ESPN, TNT Face Lost Revenue After NBA Suspends Season Over Coronavirus

March 12 2020 - 2:03PM

Dow Jones News

By Benjamin Mullin and Lillian Rizzo

The National Basketball Association's suspension of its season

over the coronavirus will have major fallout for its TV partners,

hitting their advertising revenue and potentially leaving them on

the hook for big rights-fees payments, according to analysts and

people familiar with the NBA's rights deals.

Walt Disney Co.'s ESPN and AT&T Inc.'s Turner, the parent of

TNT, together spend about $2.7 billion annually to show games

nationally. In addition, regional sports networks owned by media

giants such as Comcast Corp. and Sinclair Broadcast Group Inc.,

among others, air NBA games in local markets.

Losing NBA games will leave a major hole in the TV networks'

prime-time schedules, translating into lower ratings that will harm

their ad sales -- especially if the season doesn't resume for the

playoffs that normally begin in April, analysts said.

In the last NBA season, TV networks brought in nearly $600

million in ad revenue from NBA games and $972 million from the

playoffs, according to research firm Kantar.

Networks' other major stream of revenue -- from the

channel-carriage fees paid by cable-TV distributors -- also could

be impacted. Distributors require some TV programmers to air a

minimum number of games; if they don't, the carriage fees could be

cut, according to a report by Rich Greenfield, an analyst for

LightShed Partners. Since most of the TV season is complete, he

said, many TV programmers may have met the quota for telecasts.

As networks assess the possible damage, a major variable ais how

soon the league can resume play. If it can do so relatively

quickly, the worst business impact could be avoided, people close

to the networks say.

Mark Cuban, owner of the Dallas Mavericks and a streaming-video

entrepreneur, called the suspension of the NBA games due to the

coronavirus a "black swan event," adding that the league and its

partners are "in new territory."

"In terms of impact on media, it really depends on how the virus

plays out," Mr. Cuban said in an email. "The NBA and major media

companies will have to focus on the health and safety of their

employees and stakeholders. That will drive all

decision-making."

The NBA's suspension could have wider implications for the pay

television industry. Cable and satellite TV providers have lost

millions of subscribers to cord-cutting over the past several

years.

Live sports has been one of the major selling points of the

traditional TV bundle. The NBA's suspension could potentially

accelerate pay-TV cancellations, said Michael Nathanson, an analyst

for MoffettNathanson.

"We worry about seasonal churn," Mr. Nathanson said. "We think

sports is the glue for subscribers."

It's unclear whether the networks will be required to pay rights

fees for the full NBA season even though they aren't airing games.

Some media executives likened the season's suspension to the

1998-1999 NBA season, which was shortened due to a lockout. That

year, networks still paid rights fees.

Media contracts, including sports-rights deals, often include

exit clauses for both sides for catastrophic events, but it isn't

certain that those would apply in this case. The league could work

with TV networks to help them mitigate any losses from advertising

and distribution partners, including by letting them air more NBA

games in subsequent seasons, the people familiar with the NBA

rights deals said.

"This is an unprecedented situation," ESPN said in a statement.

"We have great relationships with our league partners and are

confident we can address all issues constructively going forward.

Our immediate focus is on everyone's safety and well-being."

A Turner Sports spokesman said the company is supportive of the

NBA's decision to "protect the health and well-being of everyone

involved." Turner's networks also air the NCAA basketball

tournament, which as of Thursday morning was planning to go ahead

without fans in stadiums.

Sinclair, which owns more than 20 regional sports networks,

including many that air NBA games, anticipates scenarios such as

this in its TV-rights agreements, said Jeff Krolik, president of

Sinclair's local sports unit. The company will continue to monitor

the situation and hold discussions with the league, teams and

pay-TV providers, he said.

David Levy, the former head of Turner Sports who struck the

unit's multibillion-dollar deal with the NBA, said that major

networks' first business priority should be preserving their

long-term relationships with leagues by supporting their decision

to protect their players.

"I wouldn't be thinking about profits and revenues at this

moment," Mr. Levy said. "I would be thinking about our employees

and our country."

(END) Dow Jones Newswires

March 12, 2020 13:48 ET (17:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

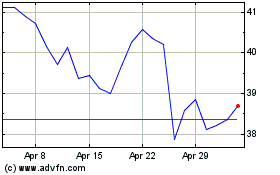

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

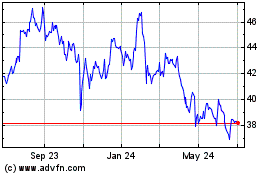

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024