As filed with the Securities and Exchange

Commission on September 23, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CLEANSPARK, INC.

(Exact name of registrant as specified in its

charter)

|

Nevada

|

|

87-0449945

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

1185 S. 1800 West, Suite 3

Woods Cross, Utah 84087

(702) 244-4405

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Zachary K. Bradford

President and CEO

CleanSpark, Inc.

1185 S. 1800 West, Suite 3

Woods Cross, Utah 84087

(702) 244-4405

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Christopher L. Tinen

Procopio, Cory, Hargreaves & Savitch

LLP

12544 High Bluff Drive, Suite 400

San Diego, California 92130

(858) 720-6320

Approximate date of commencement of proposed

sale to the public:

From time to time after the effective date

of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans,

check the following box: ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering: ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an “emerging

growth company”. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☒

|

|

|

Emerging growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount

to be

Registered (1)(2)

|

|

|

Proposed Maximum

Offering

Price Per Security (3)

|

|

|

Proposed Maximum

Aggregate

Offering Price (3)

|

|

|

Amount of

Registration Fee (4)

|

|

|

Common Stock, $0.001 par value per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

$

|

|

|

|

$

|

200,000,000

|

|

|

$

|

25,960.00

|

|

|

|

(1)

|

Pursuant to Rule 416(a), this registration statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction.

|

|

|

(2)

|

There is being registered hereunder an indeterminate number of shares of (a) common stock, (b) preferred stock, (c) debt securities, (d) warrants to purchase common stock, preferred stock, debt securities or other securities of the Registrant, (e) subscription rights to purchase common stock, preferred stock, debt securities or other securities of the Registrant, and (d) units, consisting of some or all of these securities in any combination, as may be sold from time to time by the Registrant. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. There are also being registered hereunder an indeterminate number of shares of securities as shall be issuable upon conversion, exchange or exercise of any securities that provide for such issuance. In no event will the aggregate offering price of all types of securities issued by the Registrant pursuant to this registration statement exceed $200,000,000.

|

|

|

(3)

|

The proposed maximum offering price per share and proposed maximum aggregate offering price for each type of security will be determined from time to time by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder.

|

|

|

(4)

|

Calculated pursuant to Rule 457(o) under the Securities Act.

|

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell any of these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities, and is not soliciting an offer to buy these

securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

SEPTEMBER 23, 2020

PROSPECTUS

$200,000,000

COMMON STOCK

PREFERRED STOCK

DEBT SECURITIES

WARRANTS

RIGHTS

UNITS

From time to time, we may offer up to $200,000,000

aggregate dollar amount of shares of our common stock, preferred stock, debt securities, warrants to purchase our common stock,

preferred stock, debt securities or other securities, subscription rights and/or units consisting of some or all of these securities,

in any combination, together or separately, in one or more offerings, in amounts, at prices and on the terms that we will determine

at the time of the offering and which will be set forth in a prospectus supplement and any related free writing prospectus.

This prospectus describes the general manner

in which those securities may be offered using this prospectus. Each time we offer securities, we will specify in an accompanying

prospectus supplement and any related free writing prospectus the terms of securities offered and the offering thereof and may

also add, update or change information contained in this prospectus.

You should read this prospectus, the information

incorporated, or deemed to be incorporated, by reference in this prospectus, and any applicable prospectus supplement and related

free writing prospectus carefully before you invest.

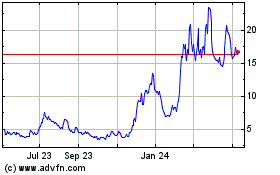

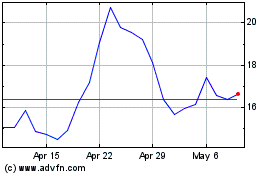

Our common stock is currently listed on the

Nasdaq Capital Market (“Nasdaq”) under the symbol “CLSK.” On September 18, 2020, the last reported sale

price of our common stock was $11.55 per share. None of the other securities we may offer are currently quoted on any market or

securities exchange.

An investment in our securities involves

a high degree of risk. You should carefully consider the information under the heading “Risk Factors” beginning on

page 5 of this prospectus and any applicable prospectus supplement, before investing in our securities.

The securities described in this prospectus

may be sold to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional

information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus.

If any underwriters, dealers or agents are involved in the sale of any securities with respect to which this prospectus is being

delivered, the names of such underwriters or agents and any applicable fees, discounts or commissions, details regarding over-allotment

options, if any, will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds

we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of

this prospectus is , 2020

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this

shelf registration process, from time to time, we may sell any combination of the securities described in this prospectus in one

or more offerings, up to an aggregate dollar amount of $200,000,000. Each time we sell securities under this shelf registration

process, we will provide a prospectus supplement that will contain specific information about the terms of the offering. We have

provided to you in this prospectus a general description of the securities we may offer.

We may also add, update or change in a prospectus

supplement any of the information contained in this prospectus. To the extent there is a conflict between the information contained

in this prospectus and any applicable prospectus supplement, you should rely on the information in such prospectus supplement; provided that,

if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having

the later date modifies or supersedes the earlier statement. You should read both this prospectus and any prospectus supplement

together with additional information described under the next heading “Where You Can Find More Information.”

You should rely only on the information contained

in or incorporated by reference into this prospectus or any applicable prospectus supplement. No dealer, salesperson or any other

person is authorized to give any information or to make any representation other than the information and representations contained

in or incorporated by reference into this prospectus or any applicable prospectus supplement. If different information is given

or different representations are made, you may not rely on that information or those representations as having been authorized

by us. You may not imply from the delivery of this prospectus and any applicable prospectus supplement, nor from a sale made under

this prospectus and any applicable prospectus supplement, that our affairs are unchanged since the date of this prospectus and

any applicable prospectus supplement or that the information contained in any document incorporated by reference is accurate as

of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus

and any applicable prospectus supplement or any sale of a security. This prospectus and any applicable prospectus supplement may

only be used where it is legal to sell the securities.

