Item 1.01 Entry Into a Material Definitive Agreement.

Agreement and Plan of Merger

On August 25, 2020, Broadway Financial Corporation, a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with CFBanc Corporation, a District of Columbia benefit corporation (“City First”).

The Merger Agreement provides that, among other things and subject to the terms and conditions of the Merger Agreement, (1) City First will merge with and into the Company (the “Merger”), with the Company surviving and continuing as the surviving entity in the Merger (the “Surviving Entity”), (2) at the effective time of the Merger (the “Effective Time”), each share of City First’s Class A Common Stock, par value $0.50 per share (the “City First Class A Common Stock”), and Class B Common Stock, par value $0.50 per share (the “City First Class B Common Stock” and, together with the City First Class A Common Stock, the “City First Common Stock”), issued and outstanding immediately prior to the Effective Time (other than any shares owned by City First or the Company and any Dissenting Shares (as defined in the Merger Agreement)) will be converted into 13.626 validly issued, fully paid and nonassessable shares, respectively, of the voting common stock of the Company, par value $0.01 per share, which will be renamed Class A Common Stock (“Company Voting Common Stock”), and a new class of non-voting common stock of the Company, par value $0.01 per share, which will be named Class B Common Stock (“New Company Non-Voting Common Stock” and, together with the Company Voting Common Stock and the currently authorized non-voting common stock of the Company, which will be renamed Class C Common Stock, the “Company Common Stock”), (3) at the Effective Time, each share of Fixed Rate Cumulative Redeemable Perpetual Preferred Stock, Series B, par value $0.50 per share, of City First (“City First Preferred Stock”) issued and outstanding immediately prior to the Effective Time will be converted into one validly issued, fully paid and non-assessable share of a new series of preferred stock of the Company, which new series will be designated as the Company’s Fixed Rate Cumulative Redeemable Perpetual Preferred Stock, Series A (the “Company Preferred Stock” and, together with the Company Common Stock, the “Company Stock”), with such rights, preferences, privileges and voting powers, and limitations and restrictions thereof, which taken as a whole, are not materially less favorable to the holders of City First Preferred Stock than the rights, preferences, privileges and voting powers, and limitations and restrictions thereof of City First Preferred Stock, (4) immediately following the Merger, Broadway Federal Bank, f.s.b., a wholly owned subsidiary of the Company (“Company Bank”), will merge with and into City First Bank of D.C., National Association, a wholly owned subsidiary of City First (“CFB”) (the “Bank Merger”), with CFB continuing as the surviving entity (the “Surviving Bank”). The Merger Agreement also provides that, subject to the terms and conditions of the Merger Agreement, cash will be paid in lieu of the issuance of fractional shares of Company Stock.

Subject to stockholder approval, in connection with the Merger, the Company will convert into a public benefit corporation, as defined in Section 362 of the Delaware General Corporation Law (the “Conversion”).

The board of directors of the Company has unanimously (1) approved and declared advisable the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement, (2) determined that it is fair to, and in the best interests of, the Company and its stockholders that the Company enter into the Merger Agreement and complete the Merger and the other transactions contemplated by the Merger Agreement on the terms and subject to the conditions set forth therein, (3) approved the Conversion and declared the Conversion advisable and in the best interests of the Company, (4) adopted and approved an amendment and restatement to the Company’s certificate of incorporation which, among other things, will increase the authorized share capital of the Company to create the New Company Non-Voting Common Stock, (5) directed that the Merger Agreement, the Merger, the Conversion and the amended and restated certificate and any other matters that may be required or appropriate in connection with the Merger be submitted to the Company’s stockholders for a vote on the approval and adoption of such matters at a meeting of the Company’s stockholders, and (6) resolved to recommend that the stockholders of the Company approve and adopt the Merger Agreement, the Merger and the amended and restated certificate.

