Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 24 2020 - 5:18PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 433

Registration Statement Number 333-232941

March 24, 2020

COMCAST

CORPORATION

$800,000,000 3.100% NOTES DUE 2025

$800,000,000 3.300% NOTES DUE 2027

$1,600,000,000 3.400% NOTES DUE 2030

$800,000,000 3.750% NOTES DUE 2040

Final

Term Sheet

|

Issuer

|

Comcast Corporation (the “Company”)

|

|

Guarantors

|

Comcast Cable Communications, LLC and NBCUniversal Media, LLC

|

|

Issue of Securities

|

3.100% Notes due 2025

3.300% Notes due 2027

3.400% Notes due 2030

3.750% Notes due 2040

|

|

Denominations

|

$2,000 and multiples of $1,000 in excess thereof

|

|

Use of Proceeds

|

The Company intends to use the net proceeds from the offering for general corporate purposes.

|

|

Indenture

|

Indenture dated as of September 18, 2013 by and among the Company, the guarantors named

therein and The Bank of New York Mellon, as trustee (the “Trustee”), as amended by the First Supplemental

Indenture dated as of November 17, 2015 by and among the Company, the guarantors named therein and the Trustee.

|

|

Trustee

|

The Bank of New York Mellon

|

|

Expected Ratings1

|

Moody’s: A3; S&P: A-; Fitch: A-

|

|

Joint Book-Running Managers

|

BofA Securities, Inc.

Citigroup Global Markets

Inc.

J.P. Morgan Securities

LLC

Morgan Stanley &

Co. LLC

Wells Fargo Securities,

LLC

|

|

Trade Date

|

March 24, 2020

|

|

Settlement Date

|

March 27, 2020 (T+3)

|

|

Other

|

The impact of coronavirus disease 2019 (“COVID-19”) and measures to prevent

its spread are affecting the Company’s businesses in a number of ways. For example, the Company has closed all of its

theme parks; the Company has delayed theatrical

|

____________________

1 A securities

rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

|

|

distribution of films

both domestically and internationally; and the creation and availability of its film and television programming in the

United States and globally has been disrupted, including from the cancellation or postponement of sports events,

including the Olympics, and suspension of entertainment content production. As they affect Sky, these impacts

materially exacerbate what was an already deteriorating economic environment and advertising market in the UK and Europe

in 2019. The Comcast Cable business, while the network performs well to meet the challenge of business and schooling

from home, will not be unaffected either as economic stress impacts the Company’s residential and

business services customer base.

The Company expects that

the ultimate significance of the impact of COVID-19 on its businesses will vary but will generally depend on the extent

of governmental measures affecting day to day life and the length of time that such measures remain in place to respond

to COVID-19. At this point, it is impossible to predict such extent and duration and the degree to which supply and demand

for the Company’s products and services, including advertising, will be affected. This uncertainty makes it challenging

for the Company’s management to estimate the future performance of its businesses, particularly over the near to

medium term. However, the impact of COVID-19 could have a material adverse impact on the Company’s results of operations

over the near to medium term.

|

|

3.100% Notes Due 2025

|

|

|

Aggregate Principal Amount

|

$800,000,000

|

|

Maturity Date

|

April 1, 2025

|

|

Interest Rate

|

3.100% per annum, accruing from March 27, 2020 (calculated on the basis of a 360-day year

consisting of twelve 30-day months)

|

|

Interest Payment Dates

|

April 1 and October 1, commencing October 1, 2020

|

|

Benchmark Treasury

|

UST 1.125% due February 28, 2025

|

|

Benchmark Treasury Price/Yield

|

102-31+ / 0.511%

|

|

Spread to Benchmark Treasury

|

+260 bps

|

|

Yield to Maturity

|

3.111%

|

|

Optional Redemption

|

The 3.100% Notes due 2025 are redeemable at the option of the Company at any time, in whole

or in part, at the “Redemption Price.” The Redemption Price will equal, with respect to the 3.100% Notes

|

|

|

due 2025, at any time prior to March 1, 2025 (one (1) month prior to the maturity of the

