Community development finance leaders City

First Bank of DC and Broadway Federal Bank in Los Angeles expand

access to capital in underserved urban areas

CFBanc Corporation (“City First”) in Washington, DC and Broadway

Financial Corporation (“Broadway,” Nasdaq: BYFC) in Los Angeles, CA

announced today that they have entered into a transformational

Merger of Equals agreement to create the largest Black-led Minority

Depository Institution (MDI) in the nation with more than $1

billion in combined assets under management and approximately $850

million in total depository institution assets (as of June 30,

2020). Combining the two institutions will increase their

collective commercial lending capacity for investments in

multifamily affordable housing, small businesses, and nonprofit

development in financially underserved urban areas, while creating

a national platform for impact investors.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20200826005490/en/

City First Bank of D.C., National Association (“City First

Bank,” a City First subsidiary) and Broadway Federal Bank, f.s.b.

(“Broadway Federal Bank,” a Broadway subsidiary) each hold a strong

financial position as Community Development Financial Institutions

(CDFIs), and have a longstanding history of advancing economic and

social equity through the provision of capital in low- to

moderate-income communities. The combined institution will maintain

its CDFI status, requiring it to deploy at least 60% of its lending

into low- to moderate-income communities. CDFIs help to close

funding gaps, create jobs, expand critical social services and spur

equitable economic development with a mission to strengthen the

overall well-being of vulnerable communities. Since the beginning

of 2015, City First Bank and Broadway Federal Bank have

collectively deployed over $1.1 billion combined in loans and

investments in their communities (as of June 30, 2020).

“Given the compounding factors of a global pandemic,

unprecedented unemployment and social unrest resulting from

centuries of inequities, the work of CDFIs has never been more

urgent and necessary,” said Brian E. Argrett, President and CEO of

City First Bank and the Vice Chair and CEO of the new combined

institution. “As part of this historic merger, we are demonstrating

that thriving urban neighborhoods are viable markets that require a

dedicated focus, long-term commitment and critical access to

capital.”

The combined nine-member board will be composed of five

directors from City First and four from Broadway. Broadway’s

president and CEO Wayne-Kent A. Bradshaw will lead the board of the

combined institution as its chair. City First board chair Marie C.

Johns will serve as the institution’s lead independent

director.

“The new combined institution will strengthen our position and

will help drive both sustainable economic growth and societal

returns,” said Mr. Bradshaw. “We envision building stronger

profitability and creating a multiplier effect of capital

availability for our customers and for the communities we

serve.”

The new institution will maintain bi-coastal headquarters and

will continue to serve and expand in the banks’ current geographic

areas, with a desire to scale to other high-potential urban

markets. As a national bank, the combined entity intends to

continue to operate under the supervision of the Office of the

Comptroller of the Currency (OCC) and to be listed on the Nasdaq

Capital Market. As a Community Development Financial Institution

(CDFI), a Minority Depository Institution (MDI), a Benefit

Corporation and a member of the Global Alliance of Banking on

Values, the new institution intends to continue to firmly anchor

its work, results and values in the rapidly expanding field of

social finance and accretive stakeholder benefits.

Under the terms of the merger agreement, which was unanimously

approved by the boards of directors of both City First and

Broadway, City First will merge with and into Broadway, with

Broadway as the surviving corporation. Broadway Federal Bank, the

wholly owned subsidiary of Broadway, will merge with and into City

First Bank, the wholly owned subsidiary of City First, with City

First Bank as the surviving bank. At the closing of the merger,

City First common shareholders will receive 13.626 shares of

Broadway common stock for each share of City First common stock

they own, resulting in Broadway stockholders owning 52.5% and City

First shareholders owning 47.5% of the combined institution.

The merger is expected to close in the first quarter of 2021,

subject to satisfaction of customary closing conditions, including

receipt of necessary regulatory approvals and approval by the

shareholders of each company.