The completion of the Merger is subject to satisfaction or waiver of certain customary closing conditions, including, among others, (1) the receipt of required approvals from the holders of shares of Company Voting Common Stock, and on a separate class basis each of the City First Class A Common Stock, City First Class B

2

Common Stock and City First Preferred Stock, (2) the authorization for listing on The Nasdaq Capital Market of the shares of Company Voting Common Stock to be issued pursuant to the Merger Agreement, (3) approvals from the Board of Governors of the Federal Reserve System and the Office of the Comptroller of the Currency and certain other regulatory approvals listed in the City First Disclosure Schedule or the Tony Disclosure Schedule (the “Requisite Regulatory Approvals”) without any such approval having resulted in the imposition of any Materially Burdensome Regulatory Condition (as defined below), (4) the effectiveness of the registration statement on Form S-4 to be filed by the Company in connection with the transactions contemplated by the Merger Agreement, (5) the absence of any governmental order or injunction preventing the consummation of the Merger or the Bank Merger or prohibiting or making illegal the consummation of the Merger, the Bank Merger or any of the other transactions contemplated by the Merger Agreement, (6) the receipt by each party of a customary opinion that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, and (7) the exercise of appraisal rights under D.C. law by the holders of outstanding shares of City First Common Stock not exceeding 5% of such stock in the aggregate. The obligation of each party to consummate the Merger is also conditioned upon the other party’s representations and warranties being true and correct (subject to certain materiality exceptions) and the other party having performed its obligations under the Merger Agreement in all material respects.

The Merger Agreement provides that, effective as of the Effective Time, Mr. Wayne Bradshaw, who is the Company’s current President and chief executive officer, will serve as the chairman of the board of directors of the Surviving Entity, and Mr. Brian Argrett, who is City First’s current chief executive officer, will serve as the vice chairman of the board of directors and chief executive officer of the Surviving Entity and the Surviving Bank. The Merger Agreement also provides that, effective as of the second anniversary of the closing of the Merger, Mr. Brian Argrett will replace Mr. Wayne Bradshaw as the chairman of the board of directors (subject to the then-current board of directors of the Surviving Entity’s exercise of its fiduciary obligations and vote).

The Merger Agreement contains customary representations and warranties of City First and the Company relating to their respective businesses and financial statements, and to the Company’s public filings, in each case generally subject to customary materiality qualifiers. Additionally, the Merger Agreement provides that, during the period between the execution of the Merger Agreement and the Effective Time or earlier termination of the Merger Agreement, each party shall comply with customary pre-closing covenants, including covenants to conduct their respective businesses in the ordinary course consistent with past practice and to refrain from taking certain actions without the other party’s consent. The Company and City First have also agreed to use their respective reasonable best efforts to take all actions necessary to consummate the transactions contemplated by the Merger Agreement and to obtain any material governmental or third-party consent required to be obtained in connection with the Merger, the Bank Merger and the other transactions contemplated by the Merger Agreement, subject to certain exceptions, including that neither the Company nor City First is required to take any action, or agree to any condition or restriction, that would reasonably be expected to be materially financially burdensome to the business, operations, financial condition or results of operations of either party and its subsidiaries (in each case taken as a whole) (which could include materially increasing capital, divesting or reducing lines of businesses or asset classes, entering into compliance or remediation programs and making material lending or investment commitments) (a “Materially Burdensome Regulatory Condition”). The Company and City First intend to cause the Surviving Entity to take reasonable actions to cause the Surviving Bank to maintain its status as a Community Development Financial Institution and as a Minority Depository Institution.

The Merger Agreement provides that each party to the Merger Agreement is subject to certain restrictions on its ability to initiate or solicit alternative acquisition proposals, to engage in negotiations with any person concerning alternative acquisition proposals or to provide confidential or nonpublic information, participate in discussions, relating to alternative acquisition proposals, or recommend the approval of or enter into any agreement relating to alternative acquisition proposals, subject to customary exceptions. Each party to the Merger Agreement is required to convene a meeting of its stockholders to approve the Merger Agreement and, subject to certain exceptions, to recommend that its stockholders adopt and approve the Merger Agreement and the transactions contemplated thereby, including the Merger and, with respect to the Company, the amended and restated certificate of incorporation.

The Merger Agreement contains termination rights for each of the Company and City First, including, among others, (1) if any Governmental Entity (as defined in the Merger Agreement) that must grant a Requisite Regulatory

3

Approval has denied approval of either the Merger or the Bank Merger, (2) if there is a final and nonappealable injunction or other legal prohibition permanently prohibiting the Merger or the Bank Merger, (3) if the Merger has not been consummated on or before August 25, 2021 (the “Termination Date”), (4) if the other party breaches the Merger Agreement such that a closing condition for the benefit of the nonbreaching party would not be satisfied and the breaching party does not cure such breach within a specified period, or (5) if the other party or its board of directors (i) changes its recommendation in favor of the Merger Agreement and the Merger or (ii) materially breaches its non-solicitation or board-recommendation obligations under the Merger Agreement.

