Coronavirus Impact on NBCUniversal, Sky Weighs on Comcast--Update

July 30 2020 - 12:28PM

Dow Jones News

By Lillian Rizzo

Comcast Corp.'s second-quarter revenue fell 12% from a year

earlier, as the impact of the coronavirus on its NBCUniversal unit

-- which includes theme parks, a movie studio and

advertising-dependent TV networks -- more than offset the cable

giant's continued success in signing up broadband customers.

The Philadelphia-based company said revenue for the quarter

ended June 30 was $23.72 billion, down from $26.86 billion a year

earlier. Net profit was nearly $3 billion, or 65 cents a share,

down about 4% from $3.12 billion, or 68 cents. FactSet analysts

were expecting earnings per share of 55 cents in the latest

period..

Comcast shares were trading at $43.81, essentially flat,

Thursday morning.

NBCUniversal was hit hard by the coronavirus pandemic. The

unit's revenue fell 25% to $6.1 billion due to the closure of theme

parks, halted theatrical releases and a sharp decline in

advertising. The theme-park business suffered a 94% drop in

revenue. While its Orlando and Japan theme parks have been open

since June, the Hollywood location has yet to reopen. Advertising

revenue at NBCU's cable networks and broadcast-television units

fell by 27% and 28%, respectively.

Comcast's broadband business, on the other hand, had its best

second quarter on record with 323,000 new subscribers, a 54%

increase from last year's second quarter. The tally didn't include

more than 600,000 broadband customers that either signed up free or

weren't disconnected due to relief pledges put in place by the

Federal Communications Commission. While such pandemic-related

pledges were discontinued July 1, Comcast has said it doesn't plan

to disconnect customers without working with them first.

The company continued to lose cable-TV customers, with 477,000

people cutting the cord in the second quarter, compared with

224,000 a year earlier. This marked the 13th consecutive quarter of

pay-TV customer losses.

Pay-TV customers of Comcast and its peers continue to migrate to

streaming services such as Netflix Inc. and Walt Disney Co.'s

Disney+. Last week, AT&T Inc. said its DirecTV satellite

business lost 886,000 U.S. premium-TV subscribers, and another

68,000 online-only channel bundles.

Earlier this month, NBCUniversal launched Peacock, which has so

far signed up 10 million streaming customers. AT&T said last

week HBO Max's total activations since its May launch topped 4

million. Disney+ said in April it had more than 50 million global

subscribers, five months after its launch.

Comcast cable-TV and internet customers receive Peacock's

premium ad-supported tier free, and make up some of the 10 million

number.

"We are leaning into streaming," Chief Executive Brian Roberts

said during an earnings call Thursday, adding that Peacock has so

far exceeded expectations.

While Comcast said Peacock users have engaged in more streaming

and for longer periods than expected, the company said it was too

early to disclose the number of monthly active accounts or

users.

Unlike its streaming competitors, Peacock is a largely

ad-supported service, and includes a free tier with less content

than its $5-a-month premium tier with commercials.

Comcast Cable, which comprises the company's broadband, pay-TV,

landline and mobile businesses, had about $14.4 billion in revenue,

slightly down from last year's second quarter. Revenue was affected

by adjustments made for customer regional-sports-network fees, as

Comcast has said it would pass down any rebates to its

customers.

Comcast's newest business, Sky, which was acquired in 2018, also

suffered. Revenue for the European media business fell 16% to about

$4.1 billion, with its advertising revenue dropping 43%.

The company said Sky was able to keep nearly all of its

sports-package customers, who weren't charged during the months

that European soccer and other sports were put on hold.

On Tuesday, AMC Entertainment Holdings Inc. and Comcast's

Universal Pictures reached a deal that would allow movies to play

in theaters for much less time before moving to home video.

The agreement came after a public spat between the two companies

on how soon movies should be released to digital platforms for home

viewing. In April, Universal made "Trolls World Tour" available as

a $20 online rental, in what was considered a success.

On Thursday, NBCUniversal President Jeff Shell said he believes

this model will help draw consumers into movie theaters when it is

safe to return to them.

"Movie studios like ours don't want to release movies into

theaters when we only have a smattering of theaters open. We need a

pretty robust amount of theaters open to justify our spending," Mr.

Shell said. "But the flip side is, exhibitors can't open theaters

if they don't have any new movies."

Write to Lillian Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

July 30, 2020 12:13 ET (16:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

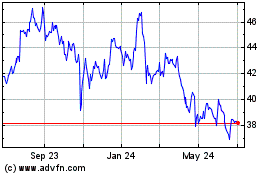

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

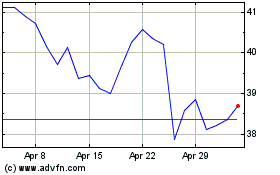

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024