Comcast Corporation (NASDAQ: CMCSA) today reported results for

the quarter ended June 30, 2020.

“Our response to COVID-19 has been extraordinarily fast and

effective, and our products and brands continue to resonate

strongly with our customers across all segments and all

geographies. The solid results that we delivered in the quarter

highlight the resilience of our company. Cable delivered record

second quarter customer relationship net adds, driven by the best

second quarter high-speed internet net adds in 13 years.

NBCUniversal successfully launched Peacock in Cable’s footprint in

April, ahead of the streaming service’s U.S. nationwide launch

earlier this month, with 10 million sign-ups to date. NBCUniversal

also just recently announced a deal with AMC Theatres in the U.S.

that allows Universal to release titles across PVOD platforms after

a 17-day exclusive theatrical window. At Sky, our flexible strategy

helped retain customers until key sports returned in May and June.

Overall, based on our results and the many organic growth

opportunities that we have across our company, I am confident in

our ability to continue to successfully navigate the impact of

COVID-19, and emerge from the crisis even stronger. I could not be

more proud of how our teams across Comcast Cable, NBCUniversal and

Sky are together managing the business," commented Brian L.

Roberts, Chairman and Chief Executive Officer of Comcast

Corporation.

($ in millions, except per share data)

2nd

Quarter

Year to

Date

Consolidated Results

2020

2019

Change

2020

2019

Change

Revenue

$23,715

$26,858

(11.7

%)

$50,324

$53,717

(6.3

%)

Net Income Attributable to Comcast

$2,988

$3,125

(4.4

%)

$5,135

$6,678

(23.1

%)

Adjusted Net Income1

$3,170

$3,610

(12.2

%)

$6,436

$7,087

(9.2

%)

Adjusted EBITDA2

$7,927

$8,716

(9.1

%)

$16,057

$17,269

(7.0

%)

Earnings per Share3

$0.65

$0.68

(4.4

%)

$1.11

$1.45

(23.4

%)

Adjusted Earnings per Share1

$0.69

$0.78

(11.5

%)

$1.40

$1.54

(9.1

%)

Net Cash Provided by Operating

Activities

$8,643

$7,040

22.8

%

$14,467

$14,271

1.4

%

Free Cash Flow4

$5,966

$4,246

40.5

%

$9,291

$8,838

5.1

%

For additional detail on segment revenue

and expenses, customer metrics, capital expenditures, and free cash

flow, please refer to the trending schedules on Comcast’s Investor

Relations website at www.cmcsa.com.

2nd Quarter 2020 Highlights:

- Generated Consolidated Adjusted EBITDA of $7.9 Billion,

Adjusted EPS of $0.69 and Free Cash Flow of $6.0 Billion

- Cable Communications Total Customer Relationships Increased by

217,000 in the Quarter, the Best Second Quarter Result on

Record

- Total High-Speed Internet Customer Net Additions Were 323,000

(Not Including Over 600,000 Additional High-Risk or Free Internet

Essentials Customers That Still Receive Our Service, But Were Not

Included in Reported Results), the Best Second Quarter Result in 13

Years

- Cable Communications Adjusted EBITDA Increased 5.5% Driven by

Strength in High-Speed Internet

- Cable Communications Extended Its Offer of 60 Days of Free

Internet Service to Eligible New Internet Essentials Customers and

Free Access to Public Xfinity WiFi Hotspots Through Year-End

- Successfully Launched Peacock, NBCUniversal's New Highly

Anticipated Streaming Service, Free to Xfinity X1 and Flex

Customers on April 15, Ahead of National Debut on July 15, With 10

Million Sign-Ups to Date

- NBCUniversal Re-Opened Universal Orlando Resort and Universal

Studios Japan After Temporary Closures Due to COVID-19

- Sky Successfully Retained 99% of Total Customers and 95% of

Sports Subscribers Since the Crisis Began

- Sky’s Key Sports Have Returned, Including Bundesliga in May and

the Premier League and Serie A in June

Consolidated Financial Results

Revenue for the second quarter of 2020 decreased 11.7% to

$23.7 billion. Net Income Attributable to Comcast decreased

4.4% to $3.0 billion. Adjusted Net Income decreased 12.2% to

$3.2 billion. Adjusted EBITDA decreased 9.1% to $7.9

billion.

For the six months ended June 30, 2020, revenue decreased 6.3%

to $50.3 billion compared to 2019. Net income attributable to

Comcast decreased 23.1% to $5.1 billion. Adjusted Net Income

decreased 9.2% to $6.4 billion. Adjusted EBITDA decreased 7.0% to

$16.1 billion.

Earnings per Share (EPS) for the second quarter of 2020

was $0.65, a decrease of 4.4% compared to the second quarter of

2019. Adjusted EPS decreased 11.5% to $0.69.

For the six months ended June 30, 2020, EPS was $1.11, a 23.4%

decrease compared to the prior year. Adjusted EPS decreased 9.1% to

$1.40.

Capital Expenditures decreased 8.3% to $2.1 billion in

the second quarter of 2020. Cable Communications’ capital

expenditures decreased 8.9% to $1.5 billion. NBCUniversal’s capital

expenditures decreased 20.9% to $375 million. Sky's capital

expenditures increased 22.1% to $215 million.

For the six months ended June 30, 2020, capital expenditures

decreased 9.2% to $4.0 billion compared to 2019. Cable

Communications' capital expenditures decreased 8.0% to $2.7

billion. NBCUniversal's capital expenditures decreased 18.8% to

$752 million. Sky's capital expenditures decreased 5.4% to $412

million.

