Cambium Networks Corporation (“Cambium Networks”) (NASDAQ: CMBM), a

leading provider of wireless broadband networking infrastructure

solutions, today announced financial results for the third quarter

ended September 30, 2019.

| |

GAAP |

|

Non-GAAP (1) |

| (in millions, except

percentages) |

Q3 2019 |

|

Q2 2019 |

|

Q3 2018 |

|

Q3 2019 |

|

Q2 2019 |

|

Q3 2018 |

|

Revenues |

$ |

65.7 |

|

|

$ |

69.2 |

|

|

$ |

59.0 |

|

|

$ |

65.7 |

|

|

$ |

69.2 |

|

|

$ |

59.0 |

|

| Gross margin |

|

48.4 |

% |

|

|

49.6 |

% |

|

|

46.6 |

% |

|

|

48.7 |

% |

|

|

50.1 |

% |

|

|

46.8 |

% |

| Operating margin |

|

6.3 |

% |

|

|

(13.6 |

)% |

|

|

(1.8 |

)% |

|

|

8.8 |

% |

|

|

10.3 |

% |

|

|

0.4 |

% |

| Adjusted EBITDA margin |

|

|

|

|

|

|

|

10.3 |

% |

|

|

11.8 |

% |

|

|

2.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[1] Refer to Supplemental Financial Information accompanying

this press release for a reconciliation of GAAP to non-GAAP numbers

and for reconciliation of adjusted EBITDA for the third quarter of

2019.

“We are pleased that our profitability remained strong as a

result of improved operating efficiencies and tighter cost

controls,” said Atul Bhatnagar, president and CEO. “Our revenues

grew 11% year-over-year during the third quarter, our twenty-second

consecutive quarter of year-over-year growth, although slower than

anticipated, as a result of softer government spending for our

Point-to-Point products.”

Bhatnagar continued, “Cambium Networks continues to broaden our

technology portfolio and remains well positioned for growth as a

leader in fixed wireless broadband infrastructure and cloud powered

enterprise Wi-Fi solutions. We will continue to capitalize on the

strength of our technologies, while focusing on improving

profitability through cost reduction initiatives and disciplined

discretionary spending.”

Revenues of $65.7 million for the third quarter 2019 increased

$6.7 million year-over-year, as a result of growth in both

Point-to-Multi-Point and Wi-Fi businesses. Revenues for the third

quarter 2019 decreased $3.4 million compared to $69.2 million for

the second quarter 2019, driven by slower government spending

partially offset by growth in enterprise Wi-Fi solutions. GAAP

gross margin for the third quarter 2019 was 48.4%, compared to

46.6% for the third quarter 2018, and 49.6% for the second quarter

2019. GAAP operating income for the third quarter 2019 was $4.1

million, compared to operating loss of $1.1 million during the

third quarter 2018, and GAAP operating loss for the second quarter

2019 of $9.4 million, which included a $16.1 million charge for

share-based compensation expense. GAAP net income for the third

quarter 2019 was $2.0 million, or net income of $0.08 per diluted

share, compared to a net loss of $2.6 million, or a net loss of

$0.19 per diluted share for the third quarter 2018, and a net loss

of $20.4 million, or a net loss of $1.47 per diluted share for the

second quarter 2019.

Non-GAAP gross margin for the third quarter 2019 was 48.7%,

compared to 46.8% for the third quarter 2018, and 50.1% for the

second quarter 2019. Non-GAAP operating income for the third

quarter 2019 was $5.8 million, compared to $0.2 million for the

third quarter 2018, and $7.1 million for the second quarter 2019.

Non-GAAP net income for the third quarter 2019 was $3.7 million, or

$0.15 per diluted share, compared to non-GAAP net loss of $1.5

million, or a net loss of $0.11 per diluted share for the third

quarter 2018, and non-GAAP net income of $3.9 million, or $0.15 per

diluted share, for the second quarter 2019.

For the third quarter 2019, adjusted EBITDA was $6.8 million or

10.3% of revenues, compared to adjusted EBITDA of $1.5 million or

2.5% of revenues for the third quarter 2018, and $8.1 million, or

11.8% of revenues for the second quarter 2019.

Cash used in operating activities was $11.8 million for the

third quarter 2019, due primarily to the timing of payments related

to the Initial Public Offering (IPO), and compared to cash provided

by operating activities of $3.2 million for the third quarter 2018,

and $6.0 million for the second quarter 2019. Cash totaled $19.0

million as of September 30, 2019, $14.8 million higher than the

third quarter 2018, and a decrease of $52.3 million from the second

quarter 2019. The decrease in cash balance for the third quarter

2019 from the second quarter 2019 was primarily the result of a

$33.2 million paydown of long-term and revolving debt, payments of

approximately $6.0 million for offering expenses and D&O

insurance, a $5.6 million past management fee, a $5.0 million

increase in inventories, and a $2.0 million payment to acquire the

Xirrus Wi-Fi business.

Third Quarter 2019 Highlights

- Revenues of $65.7 million increased 11% year-over-year.

- GAAP gross margin of 48.4%, up 180 basis points from 46.6% for

the third quarter 2018, and down 120 basis points compared to 49.6%

for the second quarter 2019.