In this prospectus, unless the context otherwise

requires, the terms “CleanSpark,” “CLSK,” the “Company,” “we,” “us,”

and “our” refer to CleanSpark, Inc., a Nevada corporation.

PROSPECTUS SUMMARY

This summary does not contain all the information

that you should consider before investing in our securities. You should read the entire prospectus and the information incorporated

by reference in this prospectus carefully, including “Risk Factors” and the financial data and related notes and other

information incorporated by reference, before making an investment decision.

Overview

We

are in the business of providing advanced energy software and control technology that enables a plug-and-play enterprise solution

to modern energy challenges. Our services consist of intelligent energy monitoring and controls, microgrid design and engineering

and consulting services. Our software allows energy users to obtain resiliency and economic optimization. Our software is uniquely

capable of enabling a microgrid to be scaled to the user's specific needs and can be widely implemented across commercial, industrial,

military and municipal deployment.

Integral

to our business is our mPulse and mVSO software platforms (the “Platforms”). When the Platforms are implemented on

a customer’s power system, they are able to control the distributed energy resources on site to provide secure, sustainable

energy often at significant cost savings for our energy customers. The Platforms allows customers to efficiently manage renewable

energy generation, other distributed energy generation technologies including energy generation assets, energy storage assets,

and energy consumption assets. By having autonomous control over the distributed facets of energy usage and energy storage, customers

are able to reduce their dependency on utilities, thereby keeping energy costs relatively constant over time. The overall aim is

to transform energy consumers into energy producers by supplying power that anticipates their routine instead of interrupting it.

We also

own patented gasification technologies. Our technology converts any organic material into SynGas. SynGas can be used as clean,

renewable, environmentally friendly, warming fuel for power plants, motor vehicles, and as feedstock for the generation of DME

(Di-Methyl Ether).

As

previously disclosed, we plan to continue our focus on the Distributed energy and microgrid side of the business in 2020, as opposed

to expending significant efforts on the Gasifier side of the business. We plan to continue our efforts to better our technology,

service existing customers and market our System (defined below) to prospective clients. We feel that this focus would provide

the best opportunity for our shareholders.

Lines

of Business

Through

CleanSpark, LLC, the Company provides microgrid engineering, design and software solutions to military, commercial and residential

customers.

The

services offered consist of, microgrid design and engineering, project development consulting services. The work is performed under

fixed price bid contracts and negotiated price contracts.

Through

CleanSpark Critical Power Systems, Inc., the Company provides custom hardware solutions for distributed energy systems that serve

military and commercial residential properties. The equipment is generally sold under negotiated fixed price contracts.

Through

GridFabric, LLC the Company provides Open Automated Demand response (“OpenADR”) and other middleware communication

protocol software solutions to commercial and utility customers.

Distributed Energy Management

and Microgrids

Integral

to our business is our Distributed Energy

Management Business (the “DER Business”). The main assets of our

DER Business include our propriety software

systems (“Systems”) and also

our engineering and methodology

trade secrets. The Distributed Energy

systems and Microgrids that

utilize our Systems are capable of providing

secure, sustainable energy with significant

cost savings for its energy customers.

The Systems allows customers to

design, engineer, and then

efficiently manage renewable energy generation,

storage and consumption. By having

autonomous control over the multiple facets of energy

usage and storage, customers are

able to reduce their dependency on utilities,

thereby keeping energy costs relatively

constant over time. The overall aim is to transform

energy consumers into intelligent energy producers by supplying and

managing power in a manner

that anticipates their routine instead of interrupting

it.

Around

the world, the aging grid is becoming unstable and

unreliable due to increases in

loads and lack of new large-scale

generation facilities. This inherent instability is compounded

by the push to integrate a growing

number and variety

of renewable but intermittent energy

generators and advanced technologies into

outdated electrical systems. Simultaneously,

defense installations, industrial complexes, communities,

and campuses across the

world are turning to virtual power plants

and microgrids as a means

to decrease their reliance from the grid,

reduce utility costs, utilize cleaner

power, and enhance energy security and

surety.

The

convergence of these factors is creating

a “perfect storm” in the

power supply optimization and energy

management arena. Efficiently building

and operating the distributed energy management

systems and microgrids of tomorrow,

while maximizing the use of sustainable

energy to produce affordable, stable, predictable, and reliable power

on a large scale, is a significant opportunity

that first-movers can leverage to capture a large

share of this emerging global industry.

A

microgrid is comprised of any

number of generation, energy storage,

and smart distribution assets that serve

a single or multiple loads, both

connected to the utility grid and

separate from the utility grid “islanded.” In the

past, distributed energy management systems

and microgrids have consisted of

off-grid generators organized with controls

to provide power where utility

lines cannot run. Today, modern distributed energy management

systems and microgrids integrate renewable

energy generation systems (REGS) with

advanced energy storage devices and interoperate

with the local utility

grid. Advanced autonomous cyber-secure

microgrids controls relay information between intelligent hardware and

localized servers to make decisions

in real-time that deliver optimum power where

it is needed, when it is needed.

Our

Systems create an integrated distributed energy

management control platform that

seamlessly integrates all forms of energy

generation with energy storage devices

and controls facility loads to provide

energy security in real time free of cyber

threats. Able to interoperate with the

local utility grid, the

Systems bring users the ability to

choose when to buy or sell power to and

from the grid, enabling

what we believe is the

most cost-effective power solution that exists on the

current market.

Our

Systems are ideal for commercial, industrial,

mining, defense, campus and

residential users and ranges

in size from 4KW to 100MW and beyond and

can deliver power at or below the current

cost of utility power.

