Current Report Filing (8-k)

February 24 2021 - 5:12PM

Edgar (US Regulatory)

000109166700012718330001271834falsefalsefalse0001091667chtr:CCOHoldingsCapitalCorp.Member2021-02-232021-02-230001091667chtr:CCOHoldingsLLCMember2021-02-232021-02-2300010916672021-02-232021-02-23

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 23, 2021

Charter Communications, Inc.

CCO Holdings, LLC

CCO Holdings Capital Corp.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

|

|

|

|

|

|

|

|

|

001-33664

|

|

84-1496755

|

|

001-37789

|

|

86-1067239

|

|

333-112593-01

|

|

20-0257904

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

400 Atlantic Street

Stamford, Connecticut 06901

(Address of principal executive offices including zip code)

(203) 905-7801

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, $.001 Par Value

|

CHTR

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. OTHER EVENTS.

On February 23, 2021, Charter Communications, Inc. (“Charter”) and Liberty Broadband Corporation (“LBB”) entered into a letter agreement (the “Letter Agreement”). The Letter Agreement implements LBB’s obligations under the Amended and Restated Stockholders Agreement by and among Charter Communications, Inc., Charter (formerly known as CCH I, LLC), LBB and Advance/Newhouse Partnership (“Advance”), dated as of May 23, 2015 (as amended, the “Stockholders Agreement”) to participate in share repurchases by Charter to the extent necessary so that LBB’s ownership of Charter does not exceed the LBB Cap (as defined below).

Under the Letter Agreement, the applicable Liberty Party (as defined in the Stockholders Agreement) will sell to Charter, generally on a monthly basis, a number of shares of Charter’s Class A common stock (“Class A Common Stock”) representing an amount sufficient for LBB’s ownership of Charter to be reduced such that it does not exceed the ownership cap then applicable to LBB under the Stockholders Agreement (the “LBB Cap”) as Charter reduces outstanding shares through repurchases from time to time. At the time of each monthly purchase of Class A Common Stock from LBB under the Letter Agreement, Charter will pay the applicable Liberty Party (as defined in the Stockholders Agreement) a purchase price per share equal to the volume weighted average price per share paid by Charter for shares repurchased during such immediately preceding calendar month other than (i) purchases from Advance, (ii) purchases in privately negotiated transactions or (iii) purchases for the withholding of shares of Class A Common Stock pursuant to equity compensation programs of Charter. The Letter Agreement terminates upon the earliest of (i) mutual written agreement of the parties, (ii) the termination of the Stockholders Agreement as to Charter or LBB in accordance with its terms and (iii) 12:01 a.m. following the first end date of a repurchase period occurring at least ten days after either party, in its sole discretion, delivers a written termination notice to the other party (provided, that, in the case of clause (iii), the rights and obligations of the parties under the Letter Agreement survive with respect to a repurchase period ending prior to such termination), and, upon any termination, the requirement of LBB to sell shares of Class A Common Stock to Charter to the extent necessary so that LBB’s ownership of Charter does not exceed the LBB Cap would revert to the terms of the Stockholders Agreement.

A copy of the Letter Agreement is filed herewith as Exhibit 99.1 and is incorporated herein by reference. The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of that document.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

Cautionary Statement Regarding Forward-Looking Statements

This current report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), regarding, among other things, our plans, strategies and prospects, both business and financial. Although we believe that our plans, intentions and expectations as reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions, including, without limitation, the factors described under "Risk Factors" from time to time in our filings with the Securities and Exchange Commission ("SEC"). Many of the forward-looking statements contained in this current report may be identified by the use of forward-looking words such as "believe," "expect," "anticipate," "should," "planned," "will," "may," "intend," "estimated," "aim," "on track," "target," "opportunity," “tentative,” "positioning," "designed," "create," "predict," "project," "initiatives," "seek," "would," "could," "continue," "ongoing," "upside," "increases," "focused on" and "potential," among others.

All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this current report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, each of Charter Communications, Inc., CCO Holdings, LLC and CCO Holdings Capital Corp. has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHARTER COMMUNICATIONS, INC.,

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin D. Howard

|

|

|

|

|

Kevin D. Howard

|

|

Date: February 24, 2021

|

|

|

Executive Vice President, Chief Accounting Officer and Controller

|

|

|

|

|

|

|

|

|

|

|

|

|

CCO Holdings, LLC

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin D. Howard

|

|

|

|

|

Kevin D. Howard

|

|

Date: February 24, 2021

|

|

|

Executive Vice President, Chief Accounting Officer and Controller

|

|

|

|

|

|

|

|

|

|

|

|

|

CCO Holdings Capital Corp.

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin D. Howard

|

|

|

|

|

Kevin D. Howard

|

|

Date: February 24, 2021

|

|

|

Executive Vice President, Chief Accounting Officer and Controller

|

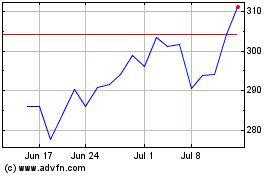

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

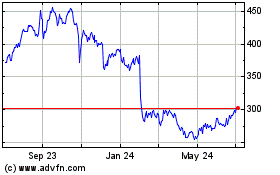

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Apr 2023 to Apr 2024