

RISK

FACTORS

Investing

in our securities involves risks. Before purchasing the securities offered by this prospectus you should consider carefully the risk

factors incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2019 filed with

the Commission on March 27, 2020, as well as the risks, uncertainties and additional information (i) set forth in our reports on Forms

10-K, 10-Q and 8-K and in the other documents incorporated by reference in this prospectus that we file with the Commission after the

date of this prospectus and which are deemed incorporated by reference in this prospectus, and (ii) the information contained in any

applicable prospectus supplement. For a description of these reports and documents, and information about where you can find them, see

“Incorporation of Certain Information By Reference.” The risks and uncertainties we discuss in this prospectus and in the

documents incorporated by reference in this prospectus are those that we currently believe may materially affect our company. Additional

risks not presently known, or currently deemed immaterial, also could materially and adversely affect our financial condition, results

of operations, business and prospects.

USE

OF PROCEEDS

Unless

we specify otherwise in an accompanying prospectus supplement, we intend to use the net proceeds from the sale of the securities by us

to provide additional funds for working capital and other general corporate purposes. Any specific allocation of the net proceeds of

an offering of securities will be determined at the time of such offering and will be described in the accompanying supplement to this

prospectus.

DESCRIPTION

OF CAPITAL STOCK

We

are authorized to issue 100,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par

value $0.001 per share.

Common

Stock

We

are authorized to issue 100,000,000 shares of common stock, par value $0.001 per share. The holders of common stock are entitled to one

vote per share on all matters submitted to a vote of shareholders, including the election of directors. There is no cumulative voting

in the election of directors. In the event of our liquidation or dissolution, holders of common stock are entitled to share ratably in

all assets remaining after payment of liabilities and the liquidation preferences of any outstanding shares of preferred stock. Holders

of common stock have no preemptive rights and have no right to convert their common stock into any other securities and there are no

redemption provisions applicable to our common stock.

The

holders of common stock are entitled to any dividends that may be declared by the Board of Directors out of funds legally available for

payment of dividends subject to the prior rights of holders of preferred stock and any contractual restrictions we have against the payment

of dividends on common stock. We have not paid dividends on our common stock since inception and do not plan to pay dividends on our

common stock in the foreseeable future.

As

of April 1, 2020, we had 52,140,699 shares of common stock outstanding. In addition, as of that date, there were 1,084,229 shares underlying

our outstanding warrants and stock options.

Preferred

Stock

We

are authorized to issue 5,000,000 shares of “blank check” preferred stock with designations, rights and preferences as may

be determined from time to time by our Board of Directors. As the date of this prospectus, we had no shares of preferred stock issued

and outstanding.

Preferred

stock is available for possible future financings or acquisitions and for general corporate purposes without further authorization of

our shareholders unless such authorization is required by applicable law, or the rules of any securities exchange or market on which

our stock is then listed or admitted or trading.

Our

Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting

power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with

possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying, deferring or preventing

a change in control of the Company. For a description of how future issuances of our preferred stock could affect the rights of our shareholders,

see “Certain Provisions of Delaware Law and of Our Charter and Bylaws - Issuance of “blank check” Preferred Stock,”

below.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering. Such

prospectus supplement will include:

|

|

●

|

the

title and stated or par value of the preferred stock;

|

|

|

|

|

|

|

●

|

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock;

|

|

|

|

|

|

|

●

|

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock;

|

|

|

|

|

|

|

●

|

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall accumulate;

|

|

|

|

|

|

|

●

|

the

provisions for a sinking fund, if any, for the preferred stock;

|

|

|

|

|

|

|

●

|

any

voting rights of the preferred stock;

|

|

|

|

|

|

|

●

|

the

provisions for redemption, if applicable, of the preferred stock;

|

|

|

|

|

|

|

●

|

any

listing of the preferred stock on any securities exchange;

|

|

|

|

|

|

|

●

|

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the conversion

price or the manner of calculating the conversion price and conversion period;

|

|

|

|

|

|

|

●

|

if

appropriate, a discussion of federal income tax consequences applicable to the preferred stock; and

|

|

|

|

|

|

|

●

|

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock.

|

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of common stock. Warrants may be issued independently or together with other securities and may be

attached to or separate from any offered securities. Each series of warrants will be issued under a separate warrant agreement. The following

outlines some of the general terms and provisions of the warrants that we may issue from time to time. Additional terms of the warrants

and the applicable warrant agreement will be set forth in the applicable prospectus supplement.