Our

services consist of distributed energy microgrid system engineering and design, and

project consulting services. The work

is performed under fixed price bid contracts

and negotiated price contracts.

mPulse Software Suite

mPulse

is a modular platform that

enables fine-grained control of a Microgrid

based on customer operational goals,

equipment and forecasts of load

and generation. mPulse performs high-frequency

calculations, threshold-based alarming, execution of domain-specific business rules,

internal and external health monitoring,

historical data persistence, and system-to-operator

notifications. The modular design increases system flexibility and

extensibility. In addition, the deployment

of the mPulse system follows a security-conscious

posture by deploying hardware-based firewalls as well

as encryption across communication channels.

mPulse allows configuration for site-specific equipment and

operation and provides a clean, informative

user interface to allow customers to monitor

and analyze the data streams

that describe how their microgrid is operating.

mPulse

supports our innovative fractal approach to microgrid

design, which enables multiple microgrids

on a single site to interact in

a number of different ways,

including as peers, in a parent-child

relationship, and in parallel or completely

disconnected. Each grid can have different

operational objectives, and those

operational objectives can change over time.

Any microgrid can be islanded from the

rest of the microgrid as well as

the larger utility grid. The mPulse

software can control the workflow required in both the

islanding steps as well as the reconnecting

steps of this maneuver and

coordinate connected equipment such that connections are only made

when it is safe to do so.

Microgrid Value Stream Optimizer (mVSO)

The Microgrid

Value Stream Optimizer (mVSO) tool provides a robust distributed energy and

microgrid system modeling solution. mVSO

takes utility rate data and load

data for a customer site and helps automate

the sizing and analysis of potential

microgrid solutions as well as providing

a financial analysis around each grid

configuration. mVSO uses historical data

to generate projected energy generation assets

and models how storage

responds to varying operational modes

and command logics

based upon predicted generation and load

curves. mVSO analyzes

multiple equipment combinations and operational situations

to determine the optimal configuration for a site

based on the financials, equipment outlay, utility cost savings,

etc., to arrive at payback and IRR values.

This ultimately provides the user with

data to design a distributed energy

and/or microgrid system that will meet

the customers’ performance benchmarks.

Switchgear Equipment

As an energy technology company, part

of our business model is to assess our technologies, product offerings and business direction and determine whether any strategic

acquisitions would benefit us. In line with our focus, on January 22, 2019, we acquired the outstanding capital stock of Pioneer

Critical Power, Inc., a Delaware corporation (“Pioneer”), which we have since renamed and redomiciled to the State

of Nevada and changed the name to CleanSpark Critical Power Systems Inc.

As

consideration for the transaction, we issued to its sole shareholder Pioneer Power

Solutions, Inc. (“Pioneer Power”) a total of 175,000 shares of our common stock, a 5-year warrant to purchase 50,000

shares of our common stock at an exercise price of $16.00 per share and a 5-year warrant to purchase 50,000 shares of our common

stock at an exercise price of $20.00 per share.

The parties also signed

additional agreements in connection with the transaction, as previously disclosed in our SEC filings, mainly requiring Pioneer

Power to indemnify us in certain circumstances and restricting Pioneer Power from engaging in a competing business.

We also signed a Contract

Manufacturing Agreement, whereby Pioneer Power shall exclusively manufacture parallel switchgears, automatic transfer switches

and related control and circuit protective equipment for us, for a period of eighteen months.

We plan to utilize the

new intellectual property we gained from the acquisition and the manufacturing agreement in place to enter into the switchgear

equipment sales industry. We acquired executed contracts and purchase orders, which we expect will result in significant gross

sales, as well as hired personnel to operate this new line of business.

As a result of this transaction,

the parties terminated a contemplated asset purchase arrangement previously disclosed in our SEC filings.

Software Development, Marketing &

Design – p2kLabs

As CleanSpark continues

to drive towards profitability and further market and sell CleanSpark software and controls, our acquisition of p2kLabs, Inc. not

only contributes additional revenues, but also adds depth to our team in sales, marketing, design and software development.

We plan to maximize the

value of our offering, internalize what would otherwise be expenses, and diversify our ability to better serve our valued clients.

As consideration for the

transaction, we issued to its sole shareholder, Amer Tadayon, a total of 95,699 shares

of our common stock and paid $1,155,000 in cash.

The parties also signed

additional agreements in connection with the transaction, as previously disclosed in our SEC filings, mainly an employment agreement

with Amer Tadayon.

OpenADR

and communication protocol software solutions – GridFabric

As CleanSpark continues

to expand its energy software offerings, our acquisition of GridFabric, LLC allows CleanSpark to offer Open ADR solutions to commercial

and utility Customers. CleanSpark will also utilize GridFabric's communications protocols as an integral part of our Demand Response

offerings integrated into mPulse.

GridFabric creates software

solutions that help power utilities and IoT (Internet of Things) products that manage energy loads. OpenADR 2.0b is now

the basis for the standard to be developed by the International Electrotechnical Commission. GridFabric's core products are Canvas

and Plaid.

Canvas

Canvas is an OpenADR 2.0b Virtual

Top Node ('VTN') built for testing and managing Virtual End Nodes ('VENs') that are piloting and running load shifting programs.

Canvas is offered to customers in the Cloud as a SaaS solution or as a licensed software.

Plaid

Plaid is a licensed software

solution that allows any internet connected product that uses energy (i.e. Solar, Storage & Inverters, Demand Response, EV

Charging, Lighting, Industrial controls, Building Management Systems, etc.) to add load shifting capabilities by translating

load shifting protocols into their existing APIs. Companies that implement Plaid through GridFabric get a Certified OpenADR 2.0b Virtual

End Node (VEN) upon completion of the implementation process.

As consideration for the

transaction, we issued to its members, a total of 26,427 shares of our common stock and paid $400,000 in cash. Additional shares

of the Company’s common stock, valued at up to $750,000.00, will be issuable to Sellers if GridFabric achieves certain

revenue and product release milestones related to the future performance of GridFabric.

Nasdaq Listing

On January 24, 2020, the Company was approved

for listing on the Nasdaq Capital Market (“Nasdaq”).