Net Cash Provided by Operating Activities was $8.6

billion in the second quarter of 2020. Free Cash Flow was

$6.0 billion. These results reflect reduced tax payments in the

second quarter of 2020 due to the extension of due dates for

federal estimated tax payments to the third quarter of 2020.

For the six months ended June 30, 2020, net cash provided by

operating activities was $14.5 billion. Free cash flow was $9.3

billion. These results reflect reduced tax payments in the second

quarter of 2020 due to the extension of due dates for federal

estimated tax payments to the third quarter of 2020.

Dividends paid during the second quarter of 2020 totaled

$1.1 billion. For the six months ended June 30, 2020, dividends

paid totaled $2.0 billion.

Cable Communications

($ in millions)

2nd

Quarter

Year to

Date

2020

2019

Change

2020

2019

Change

Cable Communications Revenue

High-Speed Internet

$5,000

$4,663

7.2

%

$10,001

$9,240

8.2

%

Video

5,415

5,594

(3.2

%)

11,047

11,222

(1.6

%)

Voice

877

982

(10.7

%)

1,776

1,972

(9.9

%)

Wireless

326

244

33.9

%

669

469

42.6

%

Business Services

2,004

1,933

3.6

%

4,047

3,824

5.8

%

Advertising

428

607

(29.6

%)

985

1,163

(15.3

%)

Other

378

427

(11.0

%)

821

840

(2.1

%)

Cable Communications Revenue

$14,428

$14,450

(0.2

%)

$29,346

$28,730

2.1

%

Cable Communications Adjusted

EBITDA

$6,176

$5,854

5.5

%

$12,252

$11,582

5.8

%

Adjusted EBITDA Margin

42.8%

40.5%

41.7%

40.3%

Cable Communications Capital

Expenditures

$1,452

$1,594

(8.9

%)

$2,721

$2,957

(8.0

%)

Percent of Cable Communications

Revenue

10.1%

11.0%

9.3%

10.3%

Revenue for Cable Communications of $14.4 billion was

consistent with the prior year period, reflecting increases in

high-speed internet, wireless and business services revenue, offset

by decreases in video, advertising, voice and other revenue. These

results were negatively impacted by COVID-19, including accrued

customer regional sports network (RSN) fee adjustments, reduced

advertising revenue, lower revenue due to Xfinity's commitment to

the FCC's Keep Americans Connected Pledge and our efforts to assist

our customers during this crisis. High-speed internet revenue

increased 7.2%, reflecting an increase in the number of residential

high-speed internet customers and an increase in average rates.

Average rates would have been higher if it were not for waived fees

due to COVID-19 and the impacts of the customer RSN fee

adjustments. Wireless revenue increased 33.9%, primarily reflecting

an increase in the number of customer lines. Business services

revenue increased 3.6%, reflecting an increase in the number of

customers receiving our services compared to the prior year period

and increases in average rates. The rates of growth were reduced

due to the negative impacts of COVID-19 on small businesses. Video

revenue decreased 3.2%, reflecting a decrease in the number of

residential video customers, partially offset by an increase in

average rates. Average rates were negatively impacted by the

impacts of the customer RSN fee adjustments, partially offset by

higher pay-per-view revenue. Advertising revenue decreased 29.6%,

primarily reflecting reduced advertiser spending due to COVID-19,

partially offset by an increase in political advertising revenue.

Voice revenue decreased 10.7%, due to decreases in average rates

and in the number of residential voice customers. Other revenue

decreased 11.0%, reflecting lower revenue due to waived late fees

and a decline in revenue associated with our security and

automation services, partially offset by an increase in revenue

from licensing our X1 and technology platforms.

For the six months ended June 30, 2020, Cable revenue increased

2.1% to $29.3 billion compared to 2019, driven by growth in

high-speed internet, business services and wireless revenue,

partially offset by a decrease in voice, advertising, video and

other revenue. These results were negatively impacted by COVID-19,

including accrued customer RSN fee adjustments, reduced advertising

revenue, lower revenue due to Xfinity's commitment to the FCC's

Keep Americans Connected Pledge and our efforts to assist our

customers during this crisis.

Total Customer Relationships increased by 217,000 to 32.1

million in the second quarter of 2020. Residential customer

relationships increased by 241,000 and business customer

relationships decreased by 24,000. Total high-speed internet

customer net additions were 323,000, which does not include over

600,000 additional high-risk or free Internet Essentials customers

that still receive our service, but were not included in reported

results. Total video customer net losses were 477,000 and total

voice customer net losses were 158,000. In addition, Cable

Communications added 126,000 wireless lines in the quarter.

(in thousands)

Net

Additions

2Q20

2Q19

2Q20

2Q19

Customer Relationships

Residential Customer Relationships

29,750

28,508

241

123

Business Services Customer

Relationships

2,384

2,356

(24

)

29

Total Customer Relationships

32,134

30,864

217

152

Residential Customer Relationships

Mix

One Product Residential Customers

11,332

9,526

531

231

Two Product Residential Customers

8,742

8,952

(107

)

(57

)

Three or More Product Residential

Customers

9,676

10,030

(184

)

(50

)

Residential High-Speed Internet

Customers

27,220

25,631

340

182

Business Services High-Speed Internet

Customers

2,209

2,176

(17

)

28

Total High-Speed Internet

Customers

29,429

27,807

323

209

Residential Video Customers

19,473

20,642

(427

)

(209

)

Business Services Video Customers

894

999

(51

)

(15

)

Total Video Customers

20,367

21,641

(477

)

(224

)

Residential Voice Customers

9,698

10,008

(142

)

