UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY

STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

14(a) of the Securities

Exchange Act of 1934 (Amendment

No. )

Filed by the Registrant

Filed by the Registrant

|

Filed by a Party other than the Registrant

Filed by a Party other than the Registrant

|

|

Check the appropriate box:

|

|

Preliminary Proxy Statement

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED

BY RULE 14a-6(e)(2))

|

|

Definitive Proxy Statement

|

|

Definitive Additional Materials

|

|

Soliciting Material under §240.14a-12

|

CDW CORPORATION

(Name of Registrant as Specified

in its Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

No fee required.

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|

|

Fee paid previously with preliminary materials.

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

|

PRELIMINARY PROXY STATEMENT,

SUBJECT

TO COMPLETION,

DATED MARCH 26, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

“Our

mission at CDW has always been to help our customers navigate and be successful in a changing world.„

|

|

Dear Fellow Stockholder:

2020 was an

extraordinary year. CDW coworkers found inspiration in our shared mission and worked unwaveringly to provide our customers

with technologies that helped dramatically change how and where they worked, learned, connected and served their own end

users and communities. I am proud of the work we did to support these businesses and institutions, all of which epitomized

great courage and resilience in the face of the COVID-19 pandemic. Amidst the turmoil of last year, the experience of our

people, the depth of our capabilities, and the breadth of our scale enabled us to meet the moment – helping our customers

address their critical technology and operational needs. The engagement, commitment and productivity of our coworkers fueled

another year of record results and market outperformance for CDW.

While the challenges of 2020 tested all of us, I believe they ultimately strengthened CDW's position as an industry leader and value creator for our stakeholders. As we look to the future, there is no doubt that technology will be more essential than ever. We will continue to do what we do best – help our customers navigate an ever-changing world and maximize their technology investments to succeed in their missions. As a trusted strategic advisor, CDW plays a dual role as a technology advisor and solutions provider to enable technology driven transformations. We are confident that we have the right strategy and remain committed to investing in our business to serve our customers for the long term.

Annual Meeting Invitation

On behalf of our Board

of Directors, I would like to invite you to CDW’s 2021 Annual Meeting of Stockholders. The meeting will be held virtually

on Thursday, May 20, 2021, at 7:30 a.m. CDT at www.virtualshareholdermeeting.com/CDW2021. The attached Notice of

Annual Meeting of Stockholders and Proxy Statement will serve as your guide to the business conducted at the meeting. Your vote

is very important. Whether or not you plan to attend the Annual Meeting, we urge you to vote either via the Internet, by telephone,

or by signing and returning a proxy card. Please vote as soon as possible so that your shares will be represented. For more information

on CDW and to take advantage of our many stockholder resources and tools, we encourage you to visit our Investor Relations website

at investor.cdw.com. Thank you for your continued trust in CDW and investment in our business.

Christine A. Leahy

President and Chief

Executive Officer

April [__],

2021

|

2021 Proxy Statement

|

1

|

When:

THURSDAY, MAY 20, 2021

7:30 a.m. CDT

Where:

Live webcast online at

www.virtualshareholdermeeting.com/CDW2021

|

REVIEW YOUR PROXY STATEMENT AND VOTE IN ADVANCE OF THE ANNUAL MEETING IN ONE OF FOUR WAYS:

|

|

|

|

|

BY INTERNET USING

YOUR COMPUTER

Visit 24/7 www.proxyvote.com

|

|

|

|

|

|

BY TELEPHONE

Dial toll-free 24/7

1-800-690-6903 (registered holders)

1-800-454-8683 (beneficial holders)

|

|

|

|

|

|

BY MAILING

YOUR PROXY CARD

Cast your ballot, sign your proxy

card and return by mail in the postage

prepaid envelope

|

|

|

|

|

|

BY INTERNET USING YOUR TABLET

OR SMARTPHONE

Scan this QR code 24/7

to vote with your mobile device

(may require free software)

|

|

|

|

|

|

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

|

|

NOTICE

|

of Annual Meeting

of Stockholders

|

|

|

WE ARE PLEASED TO INVITE YOU TO THE CDW CORPORATION ANNUAL MEETING OF STOCKHOLDERS.

|

|

|

|

|

|

|

Items of business:

|

|

|

|

|

|

|

1.

|

To elect the ten director nominees named in this

proxy statement for a term expiring at the 2022 Annual Meeting of Stockholders;

|

|

|

2.

|

To approve, on an advisory basis, named executive

officer compensation;

|

|

|

3.

|

To ratify the selection of Ernst & Young

LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021;

|

|

|

4.

|

To approve the amendment to the Company’s

certificate of incorporation to eliminate the supermajority voting requirement in Article Eleven and to make certain non-substantive

changes;

|

|

|

5.

|

To approve the amendment to the Company’s

certificate of incorporation to eliminate the obsolete competition and corporate opportunity provision;

|

|

|

6.

|

To approve the CDW Corporation 2021 Long-Term

Incentive Plan;

|

|

|

7.

|

To approve the amendment to the CDW Corporation

Coworker Stock Purchase Plan; and

|

|

|

8.

|

To consider any other matters that may properly

come before the meeting or any adjournments or postponements of the meeting.

|

RECORD DATE

Holders of our common stock at the close

of business on March 24, 2021 are entitled to notice of, and to vote at, the Annual Meeting.

HOW TO VOTE

Your vote is important to us. Please see

“Voting Information” on pages 5-6 for instructions on how to vote your shares.

These proxy materials are first

being distributed on or about April [__], 2021.

|

2021 Proxy Statement

|

2

|

ATTENDING THE VIRTUAL ANNUAL MEETING

Due to the continuing public

health impact of the coronavirus (COVID-19) pandemic, related governmental actions and the importance of safeguarding the health

of our stockholders, coworkers and representatives, the Board of Directors has determined that it is prudent to hold this year’s

Annual Meeting in a virtual-only format via live audio webcast. To participate in the Annual Meeting online, please visit www.virtualshareholdermeeting.com/CDW2021 and enter the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card

or the instructions that accompanied your proxy materials. You will be able to vote your shares electronically during the Annual

Meeting by following the instructions available on the meeting website. For beneficial holders who do not have a control number,

please contact your broker, bank, or other nominee as soon as possible and no later than May 13, 2021, so that you can be provided

with a control number and gain access to the meeting. If you do not have access to a 16-digit control number, you may access the

meeting as a guest by going to www.virtualshareholdermeeting.com/CDW2021, but you will not be able to vote during

the meeting or ask questions.

By Order of the Board of Directors,

Frederick J. Kulevich

Senior Vice President, General

Counsel

and Corporate Secretary

April [__],

2021

|

Important

Notice Regarding Availability of Proxy Materials for the Annual Meeting to be Held on

May 20, 2021:

The proxy materials relating to our 2021 Annual Meeting

(notice, proxy statement and annual report) are available at www.proxyvote.com.

|

|

2021 Proxy Statement

|

3

|

TABLE OF CONTENTS

|

2021 Proxy Statement

|

4

|

VOTING INFORMATION

Who is Eligible to Vote

You are entitled to vote at the virtual Annual Meeting

if you were a stockholder of CDW Corporation (the “Company” or “CDW”) as of the close of business on March

24, 2021, the record date for the Annual Meeting.