3.100% Notes due 2025) (the “2025 Par Call Date”), the greater of (i) 100% of the principal amount of such

notes and (ii) the sum of the present values of the principal amount of such notes and the scheduled payments of interest

thereon (exclusive of interest accrued to the date of redemption) from the redemption date to the 2025 Par Call Date, in each

case discounted to the redemption date on a semiannual basis at the Treasury Rate plus 40 basis points, provided that, if

the 3.100% Notes due 2025 are redeemed on or after the 2025 Par Call Date, the Redemption Price will equal 100% of the principal

amount of such notes; plus, in each case, accrued and unpaid interest thereon to the date of redemption

|

|

Additional Issuances

|

An unlimited amount of additional 3.100% Notes due 2025 may be issued. The 3.100% Notes

due 2025 and any additional 3.100% Notes due 2025 that may be issued may be treated as a single series for all purposes under

the Indenture

|

|

CUSIP / ISIN

|

20030N DJ7 / US20030NDJ72

|

|

Public Offering Price

|

99.949% plus accrued interest, if any, from March 27, 2020

|

|

Underwriters’ Discount

|

0.250%

|

|

Net Proceeds to Comcast, Before Expenses

|

99.699% per $1,000 principal amount of 3.100% Notes due 2025; $797,592,000 total

|

|

3.300% Notes Due 2027

|

|

|

Aggregate Principal Amount

|

$800,000,000

|

|

Maturity Date

|

April 1, 2027

|

|

Interest Rate

|

3.300% per annum, accruing from March 27, 2020 (calculated on the basis of a 360-day year

consisting of twelve 30-day months)

|

|

Interest Payment Dates

|

April 1 and October 1, commencing October 1, 2020

|

|

Benchmark Treasury

|

UST 1.125% due February 28, 2027

|

|

Benchmark Treasury Price/Yield

|

102-18+ / 0.743%

|

|

Spread to Benchmark Treasury

|

+260 bps

|

|

Yield to Maturity

|

3.343%

|

|

Optional Redemption

|

The 3.300% Notes due 2027 are redeemable at the option of the Company at any time, in whole

or in part, at the “Redemption Price.” The Redemption Price will equal, with respect to the 3.300% Notes

due 2027, at any time prior to February 1, 2027 (two

|

|

|

(2) months prior to the maturity of the 3.300% Notes due 2027) (the “2027 Par Call

Date”), the greater of (i) 100% of the principal amount of such notes and (ii) the sum of the present values of

the principal amount of such notes and the scheduled payments of interest thereon (exclusive of interest accrued to the date

of redemption) from the redemption date to the 2027 Par Call Date, in each case discounted to the redemption date on a semiannual

basis at the Treasury Rate plus 40 basis points, provided that, if the 3.300% Notes due 2027 are redeemed on or after the

2027 Par Call Date, the Redemption Price will equal 100% of the principal amount of such notes; plus, in each case, accrued

and unpaid interest thereon to the date of redemption

|

|

Additional Issuances

|

An unlimited amount of additional 3.300% Notes due 2027 may be issued. The 3.300% Notes

due 2027 and any additional 3.300% Notes due 2027 that may be issued may be treated as a single series for all purposes under

the Indenture

|

|

CUSIP / ISIN

|

20030N DK4 / US20030NDK46

|

|

Public Offering Price

|

99.733% plus accrued interest, if any, from March 27, 2020

|

|

Underwriters’ Discount

|

0.350%

|

|

Net Proceeds to Comcast, Before Expenses

|

99.383% per $1,000 principal amount of 3.300% Notes due 2027; $795,064,000 total

|

|

3.400% Notes due 2030

|

|

|

Aggregate Principal Amount

|

$1,600,000,000

|

|

Maturity Date

|

April 1, 2030

|

|

Interest Rate

|

3.400% per annum, accruing from March 27, 2020 (calculated on the basis of a 360-day year

consisting of twelve 30-day months)

|

|

Interest Payment Dates

|

April 1 and October 1, commencing October 1, 2020

|

|

Benchmark Treasury

|

UST 1.500% due February 15, 2030

|

|

Benchmark Treasury Price/Yield

|

106-14 / 0.821%

|

|

Spread to Benchmark Treasury

|

+260 bps

|

|

Yield to Maturity

|

3.421%

|

|

Optional Redemption

|

The 3.400% Notes due 2030 are redeemable at the option of the Company at any time, in whole

or in part, at the “Redemption Price.” The Redemption Price will equal, with respect to the 3.400% Notes

due 2030, at any time prior to January 1, 2030 (three (3) months prior to the maturity of the 3.400% Notes

|

|

|

due 2030) (the “2030 Par Call Date”), the greater of (i) 100% of the

principal amount of such notes and (ii) the sum of the present values of the principal amount of such notes and the scheduled

payments of interest thereon (exclusive of interest accrued to the date of redemption) from the redemption date to the 2030