Corporate Information

Our principal executive offices are located

at 1185 S. 1800 West, Suite 3, Woods Cross, Utah 84087, and our telephone number is (702) 941-8047. Our website is located at www.cleanspark.com.

Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus

supplement.

Where You Can Find More Information

For additional information as to our

business, properties and financial condition, please refer to the documents cited in "Where You Can Find More Information."

The Securities We May Offer

With this prospectus, we may offer common stock,

preferred stock, debt securities, warrants, subscription rights, and/or units consisting of some or all of these securities in

any combination. The aggregate offering price of securities that we offer with this prospectus will not exceed $200,000,000. Each

time we offer securities with this prospectus, we will provide offerees with a prospectus supplement that will contain the specific

terms of the securities being offered. The following is a summary of the securities we may offer with this prospectus.

Common Stock

We may offer shares of our common stock, par

value $0.001 per share, including securities convertible into common stock.

Preferred Stock

We may offer shares of our preferred stock,

par value $0.001 per share, including securities convertible into preferred stock

Debt Securities

We may issue debt securities from time to time,

in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. A form of indenture

has been filed as an exhibit to the registration statement of which this prospectus is a part, and supplemental indentures and

forms of debt securities containing the terms of the debt securities being offered will be filed as exhibits to the registration

statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the SEC.

Warrants

We may offer warrants for the purchase shares

of common stock, preferred stock, debt securities or other securities. We may issue warrants independently or together with other

securities. Our board of directors will determine the terms of the warrants.

Subscription Rights

We may offer subscription rights to purchase

of common stock, preferred stock, debt securities or other securities. We may issue subscription rights independently or together

with other securities. Our board of directors will determine the terms of the subscription rights.

Units

We may offer units consisting of some or all

of the securities described above, in any combination, including common stock, preferred stock, debt securities, warrants and/or

subscription rights. The terms of these units will be set forth in a prospectus supplement. The description of the terms of these

units in the related prospectus supplement will not be complete. You should refer to the applicable form of unit and unit agreement

for complete information with respect to these units.

RISK FACTORS

An investment in our securities involves a high

degree of risk. The prospectus supplement relating to a particular offering of securities will contain a discussion of the risks

applicable to an investment in the securities offered. Prior to making a decision about investing in our securities, you should

carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable prospectus supplement,

together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or

incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under

the heading “Risk Factors,” included in our most recent Annual Report on Form 10-K, as revised or supplemented by our

subsequent Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K that we have filed with the SEC, all of which are

incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with

the SEC in the future. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our operations.

FORWARD-LOOKING STATEMENTS

This prospectus and documents incorporated herein

by reference contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements involve a number of risks and uncertainties. We caution readers that any forward-looking

statement is not a guarantee of future performance and that actual results could differ materially from those contained in the

forward-looking statement. These statements are based on current expectations of future events. Such statements include, but are

not limited to, statements about future financial and operating results, plans, objectives, expectations and intentions, costs

and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, cost savings, objectives

of management, business strategies, debt financing, clinical trial timing and plans, the achievement of clinical and commercial

milestones, the advancement of our technologies and our product candidates, and other statements that are not historical facts.

You can find many of these statements by looking for words like “believes,” “expects,” “anticipates,”

“estimates,” “may,” “might,” “should,” “will,” “could,”

“plan,” “intend,” “project,” “seek” or similar expressions in this prospectus or

in documents incorporated by reference into this prospectus. We intend that such forward-looking statements be subject to the safe

harbors created thereby.

These forward-looking statements are based

on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying

assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations

and projections. Factors that might cause such a difference include those discussed in the heading “Risk Factors,”

included in our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form

10-Q or our Current Reports on Form 8-K that we have filed with the SEC, as well as those discussed in this prospectus and in the

documents incorporated by reference into this prospectus. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this prospectus or, in the case of documents referred to or incorporated by reference,

the date of those documents.

All subsequent written or oral forward-looking

statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking

statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events,

except as may be required under applicable U.S. securities law. If we do update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect to those or other forward-looking statements.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements

of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and are required to file annual, quarterly and other reports,

proxy statements and other information with the SEC. You may inspect and copy these reports, proxy statements and other information

at the public reference facilities maintained by the SEC in Washington, D.C., 100 F Street N.E., Washington, D.C. 20549. Copies

of such materials can be obtained from the SEC’s public reference section at prescribed rates. You may obtain information

on the operation of the public reference rooms by calling the SEC at (800) SEC-0330. Additionally, the SEC maintains

an Internet site (www.sec.gov) that contains reports, proxy and information statements, and various other information about us.

You may also inspect the documents described herein upon notice at our headquarters, 1185 South 1800 West, Suite 3, Woods Cross,

UT 84087 during normal business hours.

Information about us is also available at our

website at www.cleanspark.com. However, the information on our website is not a part of this prospectus and is not incorporated

by reference into this prospectus.

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information that we file with the SEC, which means that we can disclose important information to you by referring you to those

other documents. The information incorporated by reference is an important part of this prospectus, and information we file later

with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and

any future filings we make with the SEC under Section 13(a), 13(c), 14, or 15(d) of the Exchange Act prior to the termination

of any offering of securities made by this prospectus:

|

|

•

|

Our

Annual Report on Form 10-K for the fiscal year ended September 30, 2019, and filed with the SEC on December 16, 2019;

|

|

|

•

|

Our

Quarterly Reports on Form 10-Q for the quarters ended December 31, 2019, March 31, 2020 and June 30, 2020, and filed with

the SEC on February 10, 2020, May 11, 2020 and August 4, 2020, respectively;

|

|

|

•

|

Our

Current Reports on Form 8-K filed with the SEC on January 29, 2020, February 6, 2020, March 6, 2020 (amendment), March 10,

2020, March 16, 2020, April 9, 2020, May 6, 202, May 20, 2020, July 21, 2020, August 7, 2020, August 11, 2020 and September

1, 2020;

|

|

|

•

|

the description of our common

stock contained in our registration statement on Form 8-A filed with the SEC on January 22, 2020 under Section 12

of the Exchange Act, including any amendment or report filed for the purpose of updating such description; and

|

|

|

|

|

|

|

•

|

filings we make with the SEC pursuant to the

Exchange Act after the date of the initial registration statement, of which this prospectus is a part, and prior to the effectiveness

of the registration statement

|

Upon

written or oral request, we will provide without charge to each person, including any beneficial owner, to whom this prospectus

is delivered, a copy of any or all of such information that has been incorporated herein by reference (other than exhibits to

such documents unless such exhibits are specifically incorporated by reference into the documents that this prospectus incorporates).