(82

)

Business Services Voice Customers

1,331

1,324

(16

)

17

Total Voice Customers

11,029

11,331

(158

)

(65

)

Total Wireless Lines

2,393

1,586

126

181

Adjusted EBITDA for Cable Communications increased 5.5%

to $6.2 billion in the second quarter of 2020, reflecting revenue

that was consistent with the prior year period as well as a 4.0%

decrease in operating expenses. Total operating expenses benefited

from adjustments for provisions in our programming distribution

agreements with RSNs related to canceled sporting events as a

result of COVID-19. Programming costs decreased 5.0%, primarily due

to the adjustment provisions. Excluding these adjustments,

programming costs increased due to higher retransmission consent

and sports programming fees, partially offset by a decline in the

number of video subscribers. Non-programming expenses decreased

3.4%, primarily reflecting lower advertising, marketing and

promotion expenses, other operating expenses and customer service

expenses, partially offset by higher technical and product support

expenses. Non-programming expenses per customer relationship

decreased 7.1%. Non-programming expenses included additional

compensation costs for certain personnel and increases in

administrative and bad debt expenses as a result of COVID-19, that

were more than offset by cost saving initiatives and a reduction in

activity in some aspects of our business. Adjusted EBITDA per

customer relationship increased 1.4%, and Adjusted EBITDA margin

was 42.8% compared to 40.5% in the second quarter of 2019. While

the accrued RSN adjustments did not impact Adjusted EBITDA in the

second quarter of 2020, they resulted in an increase to Adjusted

EBITDA margin. Cable Communications results include a loss of $37

million from our wireless business, compared to a loss of $88

million in the prior year period.

For the six months ended June 30, 2020, Cable Adjusted EBITDA

increased 5.8% to $12.3 billion compared to 2019, reflecting higher

revenue and flat expenses. Programming costs decreased 1.6%

primarily due to adjustments for provisions in our programming

distribution agreements with RSNs related to canceled sporting

events as a result of COVID-19. Excluding these adjustments,

programming costs increased due to an increase in retransmission

consent and sports programming fees, partially offset by a decline

in the number of video subscribers. Non-programming expenses

increased 0.5%, reflecting higher costs as a result of COVID-19,

partially offset by cost savings initiatives. For the six months

ended June 30, 2020, Adjusted EBITDA per customer relationship

increased 1.8%, and Adjusted EBITDA margin was 41.7% compared to

40.3% in 2019. While the accrued RSN adjustments did not impact

Adjusted EBITDA for the six months ended June 30, 2020, they

resulted in an increase to Adjusted EBITDA margin. Cable

Communications results include a loss of $96 million from our

wireless business, compared to a loss of $191 million in the prior

year period.

Capital Expenditures for Cable Communications decreased

8.9% to $1.5 billion in the second quarter of 2020, primarily

reflecting decreased investment in customer premise equipment,

partially offset by increased investment in scalable

infrastructure. Cable capital expenditures represented 10.1% of

Cable revenue in the second quarter of 2020 compared to 11.0% in

last year's second quarter.

For the six months ended June 30, 2020, Cable capital

expenditures decreased 8.0% to $2.7 billion, primarily reflecting

decreased investment in customer premise equipment, partially

offset by increased investment in scalable infrastructure. Cable

capital expenditures represented 9.3% of Cable revenue compared to

10.3% in 2019.

NBCUniversal

($ in millions)

2nd

Quarter

Year to

Date

2020

2019

Change

2020

2019

Change

NBCUniversal Revenue

Cable Networks

$2,515

$2,947

(14.7

%)

$5,374

$5,815

(7.6

%)

Broadcast Television

2,364

2,402

(1.6

%)

5,048

4,869

3.7

%

Filmed Entertainment

1,194

1,457

(18.1

%)

2,564

3,225

(20.5

%)

Theme Parks

87

1,464

(94.1

%)

956

2,740

(65.1

%)

Headquarters, other and eliminations

(36

)

(64

)

NM

(84

)

(130

)

NM

NBCUniversal Revenue

$6,124

$8,206

(25.4

%)

$13,858

$16,519

(16.1

%)

NBCUniversal Adjusted EBITDA

Cable Networks

$1,243

$1,201

3.5

%

$2,491

$2,463

1.1

%

Broadcast Television

641

534

20.0

%

1,142

921

24.0

%

Filmed Entertainment

228

183

24.8

%

334

547

(38.8

%)

Theme Parks

(399

)

590

(167.7

%)

(323

)

1,088

(129.7

%)

Headquarters, other and eliminations

(75

)

(184

)

NM

(259

)

(358

)

NM

NBCUniversal Adjusted EBITDA

$1,638

$2,324

(29.5

%)

$3,385

$4,661

(27.4

%)

Revenue for NBCUniversal decreased 25.4% to $6.1 billion

in the second quarter of 2020. Adjusted EBITDA decreased

29.5% to $1.6 billion.

For the six months ended June 30, 2020, NBCUniversal revenue

decreased 16.1% to $13.9 billion compared to last year's results.

Adjusted EBITDA decreased 27.4% to $3.4 billion.

Cable Networks Cable Networks revenue decreased 14.7% to

$2.5 billion in the second quarter of 2020, reflecting lower

distribution revenue and advertising revenue, partially offset by

higher content licensing and other revenue. Distribution revenue

decreased 14.8%, reflecting credits accrued at some of our RSNs

resulting from the reduced number of games planned by professional

sports leagues due to COVID-19 and a decline in subscribers,

partially offset by contractual rate increases. Advertising revenue

decreased 27.0%, due to reduced spending from advertisers as a

result of COVID-19, including from the postponement or cancellation

of sporting events, and continued ratings declines at our networks.

