Citizens Holding Company (NASDAQ:CIZN) announced today results

of operations for the three and nine months ended September 30,

2019.

Effective October 1, 2019, the Company completed its acquisition

by merger of Charter Bank (“Charter”), in a transaction valued at

approximately $19.7 million. The Company issued 666,099 shares of

common stock and paid approximately $6.1 million in cash to Charter

shareholders, excluding cash paid for fractional shares. At

closing, Charter merged with and into the Company, with the Company

the surviving corporation in the merger, immediately thereafter,

Charter merged with and into the Bank, with the Bank the surviving

corporation in the merger. Founded in 2008, Charter has multiple

locations throughout the Mississippi Gulf Coast. As of September

30, 2019, Charter had approximately $141.1 million in total assets,

approximately $104.2 million in gross loans and $127.6 million in

total deposits.

Net income for the three months ended September 30, 2019 was

$1.333 million, or $0.27 per share-basic and diluted, a decrease of

$163 thousand from a net income of $1.497 million, or $0.31 per

share-basic and diluted for the same quarter in 2018. The majority

of the decrease relates to an increase in the interest paid on

interest bearing liabilities partially offset by an increase in

interest income and non-interest income.

Net interest income for the third quarter of 2019, after the

provision for loan losses, was $5.906 million, approximately 8.1%

lower than the same period in 2018. The provision for loan losses

for the three months ended September 30, 2019 was $12 thousand

compared to a provision for loan losses of $289 thousand for the

same period in 2018. The decrease in the provision reflects

management’s estimate of inherent losses in the loan portfolio

including the impact of current local and national economic

conditions and minimal historical loan losses in recent years. The

net interest margin was 2.59% for the third quarter of 2019

compared to 2.95% for the same period in 2018. This decrease was

due to an increase in interest rates paid on interest bearing

liabilities partially offset by an increase in yields on interest

bearing assets.

Non-interest income increased in the third quarter of 2019 by

$286 thousand, or 12.9%, while non-interest expenses decreased $27

thousand, or 0.4%, compared to the same period in 2018. The

increase in non-interest income was mainly the result of gains from

security sales due to strategic investment decisions partially

offset by a decrease in mortgage loan origination income from

long-term mortgages originated for sale in the secondary market.

Non-interest expense decreased due to a reduction in salaries and

employee benefits, occupancy expense and other non-interest

expenses. The decrease in other non-interest expense was due mainly

to cost containment throughout the Company partially offset by an

increase in one-time legal and consulting fees related to the

acquisition of Charter.

Net income for the nine months ended September 30, 2019

decreased 20.7% to $3.931 million, or $0.80 per share-basic and

diluted, from $4.957 million, or $1.01 per share-basic and diluted,

for the nine months ended September 30, 2018.

Net interest income for the nine months ended September 30,

2019, after the provision for loan losses, decreased 12.2% to

$17.862 million from $20.335 million for the same period in 2018.

Net interest margin for the nine months ended September 30, 2019,

decreased to 2.62% in 2019 from 3.10% in the same period in 2018.

The provision for loan losses for the nine months ended September

30, 2019 was $472 thousand compared to $148 thousand in 2018.

Non-interest income increased by $227 thousand, or 3.5%, and

non-interest expense decreased by $1.059 million, or 5.1%, for the

nine months ended September 30, 2019 when compared to the same

period in 2018. The increase in other non-interest income was

discussed previously. The decrease in other non-interest expense

was mainly due to a refund of excess prepaid postage and continued

cost containment focus throughout the Company.

Total assets as of September 30, 2019 increased to $1.050

billion, up $90.973 million, or 9.5%, when compared to $958.630

million at December 31, 2018. Deposits increased by $38.092

million, or 5.0%, and loans, net of unearned income, increased by

$44.221 million, or 10.3%, when compared to December 31, 2018. The

increase in loans, net of unearned income, was due to new loan

demand in excess of loan paydowns. Non-performing assets increased

by $2.610 million to $15.962 million at September 30, 2019 as

compared to $13.352 million at December 31, 2018, due to an

increase in non-accrual loans and loans 90 days or more past due

and still accruing partially offset by a decrease in other real

estate owned.

During the nine months ended September 30, 2019, the Company

paid dividends totaling $0.72 per share.

Citizens and its wholly-owned subsidiary, Citizens Bank, are

both headquartered in Philadelphia, Mississippi. The Bank currently

has twenty-four banking locations in fourteen counties in East

Central and South Mississippi and a Loan Production Office in

Oxford, Mississippi to offer loan services to north Mississippi. In

addition to full service commercial banking, the Bank offers

mortgage loans, title insurance services through its subsidiary,

Title Services, LLC, and a full range of Internet banking services

including online banking, bill pay and cash management services for

businesses. Internet banking services are available at the Bank’s

website, www.thecitizensbankphila.com.

Citizens stock is listed on the NASDAQ Global Market and is traded

under the symbol CIZN. The Company’s transfer agent is American

Stock Transfer & Trust Company. Information about Citizens may

be obtained by accessing its corporate website at

www.citizensholdingcompany.com.

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements

other than statements of historical facts included in this release

regarding the Company’s financial position, results of operations,

business strategies, plans, objectives and expectations for future

operations, are forward looking statements. The Company can give no

assurances that the assumptions upon which such forward-looking

statements are based will prove to have been correct.

Forward-looking statements speak only as of the date they are made.