- Non-GAAP gross margin of 48.7%, up 190 basis points from 46.8%

for the third quarter 2018, and down 140 basis points

compared to 50.1% for the second quarter 2019.

- GAAP net income of $2.0 million or $0.08 per diluted share,

non-GAAP net income $3.7 million or $0.15 per diluted share.

- Adjusted EBITDA of $6.8 million or 10.3% of revenues, compared

to $1.5 million or 2.5% of revenues for the third quarter 2018, and

$8.1 million or 11.8% of revenues for the second quarter 2019.

- Increased new channel partners by over 1,450 year-over-year, an

increase of 29%.

- Announced new cloud managed cnPilot indoor and outdoor Wi-Fi

solutions (cnPilot e505, cnPilot e510 and cnPilot e425H).

- Announced Citizens Broadband Radio Service (CBRS) wireless

broadband connectivity solution on the PMP 450 product line.

Demonstrated CBRS capabilities with Initial Commercial Deployment

(ICD) with four network operators, utilizing both Federated

Wireless and Google for spectrum access system (SAS) services in

September 2019.

- Inaugural inclusion in both the 2019 Gartner Magic Quadrant for

the Wired and Wireless LAN Access Infrastructure and the 2019

Forrester New Wave report for wireless solutions.

- Awarded manufacturer of the year for 2019 as voted by the

members of the North America Wireless Internet Service Providers

Association (WISPA).

Fourth Quarter 2019 Financial OutlookTaking

into account the company’s current visibility, and incorporating

the acquisition of Xirrus (excluding any one-time charges affecting

the acquisition), the financial outlook as of November 7, 2019 for

the fourth quarter ending December 31, 2019 is expected to be as

follows:

- GAAP revenues between $63.0-$66.0 million

- GAAP gross margin between 48.0%-49.4%; and non-GAAP gross

margin between 48.2%-49.5%

- GAAP operating income between $1.2-$2.4 million; and non-GAAP

operating income between $2.4-$3.6 million

- GAAP (net loss)/net income between ($1.0)-$0.0 million or

between ($0.04) and $0.00 per diluted share; and non-GAAP net

income between $0.8-$1.7 million or between $0.03 and $0.07 per

diluted share

- Adjusted EBITDA between $3.4-$4.5 million; and adjusted EBITDA

margin between 5.3%-6.9%

- GAAP taxes between 19.0%-21.0%; and a non-GAAP effective tax

rate of approximately 17.0%-19.0%

- Approximately 25.6 million weighted average diluted shares

outstanding

Cash requirements are expected to be as

follows:

- Paydown of debt: $2.4 million

- Interest expense: approximately $1.4 million

- Capital expenditures: $1.0-$1.1 million

Cambium Networks financial outlook does not include the

potential impact of any possible future financial transactions,

pending legal matters, or other transactions. Accordingly,

Cambium Networks only includes such items in the company’s

financial outlook to the extent they are reasonably certain;

however, actual results may differ materially from the outlook.

Conference Call and Webcast

Cambium Networks will host a live webcast and conference call to

discuss its financial results at 4:30 p.m. ET today, November 7,

2019. To access the live conference call by phone, listeners should

dial +1-877-288-4394 in the U.S. or Canada and +1-470-495-9483 for

international callers. To join the live webcast and view additional

materials, listeners should access the investor page of Cambium

Networks website at https://investors.cambiumnetworks.com/.

Following the live webcast, a replay will be available on the

investor page of Cambium Networks website for a period of one year.

A replay of the conference call will be available for 48 hours soon

after the call by phone by dialing +1-855-859-2056 in the U.S. or

Canada and +1-404-537-3406 for international callers, using the

conference access code: 5478019.

In addition, on Tuesday November 12, 2019 at 3:40 p.m. ET,

Cambium Networks president and CEO, Atul Bhatnagar, will present at

the Needham Security, Networking and Communications Conference in

New York. To join the live webcast, listeners should access the

investor page of Cambium Networks

website https://investors.cambiumnetworks.com/.

Following the live webcast, a replay will be available in the event

archives at the same web address.

About Cambium Networks

Cambium Networks is a leading provider of wireless broadband

networking infrastructure solutions for network operators,

including medium-sized wireless Internet service providers,

enterprises and government agencies. Cambium’s scalable,

reliable and high-performance solutions create a purpose-built

wireless fabric which connects people, places and things across

distances ranging from two meters to more than 100 kilometers,

indoors and outdoors, using licensed and unlicensed spectrum, at

attractive economics. Headquartered outside Chicago and with

R&D centers in the U.S., U.K. and India, Cambium Networks sells

through a range of trusted global distributors.

Cautionary Note Regarding Forward-Looking

StatementsThis release contains certain forward-looking

statements within the meaning of the federal securities laws. All

statements other than statements of historical fact contained in

this document, including statements regarding our future results of

operations and financial position, business strategy and plans and

objectives of management for future operations, are forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by

terms such as “may,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or

the negative of these terms or other similar expressions. The

forward-looking statements in this document are only predictions.