Content licensing and other revenue increased 23.1%, due to the

timing of content provided under licensing agreements, including

transactions with Peacock in the second quarter of 2020. Adjusted

EBITDA increased 3.5% to $1.2 billion in the second quarter of

2020, reflecting lower revenue that was more than offset by lower

operating costs. The decrease in operating costs was driven by

lower programming and production expenses, primarily reflecting the

postponement or cancellation of sporting events due to

COVID-19.

For the six months ended June 30, 2020, revenue from the Cable

Networks segment decreased 7.6% to $5.4 billion compared to 2019,

reflecting lower distribution and advertising revenue, partially

offset by higher content licensing and other revenue. Adjusted

EBITDA increased 1.1% to $2.5 billion compared to 2019, reflecting

lower revenue, more than offset by lower operating costs. The

decrease in operating costs was driven by lower programming and

production costs, primarily reflecting the postponement or

cancellation of sporting events due to COVID-19.

Broadcast Television Broadcast Television revenue

decreased 1.6% to $2.4 billion in the second quarter of 2020,

reflecting lower advertising revenue, partially offset by higher

content licensing revenue and distribution and other revenue.

Advertising revenue decreased 27.9%, due to reduced spending from

advertisers as a result of COVID-19, including from the

postponement or cancellation of sporting events, and continued

ratings declines. Content licensing revenue increased 58.5%,

primarily due to the timing of content provided under licensing

agreements, including transactions with Peacock in the second

quarter of 2020. Distribution and other revenue increased 9.2%,

primarily due to higher retransmission consent fees. Adjusted

EBITDA increased 20.0% to $641 million in the second quarter of

2020, reflecting lower revenue more than offset by lower operating

costs.

For the six months ended June 30, 2020, revenue from the

Broadcast Television segment increased 3.7% to $5.0 billion

compared to 2019, reflecting an increase in content licensing and

distribution and other revenue, partially offset by a decrease in

advertising revenue. Adjusted EBITDA increased 24.0% to $1.1

billion compared to 2019, reflecting higher revenue and lower

operating costs.

Filmed Entertainment Filmed Entertainment revenue

decreased 18.1% to $1.2 billion in the second quarter of 2020,

primarily reflecting lower theatrical revenue and other revenue,

partially offset by higher content licensing revenue. Theatrical

revenue decreased 96.8%, reflecting theater closures as a result of

COVID-19 and the strong performances of films in the prior year

period, including The Secret Life of Pets 2. Other revenue

decreased 59.6%, primarily due to decreases in revenue from our

movie ticketing, entertainment and live stage play businesses,

which were impacted by theater and entertainment venue closures as

a result of COVID-19. Content licensing revenue increased 19.5%,

driven by the performance of certain 2020 releases that were made

available on premium video on demand, including Trolls World Tour

and The King of Staten Island, as well as the timing of when

content was made available under licensing agreements, including

transactions with Peacock in the second quarter of 2020. Adjusted

EBITDA increased 24.8% to $228 million in the second quarter of

2020, reflecting lower revenue that was more than offset by lower

operating costs. The decrease in operating costs was primarily

driven by lower advertising, marketing and promotion expenses due

to lower spending on current period releases as a result of

COVID-19.

For the six months ended June 30, 2020, revenue from the Filmed

Entertainment segment decreased 20.5% to $2.6 billion compared to

2019, primarily reflecting lower theatrical revenue and other

revenue. Adjusted EBITDA decreased 38.8% to $334 million compared

to 2019, reflecting lower revenue, partially offset by lower

operating costs.

Theme Parks Theme Parks revenue decreased 94.1% to $87

million in the second quarter of 2020, primarily due to the

temporary closures of our theme parks as a result of COVID-19.

Universal Orlando Resort and Universal Studios Japan reopened with

limited capacity in June, while Universal Studios Hollywood remains

closed. Theme Parks Adjusted EBITDA loss was $399 million in the

second quarter of 2020, reflecting lower revenue, partially offset

by lower operating costs.

For the six months ended June 30, 2020, revenue from the Theme

Parks segment decreased 65.1% to $956 million compared to 2019,

primarily due to the temporary closures of Universal Studios Japan

in late February and Universal Orlando Resort and Universal Studios

Hollywood in mid-March as a result of COVID-19. Theme Parks

Adjusted EBITDA loss was $323 million, reflecting lower revenue,

partially offset by lower operating costs.

Headquarters, Other and Eliminations NBCUniversal

Headquarters, Other and Eliminations include overhead and

eliminations among the NBCUniversal businesses. For the quarter

ended June 30, 2020, NBCUniversal Headquarters, Other and

Eliminations Adjusted EBITDA loss was $75 million, compared to a

loss of $184 million in the second quarter of 2019.

For the six months ended June 30, 2020, NBCUniversal

Headquarters, Other and Eliminations Adjusted EBITDA loss was $259

million compared to a loss of $358 million in 2019.