Raymond James & Associates, Inc. is acting as financial

advisor, and has rendered a fairness opinion to the board of

directors of City First. Covington & Burling LLP is serving as

legal counsel to City First. Keefe, Bruyette & Woods, A Stifel

Company, is acting as financial advisor, and has rendered a

fairness opinion to the board of directors of Broadway. Arnold

& Porter Kaye Scholer LLP is serving as legal counsel to

Broadway.

About CFBanc Corporation

City First conducts its operations through its wholly owned

subsidiary, City First Bank. Founded over 25 years ago in direct

response to systemic disinvestment in our communities, City First

has been an innovator and a financial first responder for equitable

economic development in Washington, DC. Together with our

affiliates, City First has since invested over $1.3 billion as of

June 30, 2020 with a vision to advance economic equity and social

justice, impacting families and communities today and for

generations to come. City First is part of a dedicated network of

CDFIs and certified BCorps, and is a member of the Global Alliance

of Banking on Values, entities whose values are aligned with

sustainable solutions, healthier families and more prosperous

communities for our collective well-being. For more information,

please visit www.cityfirstbank.com | www.cfenterprises.org.

About Broadway Financial Corporation

Broadway conducts its operations through its wholly owned

subsidiary, Broadway Federal Bank, which is the leading

community-oriented savings bank in Southern California serving

low-to-moderate-income communities. Broadway Federal Bank offers a

variety of residential and commercial real estate loan products for

consumers, businesses and nonprofit organizations, other loan

products and a variety of deposit products, including checking,

savings and money market accounts, certificates of deposits and

retirement accounts. Broadway Federal Bank operates three

full-service branches, two in the city of Los Angeles, and one

located in the nearby city of Inglewood, California. For more

information, please visit www.broadwayfederalbank.com.

Shareholders, analysts and others seeking information about

Broadway are invited to write to: Broadway Financial Corporation,

Investor Relations, 5055 Wilshire Blvd., Suite 500, Los Angeles, CA

90036, or visit our website at www.broadwayfederalbank.com.

Additional Information and Where to Find it

This communication does not constitute an offer to buy or sell

or the solicitation of an offer to buy or sell any securities or a

solicitation of any vote or approval. This communication relates to

a proposed business combination (the “proposed transaction”) between Broadway and City

First. In connection with the proposed transaction, Broadway

intends to file with the Securities and Exchange Commission (the

“SEC”) a registration statement on

Form S-4 (the “Registration

Statement”) that will include a joint proxy statement of

Broadway and City First and a prospectus of Broadway (the

“Joint Proxy/Prospectus”). Broadway

also plans to file other relevant documents with the SEC regarding

the proposed transaction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section

10 of the U.S. Securities Act of 1933, as amended, and no offer to

sell or solicitation of an offer to buy shall be made in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. Any definitive Joint Proxy/Prospectus (if and when

available) will be mailed or otherwise provided to stockholders of

Broadway and City First. INVESTORS AND SECURITY HOLDERS OF BROADWAY

AND CITY FIRST ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT

PROXY/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION.

Investors and security holders will be able to obtain free

copies of these documents (if and when available) and other

documents containing important information about Broadway and City

First, once such documents are filed with the SEC through the

website maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by Broadway will also be available

free of charge on Broadway’s website at

https://www.broadwayfederalbank.com/financial-highlights. Copies of

the Registration Statement and the Joint Proxy/Prospectus can also

be obtained, when it becomes available, free of charge by directing

a request to Broadway Financial Corporation, 5055 Wilshire

Boulevard Suite 500 Los Angeles, California 90036, Attention:

Investor Relations, Telephone: 323-556-3264, or by email to

investor.relations@broadwayfederalbank.com, or to CFBanc

Corporation, 1432 U Street, NW DC 20009, Attention: Audrey

Phillips, Corporate Secretary, Telephone: 202-243-7141.

Certain Information Concerning Participants

Broadway, City First and certain of their respective directors

and executive officers may be deemed to be participants in the

solicitation of proxies in respect of the proposed transaction.