Participate in the Future of CDW—Vote Today

Please cast your vote as soon

as possible on all of the proposals listed below to ensure that your shares are represented.

|

Proposal

|

|

Topic

|

|

More

Information

|

|

Board

Recommendation

|

|

Proposal 1

|

|

Election of Directors

|

|

Page 21

|

|

FOR each

Director Nominee

|

|

Proposal 2

|

|

Advisory Vote to Approve Named Executive Officer Compensation

|

|

Page 31

|

|

FOR

|

|

Proposal 3

|

|

Ratification of Selection of Independent Registered

Public Accounting Firm

|

|

Page 54

|

|

FOR

|

|

Proposal 4

|

|

Approval of the Amendment to the Company’s Certificate of Incorporation to Eliminate

the Supermajority Voting Requirement in Article Eleven and to Make Certain Non-Substantive Changes

|

|

Page 57

|

|

FOR

|

|

Proposal 5

|

|

Approval of the Amendment to the Company’s

Certificate of Incorporation to Eliminate the Obsolete Competition and Corporate Opportunity Provision

|

|

Page 59

|

|

FOR

|

|

Proposal 6

|

|

Approval of the CDW Corporation 2021 Long-Term Incentive Plan

|

|

Page 60

|

|

FOR

|

|

Proposal 7

|

|

Approval of the Amendment to the CDW Corporation

Coworker Stock Purchase Plan

|

|

Page 67

|

|

FOR

|

Virtual Annual Meeting

The Annual Meeting will be held

via live audio webcast on Thursday, May 20, 2021, at 7:30 a.m. CDT, in a virtual-only meeting format. There will not be a physical

location for the Annual Meeting, and you will not be able to attend the meeting in person.

You are entitled to participate

in the Annual Meeting if you were a stockholder as of the close of business on March 24, 2021, the record date. To participate

in the Annual Meeting online, please visit www.virtualshareholdermeeting.com/CDW2021 and enter the 16-digit

control number included on your Notice of Internet Availability of Proxy Materials, proxy card or the instructions that accompanied

your proxy materials. For beneficial holders who do not have a control number, please contact your broker, bank, or other nominee

as soon as possible and no later than May 13, 2021, so that you can be provided with a control number and gain access to the meeting.

If you do not have access to a 16-digit control number, you may access the meeting as a guest by going to www.virtualshareholdermeeting.com/CDW2021,

but you will not be able to vote during the meeting or ask questions.

Voting in Advance of the Annual Meeting

Even if you plan to attend our

virtual Annual Meeting via webcast, please read this proxy statement with care and vote right away as described in the Notice on

p. 2-3 of this proxy statement. For stockholders of record, have your notice and proxy card in hand and follow the instructions.

If you hold your shares through a broker, bank or other nominee, you will receive voting instructions from your broker, bank or

other nominee, including whether telephone or Internet options are available.

|

2021 Proxy Statement

|

5

|

Voting at the Annual Meeting

You may vote electronically via

webcast at the 2021 Annual Meeting of Stockholders, which will be held on Thursday, May 20, 2021, at 7:30 a.m. CDT by following

the instructions available on the meeting website.

Frequently Asked Questions

We provide answers to many frequently

asked questions about the meeting and voting under “Frequently Asked Questions Concerning the Annual Meeting” beginning

on p. 71 of this proxy statement.

|

2021 Proxy Statement

|

6

|

PROXY SUMMARY

This summary highlights

information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should

consider, and you should read the entire proxy statement and our 2020 Annual Report on Form 10-K carefully before voting at the

Annual Meeting of Stockholders. Measures used in this proxy statement that are not based on accounting principles generally accepted

in the United States (“non-GAAP”) are each defined and reconciled to the most directly comparable GAAP measure in

Appendix A.

Business Overview

We are a leading multi-brand

provider of information technology (“IT”) solutions to over 250,000 small, medium and large business, government, education

and healthcare customers in the United States (“US”), the United Kingdom (“UK”) and Canada. We are a Fortune

500 company and member of the S&P 500 Index with approximately 10,000 coworkers. Our broad array of offerings ranges from discrete

hardware and software products to integrated IT solutions and services that include on-premise, hybrid and cloud capabilities across

data center and networking, digital workspace, security and virtualization.

We are vendor, technology,

and consumption model “agnostic,” with a solutions portfolio including more than 100,000 products and services from

over 1,000 leading and emerging brands. Our solutions are delivered in physical, virtual, and cloud-based environments through

approximately 7,000 customer-facing coworkers, including sellers, highly-skilled technology specialists and advanced service delivery

engineers. We are a leading sales channel partner for many original equipment manufacturers, software publishers and cloud providers

(collectively, our “vendor partners”), whose products we sell or include in the solutions we offer. We provide our

vendor partners with a cost-effective way to reach customers and deliver a consistent brand experience through our established

customer end-market coverage, technical expertise, and extensive customer access.

We simplify the complexities

of technology across design, selection, procurement, integration, and management for our customers. Our goal is to have our customers,

regardless of their size, view us as a trusted adviser and extension of their IT resources. Our multi-brand offering approach enables

us to identify the products or combination of products from our vendor partners that best address each customer’s specific

IT requirements and desired outcomes.

We have capabilities to provide

integrated IT solutions in more than 150 countries for customers with primary locations in the US, UK, and Canada, which are large

and growing markets. According to the International Data Corporation, the total US, UK, and Canadian IT market generated approximately

$1 trillion in sales in 2020. We believe our addressable markets in the US, UK and Canada represent approximately $360 billion

in annual sales. These are highly fragmented markets served by thousands of IT resellers and solutions providers. We believe that

demand for IT will continue to outpace general economic growth in the markets we serve fueled by new technologies, including hybrid

and cloud computing, virtualization and mobility as well as growing end-user demand for security, efficiency and productivity.

As we have evolved with the

IT market, we have built an organization with significant scale, reach and deep intimate knowledge of customer and partner needs.

When coupled with our market presence, our broad and deep solutions portfolio, and our large and highly-skilled sales and technical

organization, we deliver unique value – for both our customers and our vendor partners.

2021 Proxy

Statement 7

2021 Proxy

Statement 7

Our Business Performance

2020 Business Highlights

Our 2020 performance demonstrated

the balance and strength of our business model and strategy as the diversity of our customer end-markets and broad solutions portfolio

enabled us to outperform the market while continuing to invest in our future despite the unprecedented challenges created by the

COVID-19 pandemic as discussed below.