We have based these forward-looking statements largely on our

current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. These forward-looking

statements speak only as of the date of this document and are

subject to a number of risks, uncertainties and assumptions

including those described in the “Risk factors” section of our

registration statement on Form S-1 filed with the Securities and

Exchange Commission. Because forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot

be predicted or quantified, you should not rely on these

forward-looking statements as predictions of future events. The

events and circumstances reflected in our forward-looking

statements may not be achieved or occur and actual results could

differ materially from those projected in the forward-looking

statements. Some of the key factors that could cause actual results

to differ from our expectations include: the unpredictability of

our operating results; our inability to predict and respond to

emerging technological trends and network operators’ changing

needs; our reliance on third-party manufacturers, which subjects us

to risks of product delivery delays and reduced control over

product costs and quality; our reliance on distributors and

value-added resellers for the substantial majority of our sales;

the inability of our third-party logistics and warehousing

providers to deliver products to our channel partners and network

operators in a timely manner; the quality of our support and

services offerings; our expectations regarding outstanding

litigation; our or our distributors’ and channel partners’

inability to attract new network operators or sell additional

products to network operators that currently use our products; the

difficulty of comparing or forecasting our financial results on a

quarter-by-quarter basis due to the seasonality of our business;

our limited or sole source suppliers’ inability to produce

third-party components to build our products; the technological

complexity of our products, which may contain undetected hardware

defects or software bugs; our channel partners’ inability to

effectively manage inventory of our products, timely resell our

products or estimate expected future demand; credit risk of our

channel partners, which could adversely affect their ability to

purchase or pay for our products; our inability to manage our

growth and expand our operations; unpredictability of sales and

revenues due to lengthy sales cycles; our inability to maintain an

effective system of internal controls, remediate our material

weakness, produce timely and accurate financial statements or

comply with applicable regulations; our reliance on the

availability of third-party licenses; risks associated with

international sales and operations; current or future

unfavorable economic conditions, both domestically and in foreign

markets; and our inability to obtain intellectual property

protections for our products.

Except as required by applicable law, we do not plan to publicly

update or revise any forward-looking statements contained herein,

whether as a result of any new information, future events or

otherwise.