Information about the directors and executive officers of Broadway

is set forth in Broadway’s proxy statement for its 2020 annual

meeting of stockholders, which was filed with the SEC on May 20,

2020. Information regarding all of the persons who may, under the

rules of the SEC, be deemed participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the Joint

Proxy/Prospectus and other relevant materials to be filed with the

SEC when they become available. These documents, when available,

can be obtained free of charge from the sources indicated above.

Investors should read the Joint Proxy/Prospectus carefully when it

becomes available before making any voting or investment

decisions.

Cautionary Statement Regarding Forward-Looking

Information

This communication includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Words such as

“expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“poised,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions are intended to identify such forward-looking

statements; however the absence of these words does not mean the

statements are not forward-looking. Forward-looking statements in

this communication include matters that involve known and unknown

risks, uncertainties and other factors that may cause actual

results, levels of activity, performance or achievements to differ

materially from results expressed or implied by this communication.

Such risk factors include, among others: the uncertainty as to the

extent of the duration, scope and impacts of the COVID-19 pandemic;

political and economic uncertainty, including any decline in global

economic conditions or the stability of credit and financial

markets; the expected timing and likelihood of completion of the

proposed transaction, including the timing, receipt and terms and

conditions of any required governmental and regulatory approvals of

the proposed transaction that could reduce anticipated benefits or

cause the parties to abandon the proposed transaction, the

occurrence of any event, change or other circumstances that could

give rise to the termination of the Merger Agreement, the

possibility that stockholders of Broadway or of City First may not

approve the merger agreement, the risk that the parties may not be

able to satisfy the conditions to the proposed transaction in a

timely manner or at all or failure to close the proposed

transaction for any other reason, risks related to disruption of

management time from ongoing business operations due to the

proposed transaction, the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of Broadway Common Stock, the risk relating to the potential

dilutive effect of shares of Company Common Stock to be issued in

the proposed transaction, the risk of any unexpected costs or

expenses resulting from the proposed transaction, the risk of any

litigation relating to the proposed transaction, the risk of

possible adverse rulings, judgments, settlements and other outcomes

of pending litigation, the risk that the proposed transaction and

its announcement could have an adverse effect on the ability of

Broadway and City First to retain customers and retain and hire key

personnel and maintain relationships with their customers and on

their operating results and businesses generally, the risk the

pending proposed transaction could distract management of both

entities and that they will incur substantial costs, the risk that

problems may arise in successfully integrating the businesses of

the companies, which may result in the combined company not

operating as effectively and efficiently as expected, or that the

entities may not be able to successfully integrate the businesses,

the risk that the combined company may be unable to achieve

synergies or other anticipated benefits of the proposed transaction

or it may take longer than expected to achieve those synergies or

benefits and other important factors that could cause actual

results to differ materially from those projected. All such factors

are difficult to predict and are beyond Broadway’s control.

Additional factors that could cause results to differ materially

from those described above can be found in Broadway’s annual

reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K or other filings, which have been filed with

the SEC and are available on Broadway’s website at

https://www.broadwayfederalbank.com/financial-highlights and on the

SEC’s website at http://www.sec.gov.

Actual results may differ materially from those contained in the

forward-looking statements in this communication. Forward-looking

statements speak only as of the date they are made and Broadway

undertakes no obligation and does not intend to update these

forward-looking statements to reflect events or circumstances

occurring after the date of this communication. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this communication.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200826005490/en/

Media Contacts: Kerry-Ann Hamilton Media@kahconsultinggroup.com

301.265.5100

Gloria Nauden Gnauden@cityfirstbank.com 202.528.9005

Brenda Battey BBattey@broadwayfederalbank.com 323.556.3264

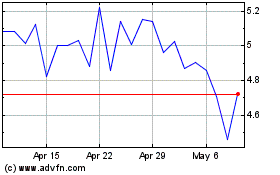

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

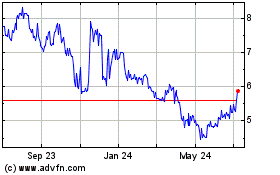

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024