Avis Budget Group Announces Pricing of $500 Million of Senior Secured Notes

May 05 2020 - 12:45PM

Avis Budget Group, Inc. (NASDAQ: CAR) announced today that its

wholly-owned subsidiaries, Avis Budget Car Rental, LLC and Avis

Budget Finance, Inc., priced an offering of $500 million aggregate

principal amount of 10.500% senior secured notes due 2025 in a

private offering, which represents a $100 million increase in the

previously announced size of the offering. The notes will have a

maturity date of May 15, 2025. The closing of the offering of the

notes is expected to occur on or about May 12, 2020, subject to

customary closing conditions. The notes were priced at 97% of their

face value and will be guaranteed by Avis Budget Group, Inc. and

certain of its U.S. subsidiaries.

Avis Budget Group intends to use the net proceeds from the notes

offering for general corporate purposes.

The notes and related guarantees were offered only to persons

reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act of 1933, as amended,

or, outside the United States, to persons other than “U.S. persons”

in compliance with Regulation S under the Securities Act. The notes

and related guarantees have not been and will not be registered

under the Securities Act or the securities laws of any other

jurisdiction and may not be offered or sold in the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities

Act.

This press release is for informational purposes only and is not

an offer to buy or the solicitation of an offer to sell any

securities.

About Avis Budget GroupAvis

Budget Group, Inc. is a leading global provider of mobility

solutions, both through its Avis and Budget brands, which have more

than 11,000 rental locations in approximately 180 countries around

the world, and through its Zipcar brand, which is the world's

leading car sharing network, with more than one million members.

Avis Budget Group operates most of its car rental offices in North

America, Europe and Australasia directly, and operates primarily

through licensees in other parts of the world. Avis Budget Group is

headquartered in Parsippany, N.J.

Forward-Looking

StatementsStatements regarding the notes offering

and the expected use of proceeds therefrom are “forward-looking

statements” and are subject to known and unknown risks and

uncertainties that may cause actual results to differ materially

from those expressed in such forward-looking statements. These

risks and uncertainties include, but are not limited to, the

ability to complete the offering on favorable terms, if at all, and

general market conditions (including the COVID-19 pandemic and

related economic impact) which might affect the offering.

Additional information concerning these and other important risks

and uncertainties can be found in the company's filings with the

SEC, including under the captions “Forward-Looking Statements” and

“Risk Factors” in the company's Annual Report on Form 10-K for the

year ended December 31, 2019 and Quarterly Report on Form 10-Q for

the period ended March 31, 2020. The company undertakes no

obligation to update any forward-looking statements to reflect

subsequent events or circumstances.

Contact

| David Calabria: IR@avisbudget.com

PR@avisbudget.com |

|

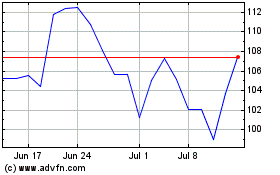

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

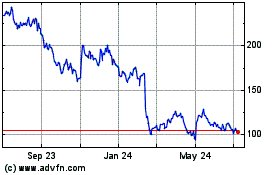

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Apr 2023 to Apr 2024