Written or oral requests for copies should be directed to CleanSpark, Inc., Attn: Chief Executive Officer, 1185 S. 1800 West,

Suite 3, Woods Cross, Utah 84087, telephone number (702) 941-8047. See the section of this prospectus entitled “Where You

Can Find More Information” for information concerning how to read and obtain copies of materials that we file with the SEC

at the SEC’s public offices.

Any statement contained in this prospectus,

or in a document all or a portion of which is incorporated by reference, shall be modified or superseded for purposes of this prospectus

to the extent that a statement contained in this prospectus, any prospectus supplement or any document incorporated by reference

modifies or supersedes such statement. Any such statement so modified or superseded shall not, except as so modified or superseded,

constitute a part of this prospectus.

USE OF PROCEEDS

We will retain broad discretion over the use

of the net proceeds to us from the sale of our securities under this prospectus. Unless otherwise provided in the applicable

prospectus supplement, we intend to use the net proceeds from the sale of securities under this prospectus for general corporate

purposes, which may include funding software development, increasing our working capital and acquisitions or investments in businesses,

products or technologies that are complementary to our own. We will set forth in the prospectus supplement our intended use for

the net proceeds received from the sale of any securities. Pending the application of the net proceeds, we intend to invest the

net proceeds in short-term or long-term, investment-grade, interest-bearing securities.

PLAN OF DISTRIBUTION

We may sell the securities covered by this prospectus

to one or more underwriters for public offering and sale by them, and may also sell the securities to investors directly or through

agents. We will name any underwriter or agent involved in the offer and sale of securities in the applicable prospectus supplement.

We have reserved the right to sell or exchange securities directly to investors on our own behalf in jurisdictions where we are

authorized to do so. We may distribute the securities from time to time in one or more transactions:

|

|

●

|

at a fixed price or prices, which may be changed;

|

|

|

|

|

|

|

●

|

at market prices prevailing at the time of sale;

|

|

|

|

|

|

|

●

|

at prices related to such prevailing market prices; or

|

|

|

|

|

|

|

●

|

at negotiated prices.

|

We may directly solicit offers to purchase the

securities being offered by this prospectus. We may also designate agents to solicit offers to purchase the securities from time

to time. We will name in a prospectus supplement any agent involved in the offer or sale of our securities. Unless otherwise indicated

in a prospectus supplement, an agent will be acting on a best efforts basis, and a dealer will purchase securities as a principal

for resale at varying prices to be determined by the dealer.

If we utilize an underwriter in the sale of

the securities being offered by this prospectus, we will execute an underwriting agreement with the underwriter at the time of

sale and we will provide the name of any underwriter in the prospectus supplement that the underwriter will use to make resales

of the securities to the public. In connection with the sale of the securities, we, or the purchasers of securities for whom the

underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter

may sell the securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions

or commissions from the underwriters or commissions from the purchasers for whom they may act as agent.

We will provide in the applicable prospectus

supplement any compensation we pay to underwriters, dealers, or agents in connection with the offering of the securities, and any

discounts, concessions or commissions allowed by underwriters to participating dealers. Underwriters, dealers and agents participating

in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities Act of 1933, or the

Securities Act, and any discounts and commissions received by them and any profit realized by them on resale of the securities

may be deemed to be underwriting discounts and commissions. We may enter into agreements to indemnify underwriters, dealers and

agents against civil liabilities, including liabilities under the Securities Act, and to reimburse them for certain expenses. We

may grant underwriters who participate in the distribution of our securities under this prospectus an option to purchase additional

securities to cover any over-allotments in connection with the distribution.

The securities we offer under this prospectus

may or may not be listed on a securities exchange. To facilitate the offering of securities, certain persons participating in the

offering may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This may include

short sales of the securities, which involves the sale by persons participating in the offering of more securities than we sold

to them. In these circumstances, these persons would cover such short positions by making purchases in the open market or by exercising

their option to purchase additional securities. In addition, these persons may stabilize or maintain the price of the securities

by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to

dealers participating in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization

transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above

that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

We may engage in at the market offerings into

an existing trading market in accordance with Rule 415(a)(4) under the Securities Act. In addition, we may enter into derivative

transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions.

If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities

covered by this prospectus and the applicable prospectus supplement, including short sale transactions. If so, the third party

may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings

of stock, and they may use securities received from us in settlement of those derivatives to close out any related open borrowings

of stock. The third party in these sale transactions will be an underwriter and will be identified in the applicable prospectus

supplement. In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn

may sell the securities short using this prospectus. The financial institution or other third party may transfer its economic short

position to investors in our securities or in connection with a concurrent offering of other securities.