Par Call Date, in each case discounted to the redemption date on a semiannual basis at the Treasury Rate plus 40 basis points,

provided that, if the 3.400% Notes due 2030 are redeemed on or after the 2030 Par Call Date, the Redemption Price will equal

100% of the principal amount of such notes; plus, in each case, accrued and unpaid interest thereon to the date of redemption

|

|

Additional Issuances

|

An unlimited amount of additional 3.400% Notes due 2030 may be issued. The 3.400% Notes

due 2030 and any additional 3.400% Notes due 2030 that may be issued may be treated as a single series for all purposes under

the Indenture

|

|

CUSIP / ISIN

|

20030N DG3 / US20030NDG34

|

|

Public Offering Price

|

99.823% plus accrued interest, if any, from March 27, 2020

|

|

Underwriters’ Discount

|

0.400%

|

|

Net Proceeds to Comcast, Before Expenses

|

99.423% per $1,000 principal amount of 3.400% Notes due 2030; $1,590,768,000 total

|

|

3.750% Notes due 2040

|

|

|

Aggregate Principal Amount

|

$800,000,000

|

|

Maturity Date

|

April 1, 2040

|

|

Interest Rate

|

3.750% per annum, accruing from March 27, 2020 (calculated on the basis of a 360-day year

consisting of twelve 30-day months)

|

|

Interest Payment Dates

|

April 1 and October 1, commencing October 1, 2020

|

|

Benchmark Treasury

|

UST 2.375% due November 15, 2049

|

|

Benchmark Treasury Price/Yield

|

123-28 / 1.389%

|

|

Spread to Benchmark Treasury

|

+240 bps

|

|

Yield to Maturity

|

3.789%

|

|

Optional Redemption

|

The 3.750% Notes due 2040 are redeemable at the option of the Company at any time, in whole

or in part, at the “Redemption Price.” The Redemption Price will equal, with respect to the 3.750% Notes

due 2040, at any time prior to October 1, 2039 (six (6) months prior to the maturity of the 3.750% Notes due 2040) (the “2040

Par Call Date”), the greater of

|

|

|

(i) 100% of the principal amount of such notes and (ii) the sum of the present values of

the principal amount of such notes and the scheduled payments of interest thereon (exclusive of interest accrued to the date

of redemption) from the redemption date to the 2040 Par Call Date, in each case discounted to the redemption date on a semiannual

basis at the Treasury Rate plus 40 basis points, provided that, if the 3.750% Notes due 2040 are redeemed on or after the

2040 Par Call Date, the Redemption Price will equal 100% of the principal amount of such notes; plus, in each case, accrued

and unpaid interest thereon to the date of redemption

|

|

Additional Issuances

|

An unlimited amount of additional 3.750% Notes due 2040 may be issued. The 3.750% Notes

due 2040 and any additional 3.750% Notes due 2040 that may be issued may be treated as a single series for all purposes under

the Indenture

|

|

CUSIP / ISIN

|

20030N DH1 / US20030NDH17

|

|

Public Offering Price

|

99.456% plus accrued interest, if any, from March 27, 2020

|

|

Underwriters’ Discount

|

0.600%

|

|

Net Proceeds to Comcast, Before Expenses

|

98.856% per $1,000 principal amount of 3.750% Notes due 2040; $790,848,000 total

|

It is expected

that delivery of the notes will be made against payment therefor on or about March 27, 2020, which is the third business day following

the date hereof (such settlement cycle being referred to as “T+3”). Under Rule 15c6-1 under the Securities Exchange

Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days unless the parties

to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the second business

day prior to the settlement date will be required, by virtue of the fact that the notes initially will settle in T+3, to specify

an alternative settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors.

The issuer

has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates.

Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with

the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR

on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any

dealer participating in the offering will arrange to send you the prospectus if you request it by calling BofA Securities, Inc.

at 800-294-1322, Citigroup Global Markets Inc. at 800-831-9146, J.P. Morgan Securities LLC at 212-834-4533, Morgan Stanley &

Co. LLC at 866-718-1649 or Wells Fargo Securities, LLC at 800-645-3751.

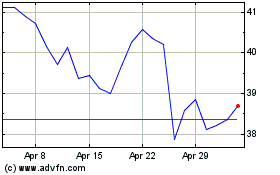

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

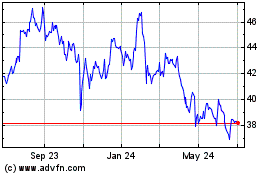

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024