There were four main drivers of performance in

2020:

|

•

|

First, our balanced portfolio of customer end-markets, including five US channels – Corporate, Small Business, Government, Education and Healthcare – and our UK and Canadian operations. The diversity of our customer end markets serves us well when macro or other external challenges impact various industries and customers differently. In 2020, our net sales performance varied by segment, channel and customer end-market due to the uneven impact of COVID-19. All customers experienced change or disruption to their technology and to their operations due to the pandemic. Our teams helped businesses – small, medium and large – to work in completely new ways. The crisis posed greater challenges for our commercial customers due to the macroeconomic slowdown, which led to net sales declines of 8.7 percent and 7.5 percent, respectively, for our Corporate and Small Business segments. Public segment net sales increased by 18.5 percent, primarily driven by strong demand from our Education and Government channels, partially offset by a decline in Healthcare. In the Education channel, our teams helped education institutions shift to remote learning solutions for students and teachers driving 43.4 percent growth. In the Government channel, we enabled work from home for government agencies, supported the expansion of first responder capacity, and delivered a complex Device-as-a-Service mobile data collection solution for the US Census Bureau leading to 18.2 percent growth. In the Healthcare channel, our teams enabled healthcare providers to establish mobile virus screening centers, to expand telehealth capabilities, and to provide services in incredibly challenging point of care environments, but, due to Healthcare customer budget constraints, net sales declined 12.0 percent. In addition, net sales for our Other segment, which is comprised of our UK and Canadian operations, decreased 3.3 percent in US dollars with a low double digit decline in Canada and low single digit growth in the UK in local currency as the pandemic similarly impacted customers in those countries.

|

|

|

|

|

•

|

Second, the breadth of our product and solutions portfolio of more than 100,000 products from over 1,000 leading and emerging brands. This breadth ensures we are well-positioned to meet our customers’ needs and pivot quickly to trends in customer demand. This was especially important in 2020 as technology needs shifted and became crucial for our customers to maintain ongoing operations and develop new capabilities for their customers and employees. In 2020, customers were focused on remote enablement, optimization, cost reduction, security, and digital transformation, with an increasing focus on cloud. We helped our customers smartly deploy their IT resources, navigate through interconnected and complex solutions, and adopt modern software and infrastructure patterns and practices whether on-premise, hybrid or in the cloud. Our performance reflected the success of past investments, especially in cloud and security, and our ability to help our customers across the full IT solutions stack and lifecycle.

|

|

|

|

|

•

|

Third, we continued

to make excellent progress against our three-part strategy for growth: (1) to acquire new customers and capture

share, (2) to enhance our solutions capabilities, and (3) to expand our services capabilities. The combination of these three

interconnected pillars, with our scope and scale, creates powerful differentiation in the market. We benefited from our strong

competitive advantages and value proposition in 2020. Customers turned to CDW as a trusted advisor to

|

2021 Proxy

Statement 8

2021 Proxy

Statement 8

|

|

help with some of their toughest challenges, to leverage our extensive logistical and distribution capabilities, and as a source of supply in a constrained market. We continued to invest in high-growth solutions and services capabilities, including three acquisitions – IGNW, a leading provider of cloud-native services expertise and software development capabilities, and Aeritae and Southern Dakota Solutions, which expanded our ServiceNow team. As we do every three years, we completed a rigorous, detailed strategic planning process in 2020 and remain confident that we have the right strategy to best serve our customers, optimize our productivity, and enhance our competitive position. We believe that technology will be more essential to all sectors of the economy and will play an increasingly important role in the years ahead, making our role as a trusted, strategic partner to our customers more important than ever.

|

|

|

|

|

•

|

Finally, our ability to adapt and respond to the COVID-19 crisis. At the beginning of the pandemic, we identified three key principles, which have guided us. First, safeguard the health and well-being of our coworkers, second, serve the mission-driven needs of our customers, and third, support our communities. At our distribution centers, we quickly implemented and have maintained precautionary measures advised by public health authorities. Our office coworkers transitioned to work from home in March and have demonstrated strong engagement, productivity and collaboration – testaments to the strength and resiliency of our culture. CDW also contributed meaningfully to support the COVID-19 response efforts locally, in the US, UK and Canada, and around the world. Our team has done an outstanding job of maintaining the high level of customer service we are known for, while safeguarding our coworkers and supporting our communities.

|

We also made progress against

our four 2020 capital allocation priorities. These priorities are designed to provide stockholders with a balance between receiving

short-term capital returns and long-term value creation. During the year, we closely monitored the macro-economic environment,

our liquidity, working capital, and leverage and adjusted as needed, including raising additional liquidity in April and pausing

share repurchases for two quarters. In November, we increased our dividend for the seventh consecutive year since going public

in 2013 and resumed share repurchases. We ended the year in a strong liquidity position with net leverage below the target range

and remain confident in the free cash flow generation of the business. This confidence led our Board of Directors to authorize

a $1.25 billion increase to the Company’s share repurchase program in February 2021.

2020 CAPITAL ALLOCATION

PRIORITIES

|

PRIORITIES

|

|

OBJECTIVES

|

ACTIONS

|

|

|

|

|

|

Increase Dividends

Annually

|

|

Target ~25% payout

of Non-GAAP net income; grow in

line with earnings

|

5.3% increase to

$1.60/share annually

|

|

|

|

|

|

Maintain Net

Leverage Ratio(1)

|

|

~2.5 to 3.0 times

Net leverage ratio

|

Ended 2020 at 1.7 times

|

|

|

|

|

|

Supplement Organic

Growth with M&A

|

|

Expand CDW’s

strategic capabilities

|

Completed 3 acquisitions in 2020

|

|

|

|

|

|

Return Excess Free Cash Flow

after Dividends &

M&A Through

Share Repurchases

|

|

Offset to incentive

plan dilution and to

supplement earnings

per share growth

|

$341 million in share repurchases in 2020

|

|

(1)

|

Defined as the ratio of total debt at period-end excluding any unamortized discount and/or premium and deferred financing costs, less cash and cash equivalents, to trailing twelve months Non-GAAP operating income plus depreciation and amortization in selling, general and administrative expenses (excluding amortization expenses for acquisition-related intangible assets).

|

For further details about

our performance in 2020, please see the Company’s 2020 Annual Report on Form 10-K.

2021 Proxy

Statement 9

2021 Proxy

Statement 9

Long-Term Performance

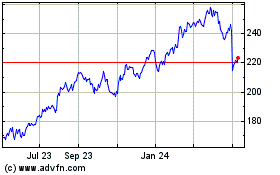

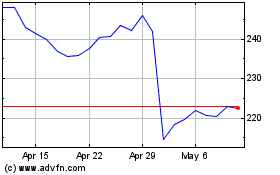

Over the past 5 years, our

cumulative total shareholder return has outpaced the S&P 500 Index and our 2020 compensation peer group set forth in the “Compensation

Discussion and Analysis — Comparison to Relevant Peer Group” section of this proxy statement, and we have returned

$3.1 billion to shareholders through dividends and share repurchases.

|

(1)

|

The cumulative total shareholder return chart compares the cumulative total shareholder return, including reinvestment of dividends, on $100 invested in CDW common stock for the period from market close on December 31, 2015 through market close on December 31, 2020, with the cumulative total return for the same time period of the same amount invested in the S&P 500 Index and our 2020 compensation peer group set forth in the “Compensation Discussion and Analysis — Comparison to Relevant Peer Group” section of this proxy statement.

|

Our COVID-19 Response

We have adhered to three principles in all aspects

of our response to the COVID-19 pandemic:

PRINCIPLES Safeguard the health and well-being of

our coworkers Serve the mission-driven

needs of our customers Support our communities

ACTIONS •Deliberate actions to foster

collaboration and coworker engagement and to maintain connectivity and productivity to preserve and bolster our culture while

working remote •Thoughtfully planning for when and how to return to the office and where and how our coworkers will work in

the future •Distribution and configuration centers have adopted precautionary measures advised by public health

authorities while maintaining a high level of customer service •Customers focused on remote

enablement, resource optimization, cost reduction,security, hybrid and cloud solutions, and digital transformation. •CDW

teams are trusted partners to help customers smartly deploy their IT resources and adopt modern software and infrastructure

patterns and practices •CDW teams help to design, orchestrate, and manage solutions leveraging our broad portfolio of

solutions and services •Pledged $1 million in donations to support COVID-19 response efforts•Contributed

meaningfully to support the COVID-19 response efforts in the US, UK and Canada, and around the world •Support local

organizations through virtual volunteering

2021 Proxy

Statement 10

2021 Proxy

Statement 10

Corporate Governance Highlights

|

Independent Chairman

|

|

|

|

|

Annual election of all Directors

|

|

|

|

|

All of our Directors, other than our President and Chief Executive Officer, are independent and the independent Directors regularly meet in Executive Session

|

|

|

|

|

100% independent Audit, Compensation and Nominating and Corporate Governance Committees

|

|

|

|

|

Four of our continuing Audit Committee members qualify as “audit committee financial experts” under SEC rules

|

|

|

|

|

12 year Board term limit to promote Board refreshment

|

|

|

|

|

Proxy access right

|

|

|

|

|

Majority vote to elect Directors with resignation policy

|

|

|

|

|

Restrictions on other board service by Directors

|

|

|

|

|

Annual Board and Audit, Compensation and Nominating and Corporate Governance Committee evaluations

|

|

|

|

|

Proposed elimination of supermajority vote requirements

|

Director Nominee Highlights

Our Board strives to maintain

a highly independent, balanced and diverse group of directors that collectively possess the expertise to ensure effective oversight.

|

Key Director Skills

|

|

Technology/Digital Solutions

|

Operations

|

International

|

|

Vertical

Markets (e.g., Healthcare, Public Sector)

|

Distribution

|

Economic/Business Trends

|

|

Strategic Planning/Leadership of Complex Organizations

|

Finance

|

Capital Market Transactions

|

|

Board Practices of Major Corporations

|

Sales and Marketing

|

Legal

|

2021 Proxy

Statement 11

2021 Proxy

Statement 11

Board Nominees

The chart below provides

summary information regarding each of our current directors standing for re-election at the Annual Meeting.

|

Name

|

Age

|

Director

Since(1)

|

Primary

Occupation

|

Independent

|

Committee

Memberships

|

Other

Public

Company

Boards

|

|

Virginia

C. Addicott

|

57

|

2016

|

Retired

President & Chief Executive Officer, FedEx

Custom Critical

|

|

•

Audit (Chair)

•

Nominating & Corporate

Governance

|

1

|

|

James

A. Bell

|

72

|

2015

|

Retired

Executive Vice President, Corporate President

and Chief Financial Officer, The Boeing Company

|

|

•

Audit

•

Nominating & Corporate

Governance

|

2

|

|

Lynda

M. Clarizio

|

60

|

2015

|

Former

Executive Vice President, Strategic Initiatives,

The Nielsen Company (US), LLC

|

|

•

Compensation

•

Nominating & Corporate

Governance

|

2

|

|

Paul

J. Finnegan

|

68

|

2011

|

Co-Chief

Executive Officer, Madison Dearborn Partners,

LLC

|

|

•

Compensation

•

Nominating & Corporate

Governance

|

—

|

|

Anthony

R. Foxx

|

49

|

2021

|

Chief

Policy Officer & Senior Advisor to the

President & Chief Executive Officer of

Lyft, Inc.

|

|

•

Audit

•

Nominating & Corporate Governance

|

2

|

|

Christine

A. Leahy

|

56

|

2019

|

President

& Chief Executive Officer, CDW Corporation

|

__

|

__

|

1

|

|

Sanjay

Mehrotra

|

62

|

2021

|

President

& Chief Executive Officer, Micron Technology,

Inc.

|

|

•

Compensation

•

Nominating & Corporate Governance

|

1

|

David

W. Nelms

(Independent Chairman)

|

60

|

2014

|

Retired

Chairman & Chief Executive Officer, Discover

Financial Services

|

|

•

Audit

•

Nominating & Corporate Governance

(Chair)

|

—

|

|

Joseph

R. Swedish

|

69

|

2015

|

Retired

Chairman, President and Chief Executive Officer,

Anthem, Inc.

|

|

•

Compensation (Chair)

•

Nominating & Corporate

Governance

|

2

|

|

Donna

F. Zarcone

|

63

|

2011

|

Retired

President and Chief Executive Officer, The

Economic Club of Chicago

|

|

•

Audit

•

Nominating & Corporate

Governance

|

1

|

|

(1)

|

The

time period for service as a director of CDW includes service on the Board of Managers of CDW Holdings LLC, our parent company

prior to our initial public offering in 2013.

|

Executive Compensation Highlights

CEO Pay for Performance

Our executive compensation

program is focused on driving sustained meaningful profitable growth and stockholder value creation. The Compensation Committee

seeks to foster these objectives through a compensation system that focuses heavily on variable, performance-based incentives that

create a balanced focus on our short-term and long-term strategic and financial goals. As shown in the chart, in 2020, approximately

86% of the target compensation of our President and Chief Executive Officer was variable and is realized only if the applicable

financial performance goals are met and/or our stock price increases.

2021 Proxy

Statement 12

2021 Proxy

Statement 12

Our Executive Compensation Practices

Our executive compensation

practices include the following, each of which the Compensation Committee believes reinforces our executive compensation objectives:

|

Our

Executive Compensation Practices

|

|

Significant percentage of target annual compensation delivered in the form of variable compensation tied to performance

|

|

Long-term objectives aligned with the creation of stockholder value

|

|

Target total compensation at the competitive market median

|

|

Market comparison of executive compensation against a relevant peer group

|

|

Use of an independent compensation consultant reporting directly to the Compensation Committee and providing no other services to the Company

|

|

Double-trigger vesting for equity awards in the event of a change in control under our long-term incentive plan

|

|

Robust stock ownership guidelines

|

|

Clawback policy

|

|

Annual say-on-pay vote

|

|

Limited perquisites

|

|

|

|

|

We do not have tax gross-ups*

|

|

We do not have an enhanced severance multiple upon a change in control

|

|

We do not have excessive severance benefits

|

|

We do not pay dividends or dividend equivalents on unearned performance-based awards under our long-term incentive plan

|

|

We do not allow repricing of underwater stock options under our long-term incentive plan without stockholder approval

|

|

We do not allow hedging or short sales of our securities, and we do not allow pledging of our securities except in limited circumstances with pre-approval

|

|

|

*Excludes

tax reimbursements with respect to customary relocation benefits and tax reimbursements made to Mr. Kebo in connection with

an expatriate assignment prior to his appointment as an executive officer, consistent with the Company’s practices for

expatriate assignments.

|

Extensive information regarding

our executive compensation program in place for 2020 can be found in the “Compensation Discussion and Analysis” section

of this proxy statement.