| CAMBIUM

NETWORKS CORPORATION |

| CONSOLIDATED

STATEMENTS OF OPERATION |

| (In

thousands, except share and per share amounts) |

|

(Unaudited) |

|

|

Three Months Ended |

| |

September 30, 2019 |

|

June 30, 2019 |

|

September 30, 2018 |

| |

|

|

|

|

|

|

Revenues |

$ |

65,703 |

|

|

$ |

69,151 |

|

|

$ |

58,981 |

|

| Cost of revenues |

|

33,871 |

|

|

|

34,839 |

|

|

|

31,469 |

|

| Gross

profit |

|

31,832 |

|

|

|

34,312 |

|

|

|

27,512 |

|

|

Gross margin |

|

48.4 |

% |

|

|

49.6 |

% |

|

|

46.6 |

% |

| Operating

expenses |

|

|

|

|

|

|

Research and development |

|

9,895 |

|

|

|

15,189 |

|

|

|

9,810 |

|

|

Sales and marketing |

|

10,363 |

|

|

|

14,227 |

|

|

|

10,805 |

|

|

General and administrative |

|

5,996 |

|

|

|

13,063 |

|

|

|

5,520 |

|

|

Depreciation and amortization |

|

1,449 |

|

|

|

1,227 |

|

|

|

2,448 |

|

| Total operating

expenses |

|

27,703 |

|

|

|

43,706 |

|

|

|

28,583 |

|

| Operating income

(loss) |

|

4,129 |

|

|

|

(9,394 |

) |

|

|

(1,071 |

) |

|

Operating margin |

|

6.3 |

% |

|

|

(13.6 |

)% |

|

|

(1.8 |

)% |

| Interest expense |

|

2,105 |

|

|

|

2,301 |

|

|

|

2,033 |

|

| Other expense |

|

61 |

|

|

|

56 |

|

|

|

116 |

|

| Income (loss) before

income taxes |

|

1,963 |

|

|

|

(11,751 |

) |

|

|

(3,220 |

) |

| Provision (benefit) for income

taxes |

|

3 |

|

|

|

8,623 |

|

|

|

(665 |

) |

| Net income

(loss) |

$ |

1,960 |

|

|

$ |

(20,374 |

) |

|

$ |

(2,555 |

) |

| |

|

|

|

|

|

| Earnings (loss) per

share |

|

|

|

|

|

|

Basic and diluted |

$ |

0.08 |

|

|

$ |

(1.47 |

) |

|

$ |

(0.19 |

) |

| Weighted-average

number of shares outstanding to compute net earnings (loss) per

share |

|

|

|

|

|

|

Basic and diluted |

|

25,634,417 |

|

|

|

13,865,111 |

|

|

|

13,600,411 |

|

|

|

|

|

|

|

|

| Share-based

compensation included in costs and expenses: |

|

|

|

|

|

|

Cost of revenues |

$ |

14 |

|

|

$ |

182 |

|

|

$ |

— |

|

|

Research and development |

|

199 |

|

|

|

4,863 |

|

|

|

— |

|

|

Sales and marketing |

|

374 |

|

|

|

3,607 |

|

|

|

— |

|

|

General and administrative |

|

241 |

|

|

|

7,426 |

|

|

|

— |

|

|

Total share-based compensation expense |

$ |

828 |

|

|

$ |

16,078 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAMBIUM

NETWORKS CORPORATION |

| CONSOLIDATED

BALANCE SHEETS |

| (In

thousands) |

| |

|

|

|

| |

|

|

|

| |

September 30, 2019 |

|

December 31, 2018 |

| ASSETS |

(Unaudited) |

|

|

|

Current assets |

|

|

|

|

Cash |

$ |

18,950 |

|

|

$ |

4,441 |

|

|

Accounts receivable, net of allowance |

|

59,824 |

|

|

|

60,389 |

|

|

Inventories, net |

|

41,933 |

|

|

|

30,710 |

|

|

Recoverable income taxes |

|

527 |

|

|

|

679 |

|

|

Prepaid expenses |

|

6,301 |

|

|

|

3,465 |

|

|

Other current assets |

|

4,516 |

|

|

|

5,889 |

|

|

Total current assets |

|

132,051 |

|

|

|

105,573 |

|

|

Noncurrent assets |

|

|

|

|

Property and equipment, net |

|

8,257 |

|

|

|

7,965 |

|

|

Software, net |

|

4,084 |

|

|

|

3,944 |

|

|

Operating lease assets |

|

6,957 |

|

|

|

— |

|

|

Intangible assets, net |

|

15,693 |

|

|

|

8,493 |

|

|

Goodwill |

|

8,963 |

|

|

|

8,060 |

|

|

Deferred tax assets, net |

|

496 |

|

|

|

8,022 |

|

|

TOTAL ASSETS |

$ |

176,501 |

|

|

$ |

142,057 |

|

| LIABILITIES AND EQUITY

(DEFICIT) |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

20,894 |

|

|

$ |

23,710 |

|

|

Accrued liabilities |

|

20,425 |

|

|

|

18,263 |

|

|

Employee compensation |

|

4,961 |

|

|

|

4,377 |

|

|

Current portion of long-term external debt |

|

9,329 |

|

|

|

8,836 |

|

|

Payable to Sponsor |

|

— |

|

|

|

5,582 |

|

|

Deferred revenues |

|

7,557 |

|

|

|

2,770 |

|

|

Other current liabilities |

|

5,870 |

|

|

|

2,761 |

|

|

Total current liabilities |

|

69,036 |

|

|

|

66,299 |

|

|

Noncurrent liabilities |

|

|

|

|

Long-term external debt |

|

56,522 |

|

|

|

94,183 |

|

|

Deferred revenues |

|

5,184 |

|

|

|

1,541 |

|

|

Noncurrent operating lease liabilities |

|

5,544 |

|

|

|

— |

|

|

Other noncurrent liabilities |

|

— |

|

|

|

605 |

|

|

Total liabilities |

|

136,286 |

|

|

|

162,628 |

|

| Shareholders' equity

(deficit) |

|

|

|

|

Share capital; $0.0001 par value; 500,000,000 shares authorized at

December 31, 2018 and September 30, 2019; 77,179 shares issued and

outstanding at December 31, 2018 and 25,725,542 issued and

25,634,417 outstanding at September 30, 2019 |

|

3 |

|

|

|

— |

|

|

Additional paid in capital |

|

103,992 |

|

|

|

772 |

|

|

Capital contribution |

|

— |

|

|

|

24,651 |

|

|

Treasury shares, at cost, 0 shares at December 31, 2018 and 91,125

shares at September 30, 2019 |

|

(1,094 |

) |

|

|

— |

|

|

Accumulated deficit |

|

(62,325 |

) |

|

|

(45,773 |

) |

|

Accumulated other comprehensive loss |

|

(361 |

) |

|

|

(221 |

) |

|

Total shareholders’ equity (deficit) |

|

40,215 |

|

|

|

(20,571 |

) |

|

TOTAL LIABILITIES AND EQUITY (DEFICIT) |

$ |

176,501 |

|

|

$ |

142,057 |

|

|

|

|

|

|

|

|

|

|

| CAMBIUM

NETWORKS CORPORATION |

| CONSOLIDATED

STATEMENTS OF CASH FLOWS |

| (In

thousands) |

|

(Unaudited) |

| |

Three Months Ended |

| |

September 30, 2019 |

|

June 30, 2019 |

|