The Company or City First, as applicable, must pay the other party a termination fee of $1.75 million (the “Termination Fee”) if (1) (i) a bona fide competing proposal to acquire 50% or more of a party’s assets or securities, or for a merger, business combination, reorganization or other similar transaction is made known to such party’s board or senior management or is publicly announced (after the date of the Merger Agreement) which is not withdrawn at least two days prior to such party’s stockholder meeting to approve the Merger Agreement; (ii) (a) either party then terminates the Merger Agreement due to the Merger not having been completed on or before the Termination Date without the first party’s requisite stockholder approval having been obtained or (b) the other party terminates the Merger Agreement as a result of a willful breach by the first party; and (iii) prior to the date that is 12 months after the date of such termination of the Merger Agreement, the first party enters into a definitive agreement or consummates a transaction with respect to an acquisition of 50% or more of the first party’s assets or securities, or for a merger, business combination, reorganization or other similar transaction; or (2) if the other party or its board changes its recommendation in favor of the Merger Agreement and the Merger or materially breaches its obligations under the Merger Agreement with respect to non-solicitation or board recommendation.

The Merger Agreement has been included to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Company or City First. The representations, warranties and covenants contained in the Merger Agreement were made only for purposes of the Merger Agreement as of the specific dates therein, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures, made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Merger Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties thereto or any of their respective subsidiaries or affiliates. Moreover, such representations and warranties will not survive the consummation of the Merger and the information concerning the subject matter of representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Company, City First, their respective affiliates or their respective businesses, the Merger Agreement and the Merger that will be contained in, or incorporated by reference into, the Registration Statement on Form S-4 that will include a joint proxy statement of the Company and City First and a prospectus of the Company, as well as in the Forms 10-K, Forms 10-Q, Forms 8-K and other filings that the Company makes with the U.S. Securities and Exchange Commission (the “SEC”).

The foregoing description of the Merger Agreement and the transactions contemplated thereby in this Current Report on Form 8-K is a summary only, does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is filed as Exhibit 2.1 hereto and incorporated by reference herein.

Amendment to Rights Agreement

Effective August 25, 2020, the Company and Computershare Trust Company, N.A. (the “Rights Agent”) entered into an Amendment (the “Amendment”) to the Rights Agreement, dated as of September 10, 2019, between the Company and the Rights Agent (the “Rights Agreement”) in order to provide that (i) neither the execution, delivery, performance or approval of the Merger Agreement, nor the completion, announcement, or announcement of the completion, of the Merger would or should be construed to (a) cause any Right (as defined in the Rights Agreement)to become exercisable, (b) cause City First or any of its Affiliates or Associates to become an Acquiring Person (each such term as defined in the Rights Agreement) solely as a result of the Merger, (c) result in a

4

Triggering Event (as defined in the Rights Agreement), or (d) give rise to a Shares Acquisition Date or Distribution Date (as each such term as defined in the Rights Agreement), and (ii) any Person (as defined in the Rights Agreement) who as a result of the Merger will become as of the time of Closing the Beneficial Owner (as defined in the Rights Agreement) of 10% or more of the then outstanding Common Shares shall be deemed to be a Grandfathered Person (as defined in the Rights Agreement). The amendment also confirms that, for purposes of the Rights Agreement, the term Common Stock will include the New Company Non-Voting Common Stock to be issued in connection with the Merger.

The foregoing description of the Amendment in this Current Report on Form 8-K is a summary only and does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is filed as Exhibit 4.1 hereto and incorporated by reference herein.

Item 5.01 Changes in Control of Registrant.

On August 25, 2020, the Company entered into the Merger Agreement, which provides that, among other things and subject to the terms and conditions of the Merger Agreement, following the Merger, a majority of the board of directors of the Surviving Entity will be individuals who were previously directors of City First, which change in board membership may be deemed to constitute a change in control of the Company.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

Item 7.01 Regulation FD Disclosure.

On August 26, 2020, the Company and City First released a presentation to investors about the Merger. A copy of the presentation is attached as Exhibit 99.1 to this report and incorporated herein by reference.

The information in Item 7.01 of this Form 8-K (including Exhibit 99.1) is furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 134, as amended.

Item 8.01 Other Events.