2020 Say-on-Pay Vote

Stockholders continued to

show strong support of our executive compensation program, with approval by approximately 96% of the votes cast for the Company’s

say-on-pay vote at our 2020 Annual Meeting of Stockholders and, since our IPO in 2013, our stockholders have overwhelmingly supported

our executive compensation program, with an average approval of 97% of the votes cast for the Company’s say-on-pay vote at

the annual meetings of stockholders since our IPO.

2021 Proxy

Statement 13

2021 Proxy

Statement 13

CORPORATE GOVERNANCE

Our success is built on the

trust we have earned from our customers, coworkers, business partners, investors and communities, and that trust sustains our success.

Part of this trust stems from our commitment to good corporate governance. Our Company is governed by our Board of Directors (“Board

of Directors” or “Board”). The Board is responsible for providing oversight of the strategic and operational

direction of the Company and supporting the Company’s long-term interests.

To provide a framework for

effective governance, our Board has adopted Corporate Governance Guidelines, which outline the operating principles of our Board

and the composition and working processes of our Board and its committees. The Nominating and Corporate Governance Committee periodically

reviews our Corporate Governance Guidelines and developments in corporate governance and recommends proposed changes to the Board

for approval.

Our Corporate Governance

Guidelines, along with other corporate governance documents such as committee charters and The CDW Way Code (our code of business

conduct and ethics), are available on our website at www.cdw.com by clicking on Investor Relations and then Corporate

Governance.

Corporate Governance Highlights

|

Independent Chairman. David W. Nelms serves as our independent Chairman of the Board.

|

|

All Directors Elected Annually. All Directors are elected annually. Our Board of Directors and our stockholders approved the phased declassification of our Board in 2018, which will be complete as of the Annual Meeting.

|

|

Independent Board. Our Board of Directors is comprised entirely of independent directors, other than our President and Chief Executive Officer. The independent members of our Board of Directors regularly meet in executive session.

|

|

Independent Board Committees. All members of our Audit, Compensation, and Nominating and Corporate Governance Committees are independent directors.

|

|

Audit Committee Financial Experts. Four of our continuing members of our Audit Committee qualify as “audit committee financial experts” as defined under SEC rules.

|

|

Board Term Limit. Our Corporate Governance Guidelines provide that a director will not be renominated at the next annual meeting of stockholders after 12 years of service on our Board of Directors, absent special circumstances. Messrs. Alesio, Allen and Chereskin are retiring from our Board immediately prior to the Annual Meeting under this term limit policy.

|

|

Proxy Access. Our Amended and Restated Bylaws (“Bylaws”) permit a stockholder, or a group of up to 20 stockholders, owning at least 3% of our outstanding common stock continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 2 individuals or 20% of the Board, whichever is greater, as further detailed in our Bylaws.

|

|

Majority Vote. Directors are elected by majority vote of our stockholders in uncontested elections. We have a resignation policy that applies if a director fails to receive a majority of the votes cast.

|

|

Restrictions on Other Board Service. Our Corporate Governance Guidelines restrict the number of public company boards on which our directors may serve. A director who is currently an executive officer of a public company may serve on a total of 2 public company boards (including our Board) and a director who is not currently an executive officer of a public company may serve on a total of 4 public company boards (including our Board).

|

|

Annual Board and Committee Evaluations. Our Chairman leads the annual Board evaluation process by conducting a one-on-one interview with each director to obtain feedback on and discuss Board performance and effectiveness. The results are then discussed by the Nominating and Corporate Governance Committee, which consists of all of our independent directors. Each of the Audit, Compensation and Nominating and Corporate Governance Committees also conducts an annual self-evaluation to discuss Committee performance and effectiveness.

|

|

Proposed Elimination of Supermajority Vote Provisions. Our Board of Directors has approved the amendment of our certificate of incorporation to eliminate supermajority vote provisions (Proposal 4 in this proxy statement).

|

2021 Proxy

Statement 14

2021 Proxy

Statement 14

Environmental, Social and Governance (ESG)

At CDW, we continue to build

upon our long history of providing value to stakeholders, rewarding careers to our coworkers and support to the communities where

we live and work. We are committed to implementation of an increasingly robust and proactive environmental, social and governance

(ESG) agenda that reflects topics of highest priority and relevance to CDW. In April 2021, we intend to publish our 2020 ESG report

and our first disclosures under the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial

Disclosures (TCFD) frameworks, which demonstrate this commitment and our progress and are available on the ESG section of our website

at www.cdw.com. Also in early 2021, our Board of Directors approved an update to the Nominating and Corporate Governance

Committee charter to assign specific ESG oversight responsibility to that committee.

While we continued advancing

our ESG strategy in 2020 and into 2021, we also had to pivot and adjust wherever needed to address the unprecedented challenges

associated with the COVID-19 pandemic and the social and racial equity issues brought to the forefront by several high-profile

tragic events last summer. Our approach to the pandemic focused on three principles: 1) Safeguard the health and well-being of

our coworkers; 2) Serve the mission-driven needs of our customers; and 3) Support our communities. Our ESG report includes a detailed

discussion of our COVID-19 response efforts and our commitment to implementing our ReunITe plan under the mantra of “Let’s

not get back to normal, let’s be even better.”

To address the events of

last summer, we accelerated our efforts to listen and learn more about diversity, equity and inclusion. While CDW has been on the

pathway to driving diversity, equity and inclusion – a sense of belonging for all – we took several additional steps such

as enhancing resource guides, holding frank and open panel discussions on the topic of race and offering training sessions to help

supervisors and managers talk about race and its impact on our coworkers. Our ESG report provides additional information on the

steps we took to enhance our diversity, equity and inclusion program and address these events.

Based on the results of our

materiality assessment conducted in 2019, and updated in 2020, the topics below reflect the areas of ESG that are of highest priority

and relevance to CDW and our key stakeholders. They guide our activities and our approach to reporting.

2021 Proxy

Statement 15

2021 Proxy

Statement 15

|

2020-2021

Recognition Snapshot

|

|

2021 Best Places to Work

by Glassdoor

2021

Corporate Equality Index Perfect Score

By Human Rights Campaign

2020 Culture 500 Champion

By MITSloan & Glassdoor

2021 Gold Military Friendly Employer

By Military Friendly

|

America’s Most JUST Companies 2020

By JUST Capital

America’s Best Large Employers 2021

By Forbes

America’s

Best Employers for Diversity 2020

By Forbes

Best Companies for Women

By Fairygodboss

Best

Companies Where CEOs Support Gender Diversity

By Fairygodboss

|

Best for Vets 2020 Employer

By Military Times

Best Place to Work in IT

By Computerworld

Best

of the Best Supplier Diversity Program 2020

By

U.S. Veteran’s Magazine, Professional Woman’s

Magazine, Black EOE Journal & HISPANIC

Network Magazine

Best Technology Companies for Women

By Fairygodboss

|

Independence of Our Board of Directors

Under our Corporate Governance

Guidelines and the listing standards of the Nasdaq Global Select Market (“Nasdaq”), a majority of our Board members

must be independent. The Board of Directors annually determines whether each of our directors is independent. In determining independence,

the Board follows the independence criteria set forth in the Nasdaq listing standards and considers all relevant facts and circumstances.