September 30, 2018 |

| Cash flows from operating

activities: |

|

|

|

Net income (loss) |

$ |

1,960 |

|

|

$ |

(20,374 |

) |

|

$ |

(2,555 |

) |

| Adjustments to reconcile net

income (loss) to net cash (used in ) provided by

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

1,568 |

|

|

|

1,393 |

|

|

|

2,529 |

|

|

Amortization of debt issuance costs |

|

663 |

|

|

|

177 |

|

|

|

142 |

|

|

Share-based compensation |

|

828 |

|

|

|

16,078 |

|

|

|

- |

|

|

Deferred income taxes |

|

(9 |

) |

|

|

7,198 |

|

|

|

(1,106 |

) |

|

Other |

|

(31 |

) |

|

|

(429 |

) |

|

|

265 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

2,423 |

|

|

|

1,717 |

|

|

|

(1,343 |

) |

|

Inventories |

|

(1,977 |

) |

|

|

(4,034 |

) |

|

|

(3,996 |

) |

|

Accounts payable |

|

(6,223 |

) |

|

|

2,736 |

|

|

|

4,776 |

|

|

Accrued employee compensation |

|

(1,394 |

) |

|

|

346 |

|

|

|

902 |

|

|

Other assets and liabilities |

|

(9,609 |

) |

|

|

1,146 |

|

|

|

3,546 |

|

|

Net cash (used in) provided by operating activities |

|

(11,801 |

) |

|

|

5,954 |

|

|

|

3,160 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

Purchase of property and equipment |

|

(828 |

) |

|

|

(579 |

) |

|

|

(1,343 |

) |

|

Purchase of software |

|

(157 |

) |

|

|

(332 |

) |

|

|

(467 |

) |

|

Cash paid for acquisition |

|

(2,000 |

) |

|

|

— |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(2,985 |

) |

|

|

(911 |

) |

|

|

(1,810 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

Proceeds from issuance of term loan |

|

— |

|

|

|

— |

|

|

|

— |

|

|

Proceeds from issuance of revolver debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

Repayment of term loan |

|

(23,087 |

) |

|

|

(2,375 |

) |

|

|

(1,125 |

) |

|

Repayment of revolver debt |

|

(10,000 |

) |

|

|

— |

|

|

|

— |

|

|

Payment of debt issuance costs |

|

(128 |

) |

|

|

(208 |

) |

|

|

— |

|

|

Proceeds from initial public offering, net of underwriters

commission and fees and payment of deferred offering costs |

|

(3,428 |

) |

|

|

64,981 |

|

|

|

— |

|

|

Taxes paid related to net share settlement of equity awards |

|

(802 |

) |

|

|

— |

|

|

|

— |

|

|

Net cash (used in) provided by financing activities |

|

(37,445 |

) |

|

|

62,398 |

|

|

|

(1,125 |

) |

| Effect of exchange rate on

cash |

|

(65 |

) |

|

|

4 |

|

|

|

(2 |

) |

| Net (decrease) increase in

cash |

|

(52,296 |

) |

|

|

67,445 |

|

|

|

223 |

|

| Cash, beginning of period |

|

71,246 |

|

|

|

3,801 |

|

|

|

3,932 |

|

| Cash, end of period |

$ |

18,950 |

|

|

$ |

71,246 |

|

|

$ |

4,155 |

|

| |

|

|

|

|

|

| Supplemental disclosure of

cash flow information: |

|

|

|

|

|

|

Income taxes paid |

$ |

1,076 |

|

|

$ |

155 |

|

|

$ |

293 |

|

|

Interest paid |

$ |

1,371 |

|

|

$ |

1,949 |

|

|

$ |

1,778 |

|

| Significant non-cash

activities: |

|

|

|

|

|

|

Issuance of shares for unreturned capital and accumulated

yield |

$ |

— |

|

|

$ |

49,252 |

|

|

$ |

— |

|

|

Deferred offering costs included in accrued liabilities |

$ |

179 |

|

|

$ |

3,246 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAMBIUM NETWORKS CORPORATION |

|

SUPPLEMENTAL FINANCIAL INFORMATION |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

| REVENUES BY PRODUCT

TYPE |

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, 2019 |

|

June 30, 2019 |

|

September 30, 2018 |

|

Point-to-Multi-Point |

$ |

38,856 |

|

$ |

41,730 |

|

$ |

33,024 |

| Point-to-Point |

|

15,976 |

|

|

17,830 |

|

|

20,566 |

| Wi-Fi |

|

10,141 |

|

|

8,430 |

|

|

4,370 |

| Other |

|

730 |

|

|

1,161 |

|

|

1,021 |

|

Total Revenues |

$ |

65,703 |

|

$ |

69,151 |

|

$ |

58,981 |

| |

|

|

|

|

|

| REVENUES BY

REGION |

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, 2019 |

|

June 30, 2019 |

|

September 30, 2018 |

| North America |

$ |

29,032 |

|

$ |

30,056 |

|

$ |

29,104 |

| Europe, Middle East and Africa |

|

21,749 |

|

|

22,994 |

|

|

17,082 |

| Caribbean and Latin America |

|

8,008 |

|

|

8,420 |

|

|

6,624 |

| Asia Pacific |

|

6,914 |

|

|

7,681 |

|

|

6,171 |

|

Total Revenues |

$ |

65,703 |

|

$ |

69,151 |

|

$ |

58,981 |

|

|

|

|

|

|

|

|

|

|

Use of non-GAAP (Adjusted) Financial MeasuresIn

addition to providing financial measurements based on generally

accepted accounting principles in the United States (GAAP), we

provide additional financial metrics that are not prepared in

accordance with GAAP (non-GAAP), including Adjusted EBITDA,

non-GAAP gross margin, non-GAAP operating expenses, non-GAAP

operating income and non-GAAP operating margin, non-GAAP pre-tax

income, non-GAAP provision for income taxes, non-GAAP net income,

and non-GAAP fully weighted basic and diluted shares. Management

uses these non-GAAP financial measures, in addition to GAAP

financial measures, to understand and compare operating results

across accounting periods, for financial and operational decision

making, for planning and forecasting purposes, to measure executive

compensation and to evaluate our financial performance. We believe

that these non-GAAP financial measures help us to identify

underlying trends in our business that could otherwise be masked by

the effect of the expenses that we exclude in the calculations of

the non-GAAP financial measures.

