By Drew FitzGerald and Lillian Rizzo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 11, 2020).

Americans' urge to disconnect the living-room cable is spreading

to Main Street.

The largest cable and satellite TV companies lost more than two

million customers in the first three months of the year, the

industry's sharpest quarterly decline on record, as restaurants,

bars and hotels hit by the coronavirus pandemic joined consumers

canceling or pausing service.

Those commercial disconnections so far make up only a small

portion of the overall customer losses, but they are making a bad

situation worse for business-focused providers such as DirecTV

owner AT&T Inc. The industry's first-quarter decline was

uneven, with sharper drops at Comcast Corp. and Dish Network Corp.

and narrower losses at Charter Communications Inc.

Before the pandemic, those TV distributors were already being

squeezed as more households shifted to streaming services such as

Netflix Inc., Amazon.com Inc.'s Prime Video and Walt Disney Co.'s

Disney+ and Hulu.

Cable and satellite companies warned in recent weeks that the

pace of "cord-cutting" could pick up as the pandemic pinches U.S.

households, particularly if U.S. live sports -- one of the biggest

draws of having a cable package -- don't return to action for a

long time.

Hotels have stopped paying for TV sets in rooms where few guests

are staying, according to pay-TV companies and analysts, and some

airlines are pushing for breaks on the cost of in-flight

entertainment. Sports bars that are able to open their doors say

they have no games to show in any event.

On Thursday, Dish said it had paused or waived charges on about

250,000 commercial accounts. Dish finance chief Paul Orban said the

"vast majority" of those clients would start paying again in the

coming quarters, but he didn't specify a timeline for such a

recovery.

AT&T reported lower revenue from hotels, bars and

restaurants in the first quarter without quantifying the

decline.

Monsoons Tap and Grill saved more than $1,600 a month by cutting

its subscription to DirecTV, which told the restaurant it could

pause service through the summer, according to co-owner Daniel

Liebeskind. The Tucson, Ariz.,-area business plans to reopen to

in-person diners in the coming days, without its typical baseball

and basketball games on TV and with tables spaced farther

apart.

"We actually turned them around so they're not facing the TVs,

because there isn't anything on," Mr. Liebeskind said. Baseball,

basketball and hockey leagues have put their games on hiatus.

Pay-TV companies are expected to face a harder time maintaining

revenue from more vulnerable businesses struggling to survive the

summer.

"The most disconcerting, troublesome area that we're seeing is

what's happening down in small business," AT&T Chief Executive

Randall Stephenson, who plans to step down as CEO at the end of

June, said during an April conference call.

The closure of small businesses across the board has dented

pay-TV company earnings.

"It will likely take time for this part of the business to

recover," Charter Chief Financial Officer Chris Winfrey said of the

small-and-medium-business segment in an April earnings call. Mr.

Winfrey added that certain bars, restaurants and hotels are among

the businesses that have reduced service or monthly bills until

they fully reopen.

Charter, which has nearly two million small-business customers,

said many of its business customers are still closed.

AT&T lost more than one million domestic pay-TV customers in

the first quarter and warned of more defections from cash-strapped

households and businesses later this year. Dish ended the March

quarter with 413,000 fewer paying subscribers.

Comcast saw 409,000 customers cancel their pay-TV subscriptions

in the first quarter, more than half of its total 2019 pay-TV

subscriber losses. The company partly attributed the first-quarter

losses to a price increase; cable TV revenue remained flat for the

same reason.

Comcast, Charter and Altice USA Inc. have so far managed to

offset the pay-TV revenue drop with more broadband internet

subscribers. Internet use has soared over the past two months as

millions of U.S. residents stayed home during the pandemic and

picked up on-demand services like Netflix.

Craig Moffett, an analyst for telecom consulting firm

MoffettNathanson, said the virus -- and the loss of live sports --

has accelerated a "death spiral" for the pay-TV category.

"Sports are the glue that hold the whole thing together," Mr.

Moffett said. "Without sports, the system is unraveling."

Eric Goldspiel owns three bars: Divine Bar and Grill and 895

Bar, both in Brooklyn, N.Y.; and El Coqui Bar & Billiards in

Queens, N.Y. He said he would likely close two of them

permanently.

His DirecTV service has been suspended at all three locations,

and the internet service -- provided by Altice's Optimum at the two

Brooklyn bars and Charter's Spectrum in Queens -- lapsed.

Mr. Goldspiel has applied for Paycheck Protection Program loans,

to pay his 28 staffers across all three locations. "I'm not going

to use a PPP loan to pay my cable bill," he said.

Mr. Liebeskind, the co-owner of Monsoons, said he expects to pay

for live sports after games restart. But for now, the owners and

their families are making do with prerecorded TV while they fulfill

pickup orders.

"If it gets boring during the day, we have Hulu," he said.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and

Lillian Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

May 11, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

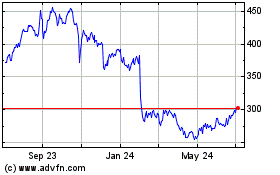

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

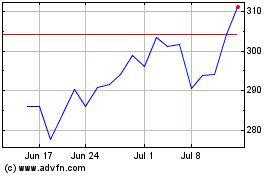

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Apr 2023 to Apr 2024