The

following descriptions, and any description of the warrants included in a prospectus supplement, may not be complete and is subject to

and qualified in its entirety by reference to the terms and provisions of the applicable warrant agreement, which we will file with the

Commission in connection with any offering of warrants.

General

The

prospectus supplement relating to a particular issue of warrants will describe the terms of the warrants, including the following:

|

●

|

the

title of the warrants;

|

|

|

|

|

●

|

the

offering price for the warrants, if any;

|

|

|

|

|

●

|

the

aggregate number of the warrants;

|

|

|

|

|

●

|

the

terms of the security that may be purchased upon exercise of the warrants;

|

|

|

|

|

●

|

if

applicable, the designation and terms of the securities that the warrants are issued with and the number of warrants issued with

each security;

|

|

|

|

|

●

|

if

applicable, the date from and after which the warrants and any securities issued with the warrants will be separately transferable;

|

|

|

|

|

●

|

the

dates on which the right to exercise the warrants commence and expire;

|

|

|

|

|

●

|

if

applicable, the minimum or maximum amount of the warrants that may be exercised at any one time;

|

|

|

|

|

●

|

if

applicable, a discussion of material United States federal income tax considerations;

|

|

|

|

|

●

|

anti-dilution

provisions of the warrants, if any;

|

|

|

|

|

●

|

redemption

or call provisions, if any, applicable to the warrants; and

|

|

|

|

|

●

|

any

additional terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants.

|

Exercise

of warrants

Each

warrant will entitle the holder of the warrant to purchase the securities that we specify in the applicable prospectus supplement at

the exercise price that we describe in the applicable prospectus supplement. Holders may exercise warrants at any time up to the close

of business on the expiration date set forth in the applicable prospectus supplement. After the close of business on the expiration date,

unexercised warrants will be void. Holders may exercise warrants as set forth in the prospectus supplement relating to the warrants being

offered. Until a holder exercises the warrants to purchase any securities underlying the warrants, the holder will not have any rights

as a holder of the underlying securities by virtue of ownership of warrants.

DESCRIPTION

OF UNITS

As

specified in any applicable prospectus supplement, we may issue units consisting of one or more warrants, debt securities, shares of

preferred stock, shares of common stock or any combination of such securities.

Transfer

Agent

We

have appointed Equity Stock Transfer as our transfer agent. Their contact information is: 237 West 37th Street, Suite 602, New York,

New York 10018, phone number (212) 575-5757.

CERTAIN

PROVISIONS OF DELAWARE LAW AND OF OUR CHARTER AND BYLAWS

Anti-takeover

Provisions

In

general, Section 203 of the Delaware General Corporation Law (the “DGCL”) prohibits a Delaware corporation with a class of

voting stock listed on a national securities exchange or held of record by 2,000 or more shareholders from engaging in a “business

combination” with an “interested shareholder” for a three-year period following the time that this shareholder becomes

an interested shareholder, unless the business combination is approved in a prescribed manner. A “business combination” includes,

among other things, a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested shareholder.