Accordingly, we believe that these financial measures reflect

our ongoing business in a manner that allows for meaningful

comparisons and analysis of trends in the business and provides

useful information to investors and others in understanding and

evaluating our operating results, enhancing the overall

understanding of our past performance and future prospects.

Excluding these non-GAAP measures eliminate the variability caused

by share-based compensation as a result of the variety of equity

awards used by other companies and the varying methodologies and

assumptions used, the variability caused by purchase accounting and

provide a more relevant measure of operating performance. Although

the calculation of non-GAAP financial measures may vary from

company to company, our detailed presentation may facilitate

analysis and comparison of our operating results by management and

investors with other peer companies, many of which use similar

non-GAAP financial measures to supplement their GAAP results in

their public disclosures. These non-GAAP financial measures are

discussed below.

Adjusted EBITDA is defined as net income as reported in our

consolidated statements of income excluding the impact of (i)

interest expense (income), net; (ii) income tax provision

(benefit); (iii) depreciation and amortization expense; (iv)

Sponsor fees associated with advisory services, and (v) share-based

compensation expense. EBITDA is widely used by securities analysts,

investors and other interested parties to evaluate the

profitability of companies. EBITDA eliminates potential differences

in performance caused by variations in capital structures

(affecting net finance costs), tax positions (such as the

availability of net operating losses against which to relieve

taxable profits), the cost and age of tangible assets (affecting

relative depreciation expense) and the extent to which intangible

assets are identifiable (affecting relative amortization expense).

We adjust EBITDA to also exclude Sponsor fees, in order to

eliminate the impact on reported performance caused by these fees,

which are related to our past ownership structure. We adjust EBITDA

for share-based compensation expense which is a non-cash expense

that varies in amount from period to period and is dependent on

market forces that are often beyond Cambium Networks control. As a

result, management excludes this item from Cambium Networks

internal operating forecasts and models.

Non-GAAP gross margin, non-GAAP operating expenses, non-GAAP

operating income and non-GAAP operating margin, and non-GAAP net

income are used as a supplement to our unaudited consolidated

financial statements presented in accordance with GAAP. We

believe these non-GAAP measures are the most meaningful for period

to period comparisons because they exclude the impact of

share-based compensation expense, amortization of acquired

intangibles, and amortization of capitalized software costs as we

do not consider these costs and expenses to be indicative of our

ongoing operations.

- Share-based compensation expense and associated employment

taxes paid. Management may issue different types of awards,

including share options, restricted share awards and restricted

share units, as well as awards with performance or other market

characteristics, and excludes the associated expense in this

non-GAAP measure. Share-based compensation expense is a non-cash

expense that varies in amount from period to period and is

dependent on market forces that are often beyond Cambium Networks'

control while the associated employment taxes are cash-based

expenses that vary in amount from period-to-period and are

dependent on market forces as well as jurisdictional tax

regulations that are often beyond Cambium Networks' control.

In addition, in the three-month period ended June 30, 2019, Cambium

Networks incurred a one-time share-based compensation expense of

$16.1 million in connection with (i) the recognition of deferred

share-based compensation expense and (ii) the issuance of 2,172,000

share options, each upon the completion of our initial public

offering as well as employment taxes paid by Cambium Networks in

conjunction with the settlement of deferred share-based

compensation into ordinary shares.

- Amortization of acquired intangibles includes customer

relationships, unpatented technology, patents, software, and

trademarks.

- Amortization of capitalized software costs include capitalized

research and development activities amortized over their useful

life and included in cost of revenues.

- Debt amortization costs associated with the extinguishment of

long-term debt. Cambium Networks excludes these expenses from

non-GAAP income since they result from an event that is outside the

ordinary course of continuing operations.

- Acquisition and integration costs consist of legal and

professional fees relations to the acquisition of Xirrus. Cambium

Networks excludes these expenses since they result from an event

that is outside the ordinary course of continuing operations.

- One-time charges associated with the completion of an

acquisition including items such as contract termination costs,

severance and other acquisition-related restructuring costs; costs

incurred in connection with integration activities; and legal and

accounting costs. Cambium Networks excludes these expenses since

they result from an event that is outside the ordinary course of

continuing operations.

- Restructuring expenses primarily consist of severance costs for

employees which are not related to future operating expenses.

Cambium Networks excludes these expenses since they result from an

event that is outside the ordinary course of continuing operations.

Excluding these charges permits more accurate comparisons of

Cambium Networks' ongoing business results.

Our non-GAAP tax adjustments include the tax

impacts from share-based compensation expense including excess or

decremental tax benefits available to the company that are recorded

when incurred, one-time and ongoing impacts from the company's

valuation allowance recognized in the quarter ended June 30, 2019,

and one-time tax impacts from share-based compensation expense

incurred upon the completion of our initial public offering as

noted above. Cambium Networks excludes these amounts to more

closely approximate the company’s ongoing effective tax rate (ETR)

after adjusting for one-time or unique reoccurring items. The

associated non-GAAP effective tax rate is also applied to the gross

amount of non-GAAP adjustments for purposes of calculating non-GAAP

net income in total and on a per-share basis. This approach is

designed to enhance the ability of investors to understand the

company's tax expense on its current operations, provide improved

modeling accuracy, and substantially reduce fluctuations caused by

GAAP adjustments which may not reflect actual cash tax

expense.