Sky

($ in millions)

2nd

Quarter

Year to

Date

2020

2019

Change

Constant Currency Change5

2020

2019

Change

Constant Currency Change5

Sky Revenue

Direct-to-Consumer

$3,524

$3,889

(9.4

%)

(6.7

%)

$7,203

$7,723

(6.7

%)

(4.3

%)

Content

234

376

(37.7

%)

(35.7

%)

559

746

(25.1

%)

(23.3

%)

Advertising

321

563

(43.0

%)

(41.2

%)

834

1,156

(27.9

%)

(26.1

%)

Sky Revenue

$4,079

$4,828

(15.5

%)

(12.9

%)

$8,596

$9,625

(10.7

%)

(8.4

%)

Sky Operating Costs and

Expenses

$3,330

$4,056

(17.9

%)

(15.5

%)

$7,296

$8,190

(10.9

%)

(8.6

%)

Sky Adjusted EBITDA

$749

$772

(2.9

%)

0.2

%

$1,300

$1,435

(9.4

%)

(7.2

%)

Adjusted EBITDA Margin

18.4%

16.0%

15.1%

14.9%

Revenue for Sky decreased 15.5% to $4.1 billion in the

second quarter of 2020. Excluding the impact of currency, revenue

decreased 12.9%, driven by lower direct-to-consumer revenue,

advertising revenue and content revenue. Direct-to-consumer revenue

decreased 6.7% to $3.5 billion, primarily reflecting a decrease in

average revenue per customer relationship, driven by the impacts of

COVID-19, which resulted in lower sports subscription revenues, as

well as decreases in customers receiving our services. Advertising

revenue decreased 41.2% to $321 million, primarily due to overall

market weakness, which was worsened by COVID-19, as well as an

unfavorable impact from a change in legislation related to gambling

advertisements in the UK and Italy. Content revenue decreased 35.7%

to $234 million, due to lower revenue from sports programming as a

result of the postponement of sporting events due to COVID-19.

For the six months ended June 30, 2020, Sky revenue decreased

10.7% to $8.6 billion compared to 2019. Excluding the impact of

currency, revenue decreased 8.4%, reflecting lower

direct-to-consumer, advertising and content revenue.

Total Customer Relationships decreased by 214,000 to 23.7

million in the second quarter of 2020, reflecting the postponement

of sporting events and the suspension of certain sales channels due

to COVID-19.

(in thousands)

Customers

Net

Additions

2Q20

2Q19

2Q20

2Q19

Total Customer Relationships

23,716

24,016

(214

)

304

Adjusted EBITDA for Sky decreased 2.9% to $749 million in

the second quarter of 2020. Excluding the impact of currency,

Adjusted EBITDA was consistent with the prior year period,

reflecting lower revenue, offset by lower operating costs. The

decrease in operating costs was primarily driven by lower

programming and production costs reflecting the postponement of

sporting events due to COVID-19.

For the six months ended June 30, 2020, Sky Adjusted EBITDA

decreased 9.4% to $1.3 billion compared to 2019. Excluding the

impact of currency, Adjusted EBITDA decreased 7.2%.

Corporate, Other and Eliminations

Corporate and Other Corporate and Other primarily relates

to corporate operations, Comcast Spectacor and Peacock. Revenue for

the quarter ended June 30, 2020 was $46 million, a decrease of $10

million compared to 2019. Corporate and Other Adjusted EBITDA loss

was $506 million, an increase of $293 million compared to 2019, due

to certain costs incurred in the second quarter of 2020 in response

to COVID-19, including severance and restructuring charges related

to our NBCUniversal segments, which are presented in Corporate and

Other, and costs associated with Peacock.

For the six months ended June 30, 2020, Corporate and Other

revenue was $166 million, relatively flat compared to 2019.

Corporate and Other Adjusted EBITDA loss was $758 million, an

increase of $358 million compared to 2019, primarily driven by

severance and restructuring costs, and costs associated with

Peacock.

Eliminations Eliminations reflects the accounting for

transactions between Cable Communications, NBCUniversal, Sky and

Corporate and Other. Revenue eliminations for the quarter ended

June 30, 2020 were $962 million compared to $682 million in 2019,

and Adjusted EBITDA eliminations were $130 million compared to $21

million in 2019. The increases were primarily driven by the

licensing of content between our NBCUniversal segments and

Peacock.

For the six months ended June 30, 2020, revenue eliminations

were $1.6 billion compared to $1.3 billion in 2019, and Adjusted

EBITDA eliminations were $122 million compared to $9 million in

2019. The increases were primarily driven by the licensing of

content between our NBCUniversal segments and Peacock.

Notes:

- We define Adjusted Net Income and Adjusted EPS as net income

attributable to Comcast Corporation and diluted earnings per common

share attributable to Comcast Corporation shareholders,

respectively, adjusted to exclude the effects of the amortization

of acquisition-related intangible assets, investments that

investors may want to evaluate separately (such as based on fair

value) and the impact of certain events, gains, losses or other

charges that affect period-over-period comparisons. See Table 5 for

reconciliations of non-GAAP financial measures.

- We define Adjusted EBITDA as net income attributable to Comcast

Corporation before net income (loss) attributable to noncontrolling

interests and redeemable subsidiary preferred stock, income tax

expense, investment and other income (loss), net, interest expense,

depreciation and amortization expense, and other operating gains

and losses (such as impairment charges related to fixed and

intangible assets and gains or losses on the sale of long-lived

assets), if any. From time to time, we may exclude from Adjusted

EBITDA the impact of certain events, gains, losses or other charges

(such as significant legal settlements) that affect the

period-to-period comparability of our operating performance. See

Table 4 for reconciliation of non-GAAP financial measure.

- All earnings per share amounts are presented on a diluted

basis.

- We define Free Cash Flow as net cash provided by operating

activities (as stated in our Consolidated Statement of Cash Flows)

reduced by capital expenditures and cash paid for intangible

assets. From time to time, we may exclude from Free Cash Flow the

impact of certain cash receipts or payments (such as significant

legal settlements) that affect period-to-period comparability. Cash

payments for acquisitions and construction of real estate

properties and the construction of Universal Beijing Resort are

presented separately in our Consolidated Statement of Cash Flows

and are therefore excluded from capital expenditures for Free Cash

Flow. See Table 4 for reconciliation of non-GAAP financial

measure.