We will file a prospectus supplement to describe

the terms of any offering of our securities covered by this prospectus. The prospectus supplement will disclose:

|

|

●

|

the terms of the offer;

|

|

|

|

|

|

|

●

|

the names of any underwriters, including any managing underwriters, as well as any dealers or agents;

|

|

|

|

|

|

|

●

|

the purchase price of the securities from us;

|

|

|

|

|

|

|

●

|

the net proceeds to us from the sale of the securities;

|

|

|

|

|

|

|

●

|

any delayed delivery arrangements;

|

|

|

|

|

|

|

●

|

any underwriting discounts, commissions or other items constituting underwriters’ compensation, and any commissions paid to agents;

|

|

|

|

|

|

|

●

|

in a subscription rights offering, whether we have engaged dealer-managers to facilitate the offering or subscription, including their name or names and compensation;

|

|

|

|

|

|

|

●

|

any public offering price; and

|

|

|

|

|

|

|

●

|

other facts material to the transaction.

|

We will bear all or substantially all of the

costs, expenses and fees in connection with the registration of our securities under this prospectus. The underwriters, dealers

and agents may engage in transactions with us, or perform services for us, in the ordinary course of business.

DESCRIPTION OF CAPITAL STOCK

The description below of our capital stock

and provisions of our articles of incorporation and bylaws, as amended, are summaries and are qualified by reference to the articles

of incorporation and bylaws, as amended, and the applicable provisions of Nevada law.

General

Our articles of incorporation authorize us to

issue up to 20,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par

value per share.

As of September 21, 2020, there were 17,380,704

shares of common stock outstanding and 1,750,000 shares of preferred stock outstanding.

Common Stock

Voting rights. Each holder

of our common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the

election of directors. Our stockholders do not have cumulative voting rights in the election of directors. As a result, the holders

of a majority of the shares of common stock entitled to vote in any election of directors can elect all of the directors standing

for election, if they should so choose.

Dividends. Subject to preferences

that may be applicable to any then-outstanding preferred stock, holders of common stock are entitled to receive ratably those dividends,

if any, as may be declared from time to time by our Board out of legally available funds. We have never declared or paid any cash

dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business.

As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Liquidation. In the event

of our liquidation, dissolution or winding up of the Company, holders of common stock are entitled to share ratably in the net

assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction

of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock.

Rights and preferences. Holders

of common stock have no preemptive, conversion or subscription rights and there are no redemption or sinking fund provisions applicable

to the common stock. The rights, preferences and privileges of the holders of common stock are subject to, and may be adversely

affected by, the rights of the holders of shares of any series of preferred stock that we may designate in the future.

Fully paid and nonassessable. All

of our outstanding shares of common stock are, and the shares of common stock to be issued in this offering, if any, will be, fully

paid and nonassessable.

Preferred Stock

Under our articles of incorporation, as amended,

our Board has the authority, without further action by the stockholders (unless such stockholder action is required by applicable

law or the rules of any stock exchange or market on which our securities are then traded), to designate and issue up to 10,000,000

shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each such

series, to fix the designations, voting powers, preferences and rights of the shares of each wholly unissued series, and any qualifications,

limitations or restrictions thereof, and to increase or decrease the number of shares of any such series, but not below the number

of shares of such series then outstanding.

We will fix the designations, voting powers,

preferences and rights of the preferred stock of each series, as well as the qualifications, limitations or restrictions thereof,

in a certificate of designation relating to that series. We will file as an exhibit to our reports, or will incorporate by reference

from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred

stock we are offering before the issuance of that series of preferred stock. This description will include:

|

|

§

|

the title and stated value;

|

|

|

§

|

the number of shares we are offering;

|

|

|

§

|

the liquidation preference per share;

|

|

|

§

|

the dividend rate, period and payment date and method of calculation for dividends;

|

|

|

§

|

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

|

|

|

§

|

the procedures for any auction and remarketing, if any;

|

|

|

§

|

the provisions for a sinking fund, if any;

|

|

|

§

|

the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

|

|

|

§

|

any listing of the preferred stock on any securities exchange or market;

|

|

|

§

|

whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period;

|

|

|

§

|

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period;

|

|

|

§

|

voting rights, if any, of the preferred stock;

|

|

|

§

|

preemptive rights, if any;

|

|

|

§

|

restrictions on transfer, sale or other assignment, if any;

|

|

|

§

|

whether interests in the preferred stock will be represented by depositary shares;

|

|

|

§

|

a discussion of any material U.S. federal income tax considerations applicable to the preferred stock;

|

|

|

§

|

the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

|

|

|

§

|

any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

|

|

|

§

|

any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

|

Nevada law provides that the holders of preferred

stock will have the right to vote separately as a class (or, in some cases, as a series) on an amendment to our articles of incorporation

if the amendment would change the par value or, unless the articles of incorporation provided otherwise, the number of authorized

shares of the class or change the powers, preferences or special rights of the class or series so as to adversely affect the class

or series, as the case may be. This right is in addition to any voting rights that may be provided for in the applicable certificate

of designation.

Our Board may authorize the issuance of preferred

stock with voting, exchange or conversion rights that could adversely affect the voting power or other rights of the holders of

our common stock. Preferred stock could be issued quickly with terms designed to delay or prevent a change in control of our company

or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the

market price of our common stock.

Series A Preferred Stock

On April 15, 2015, pursuant to Article IV of

our Articles of Incorporation, the Company’s Board of Directors voted to designate a class of preferred stock entitled Series

A Preferred Stock, consisting of up to one million (1,000,000) shares, par value $0.001. Under the Certificate of Designation,

holders of Series A Preferred Stock will be entitled to quarterly dividends on 2% of our earnings before interest, taxes and amortization.

The dividends are payable in cash or common stock. The holders will also have a liquidation preference on the state value of $0.02

per share plus any accumulated but unpaid dividends. The holders are further entitled to have the Company redeem their Series A

Preferred Stock for three shares of common stock in the event of a change of control and they are entitled to vote together with

the holders of the Company’s common stock on all matters submitted to stockholders at a rate of forty-five (45) votes for

each share held.

On October 4, 2019, pursuant to Article IV of

our Articles of Incorporation, our Board of Directors voted to increase the number of shares of preferred stock designated as Series

A Preferred Stock from one million (1,000,000) shares to two million (2,000,000) shares, par value $0.001.