Non-GAAP fully weighted basic and diluted shares

are shown as outstanding during the entire period presented and

include dilutive shares, if their effect to earnings per share is

dilutive. We also use non-GAAP fully weighted basic and

diluted shares to provide more comparable per-share results across

periods.

These non-GAAP financial measures do not replace the

presentation of our GAAP financial results and should only be used

as a supplement to, not as a substitute for, our financial results

presented in accordance with GAAP. There are limitations in the use

of non-GAAP measures, because they do not include all the expenses

that must be included under GAAP and because they involve the

exercise of judgment concerning exclusions of items from the

comparable non-GAAP financial measure. In addition, other companies

may use other measures to evaluate their performance, or may

calculate non-GAAP measures differently, all of which could reduce

the usefulness of our non-GAAP financial measures as tools for

comparison. We present a “Reconciliation of GAAP Financial Measures

to Non-GAAP Financial Measures” in the tables below.

The following table reconciles net income (loss) to Adjusted

EBITDA, the most directly comparable financial measure, calculated

and presented in accordance with GAAP (in thousands):

|

CAMBIUM NETWORKS CORPORATION |

|

SUPPLEMENTAL SCHEDULE OF NON-GAAP ADJUSTED

EBITDA |

|

(In thousands) |

|

(Unaudited) |

| |

Three Months Ended |

| |

September 30, 2019 |

|

June 30, 2019 |

|

September 30, 2018 |

|

Net income (loss) |

$ |

1,960 |

|

|

$ |

(20,374 |

) |

|

$ |

(2,555 |

) |

|

Interest expense, net |

|

2,105 |

|

|

|

2,301 |

|

|

|

2,033 |

|

|

Provision (benefit) for income taxes |

|

3 |

|

|

|

8,623 |

|

|

|

(665 |

) |

|

Depreciation and amortization |

|

1,568 |

|

|

|

1,393 |

|

|

|

2,528 |

|

| EBITDA |

|

5,636 |

|

|

|

(8,057 |

) |

|

|

1,341 |

|

|

Share-based compensation |

|

966 |

|

|

|

16,078 |

|

|

|

— |

|

|

Sponsor management fee |

|

— |

|

|

|

125 |

|

|

|

125 |

|

|

Xirrus one-time acquisition charges |

|

168 |

|

|

|

— |

|

|

|

— |

|

| Adjusted EBITDA |

$ |

6,770 |

|

|

$ |

8,146 |

|

|

$ |

1,466 |

|

| |

|

|

|

|

|

| Adjusted EBITDA Margin |

|

10.3 |

% |

|

|

11.8 |

% |

|

|

2.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

The following table reconciles all other GAAP to non-GAAP

financial measures (in thousands):