On August 26, 2020, the Company and City First issued a joint press release announcing their entry into the Merger Agreement. A copy of the joint press release is attached as Exhibit 99.2 to this report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

|

Description of Exhibits

|

|

2.1

|

|

Agreement and Plan of Merger, dated as of August 25, 2020, by and between Broadway Financial Corporation and CFBanc Corporation. †

|

|

4.1

|

|

Amendment to Rights Agreement, dated as of August 25, 2020, by and between Broadway Financial Corporation and Computershare Trust Company, N.A.

|

|

99.1

|

|

Investor Presentation, dated as of August 26, 2020.

|

|

99.2

|

|

Joint press release, dated as of August 26, 2020.

|

† Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The registrant hereby undertakes to furnish supplementally copies of any of the omitted schedules upon request by the SEC;

5

provided, however, that the parties may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any document so furnished.

Additional Information and Where to Find it

This report does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This report relates to a proposed business combination (the “proposed transaction”) between Broadway Financial Corporation, a Delaware corporation (the “Company”), and CFBanc Corporation, a District of Columbia benefit corporation (“City First”). In connection with the proposed transaction, the Company intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”) that will include a joint proxy statement of the Company and City First and a prospectus of the Company (the “Joint Proxy/Prospectus”). The Company also plans to file other relevant documents with the SEC regarding the proposed transaction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. Any definitive Joint Proxy/Prospectus (if and when available) will be mailed or otherwise provided to stockholders of the Company and City First. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND CITY FIRST ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about the Company and City First, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by the Company will also be available free of charge on the Company’s website at https://www.broadwayfederalbank.com/financial-highlights. Copies of the Registration Statement and the Joint Proxy/Prospectus can also be obtained, when it becomes available, free of charge by directing a request to Broadway Financial Corporation, 5055 Wilshire Boulevard Suite 500, Los Angeles, California 90036, Attention: Investor Relations, Telephone: (323) 556-3264, or by email to investor.relations@broadwayfederalbank.com, or to CFBanc Corporation, 1432 U Street, NW DC 20009, Attention: Audrey Phillips, Corporate Secretary, Telephone: (202) 243-7141.

Certain Information Concerning Participants

The Company, City First and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of the Company is set forth in the Company’s proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on May 20, 2020. Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy/Prospectus and other relevant materials to be filed with the SEC when they become available. These documents, when available, can be obtained free of charge from the sources indicated above. Investors should read the Joint Proxy/Prospectus carefully when it becomes available before making any voting or investment decisions.

Cautionary Statement Regarding Forward-Looking Information

This report includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “poised,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements; however the absence of these words does not mean the statements are not forward-looking. Forward-looking statements in this report include matters that involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to differ materially from results expressed or implied by this report. Such risk factors include, among others: the uncertainty as to the extent of the

6

duration, scope and impacts of the COVID-19 pandemic; political and economic uncertainty, including any decline in global economic conditions or the stability of credit and financial markets; the expected timing and likelihood of completion of the proposed transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction that could reduce anticipated benefits or cause the parties to abandon the proposed transaction, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the possibility that stockholders of the Company or of City First may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all or failure to close the proposed transaction for any other reason, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company Common Stock, the risk relating to the potential dilutive effect of shares of Company Common Stock to be issued in the proposed transaction, the risk of any unexpected costs or expenses resulting from the proposed transaction, the risk of any litigation relating to the proposed transaction, the risk of possible adverse rulings, judgments, settlements and other outcomes of pending litigation, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company and City First to retain customers and retain and hire key personnel and maintain relationships with their customers and on their operating results and businesses generally, the risk the pending proposed transaction could distract management of both entities and that they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, or that the entities may not be able to successfully integrate the businesses, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond the Company’s control. Additional factors that could cause results to differ materially from those described above can be found in the Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K or other filings, which have been filed with the SEC and are available on the Company’s website at https://www.broadwayfederalbank.com/financial-highlights and on the SEC’s website at http://www.sec.gov.

Actual results may differ materially from those contained in the forward-looking statements in this report. Forward-looking statements speak only as of the date they are made and the Company undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after the date of this report. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

7

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 26, 2020

|

BROADWAY FINANCIAL CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Brenda J. Battey

|

|

|

|

Name:

|

Brenda J. Battey

|

|

|

|

Title:

|

Chief Financial Officer

|

8

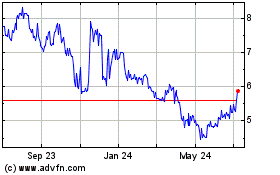

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

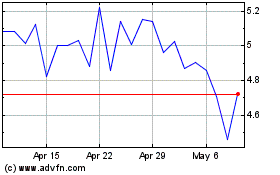

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024