Under the Nasdaq independence

criteria, a director cannot be considered independent if he or she has one of the relationships specifically enumerated in the

Nasdaq listing standards. In addition, the Board must affirmatively determine that a director does not have a relationship that,

in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of

a director. The Board has affirmatively determined that each of our current directors is independent under the applicable listing

standards of Nasdaq, other than our President and Chief Executive Officer, Christine A. Leahy.

Board of Directors Leadership Structure

Christine A. Leahy currently

serves as our President and Chief Executive Officer and David W. Nelms serves as our non-executive Chairman. The Board presently

believes that separating the roles of Chairman and Chief Executive Officer aids in the Board’s oversight responsibility.

However, the Board does not believe that a single leadership structure is right for all companies at all times, so the Board periodically

reviews its leadership structure to determine, based on the circumstances at such time, what leadership structure would be most

appropriate.

Board and Committee Meetings

Under our Corporate Governance

Guidelines, our directors are expected to attend meetings of the Board and applicable committees and our annual meetings of stockholders.

In 2020, the Board held seven

meetings. In 2020, each of the directors attended at least 75% of the aggregate of all meetings of the Board and the committees

on which he or she served (during the periods for which he or she served on the Board and such committees). In addition, each of

our directors serving at the time of our 2020 Annual Meeting of Stockholders attended our 2020 Annual Meeting of Stockholders.

Board Committees

Our Board has an Audit Committee,

Compensation Committee and Nominating and Corporate Governance Committee. Our Board has adopted charters for each of these committees,

which are available on our website at www.cdw.com. Under the committees’ charters, the committees report regularly

to the Board and as the Board requests. Additional information on each of these committees is set forth below.

2021 Proxy

Statement 16

2021 Proxy

Statement 16

|

Audit Committee

Chairperson: Virginia

C. Addicott

Other Members

of the Committee: James A. Bell, Benjamin D. Chereskin*, Anthony R. Foxx, David W. Nelms,

Donna F. Zarcone

Meetings Held in 2020: 8

Primary Responsibilities:

Our Audit Committee is responsible

for, among other things: (1) appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered

public accounting firm; (2) discussing with our independent registered public accounting firm its independence from management;

(3) reviewing with our independent registered public accounting firm the scope and results of its audit; (4) preapproving all audit

and permissible non-audit services to be performed by our independent registered public accounting firm; (5) overseeing the accounting

and financial reporting process and discussing with management and our independent registered public accounting firm the interim

and annual financial statements that we file with the U.S. Securities and Exchange Commission (“SEC”); (6) reviewing

and monitoring our accounting principles, accounting policies and financial and accounting controls; (7) establishing procedures

for the confidential and anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters;

(8) reviewing and approving or ratifying related person transactions; (9) overseeing our business process assurance function (internal

audit); and (10) reviewing the Company’s compliance and ethics and risk management programs, including with respect to cybersecurity.

Independence:

Each member of the Audit

Committee meets the audit committee independence requirements of Nasdaq and the rules under the Securities Exchange Act of 1934

(the “Exchange Act”).

The Board has designated

each of the Chair, Ms. Addicott, Messrs. Bell, Chereskin, and Nelms and Ms. Zarcone as an “audit committee financial expert.”

Each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements.

|

|

|

|

Compensation Committee

Chairperson: Joseph

R. Swedish

Other Members

of the Committee: Steven W. Alesio*, Barry K. Allen*, Lynda M. Clarizio, Paul J. Finnegan,

Sanjay Mehrotra

Meetings Held in 2020: 6

Primary Responsibilities:

Our Compensation Committee

is responsible for, among other things: (1) reviewing and approving the compensation of our chief executive officer and other executive

officers; (2) reviewing and approving employment agreements and other similar arrangements between CDW and our executive officers;

(3) administering our stock plans and other incentive compensation plans; (4) periodically reviewing and recommending to the Board

any changes to our incentive compensation and equity-based plans; and (5) reviewing trends in executive compensation. The Compensation

Committee may form, and delegate authority to, subcommittees when it deems appropriate.

Independence:

Each member of the Compensation

Committee meets the compensation committee independence requirements of Nasdaq and the rules under the Exchange Act.

|

|

*

|

Retiring

immediately prior to the Annual Meeting

|

2021 Proxy

Statement 17

2021 Proxy

Statement 17

|

Nominating

and Corporate Governance Committee

|

|

Chairperson: David

W. Nelms

|

|

|

Other Members of the Committee:

|

Virginia C. Addicott,

Steven W. Alesio*, Barry K. Allen*, James A. Bell, Benjamin D. Chereskin*, Lynda M. Clarizio, Paul J. Finnegan, Anthony R.

Foxx, Sanjay Mehrotra, Joseph R. Swedish, Donna F. Zarcone

|

|

Meetings Held in 2020: 4

Primary Responsibilities:

Our Nominating and Corporate Governance Committee is responsible for, among other things: (1) identifying individuals qualified to become members of our Board of Directors, consistent with criteria approved by our Board; (2) evaluating potential nominees for our Board of Directors recommended by our stockholders and maintaining procedures for the submission of stockholder nominees; (3) overseeing the organization of our Board to discharge the Board’s duties and responsibilities properly and efficiently; (4) identifying best practices and recommending corporate governance principles; (5) developing and recommending to our Board a set of corporate governance guidelines and principles applicable to us; (6) reviewing compliance with The CDW Way Code, our code of business conduct and ethics; (7) reviewing and approving the compensation of our directors; (8) setting performance goals for and reviewing the performance of our chief executive officer; (9) overseeing our environmental, social and governance program; and (10) executive succession planning.

Independence:

Each member of the Nominating and Corporate Governance Committee meets the nominating and corporate governance committee independence requirements of Nasdaq.

|

* Retiring immediately

prior to the Annual Meeting

Oversight of Strategy

One of the primary responsibilities

of the Board is to oversee management’s development and execution of the Company’s long-term strategy. Strategy is

a recurring topic of discussion at Board meetings, with periodic additional in-depth strategic planning sessions. Discussions on

strategy include updates on the ongoing strategic planning process, progress against various strategic initiatives, the competitive

landscape and potential risks to the Company’s long-term strategy.

Oversight of Risk

Enterprise Risk Management

Program

Our Board of Directors, as

a whole and through the Audit Committee, oversees our Enterprise Risk Management Program (“ERM Program”), which is

designed to drive the identification, analysis, discussion and reporting of our high priority enterprise risks. The ERM Program

facilitates constructive dialogue at the senior management and Board levels to proactively identify and manage enterprise risks.

Under the ERM Program, senior management develops a holistic portfolio of enterprise risks by facilitating business and supporting

function assessments of strategic, operational, financial reporting and compliance risks, and helps to ensure appropriate response

strategies are in place.