|

CAMBIUM NETWORKS CORPORATION |

|

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP

FINANCIAL MEASURES |

|

(in thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30, 2019 |

June 30, 2019 |

|

September 30, 2018 |

|

GAAP gross profit |

|

$ |

31,832 |

|

|

$ |

34,312 |

|

|

$ |

27,512 |

|

| Share-based compensation

expense |

|

|

14 |

|

|

|

182 |

|

|

|

— |

|

| Amortization of capitalized

software costs |

|

|

119 |

|

|

|

166 |

|

|

|

80 |

|

| Non-GAAP gross

profit |

|

$ |

31,965 |

|

|

$ |

34,660 |

|

|

$ |

27,592 |

|

| Non-GAAP gross

margin |

|

|

48.7 |

% |

|

|

50.1 |

% |

|

|

46.8 |

% |

|

|

|

|

|

|

|

|

| GAAP research and

development expense |

|

$ |

9,895 |

|

|

$ |

15,189 |

|

|

$ |

9,810 |

|

| Share-based compensation

expense |

|

|

337 |

|

|

|

4,863 |

|

|

|

— |

|

| Non-GAAP research and

development expense |

|

$ |

9,558 |

|

|

$ |

10,326 |

|

|

$ |

9,810 |

|

|

|

|

|

|

|

|

|

| GAAP sales and

marketing expense |

|

$ |

10,363 |

|

|

$ |

14,227 |

|

|

$ |

10,805 |

|

| Share-based compensation

expense |

|

|

374 |

|

|

|

3,607 |

|

|

|

— |

|

| Non-GAAP sales and

marketing expense |

|

$ |

9,989 |

|

|

$ |

10,620 |

|

|

$ |

10,805 |

|

|

|

|

|

|

|

|

|

| GAAP general and

administrative expense |

|

$ |

5,996 |

|

|

$ |

13,063 |

|

|

$ |

5,520 |

|

| Share-based compensation

expense |

|

|

241 |

|

|

|

7,426 |

|

|

|

— |

|

| Xirrus one-time acquisition

charges |

|

|

168 |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP general and

administrative expense |

|

$ |

5,587 |

|

|

$ |

5,637 |

|

|

$ |

5,520 |

|

|

|

|

|

|

|

|

|

| GAAP depreciation and

amortization |

|

$ |

1,449 |

|

|

$ |

1,227 |

|

|

$ |

2,448 |

|

| Amortization of acquired

intangibles |

|

|

424 |

|

|

|

293 |

|

|

|

1,201 |

|

| Non-GAAP depreciation

and amortization |

|

$ |

1,025 |

|

|

$ |

934 |

|

|

$ |

1,247 |

|

|

|

|

|

|

|

|

|

| GAAP operating income

(loss) |

|

$ |

4,129 |

|

|

$ |

(9,394 |

) |

|

$ |

(1,071 |

) |

| Share-based compensation

expense |

|

|

966 |

|

|

|

16,078 |

|

|

|

— |

|

| Amortization of capitalized

software costs |

|

|

119 |

|

|

|

166 |

|

|

|

80 |

|

| Amortization of acquired

intangibles |

|

|

424 |

|

|

|

293 |

|

|

|

1,201 |

|

| Xirrus one-time acquisition

charges |

|

|

168 |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP operating

income |

|

$ |

5,806 |

|

|

$ |

7,143 |

|

|

$ |

210 |

|

|

|

|

|

|

|

|

|

| GAAP pre-tax income

(loss) |

|

$ |

1,963 |

|

|

$ |

(11,751 |

) |

|

$ |

(3,220 |

) |

| Share-based compensation

expense |

|

|

966 |

|

|

|

16,078 |

|

|

|

— |

|

| Amortization of capitalized

software costs |

|

|

119 |

|

|

|

166 |

|

|

|

80 |

|

| Amortization of acquired

intangibles |

|

|

424 |

|

|

|

293 |

|

|

|

1,201 |

|

| Xirrus one-time acquisition

charges |

|

|

168 |

|

|

|

— |

|

|

|

— |

|

| Write-down of debt issuance

costs upon prepayment of debt |

|

|

527 |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP pre-tax

income (loss) |

|

$ |

4,167 |

|

|

$ |

4,786 |

|

|

$ |

(1,939 |

) |

|

|

|

|

|

|

|

|

| GAAP provision for

income taxes |

|

$ |

3 |

|

|

$ |

8,623 |

|

|

$ |

(665 |

) |

| Valuation allowance

impacts |

|

|

— |

|

|

|

8,238 |

|

|

|

— |

|

| Tax impacts of share

vesting |

|

|

— |

|

|

|

2,530 |

|

|

|

— |

|

| Tax effect of share-based

compensation expense, amortization of acquired intangibles, Xirrus

one-time acquisition charges and write-down of debt issuance costs,

using non-GAAP ETR |

|

|

(511 |

) |

|

|

(3,010 |

) |

|

|

(299 |

) |

| All other discrete items |

|

|

85 |

|

|

|

(6 |

) |

|

|

87 |

|

| Non-GAAP provision

(benefit) for income taxes |

|

$ |

429 |

|

|

$ |

871 |

|

|

$ |

(453 |

) |

| Non-GAAP

ETR |

|

|

10.3 |

% |

|

|

18.2 |

% |

|

|

23.4 |

% |

|

|

|

|

|

|

|

|

| GAAP net income

(loss) |

|

$ |

1,960 |

|

|

$ |

(20,374 |

) |

|

$ |

(2,555 |

) |

| Share-based compensation

expense |

|

|

966 |

|

|

|

16,078 |

|

|

|

— |

|

| Amortization of capitalized

software costs |

|

|

119 |

|

|

|

166 |

|

|

|

80 |

|

| Amortization of acquired

intangibles |

|

|

424 |

|

|

|

293 |

|

|

|

1,201 |

|

| Xirrus one-time acquisition

charges |

|

|

168 |

|

|

|

— |

|

|

|

— |

|

| Write-down of debt issuance

costs upon prepayment of debt |

|

|

527 |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP adjustments to

tax |

|

|

85 |

|

|

|

10,761 |

|

|

|

87 |

|

| Tax effect of share-based

compensation expense, amortization of acquired intangibles, Xirrus

one-time acquisition charges and write-down of debt issuance costs,

using non-GAAP ETR |

|

|

(511 |

) |

|

|

(3,010 |

) |

|

|

(299 |

) |

| Non-GAAP net income

(loss) |

|

$ |

3,738 |

|

|

$ |

3,915 |

|

|

$ |

(1,486 |

) |

|

|

|

|

|

|

|

|

| Non-GAAP fully

weighted basic and diluted shares |

|

|

25,634 |

|

|

|

25,632 |

|

|

|

13,600 |

|

|

|

|

|

|

|

|

|

| Non-GAAP net income

(loss) per Non-GAAP fully weighted basic and diluted

shares |

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

(0.11 |

) |

Investor Inquiries:Peter Schuman,

IRCSr. Director Investor RelationsCambium Networks+1 (847)

264-2188peter.schuman@cambiumnetworks.com

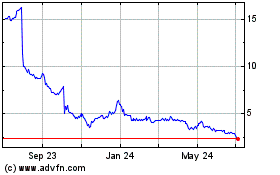

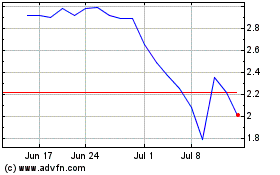

Cambium Networks (NASDAQ:CMBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cambium Networks (NASDAQ:CMBM)

Historical Stock Chart

From Apr 2023 to Apr 2024