Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

August 14 2019 - 6:08AM

Edgar (US Regulatory)

Filed by C&F Financial Corporation

pursuant to Rule 425 under the

Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Peoples Bankshares, Incorporated

Q 1.

Why is this merger a positive event for customers, employees, and local communities?

A 1.

The merger represents a unique opportunity to build a financially-strong bank committed to our Virginia communities, a bank poised for long-term independence and therefore long-term service to our customers, employees, and shareholders. The combination of C&F Bank and Peoples Community Bank will also greatly increase the products and services, locations, and ATMs available to customers of both banks.

Q 2.

What can you tell me about Peoples Community Bank (Peoples)?

A 2.

Headquartered in Montross Virginia, Peoples Community Bank was founded in 1913 and is the oldest bank based on the Northern Neck of Virginia. The bank has a strong reputation for outstanding customer service, community involvement, and helping customers achieve financial success. Peoples has five locations from Warsaw to Fredericksburg as well as a commercial lending officer in Richmond. Long-time banker Robert K. (Bob) Bailey, III is the President and CEO of Peoples Community Bank.

Q 3.

What can you tell me about C&F Bank (C&F)?

A 3.

C&F Bank was formed in 1927 in West Point, Virginia and offers 25 locations to personal and business customers, including branches in the counties of Cumberland, Powhatan, Goochland, Chesterfield, Henrico, Hanover, New Kent, James City, Middlesex, and York as well as the town of West Point and cities of Charlottesville, Richmond, Newport News, and Williamsburg. The bank recently opened a financial center in Williamsburg to house representatives from its wealth management, mortgage, and commercial banking teams. Additional financial centers with retail banking services are slated to open in downtown Richmond and Charlottesville in 2020.

Thomas F. (Tom) Cherry is the President and CEO of C&F Bank; he is only the fourth President in the bank’s 92‑year history and has served in a variety of leadership and advisory roles over his 22 years with C&F.

There are three additional subsidiaries that comprise C&F Financial Corporation in addition to C&F Bank: C&F Wealth Management Corporation offers full investment and insurance services; C&F Mortgage Corporation provides mortgage, title, and appraisal services; and, C&F Finance Company purchases automobile, marine, and RV loan contracts.

Q 4.

I’m worried about the employees at my Peoples Community branch; will any jobs be eliminated as a result of the merger?

A 4.

Retaining Peoples employees is a top priority and something we know you care a lot about as well. We are working hard to quickly analyze the staffing needs of the combined bank to minimize job eliminations. With regular attrition and the hiring freeze for certain positions

C&F has already initiated, we believe we will be able to retain a majority of Peoples Bank staff.

Q 5. Will there be any branch closures or consolidations as part of this merger? When can I begin using a C&F Bank or Peoples branch?

A 5.

No branch closings are planned as a part of this merger and we are excited at the prospect of offering customers of both banks more locations for their convenience when Peoples branches convert to C&F products, systems, and signage, likely in the second quarter of 2020. Customers of each bank will use their existing branch and ATM locations until we reach that milestone. We are not in a hurry to do this conversion as it is far more important to prioritize quality for our customers.

Q 6. Are my Peoples accounts changing immediately? What types of accounts will C&F Bank offer?

A 6.

No changes will be made to your Peoples account terms and conditions at this time; however, we do look forward to giving you more options for managing your finances and achieving financial goals in the very near future. C&F Bank offers a comprehensive and innovative suite of deposit, loan, and digital services to both personal and business customers. Business customers and prospects will also benefit from enhanced treasury management services and a larger lending capacity than previously available at Peoples.

Q 7. How will I know what’s happening with the transition of Peoples Community Bank into C&F Bank?

A 7.

We understand how important consistent communication is to our customers, which is why we are committed to being as transparent as possible with merger updates. You can find information from a variety of sources, including website updates from both banks, customer mailings (traditional and email), and update calls from your own Peoples Community Bank employees to keep you informed.

Q 8. What roles will Tom Cherry and Bob Bailey have after the merger?

A 8.

Tom Cherry will continue to hold the positions of President and CEO of C&F Bank and C&F Financial Corporation. Bob Bailey will serve as a Senior Banking Officer with C&F Bank.

Q 9. Whom do I contact if I still have unanswered questions?

A 9.