The Company does not undertake a duty to update forward-looking

statements to reflect circumstances or events that occur after the

date the forward-looking statements are made. Such forward-looking

statements are subject to certain risks, uncertainties and

assumptions. The risks and uncertainties that may affect the

operation, performance, development and results of the Company’s

and the Bank’s business include, but are not limited to, the

following: (a) the risk of adverse changes in business conditions

in the banking industry generally and in the specific markets in

which the Company operates; (b) changes in the legislative and

regulatory environment that negatively impact the Company and Bank

through increased operating expenses; (c) increased competition

from other financial institutions; (d) the impact of technological

advances; (e) expectations about the movement of interest rates,

including actions that may be taken by the Federal Reserve Board in

response to changing economic conditions; (f) changes in asset

quality and loan demand; (g) expectations about overall economic

strength and the performance of the economics in the Company’s

market area; and (h) other risks detailed from time to time in the

Company’s filings with the Securities and Exchange Commission.

Should one or more of these risks materialize or should any such

underlying assumptions prove to be significantly different, actual

results may vary significantly from those anticipated, estimated,

projected or expected.

Citizens Holding Company

Financial Highlights

(amounts in thousands, except

share and per share data)

For the Three Months Ending

For the Nine Months Ending

September 30,

June 30,

September 30,

September 30,

September 30,

2019

2019

2018

2019

2018

INTEREST INCOME

Loans, including fees

$5,940

$5,830

$5,166

$17,220

$14,867

Investment securities

2,291

2,738

2,697

7,728

8,254

Other interest

213

82

24

530

145

8,444

8,650

7,887

25,478

23,266

INTEREST EXPENSE

Deposits

1,923

1,916

710

5,568

1,727

Other borrowed funds

603

528

458

1,576

1,063

2,526

2,444

1,168

7,144

2,790

NET INTEREST INCOME

5,918

6,206

6,719

18,334

20,476

PROVISION FOR LOAN LOSSES

12

265

289

472

141

NET INTEREST INCOME AFTER

PROVISION FOR LOAN LOSSES

5,906

5,941

6,430

17,862

20,335

NON-INTEREST INCOME

Service charges on deposit accounts

1,126

1,046

1,171

3,269

3,382

Other service charges and fees

864

769

762

2,317

2,147

Other non-interest income

517

257

288

1,040

870

2,507

2,072

2,221

6,626

6,399

NON-INTEREST EXPENSE

Salaries and employee benefits

3,509

3,469

3,668

10,525

11,011

Occupancy expense

1,288

1,409

1,486

4,120

4,373

Other non-interest expense

2,071

1,444

1,740

5,185

5,505

6,868

6,322

6,894

19,830

20,889

NET INCOME BEFORE TAXES

1,545

1,691

1,757

4,658

5,845

INCOME TAX EXPENSE

212

320

260

727

888

NET INCOME

$1,333

$1,371

$1,497

$3,931

$4,957

Earnings per share - basic

$0.27

$0.28

$0.31

$0.80

$1.01

Earnings per share - diluted

$0.27

$0.28

$0.31

$0.80

$1.01

Dividends Paid

$0.24

$0.24

$0.24

$0.72

$0.72

Average shares outstanding - basic

4,900,030

4,897,970

4,899,520

4,896,871

4,888,372

Average shares outstanding - diluted

4,901,495

4,900,891

4,904,613

4,899,192

4,897,958

For the Period Ended,

September 30,

June 30,

December 31,

2019

2019

2018

Period End Balance Sheet Data:

Total assets

$1,049,603

$1,034,031

$958,630

Total earning

assets

971,289

953,317

885,416

Loans, net of

unearned income

473,498

465,736

429,277

Allowance for

loan losses

3,806

3,821

3,372

Total

deposits

794,314

794,859

756,222

Short-term

borrowings

-

12,000

-

Long-term

borrowings

8

10

15

Shareholders'

equity

98,999

96,136

83,866

Book value per

share

$20.15

$19.57

$17.09

Period End Average Balance Sheet Data:

Total assets

$1,026,700

$1,019,184

$971,893

Total earning

assets

951,520

943,158

894,099

Loans, net of

unearned income

453,503

445,985

418,136

Total

deposits

807,230

809,954

760,992

Short-term

borrowings

1,983

1,662

20,986

Long-term

borrowings

11

12

512

Shareholders'

equity

90,885

87,995

83,907

Period End Non-performing Assets:

Non-accrual

loans

$12,359

$11,157

$9,839

Loans 90+ days

past due and accruing

220

44

73

Other real estate

owned

3,383

3,383

3,440

As of

September 30,

June 30,

December 31,

2019

2019

2018

Year to Date Net charge-offs as a

percentage of

average net loans

0.01%

0.00%

0.00%

Year to Date Performance Ratios:

Return on average

assets(1)

0.51%

0.51%

0.69%

Return on average

equity(1)

5.77%

5.90%

7.95%

Year to Date Net Interest

Margin (tax

equivalent)(1)

2.62%

2.69%

3.05%

(1) Annualized

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191024005164/en/

Citizens Holding Company, Philadelphia Robert T. Smith,

601/656-4692 rsmith@tcbphila.com

Citizens (NASDAQ:CIZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

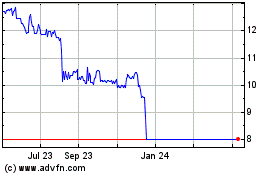

Citizens (NASDAQ:CIZN)

Historical Stock Chart

From Apr 2023 to Apr 2024