Our Audit Committee is

primarily responsible for overseeing our risk management processes on behalf of the full Board. Enterprise risks are

considered in business decision making and as part of our overall business strategy. Our management team, including our

executive officers, is primarily responsible for managing the risks associated with the operation and business of our

company. Senior management provides regular updates to the Audit Committee and periodic updates to the full Board on the ERM

Program, and reports to both the Audit Committee and the full Board on any identified high priority enterprise risks. This

includes risk assessments from management with regard to cybersecurity, including assessments of the overall threat landscape

and strategies and infrastructure investments to monitor and mitigate such threats. In addition, management provides regular

updates to the full Board and/or the Audit Committee relating to newly-identified and evolving high priority risks, such as

those presented by the COVID-19 pandemic.

|

2021 Proxy Statement

|

18

|

Compensation Risk Assessment

We conducted an assessment

of the risks associated with our compensation practices and policies, and determined that risks arising from such policies and

practices are not reasonably likely to have a material adverse effect on the Company. In conducting the assessment, we undertook

a review of our compensation philosophies, our compensation governance structure and the design and oversight of our compensation

programs. Overall, we believe that our programs include an appropriate mix of fixed and variable features, and short- and long-term

incentives with compensation-based goals aligning with corporate goals. Centralized oversight helps ensure compensation programs

align with the Company’s goals and compensation philosophies and, along with other factors, operate to mitigate against the

risk that such programs would encourage excessive risk-taking.

Oversight of Human Capital Management

Cultivating a welcoming work

environment and inclusive culture that allows all coworkers to feel a sense of belonging, be valued and have the confidence to

do great things is fundamental to CDW. We’re a unified team of diverse perspectives, driven by our desire to succeed together.

Our Board understands the importance of our inclusive, performance-driven culture to our ongoing success and is actively engaged

with our President and Chief Executive Officer and our Chief Human Resources Officer across a broad range of human capital management

topics. On an annual basis, the Board reviews the results of our annual talent review process and succession plans for our President

and Chief Executive Officer and our other executive officers. In addition, talent strategy is regularly discussed with the Board,

including culture, diversity and inclusion, recruiting, retention, engagement and talent development. The Compensation Committee

also annually reviews compensation trends and developments and the results of a review of risks of our compensation practices and

policies.

Code of Business Conduct and Ethics

We have adopted The CDW

Way Code, our code of business conduct and ethics, that is applicable to all of our coworkers and directors. A copy of this code

is available on our website at www.cdw.com. Within The CDW Way Code is a Financial Integrity Code of Ethics that

sets forth an even higher standard applicable to our executives, officers, members of our internal disclosure committee and all

managers and above in our finance department. We intend to disclose any substantive amendments to, or any waivers from, The CDW

Way Code by posting such information on our website or by filing a Form 8-K, in each case to the extent such disclosure is required

by rules of the SEC or Nasdaq.

Hedging, Short Sales and Pledging Policies

Our Policy on Insider Trading,

which applies to all coworkers, Board members and consultants, includes policies on hedging, short sales and pledging of our securities.

Our policy prohibits hedging or monetization transactions involving Company securities, such as prepaid variable forwards, equity

swaps, collars and exchange funds. It also prohibits short sales of our securities, including sales of securities that are owned

with delayed delivery. In addition, it prohibits holding Company securities in a margin account or pledging Company securities

as collateral for a loan except in limited circumstances with pre-approval from our General Counsel, which pre-approval will only

be granted when such person clearly demonstrates the financial capacity to repay the loan without resort to any pledged securities.

Executive Compensation Policies and Practices

See the “Compensation

Discussion and Analysis” for a discussion of the Company’s executive compensation policies and practices.

|

2021 Proxy Statement

|

19

|

Communications with the Board of Directors

Stockholders who would like

to communicate with the Board of Directors or its committees may do so by writing to them via the Company’s Corporate Secretary

by email at board@cdw.com or by mail at our principal executive offices at CDW Corporation, 200 North Milwaukee Avenue, Vernon

Hills, Illinois 60061. Correspondence may be addressed to the collective Board of Directors or to any of its individual members

or committees at the election of the sender. Any such communication is promptly distributed to the director or directors named

therein unless such communication is considered, either presumptively or in the reasonable judgment of the Company’s Corporate

Secretary, to be improper for submission to the intended recipient or recipients. Examples of communications that would presumptively

be deemed improper for submission include, without limitation, solicitations, communications that raise grievances that are personal

to the sender, communications that relate to the pricing of the Company’s products or services, communications that do not

relate directly or indirectly to the Company and communications that are frivolous in nature. In addition, when appropriate, the

Chairman of the Board is available for engagement with stockholders.

Compensation Committee Interlocks and Insider

Participation

During 2020, our Compensation

Committee consisted of Steven W. Alesio, Barry K. Allen, Lynda M. Clarizio, Paul J. Finnegan and Joseph R. Swedish. No member of

the Compensation Committee was, during 2020 or previously, an officer or employee of the Company or its subsidiaries. In addition,

during 2020, there were no compensation committee interlocks required to be disclosed.

Related Person Transactions

Related Person Transactions Approval/Ratification

Procedures

The Company has written procedures

regarding the approval and ratification of related person transactions. Under these procedures, our Audit Committee is responsible

for reviewing and approving or ratifying all related person transactions. If the Audit Committee determines that approval or ratification

of a related person transaction should be considered by the Board, such transaction will be submitted for consideration by all

disinterested members of the Board. The Chair of the Audit Committee has the authority to approve or ratify any related person

transaction in which the aggregate amount involved is expected to be less than $300,000 and in which the Chair of the Audit Committee

has no direct or indirect interest.

For these purposes, a related

person transaction is considered to be any transaction that is required to be disclosed pursuant to Item 404 of the SEC’s

Regulation S-K, including transactions between us and our directors, director nominees or executive officers, 5% record or beneficial

owners of our common stock or immediate family members of any such persons, when such related person has a direct or indirect material

interest in such transaction.

Potential related person

transactions are identified based on information submitted by our officers and managers and then submitted to our Audit Committee

for review. The CDW Way Code, our code of business conduct and ethics, requires that our directors and coworkers identify and disclose

any material transaction or relationship that could reasonably be expected to create a conflict of interest and interfere with

their impartiality or loyalty to the Company. Further, at least annually, each director and executive officer is required to complete

a detailed questionnaire that asks questions about any business relationship that may give rise to a conflict of interest and all

transactions in which we are involved and in which the executive officer, a director or a related person has a direct or indirect

material interest.

When deciding to approve

or ratify a related person transaction, our Audit Committee takes into account all relevant considerations, including without limitation

the following:

|

|

•

|

the size of the transaction and the amount payable to or by the related

person;

|

|

|

•

|

the nature of the interest of the related person in the transaction;

|

|

|

•

|

whether the transaction may involve a conflict of interest;

|

|

|

•

|

whether the transaction is at arm’s-length, in the ordinary

course or on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances;

and

|

|

|

•

|

the purpose of the transaction and any potential benefits to us.

|

Related Person Transactions

There have been no transactions

since January 1, 2020 for which disclosure under Item 404(a) of Regulation S-K is required.

|

2021 Proxy Statement

|

20

|

PROPOSAL

1—Election of Directors

Under our Fifth Amended and

Restated Certificate of Incorporation (as amended, our “Certificate of Incorporation”), the number of Board members

is set from time to time by the Board. Our Board presently consists of thirteen directors. Three of our current directors, Messrs.

Alesio, Allen and Chereskin, are not standing for reelection at the 2021 Annual Meeting and will retire immediately prior to the

2021 Annual Meeting under our twelve year term limit policy. We thank Messrs. Alesio, Allen and Chereskin for their service to

the Company. The Board has decreased the size of the Board to ten directors immediately prior to the 2021 Annual Meeting.