- Sky constant currency growth rates are calculated by comparing

the current period results to the comparative period results in the

prior year adjusted to reflect the average exchange rates from the

current year period rather than the actual exchange rates in effect

during the respective prior year periods. See Table 6 for

reconciliation of Sky's constant currency growth. All percentages

are calculated on whole numbers. Minor differences may exist due to

rounding.

Conference Call and Other Information Comcast Corporation

will host a conference call with the financial community today,

July 30, 2020 at 8:30 a.m. Eastern Time (ET). The conference call

and related materials will be broadcast live and posted on its

Investor Relations website at www.cmcsa.com. Those parties

interested in participating via telephone should dial (800)

263-8495 with the conference ID number 5765399. A replay of the

call will be available starting at 12:00 p.m. ET on July 30, 2020,

on the Investor Relations website or by telephone. To access the

telephone replay, which will be available until Thursday, August 6,

2020 at midnight ET, please dial (855) 859-2056 and enter the

conference ID number 5765399.

From time to time, we post information that may be of interest

to investors on our website at www.cmcsa.com and on our corporate

website, www.comcastcorporation.com. To automatically receive

Comcast financial news by email, please visit www.cmcsa.com and

subscribe to email alerts.

Caution Concerning Forward-Looking Statements This press

release contains forward-looking statements. Readers are cautioned

that such forward-looking statements involve risks and

uncertainties that could cause actual events or our actual results

to differ materially from those expressed in any such

forward-looking statements. Readers are directed to Comcast’s

periodic and other reports filed with the Securities and Exchange

Commission (SEC) for a description of such risks and uncertainties.

We undertake no obligation to update any forward-looking

statements.

Non-GAAP Financial Measures In this discussion, we

sometimes refer to financial measures that are not presented

according to generally accepted accounting principles in the U.S.

(GAAP). Certain of these measures are considered “non-GAAP

financial measures” under the SEC regulations; those rules require

the supplemental explanations and reconciliations that are in

Comcast’s Form 8-K (Quarterly Earnings Release) furnished to the

SEC.

About Comcast Corporation Comcast Corporation (Nasdaq:

CMCSA) is a global media and technology company with three primary

businesses: Comcast Cable, NBCUniversal, and Sky. Comcast Cable is

one of the United States’ largest high-speed internet, video, and

phone providers to residential customers under the Xfinity brand,

and also provides these services to businesses. It also provides

wireless and security and automation services to residential

customers under the Xfinity brand. NBCUniversal is global and

operates news, entertainment and sports cable networks, the NBC and

Telemundo broadcast networks, television production operations,

television station groups, Universal Pictures, and Universal Parks

and Resorts. Sky is one of Europe's leading media and entertainment

companies, connecting customers to a broad range of video content

through its pay television services. It also provides

communications services, including residential high-speed internet,

phone, and wireless services. Sky operates the Sky News broadcast

network and sports and entertainment networks, produces original

content, and has exclusive content rights. Visit

www.comcastcorporation.com for more information.

TABLE 1Condensed Consolidated Statement of Income

(Unaudited)

Three Months Ended

Six Months Ended

(in millions, except per share data)

June 30,

June 30,

2020

2019

2020

2019

Revenue

$23,715

$26,858

$50,324

$53,717

Costs and expenses

Programming and production

6,817

8,255

15,118

16,824

Other operating and administrative

7,646

8,086

15,900

15,986

Advertising, marketing and promotion

1,341

1,885

3,279

3,773

Depreciation

2,099

2,197

4,206

4,437

Amortization

1,165

1,079

2,322

2,159

19,068

21,502

40,825

43,179

Operating income

4,647

5,356

9,499

10,538

Interest expense

(1,112

)

(1,137

)

(2,324

)

(2,287

)

Investment and other income (loss),

net

Equity in net income (losses) of

investees, net

300

(202

)

(368

)

60

Realized and unrealized gains (losses) on

equity securities, net

5

194

(53

)

408

Other income (loss), net

115

(47

)

125

153

420

(55

)

(296

)

621

Income before income taxes

3,955

4,164

6,879

8,872

Income tax expense

(946

)

(961

)

(1,646

)

(2,037

)

Net income

3,009

3,203

5,233

6,835

Less: Net income (loss) attributable to

noncontrolling interests and redeemable subsidiary preferred

stock

21

78

98

157

Net income attributable to Comcast

Corporation

$2,988

$3,125

$5,135

$6,678

Diluted earnings per common share

attributable to Comcast Corporation shareholders

$0.65

$0.68

$1.11

$1.45

Diluted weighted-average number of common

shares

4,607

4,607

4,611

4,600

TABLE 2Consolidated Statement of Cash Flows (Unaudited)

Six Months Ended

(in millions)

June 30,

2020

2019

OPERATING ACTIVITIES

Net income

$5,233

$6,835

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

6,528

6,596

Share-based compensation

621

533

Noncash interest expense (income), net

352

168

Net (gain) loss on investment activity and

other

399

(367

)

Deferred income taxes

(84

)

466

Changes in operating assets and

liabilities, net of effects of acquisitions and divestitures:

Current and noncurrent receivables,

net

900

295

Film and television costs, net

573

970

Accounts payable and accrued expenses

related to trade creditors

(879

)

(815

)

