Universal Makes Movies Now Playing in Theaters Available for Digital Rental -- 2nd Update

March 16 2020 - 7:46PM

Dow Jones News

By R.T. Watson

Comcast Corp.'s Universal Pictures said it is making its movies

available to watch at home while they are still in theaters, a

massive change from Hollywood's long-established business model

that could upend the industry if other studios follow suit.

The decision comes amid widespread closures of movie theaters as

the global coronavirus pandemic spreads. Authorities in New York

City and Los Angeles on Sunday ordered all movie theaters to close;

exhibitors had previously said they would limit attendance in

theaters to 50% of their capacity. China, the world's

second-largest market, has kept tens of thousands of theaters

closed since late January.

One of the nation's largest theater chains, Cineworld Group

PLC's Regal Entertainment Group, said Monday that it is temporarily

closing all of its 542 U.S. locations.

Major studios typically release new movies exclusively in

theaters during a window of 75 days in a bid to maintain ticket

sales, on the theory that fans are more likely to watch a new movie

at home if that is an option.

Keeping that strategy in place has long been a priority for

theaters, and major studios generally have been reluctant to do

away with such windows altogether, even as the lengths of those

periods have steadily shortened over the years.

Universal said that by Friday, recently released films like "The

Invisible Man," "The Hunt" and "Emma" will be available for digital

rental for $19.99 in the U.S., or the equivalent value in overseas

markets. Paying the rental fee will allow customers 48 hours to

watch the movie.

In an even bolder move, Universal also said "Trolls World Tour"

will open simultaneously in theaters and at home on April 10.

Universal released "The Hunt" in theaters over the weekend while

"The Invisible Man" and "Emma" both came out late last month.

Costing just $7 million to make, "The Invisible Man" has already

had a successful run in theaters, grossing $122.4 million globally

in three weekends.

"Rather than delaying these films or releasing them into a

challenged distribution landscape, we wanted to provide an option

for people to view these titles in the home," said NBCUniversal

Chief Executive Jeff Shell, who has long said he thinks theatrical

windows would continue to shrink under pressure from consumers.

"We hope and believe that people will still go to the movies in

theaters where available, but we understand that for people in

different areas of the world, that is increasingly becoming less

possible," he said.

Comcast's cable-television system also offers movies for rent

through on-demand video. The company is also launching its own

streaming service, called Peacock, in April. Universal didn't say

when these movies would move from on-demand to the new service.

Universal isn't the only studio rattling the market with

precipitous moves. On Friday, Walt Disney Co. said it was adding

"Frozen 2" to its Disney+ streaming platform three months ahead of

schedule, a move that could create a drag on DVD and online sales

and rentals.

Hollywood has discussed for years the possibility of shortening

the window, which prevented studios from releasing movies on DVD or

online until a certain period had passed. Theaters have resisted

such a move, though, seeing windows as key to their business model.

A reduced window might cause more people to simply wait until

titles are made available online rather than going to the

theater.

At least as far back as 2018, executives at Universal and

AT&T Inc.'s Warner Bros. film studio were considering making

movies available to on-demand digital entertainment platforms 17

days after they premiered in theaters, The Wall Street Journal

previously reported.

Prospective prices ranged from $30 to $50. The studios even

offered to share the video-on-demand revenue with theaters.

For Universal, coordinating Monday's move could have been

legally tricky, risking an antitrust-law violation.

Long before people were facing extended periods at home under

self-quarantine in an effort to combat the spread of the new

coronavirus, Hollywood studios have suffered financially, as large

franchise films -- like Disney's Marvel and Star Wars titles --

tend to be the most reliable box-office performers.

As a result, streaming-subscription platforms like those offered

by Netflix Inc. and Amazon.com Inc. have started to produce

smaller-budget films, like adult dramas and comedies, which are

less likely to draw massive crowds to theaters.

While in recent years theatrical ticket sales in the U.S. and

Canada have posted some record years, much of the growth has been

created by rising ticket prices as attendance plateaus. Disney has

also attained an unprecedented level of dominance, capturing about

a third of the market on the back of its Marvel, Star Wars and

Pixar movies.

Meanwhile, robust growth in international streaming revenues

powered global entertainment spending beyond $100 billion for the

first time in 2019, according to data released by the Motion

Picture Association.

(END) Dow Jones Newswires

March 16, 2020 19:31 ET (23:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

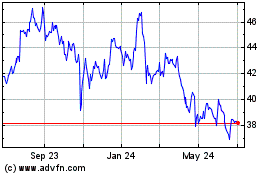

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

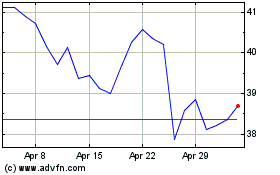

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024