The terms of all of our directors

expire on the date of the 2021 Annual Meeting, subject to the election and qualification of their successors.

Director Nomination Process

The Board of Directors is

responsible for nominating individuals for election to the Board and for filling vacancies on the Board that may occur between

annual meetings of stockholders. The Nominating and Corporate Governance Committee is responsible for identifying and screening

potential candidates and recommending qualified candidates to the Board for nomination. Third-party search firms may be and have

been retained to identify individuals that meet the criteria of the Nominating and Corporate Governance Committee. Each of Mr.

Foxx and Mr. Mehrotra was recommended to the Nominating and Corporate Governance Committee by a third-party search firm.

The Nominating and Corporate

Governance Committee will consider director candidates recommended by stockholders in the same manner in which it evaluates candidates

it identified, if such recommendations are properly submitted to the Company. Stockholders wishing to recommend nominees for election

to the Board should submit their recommendations in writing to our Corporate Secretary by email at board@cdw.com or by mail at

CDW Corporation, 200 North Milwaukee Avenue, Vernon Hills, Illinois 60061. Nominations for the 2022 Annual Meeting of Stockholders

must be received no earlier than January 20, 2022 and no later than February 19, 2022. See “Stockholder Proposals for the

2022 Annual Meeting” for additional information regarding the process for submitting nominations.

Our Amended and Restated

Bylaws also permit qualified stockholders, or groups of up to 20 stockholders, to nominate and include in our proxy materials director

nominees, provided that the stockholder(s) and nominee(s) satisfy the requirements specified in our Amended and Restated Bylaws.

Notice of a proxy access nomination must be received no earlier than November 9, 2021 and no later than December 9, 2021. See “Stockholder

Proposals for the 2022 Annual Meeting” for additional information regarding including director nominees in our proxy materials.

Director Qualifications

In selecting director candidates,

the Nominating and Corporate Governance Committee and the Board of Directors consider the qualifications and skills of the candidates

individually and the composition of the Board as a whole. Under our Corporate Governance Guidelines, the Nominating and Corporate

Governance Committee and the Board review the following for each candidate, among other qualifications deemed appropriate, when

considering the suitability of candidates for nomination as director:

|

|

•

|

Principal employment, occupation or association involving an active

leadership role

|

|

|

•

|

Qualifications, attributes, skills and/or experience relevant to the

Company’s business

|

|

|

•

|

Ability to bring diversity to the Board, including gender, race/ ethnicity

and complementary skills and viewpoints

|

|

|

•

|

Other time commitments, including the number of other boards on which

the potential candidate may serve

|

|

|

•

|

Independence and absence of conflicts of interest as determined by

the Board’s standards and policies, the listing standards of Nasdaq and other applicable laws, regulations and rules

|

|

|

•

|

Financial literacy and expertise

|

|

|

•

|

Personal qualities, including strength of character, maturity of thought

process and judgment, values and ability to work collegially

|

|

2021 Proxy Statement

|

21

|

Our Board strives to maintain

a highly independent, balanced and diverse group of directors that collectively possess the expertise to ensure effective oversight.

|

Key

Director Skills

|

|

Technology/Digital Solutions

|

Operations

|

International

|

|

Vertical Markets (e.g.,

Healthcare, Public Sector)

|

Distribution

|

Economic/Business Trends

|

|

Strategic Planning/Leadership of Complex Organizations

|

Finance

|

Capital Market Transactions

|

|

Board Practices of Major Corporations

|

Sales and Marketing

|

Legal

|

2021 Nominees for Election

to the Board of Directors

Each of the ten director

nominees listed below is currently a director of the Company. Each of the director nominees, other than Christine A. Leahy, our

President and Chief Executive Officer, has been determined by the Board to be independent.

The following biographies

describe the business experience of each director nominee. Following the biographical information for each director nominee, we

have listed the specific experience and qualifications of that nominee that strengthen the Board’s collective qualifications,

skills and experience. The time period for each of Mr. Finnegan and Ms. Zarcone’s service as a director of CDW includes service

on the Board of Managers of CDW Holdings LLC, our parent company prior to our IPO.

If elected, each of the director

nominees is expected to serve for a term expiring at the 2022 Annual Meeting, subject to the election and qualification of his

or her successor. The Board expects that each of the nominees will be available for election as a director. However, if by reason

of an unexpected occurrence one or more of the nominees is not available for election, the persons named in the form of proxy have

advised that they will vote for such substitute nominees as the Board may nominate.

|

PROPOSAL 1: The Board of Directors recommends a vote FOR the following nominees for election as directors.

|

|

VIRGINIA C. ADDICOTT

|

Audit (Chair) and Nominating and Corporate Governance Committees

|

|

|

INDEPENDENT

Director

since: 2016

Age 57

|

Ms. Addicott is the retired President and Chief Executive Officer of FedEx Custom Critical, a North American expedited freight carrier, a position she held from June 2007 to December 2019. Ms. Addicott joined FedEx Custom Critical in 1999 as Division Managing Director, Service and Safety, and in 2001 became Division Vice President, Operations and Customer Service. Prior to joining FedEx Custom Critical, Ms. Addicott spent thirteen years at Roberts Express, Inc. (acquired by FedEx Custom Critical in 1999) in various operations roles.

|

|

|

|

Other

Public Company Directorships:

• Element

Fleet Management Corp.

|

Selected Directorships and Positions:

• Board

of Directors, Akron Children’s Hospital

• Board

of Trustees, Kent State University

• Board

of Directors, Smither’s Oasis

|

|

|

|

|

|

|

|

Director Qualification

Highlights:

• Strategic

planning and leadership of complex organizations

• Finance

|

• Operations/Distribution

• Technology/Digital

Solutions

|

|

2021 Proxy Statement

|

22

|

|

JAMES A. BELL

|

Audit and Nominating and Corporate Governance Committees

|

|

|

INDEPENDENT

Director

since: 2015

Age 72

|

Mr. Bell is the retired Executive Vice President, Corporate President and Chief Financial Officer of The Boeing Company, an aerospace company and manufacturer of commercial jetliners and military aircraft. Mr. Bell served in that role at Boeing from 2008 to 2012. Previously, he served as Boeing’s Executive Vice President, Finance and Chief Financial Officer from 2003 to 2008; Senior Vice President of Finance and Corporate Controller from 2000 to 2003; and Vice President of Contracts and Pricing for Boeing Space and Communications from 1996 to 2000.

|

|

|

|

Other

Public Company Directorships:

• Apple,

Inc.

• Dow

Inc. (through April 15, 2021)

|

Former Public Company

Directorships (within the past 5 years):

• DowDupont

Inc.

• JPMorgan

Chase & Co.

|

|

|

|

|

|

|

|

Director Qualification

Highlights:

• Strategic

planning and leadership of complex organizations

• Finance

|

• Technology/Digital

Solutions

• Board

practices of other major corporations

|

|

LYNDA M. CLARIZIO

|

Compensation and Nominating and Corporate Governance Committees

|

|

|

INDEPENDENT

Director

since: 2015

Age 60

|