An “interested shareholder” is a person who, together with affiliates and associates, owns, or did own within three years

prior to the determination of interested shareholder status, 15% or more of the corporation’s voting stock. Under Section 203,

a business combination between a corporation and an interested shareholder is prohibited unless it satisfies one of the following conditions:

|

●

|

before

the shareholder became interested, the board of directors approved either the business combination or the transaction which resulted

in the shareholder becoming an interested shareholder;

|

|

|

|

|

●

|

upon

consummation of the transaction which resulted in the shareholder becoming an interested shareholder, the interested shareholder

owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes

of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee stock plans,

in some instances; or

|

|

|

|

|

●

|

at

or after the time the shareholder became interested, the business combination was approved by the board of directors of the corporation

and authorized at an annual or special meeting of the shareholders by the affirmative vote of at least two-thirds of the outstanding

voting stock which is not owned by the interested shareholder.

|

The

DGCL permits a corporation to opt out of, or choose not to be governed by, its anti-takeover statute by expressly stating so in its original

certificate of incorporation (or subsequent amendment to its certificate of incorporation or bylaws approved by its shareholders). Our

Certificate of Incorporation does not contain a provision expressly opting out of the application of Section 203 of the DGCL; therefore

we are subject to the anti-takeover statute.

Issuance

of “Blank Check” Preferred Stock

Our

Certificate of Incorporation authorizes the issuance of up to 5,000,000 shares of “blank check” preferred stock with designations,

rights and preferences as may be determined from time to time by our Board of Directors. Our Board of Directors is empowered, without

shareholder approval, to issue a series of preferred stock with dividend, liquidation, conversion, voting or other rights which could

dilute the interest of, or impair the voting power of, our common shareholders. The issuance of a series of preferred stock could be

used as a method of discouraging, delaying or preventing a change in control. For example, it would be possible for our Board of Directors

to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to effect a change in

control of our Company.

Our

Bylaws also allow our Board of Directors to fix the number of directors. Our shareholders do not have cumulative voting in the election

of directors.

Special

Shareholder Meetings and Action by Written Consent

Under

our Bylaws, special meetings of the shareholders shall be held when directed by (i) the Board of

Directors, or (ii) when requested in writing by the holders of not less than 20 percent of all the shares entitled to vote at the meeting.

Our Bylaws do not permit meetings of shareholders to be called by any other person. This could have the effect of delaying or preventing

unsolicited takeovers and changes in control or changes in our management.

Indemnification

of Directors and Officers.

Section

145(a) of the DGCL, which Cocrystal is subject to, provides that a corporation may indemnify any person who was or is a party or is threatened

to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative

(other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee

or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another

corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the

person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation,

and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. Section

145(b) of the DGCL provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to

any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason

of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request

of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise

against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement

of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the

best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which

such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the

court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view

of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of

Chancery or such other court shall deem proper. To the extent that a present or former director or officer of a corporation has been

successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Section 145(a) and (b) of the DGCL,

or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees)

actually and reasonably incurred by such person in connection therewith.

Any

indemnification under Section 145(a) and (b) of the DGCL (unless ordered by a court) shall be made by Cocrystal only as authorized in

the specific case upon a determination that indemnification of the present or former director, officer, employee or agent is proper in

the circumstances because the person has met the applicable standard of conduct set forth in Section 145(a) and (b). Such determination

shall be made, with respect to a person who is a director or officer at the time of such determination, (1) by a majority vote of the

directors who are not parties to such action, suit or proceeding, even though less than a quorum, or (2) by a committee of such directors

designated by majority vote of such directors, even though less than a quorum, or (3) if there are no such directors, or if such directors

so direct, by independent legal counsel in a written opinion, or (4) by the shareholders. Expenses (including attorneys’ fees)

incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be

paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on

behalf of such director or officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified

by the corporation as authorized in this section. Such expenses (including attorneys’ fees) incurred by former directors and officers

or other employees and agents may be so paid upon such terms and conditions, if any, as the corporation deems appropriate. The indemnification

and advancement of expenses provided by, or granted pursuant to, Section 145 shall not be deemed exclusive of any other rights to which

those seeking indemnification or advancement of expenses may be entitled under any bylaw, agreement, vote of shareholders or disinterested

directors or otherwise, both as to action in such person’s official capacity and as to action in another capacity while holding

such office. We have entered into Indemnification Agreements with each director and executive officer.

Section

145 of the DGCL also empowers a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer,

employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent

of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and

incurred by such person in any such capacity, or arising out of such person’s status as such, whether or not the corporation would

have the power to indemnify such person against such liability under Section 145.

