Credit Acceptance Announces Redemption of Outstanding 7.375% Senior Notes Due 2023

February 14 2020 - 4:02PM

Credit Acceptance Corporation (Nasdaq:

CACC) (referred to as the “Company”, “Credit Acceptance”,

“we”, “our”, or “us”) announced today the redemption of all of the

Company’s 7.375% senior notes due 2023 (the “2023 notes”) in

accordance with the terms of the indenture governing the 2023 notes

(the “2023 notes indenture”). The Company has provided an

irrevocable notice to U.S. Bank National Association, the trustee

under the 2023 notes indenture, of the Company’s election to redeem

all of the outstanding 2023 notes on March 15, 2020, in

accordance with the terms of the 2023 notes indenture, at a

redemption price equal to 101.844% of the principal amount thereof.

In accordance with the 2023 notes indenture, accrued and unpaid

interest on the 2023 notes from September 15, 2019 (the most

recent date to which interest on the 2023 notes has been paid) will

be payable on March 15, 2020 to the holders of record of the

2023 notes as of the March 1, 2020 interest record date, and

no additional interest will be payable on the 2023 notes. Interest

on the 2023 notes will cease to accrue on and after the

March 15, 2020 redemption date. In accordance with the 2023

notes indenture, because March 15, 2020 is a Sunday, payment

of the redemption price and of interest payable on that date with

respect to the 2023 notes will be made on Monday, March 16,

2020.

Notice of the redemption of the 2023 notes will

be sent to holders of the 2023 notes by U.S. Bank National

Association as specified under the 2023 notes indenture. This press

release does not constitute a notice of redemption with respect to

the 2023 notes.

Cautionary Statement Regarding

Forward-Looking Information

Statements in this release that are not

historical facts, such as those using terms like “may,” “will,”

“should,” “believe,” “expect,” “anticipate,” “assume,” “forecast,”

“estimate,” “intend,” “plan,” “target” and those regarding our

future results, plans and objectives, are “forward-looking

statements” within the meaning of the federal securities laws.

These forward-looking statements, which include statements

concerning the redemption of the 2023 notes, represent our outlook

only as of the date of this release. Actual results could differ

materially from these forward-looking statements since the

statements are based on our current expectations, which are subject

to risks and uncertainties. We do not undertake, and expressly

disclaim any obligation, to update or alter our statements whether

as a result of new information, future events or otherwise, except

as required by applicable law.

Investor Relations: Douglas W. Busk

Senior Vice President and Treasurer

(248) 353-2700 Ext. 4432

IR@creditacceptance.com

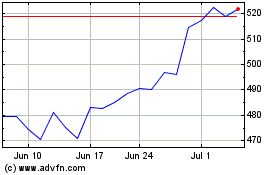

Credit Acceptance (NASDAQ:CACC)

Historical Stock Chart

From Mar 2024 to Apr 2024

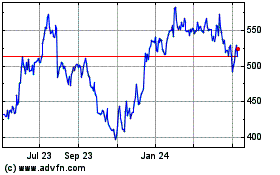

Credit Acceptance (NASDAQ:CACC)

Historical Stock Chart

From Apr 2023 to Apr 2024