Current Report Filing (8-k)

March 26 2020 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

March 25, 2020

________________________________

CAPRICOR THERAPEUTICS, INC.

(Exact name of Registrant as Specified

in its Charter)

|

Delaware

|

|

001-34058

|

|

88-0363465

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

8840 Wilshire Blvd., 2nd Floor, Beverly

Hills, CA

(Address of principal executive offices)

|

|

90211

(Zip Code)

|

(310) 358-3200

(Registrant’s telephone number,

including area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.001 per share

|

|

CAPR

|

|

The Nasdaq Capital Market

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

As previously reported, in December 2019,

Capricor Therapeutics, Inc. (the “Company”) completed a public offering (the “December Offering”) pursuant

to which the Company issued (i) 531,173 shares of its common stock, par value $0.001 per share (the “Common Stock”),

(ii) warrants to purchase up to 4,139,477 shares of Common Stock (the “Existing Warrants”), and (iii) pre-funded warrants

to purchase up to 3,608,304 shares of Common Stock (the “Pre-Funded Warrants”). As of March 25, 2020, all of the Pre-Funded

Warrants had been exercised, and 78,304 of the Existing Warrants had been exercised by the holder thereof.

On March 25, 2020, the Company entered

into a letter agreement (the “Exercise Agreement”) with a holder of the Existing Warrants (the “Exercising Holder”).

Pursuant to the Exercise Agreement, in connection with exercise by the Exercising Holder of the remaining 4,000,000 Existing Warrants

held by the Exercising Holder which had not been previously exercised, the Company agreed to issue 4,000,000 additional warrants

(the “New Warrants”) to purchase Common Stock. The Existing Warrants had a per share exercise price of $1.10, and pursuant

to the Exercise Agreement, the Exercising Holder agreed to pay $1.225 per share to cover both the exercise price of the Existing

Warrants and a $0.125 per share purchase price for the New Warrants. The New Warrants have an exercise price of $1.27 per share.

The New Warrants and the shares of Common

Stock issuable upon the exercise of the New Warrants are not being registered under the Securities Act of 1933, as amended (the

“Securities Act”), and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities

Act or Rule 506(b) promulgated thereunder. Pursuant to the Exercise Agreements, the New Warrants shall be substantially in the

form of the Existing Warrants (except for customary legends and other language typical for an unregistered warrant, including the

ability for the holder of the New Warrant to make a cashless exercise if no resale registration statement covering the Common Stock

underlying the New Warrants is effective after six months), will be exercisable immediately, and will have a term of exercise of

5 1/2 years), and the Company will be required to register for resale the shares of Common Stock underlying the New Warrants.

The Company expects to receive aggregate

gross proceeds of approximately $4.9 million from the exercise of the Existing Warrants by the Exercising Holder. These gross proceeds

will be reduced by fees due and payable to the placement agent for the transactions pursuant to the Exercise Agreement and New

Warrants in the amount of $343,000, and further reduced by reimbursements to the placement agent for legal fees and other expenses.

In addition, the placement agent will receive a new warrant for shares of Common Stock equal to 5.0% of the New Warrants issued,

or 200,000 shares.

The description of terms and conditions

of the Exercise Agreement and the New Warrant set forth herein do not purport to be complete and are qualified in their entirety

by reference to the full text of the form of Exercise Agreement and the New Warrant. A copy of the Exercise Agreement is filed

as Exhibit 10.1 hereto, and a copy of the New Warrant will be filed as an exhibit to the Company’s Quarterly Report on Form

10-Q for the quarterly period ended March 31, 2020.

|

Item 3.02

|

Unregistered Sale of Equity Securities.

|

The information contained in Item 1.01

of this Current Report on Form 8-K in relation to the Existing Warrants and the New Warrants and the shares of Common Stock issuable

upon the exercise thereof is hereby incorporated by reference into this Item 3.02.

|

Item 3.03

|

Material Modifications to Rights of Security Holders.

|

The information contained above in Item

1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.03.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

|

|

CAPRICOR THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

Date: March 25, 2020

|

By:

|

/s/ Linda Marbán, Ph.D.

|

|

|

|

|

Linda Marbán, Ph.D.

|

|

|

|

|

Chief Executive Officer

|

|

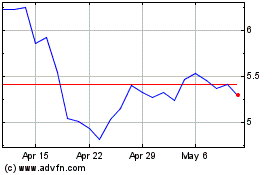

Capricor Therapeutics (NASDAQ:CAPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

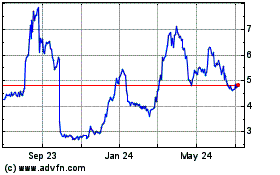

Capricor Therapeutics (NASDAQ:CAPR)

Historical Stock Chart

From Apr 2023 to Apr 2024