Other operating assets and liabilities

824

(410

)

Net cash provided by operating

activities

14,467

14,271

INVESTING ACTIVITIES

Capital expenditures

(3,957

)

(4,355

)

Cash paid for intangible assets

(1,219

)

(1,078

)

Construction of Universal Beijing

Resort

(708

)

(450

)

Acquisitions, net of cash acquired

(198

)

(114

)

Proceeds from sales of businesses and

investments

2,042

150

Purchases of investments

(471

)

(1,605

)

Other

33

38

Net cash provided by (used in) investing

activities

(4,478

)

(7,414

)

FINANCING ACTIVITIES

Proceeds from (repayments of) short-term

borrowings, net

—

(801

)

Proceeds from borrowings

13,612

363

Repurchases and repayments of debt

(10,712

)

(4,156

)

Repurchases of common stock under employee

plans

(269

)

(350

)

Dividends paid

(2,028

)

(1,823

)

Other

(2,128

)

35

Net cash provided by (used in) financing

activities

(1,525

)

(6,732

)

Impact of foreign currency on cash, cash

equivalents and restricted cash

(77

)

(15

)

Increase (decrease) in cash, cash

equivalents and restricted cash

8,387

110

Cash, cash equivalents and restricted

cash, beginning of period

5,589

3,909

Cash, cash equivalents and restricted

cash, end of period

$13,976

$4,019

TABLE 3Condensed Consolidated Balance Sheet (Unaudited)

(in millions)

June 30, 2020

December 31, 2019

ASSETS

Current Assets

Cash and cash equivalents

$13,935

$5,500

Receivables, net

10,227

11,292

Programming rights

—

3,877

Other current assets

3,323

4,723

Total current assets

27,485

25,392

Film and television costs

12,213

8,933

Investments

6,845

6,989

Investment securing collateralized

obligation

533

694

Property and equipment, net

48,985

48,322

Goodwill

67,354

68,725

Franchise rights

59,365

59,365

Other intangible assets, net

34,186

36,128

Other noncurrent assets, net

9,012

8,866

$265,978

$263,414

LIABILITIES AND EQUITY

Current Liabilities

Accounts payable and accrued expenses

related to trade creditors

$10,426

$10,826

Accrued participations and residuals

1,800

1,730

Deferred revenue

2,403

2,768

Accrued expenses and other current

liabilities

9,770

10,516

Current portion of long-term debt

4,046

4,452

Total current liabilities

28,445

30,292

Long-term debt, less current portion

100,764

97,765

Collateralized obligation

5,167

5,166

Deferred income taxes

27,947

28,180

Other noncurrent liabilities

17,608

16,765

Redeemable noncontrolling interests and

redeemable subsidiary preferred stock

1,256

1,372

Equity

Comcast Corporation shareholders'

equity

83,614

82,726

Noncontrolling interests

1,177

1,148

Total equity

84,791

83,874

$265,978

$263,414

TABLE 4 Reconciliation from Net Income

Attributable to Comcast Corporation to Adjusted EBITDA

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions)

2020

2019

2020

2019

Net income attributable to Comcast

Corporation

$2,988

$3,125

$5,135

$6,678

Net income (loss) attributable to

noncontrolling interests and redeemable subsidiary preferred

stock

21

78

98

157

Income tax expense

946

961

1,646

2,037

Interest expense

1,112

1,137

2,324

2,287

Investment and other (income) loss,

net

(420

)

55

296

(621

)

Depreciation and amortization

3,264

3,276

6,528

6,596

Adjustments (1)

16

84

30

135

Adjusted EBITDA

$7,927

$8,716

$16,057

$17,269

Reconciliation from Net Cash Provided

by Operating Activities to Free Cash Flow (Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions)

2020

2019

2020

2019

Net cash provided by operating

activities

$8,643

$7,040

$14,467

$14,271

Capital expenditures

(2,076

)

(2,263

)

(3,957

)

(4,355

)

Cash paid for capitalized software and

other intangible assets

(601

)

(531

)

(1,219

)

(1,078

)

Total Free Cash Flow

$5,966

$4,246

$9,291

$8,838

Alternate Presentation of Free Cash

Flow (Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions)

2020

2019

2020

2019

Adjusted EBITDA

$7,927

$8,716

$16,057

$17,269

Capital expenditures

(2,076

)

(2,263

)

(3,957

)

(4,355

)

Cash paid for capitalized software and

other intangible assets

(601

)

(531

)

(1,219

)

(1,078

)

Cash interest expense

(945

)

(1,141

)

(1,936

)

(2,111

)

Cash taxes

(52

)

(1,445

)

(333

)

(1,634

)

Changes in operating assets and

liabilities

1,378

630

(15

)

95

Noncash share-based compensation

323

288

621

533

Other (2)

12

(8

)

73

119

Total Free Cash Flow

$5,966

$4,246

$9,291

$8,838

(1)

2nd quarter and year to date 2020 Adjusted

EBITDA exclude $16 million and $30 million of other operating and

administrative expense, respectively, related to the Sky

transaction. 2nd quarter and year to date 2019 Adjusted EBITDA

exclude $84 million and $135 million of other operating and

administrative expense, respectively, related to the Sky

transaction.

(2)

2nd quarter and year to date 2020 include

decreases of $16 million and $30 million of costs related to the

Sky transaction, respectively, as these amounts are excluded from

Adjusted EBITDA. 2nd quarter and year to date 2019 include

decreases of $84 million and $135 million of costs related to the

Sky transaction, respectively, as these amounts are excluded from

Adjusted EBITDA.