Series B Preferred Stock

On April 16, 2019, pursuant to Article IV of

our Articles of Incorporation, the Company’s Board of Directors voted to designate a class of preferred stock entitled Series

B Preferred Stock, consisting of up to one hundred thousand (100,000) shares, par value $0.001. Under the Certificate of Designation,

the holders of Series B Preferred Stock are entitled to the following powers, designations, preferences and relative participating,

optional and other special rights, and the following qualifications, limitations and restrictions, among others as set forth in

the Certificate of Designation:

|

|

§

|

The holders of shares of Series B Preferred Stock will have no right to vote on any matters, questions or proceedings of the Company including, without limitation, the election of directors;

|

|

|

§

|

Commencing on the date of issuance, the Series B Preferred Stock will accrue cumulative in kind accruals (“the Accruals”) at the rate of 7.5% per annum;

|

|

|

§

|

Upon any liquidation, dissolution or winding up of the Company, the holders of the Series B Preferred Stock will be entitled to be paid out of the assets of the Company available for distribution to its stockholders an amount with respect to each share of Series B Preferred Stock equal to $5,000.00 (the “Face Value”), plus an amount equal to any accrued but unpaid Accruals thereon (the “Liquidation Value”);

|

|

|

§

|

On maturity, the Company may redeem the Series B Preferred Stock by paying the holder the Liquidation Value;

|

|

|

§

|

Before maturity, the Company may redeem the Series B Preferred stock on 30 days’ notice by paying 145% of the outstanding Face Value per share;

|

|

|

§

|

If the Company determines to liquidate, dissolve or wind-up its business and affairs, the Company will, within three trading days of such determination and prior to effectuating any such action, redeem all outstanding shares of Series B Preferred Stock;

|

|

|

§

|

In the event of a conversion of any shares of Series B Preferred Stock, the Company will (a) satisfy the payment of the Conversion Premium, which is defined as the Face Value of the shares converted multiplied by the product of 7.5% and the number of whole years between issuance and maturity, and (b) issue to the holder of the shares of Series B Preferred Stock a number of conversion shares equal to the Face Value divided by the applicable Conversion Price (defined as 90% of the of the 5 lowest individual daily volume weighted average prices of the Common Stock from issuance to conversion less $0.075 per share, but no less than the Floor Price [$1.00 prior to corporate approvals to increase the authorized stock and approve the financing and $0.35 after approvals]) with respect to the number of shares converted;

|

|

|

§

|

if at any time the Company grants, issues or sells any options, convertible securities or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which holder could have acquired if holder had held the number of shares of Common Stock acquirable upon conversion of Series B Preferred Stock;

|

|

|

▪

|

At maturity (2 years from issuance), all outstanding shares of Series B Preferred Stock shall automatically convert into common stock at the Conversion Price; and

|

|

|

▪

|

At no time may the holders of Series B Preferred Stock own more than 4.99% of the outstanding common stock in the Company.

|

On March 10, 2020, the Company terminated the

obligation to issue any Series B Preferred Stock, has issued no Series B Preferred Stock and has filed a withdrawal of the Series

B Certificate of Designation which was filed with the Nevada Secretary of State. No Series B Preferred Stock was ever issued.

Stock Options

The Company sponsors a

stock-based incentive compensation plan known as the 2017 Incentive Plan (the “Plan”), which was established by the

Board of Directors of the Company on June 19, 2017. A total of 300,000 shares were initially reserved for issuance under the 2017

Plan. As of July 20, 2020, there were 21,360 shares available for issuance under the 2017 Plan. See Action 2 for the Plan Amendment

to increase the reserved option pool to 1,500,000 shares.

The 2017 Plan allows the

Company to grant incentive stock options, non-qualified stock options, stock appreciation right, or restricted stock. The incentive

stock options are exercisable for up to ten years, at an option price per share not less than the fair market value on the date

the option is granted. The incentive stock options are limited to persons who are regular full-time employees of the Company at

the date of the grant of the option. Non-qualified options may be granted to any person, including, but not limited to, employees,

independent agents, consultants and attorneys, who the Company’s Board believes have contributed, or will contribute, to

the success of the Company. Non-qualified options may be issued at option prices of less than fair market value on the date of

grant and may be exercisable for up to ten years from date of grant. The option vesting schedule for options granted is determined

by the Board of Directors at the time of the grant. The 2017 Plan provides for accelerated vesting of unvested options if there

is a change in control, as defined in the 2017 Plan.

As

of September 21, 2020, there are options exercisable to purchase 224,757 shares of common stock in the Company and 53,191 unvested

options outstanding that cannot be exercised until vesting conditions are met. As of September 21, 2020, the outstanding options

have a weighted average remaining term of 2.37 years and an intrinsic value of $1,555,561.

Warrants

As

of September 21, 2020, there are warrants exercisable to purchase 1,289,779 shares

of common stock in the Company and 24,286 unvested

warrants outstanding that cannot be exercised until vesting conditions are met. 996,198 of

the warrants require a cash investment to exercise as follows ,

5,000 required a cash investment of $8.00 per share, 449,865 require a cash investment of $15.00 per share, 125,000 require a

cash investment of $20.00 per share, 103,000 require a cash investment of $25.00 per share, 200,000 require an investment of

$35.00 per share, 10,000 require an investment of $40.00 per share, 60,000 require an investment of $50.00 per share, 38,333

require a cash investment of $75.00 per share and 5,000 require a cash investment of $100.00 per share. 317,867 of the

outstanding warrants contain provisions allowing a cashless exercise at their respective exercise prices.

Registration Rights

On December 28, 2018 and April 17, 2019, the

Company agreed with the Investor that it will keep a registration available to cover the resale of the Warrant Shares issued in

each of the financings.

Listing

The Company’s Common Stock is listed on

the Nasdaq Capital Market.

Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379

provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation

or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws

do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity

to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt,

among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more

stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State

of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our

company.