Please call or visit your normal branch location(s) for answers to your questions. Or, you may reach Peoples Community Bank Customer Service at 804.493.8031 or C&F Customer Support at 804.843.2360. Additionally, Peoples customers can email questions or concerns using the “contact/locations” tab on peoplescommunitybank.biz. C&F Bank customers may do the same by using the “contact us” quick link on cffc.com. We also encourage all customers to use the

Talk to the Top

link on cffc.com if you have questions or feedback.

We always are happy to hear from you!

|

|

|

|

Questions and Answers for Customers and Communities

|

| Page 2

|

Important Information and Where to Find It:

This communication does not constitute an offer to sell or the solicitation of an offer to buy securities of C&F Financial Corporation (the “Corporation”) or a solicitation of any vote or approval. The Corporation will file a registration statement on Form S‑4 and other documents regarding the proposed transaction with the Securities and Exchange Commission (“SEC”) to register the shares of the Corporation’s common stock to be issued to the shareholders of Peoples Bankshares, Incorporated (“PBVA”). The registration statement will include a proxy statement/prospectus, which will be sent to the shareholders of PBVA in advance of its special meeting of shareholders that will be held to consider the proposed transaction.

Before making any voting or investment decision investors and security holders are urged to read the proxy statement/prospectus and any other relevant documents to be filed with the SEC in connection with the proposed transaction because they contain important information about the Corporation, PBVA and the proposed transaction.

Shareholders are also urged to carefully review the Corporation’s public filings with the SEC, including, but not limited to, its Annual Reports on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K and proxy statements. Investors and security holders may obtain a free copy of these documents (when available) through the website maintained by the SEC at www.sec.gov. These documents may also be obtained, without charge, from the Corporation at www.cffc.com under the tab “Investor Relations” or by directing a request to C&F Financial Corporation, 3600 La Grange Parkway, Toano, Virginia 23168, Attn.: Investor Relations. The information on the Corporation’s website is not, and shall not be deemed to be, a part of this report or incorporated into other filings the Corporation makes with the SEC.

The Corporation, PBVA and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of PBVA in connection with the proposed transaction. Information about the directors and executive officers of the Corporation and their ownership of the Corporation’s common stock is set forth in the Corporation’s proxy statement in connection with its annual meeting of shareholders, as previously filed with the SEC on March 8, 2019. Information about the directors and executive officers of PBVA and their ownership of PBVA’s common stock may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information regarding the interests of these participants and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

Safe Harbor Statement:

Statements made in this communication that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of the Corporation and PBVA, include statements as to the anticipated benefits of the proposed transaction, including future financial and operating results, cost savings and enhanced revenues that may be realized from the proposed transaction as well as other statements of expectations regarding the proposed transaction and any other statements regarding future results or expectations. The companies’ respective abilities to predict results, or the actual effect of future plans or strategies, are inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Corporation and PBVA and their respective subsidiaries include, but are not limited to the ability to obtain required regulatory and shareholder approvals and meet other closing conditions to the transaction; the ability to complete the proposed transaction as expected and within the expected time frame; disruptions to customer and employee relationships and business operations caused by the proposed transaction; the ability to implement integration plans associated with the transaction, which integration may be more difficult, time-consuming or

|

|

|

|

Questions and Answers for Customers and Communities

|

| Page

3

|

costly than expected; the ability to achieve the cost savings and synergies contemplated by the proposed transaction within the expected time frame, or at all; changes in local and national economies, or market conditions; changes in interest rates; regulations and accounting principles; changes in policies or guidelines; loan demand and asset quality, including values of real estate and other collateral; deposit flow; the impact of competition from traditional or new sources; and the other factors detailed in the Corporation’s publicly filed documents, including its Annual Report on Form 10‑K for the year ended December 31, 2018. As a result, actual results may differ materially from the forward-looking statements in this communication.

These factors are not necessarily all of the factors that could cause the Corporation’s, PBVA’s or the combined company’s actual results, performance, or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other unknown or unpredictable factors also could harm the Corporation’s, PBVA’s or the combined company’s results.

|

|

|

|

Questions and Answers for Customers and Communities

|

| Page

4

|

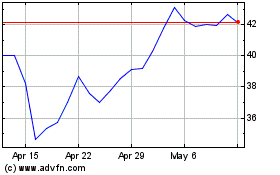

C and F Financial (NASDAQ:CFFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

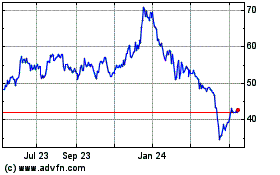

C and F Financial (NASDAQ:CFFI)

Historical Stock Chart

From Apr 2023 to Apr 2024