Note: Minor differences may exist due to

rounding.

TABLE 5 Reconciliations of Adjusted Net

Income and Adjusted EPS (Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

(in millions, except per share data)

$

EPS

$

EPS

$

EPS

$

EPS

Net income attributable to Comcast

Corporation and diluted earnings per share attributable to Comcast

Corporation shareholders

$2,988

$0.65

$3,125

$0.68

$5,135

$1.11

$6,678

$1.45

Change

(4.4

%)

(4.4

%)

(23.1

%)

(23.4

%)

Amortization of acquisition-related

intangible assets (1)

449

0.10

395

0.08

907

0.20

795

0.17

Investments (2)

(280)

(0.06)

(20)

—

264

0.06

(458)

(0.09

)

Items affecting period-over-period

comparability:

Loss on early redemption of debt (3)

—

—

—

—

106

0.02

—

—

Costs related to Sky transaction (4)

13

—

68

0.01

24

0.01

109

0.02

Purchase accounting adjustments (5)

—

—

—

—

—

—

39

0.01

Gains and losses related to businesses and

investments (6)

—

—

42

0.01

—

—

(76)

(0.02

)

Adjusted Net income and Adjusted

EPS

$3,170

$0.69

$3,610

$0.78

$6,436

$1.40

$7,087

$1.54

Change

(12.2

%)

(11.5

%)

(9.2

%)

(9.1

%)

(1)

Acquisition-related intangible assets are

recognized as a result of the application of Accounting Standards

Codification Topic 805, Business Combinations (such as customer

relationships), and their amortization is significantly affected by

the size and timing of our acquisitions. Amortization of intangible

assets not resulting from business combinations (such as software

and acquired intellectual property rights used in our theme parks)

is included in Adjusted Net Income and Adjusted EPS.

Three Months Ended June 30,

Six Months Ended June 30,

2020

2019

2020

2019

Amortization of acquisition-related

intangible assets before income taxes

$565

$499

$1,140

$1,003

Amortization of acquisition-related

intangible assets, net of tax

$449

$395

$907

$795

(2)

Adjustments for investments include

realized and unrealized (gains) losses on equity securities, net

(as stated in Table 1), as well as the equity in net (income)

losses of investees, net, for our investments in Atairos and Hulu

(following May 2019 transaction).

Three Months Ended June 30,

Six Months Ended June 30,

2020

2019

2020

2019

Realized and unrealized (gains) losses on equity

securities, net

($5

)

($194

)

$53

($408

)

Equity in net (income) losses of investees, net

(367

)

166

296

(208

)

Investments before income taxes

(372

)

(28

)

349

(616

)

Investments, net of tax

($280

)

($20

)

$264

($458

)

(3)

2020 year to date net income attributable

to Comcast Corporation includes $140 million of interest expense,

$106 million net of tax, resulting from the early redemption of

debt.

(4)

2nd quarter and year to date 2020 net

income attributable to Comcast Corporation includes $16 million and

$30 million of operating costs and expenses, $13 million and $24

million net of tax, respectively, related to the Sky transaction,

primarily relating to the replacement of share-based compensation

awards and costs related to integration activities. 2nd quarter and

year to date 2019 net income attributable to Comcast Corporation

includes $84 million and $135 million of operating costs and

expenses, $68 million and $109 million net of tax, respectively,

related to the Sky transaction, primarily relating to the

replacement of share-based compensation awards and costs related to

integration activities.

(5)

2019 year to date net income attributable

to Comcast Corporation includes $53 million of depreciation and

amortization expense, $39 million net of tax, related to the 4th

quarter 2018, as a result of adjustments to the purchase price

allocation of Sky, primarily related to intangible assets and

property and equipment.

(6)

2nd quarter 2019 net income attributable

to Comcast Corporation includes $56 million of other losses, $42

million net of tax, related to an impairment of an equity method

investment. 2019 year to date net income attributable to Comcast

Corporation also includes $159 million of other income, $118

million net of tax, related to our investment in Hulu.

Note: Minor differences may exist due to

rounding.

TABLE 6Reconciliation of Sky Constant Currency Growth

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions)

2020

2019(1)

Change

2020

2019(1)

Change

Direct-to-Consumer

$3,524

$3,774

(6.7

%)

$7,203

$7,525

(4.3

%)

Content

234

364

(35.7

%)

559

727

(23.3

%)

Advertising

321

547

(41.2

%)

834

1,127

(26.1

%)

Revenue

$4,079

$4,685

(12.9

%)

$8,596

$9,379

(8.4

%)

Operating costs and expenses

$3,330

$3,938

(15.5

%)

$7,296

$7,980

(8.6

%)

Adjusted EBITDA

$749

$747

0.2

%

$1,300

$1,399

(7.2

%)

(1)

2019 results for entities reporting in

currencies other than United States dollars are converted into

United States dollars using the average exchange rates from the

current period rather than the actual exchange rates in effect

during the respective periods.

Note: Minor differences may exist due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200730005461/en/

Investor Contacts: Marci Ryvicker (215) 286-4781 Jane

Kearns (215) 286-4794 Marc Kaplan (215) 286-6527 Press

Contacts: Jennifer Khoury (215) 286-7408 John Demming (215)

286-8011

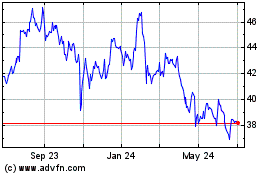

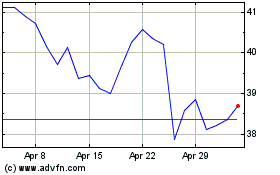

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024