Transfer Agent and Registrar

The transfer agent and registrar for

our common stock is Action Stock Transfer. Its address is 2469 E. Fort Union Blvd, Suite 214 Salt Lake City, UT 84121.

DESCRIPTION

OF DEBT SECURITIES

We may issue debt securities from time to time,

in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. While the terms we

have summarized below will apply generally to any debt securities that we may offer under this prospectus, we will describe the

particular terms of any debt securities that we may offer in more detail in the applicable prospectus supplement. The terms of

any debt securities offered under a prospectus supplement may differ from the terms described below. Unless the context requires

otherwise, whenever we refer to the indenture, we also are referring to any supplemental indentures that specify the terms of a

particular series of debt securities.

We will issue the debt securities under the

indenture that we will enter into with the trustee named in the indenture. The indenture will be qualified under the Trust Indenture

Act of 1939, as amended, or the Trust Indenture Act. We have filed the form of indenture as an exhibit to the registration statement

of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities

being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated

by reference from reports that we file with the SEC.

The following summary of material provisions

of the debt securities and the indenture is subject to, and qualified in its entirety by reference to, all of the provisions of

the indenture applicable to a particular series of debt securities. We urge you to read the applicable prospectus supplements and

any related free writing prospectuses related to the debt securities that we may offer under this prospectus, as well as the complete

indenture that contains the terms of the debt securities.

General

The indenture does not limit the amount of debt

securities that we may issue. It provides that we may issue debt securities up to the principal amount that we may authorize and

may be in any currency or currency unit that we may designate. Except for the limitations on consolidation, merger and sale of

all or substantially all of our assets contained in the indenture, the terms of the indenture do not contain any covenants or other

provisions designed to give holders of any debt securities protection against changes in our operations, financial condition or

transactions involving us.

We may issue the debt securities issued under

the indenture as “discount securities,” which means they may be sold at a discount below their stated principal amount.

These debt securities, as well as other debt securities that are not issued at a discount, may be issued with “original issue

discount,” or OID, for U.S. federal income tax purposes because of interest payment and other characteristics or terms of

the debt securities. Material U.S. federal income tax considerations applicable to debt securities issued with OID will be described

in more detail in any applicable prospectus supplement.

We will describe in the applicable prospectus

supplement the terms of the series of debt securities being offered, including:

|

|

§

|

the title of the series of debt securities;

|

|

|

§

|

any limit upon the aggregate principal amount that may be issued;

|

|

|

§

|

the maturity date or dates;

|

|

|

§

|

the form of the debt securities of the series;

|

|

|

§

|

the applicability of any guarantees;

|

|

|

§

|

whether or not the debt securities will be secured or unsecured, and the terms of any secured debt;

|

|

|

§

|

whether the debt securities rank as senior debt, senior subordinated debt, subordinated debt or any combination thereof, and the terms of any subordination;

|

|

|

§

|

if the price (expressed as a percentage of the aggregate principal amount thereof) at which such debt securities will be issued is a price other than the principal amount thereof, the portion of the principal amount thereof payable upon declaration of acceleration of the maturity thereof, or if applicable, the portion of the principal amount of such debt securities that is convertible into another security or the method by which any such portion shall be determined;

|

|

|

§

|

the interest rate or rates, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining such dates;

|

|

|

§

|

our right, if any, to defer payment of interest and the maximum length of any such deferral period;

|

|

|

§

|

if applicable, the date or dates after which, or the period or periods during which, and the price or prices at which, we may, at our option, redeem the series of debt securities pursuant to any optional or provisional redemption provisions and the terms of those redemption provisions;

|

|

|

§

|

the date or dates, if any, on which, and the price or prices at which we are obligated, pursuant to any mandatory sinking fund or analogous fund provisions or otherwise, to redeem, or at the holder’s option to purchase, the series of debt securities and the currency or currency unit in which the debt securities are payable;

|

|

|

§

|

the denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple thereof;

|

|

|

§

|

any and all terms, if applicable, relating to any auction or remarketing of the debt securities of that series and any security for our obligations with respect to such debt securities and any other terms which may be advisable in connection with the marketing of debt securities of that series;

|

|

|

§

|

whether the debt securities of the series shall be issued in whole or in part in the form of a global security or securities; the terms and conditions, if any, upon which such global security or securities may be exchanged in whole or in part for other individual securities; and the depositary for such global security or securities;

|

|

|

§

|

if applicable, the provisions relating to conversion or exchange of any debt securities of the series and the terms and conditions upon which such debt securities will be so convertible or exchangeable, including the conversion or exchange price, as applicable, or how it will be calculated and may be adjusted, any mandatory or optional (at our option or the holders’ option) conversion or exchange features, the applicable conversion or exchange period and the manner of settlement for any conversion or exchange;

|

|

|

§

|

additions to or changes in the covenants applicable to the particular debt securities being issued, including, among others, the consolidation, merger or sale covenant;

|

|

|

§

|

additions to or changes in the events of default with respect to the securities and any change in the right of the trustee or the holders to declare the principal, premium, if any, and interest, if any, with respect to such securities to be due and payable;

|

|

|

§

|

additions to or changes in or deletions of the provisions relating to covenant defeasance and legal defeasance;

|

|

|

§

|

additions to or changes in the provisions relating to satisfaction and discharge of the indenture;

|

|

|

§

|

additions to or changes in the provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the indenture;

|

|

|

§

|

the currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars;

|

|

|

§

|

whether interest will be payable in cash or additional debt securities at our or the holders’ option and the terms and conditions upon which the election may be made;

|

|

|

§

|

the terms and conditions, if any, upon which we will pay amounts in addition to the stated interest, premium, if any, and principal amounts of the debt securities of the series to any holder that is not a “United States person” for federal tax purposes;

|

|

|

§

|

any restrictions on transfer, sale or assignment of the debt securities of the series; and

|

|

|

§

|