Article

11 of Cocrystal’s Certificate of Incorporation provides that directors and officers of the Company, and any persons serving at

the request of the Company as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust

or other enterprise, including service with respect to employee benefit plans, shall be indemnified to the fullest extent permitted by

the DGCL.

Cocrystal

carries directors and officers liability coverages designed to insure its officers and directors and those of its subsidiaries against

certain liabilities incurred by them in the performance of their duties, and also providing for reimbursement in certain cases to Cocrystal

and its subsidiaries for sums paid to directors and officers as indemnification for similar liability.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 (the “Securities Act”) may be permitted to our

directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, Cocrystal has been advised that in the

opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Governing

Law and Forum Selection

Article

12 of Cocrystal’s Certificate of Incorporation provides that the internal affairs of the Company shall be governed by and interpreted

under the laws of the State of Delaware, excluding its conflict of laws principles, and that unless the Company consents in writing to

the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any

derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim of breach of a fiduciary duty owed

by any director or officer (or affiliate of any of the foregoing) of the Company to the Company or the Company’s shareholders,

(iii) any action asserting a claim arising pursuant to any provision of the DGCL or the Company’s Certificate of Incorporation

or Bylaws, or (iv) any other action asserting a claim arising under, in connection with, and governed by the internal affairs doctrine.

Article

12 of the Company’s Certificate of Incorporation has the effect of requiring parties bringing actions concerning the Company’s

internal affairs, including actions brought by the Company’s shareholders, to litigate such matters in the Delaware Court of Chancery,

to the extent such exclusive jurisdiction is permitted under applicable law. As such, shareholders of the Company seeking to bring a

claim regarding the internal affairs of the Company may be subject to increased costs associated with litigating in Delaware as opposed

to their home state or other forum, precluded from bringing such a claim in a forum they otherwise consider to be more favorable, and

discouraged from bringing such claims as a result of the foregoing or other factors related to forum selection.

Article

12 of the Company’s Certificate of Incorporation does not provide the Delaware Court of Chancery with jurisdiction over matters

for which federal courts have exclusive jurisdiction, such as suits brought to enforce any duty or liability created by the Exchange

Act or the rules and regulations promulgated thereunder. Based on a case brought against Facebook, Inc. and its directors in a federal

district court in California, the Company believes that Article 12 will effect a claim made under the DGCL that is combined with a claim

made under the Exchange Act by causing the DGCL claim and the Exchange Act claim to be separated between the courts having jurisdiction

over the respective claims. However, because the case in question was decided by a federal district court, its ruling is not binding

on any other courts, and we cannot assure you that other courts will rule the same way.

Additionally,

Section 22 of the Securities Act provides that state and federal courts have concurrent jurisdiction over claims to enforce any duty

or liability created by the Securities Act or the rules and regulations promulgated thereunder. As such, there is some uncertainty as

to the effect that Article 12 of our Certificate of Incorporation would have when a claim under the DGCL is combined with a claim under

the Securities Act, and in such a case Article 12 may cause the DGCL claim and the Securities Act claim to be separated between the courts

having jurisdiction over the respective claims, or alternatively it may cause the DGCL claim and the Securities Act claim to be consolidated

in the Delaware Court of Chancery.

Because

Article 12 of our Certificate of Incorporation may have the effect of severing certain causes of action between federal and state courts,

shareholders seeking to assert such claims face the risk of increased litigation expenses arising from litigating multiple related claims

in two separate courts, and shareholders may be discouraged from bringing all or some of these claims as a result. Notwithstanding the

foregoing, the Company’s shareholders will not be deemed to have waived the Company’s compliance obligations with respect

to the federal securities laws, including the Exchange Act and the Securities Act, or the rules and regulations promulgated thereunder.

PLAN

OF DISTRIBUTION

We

may sell the securities offered by this prospectus from time to time in one or more transactions, including without limitation:

|

●

|

through

underwriters or brokers;

|

|

|

|

|

●

|

directly

to purchasers;

|

|

|

|

|

●

|

in